Dissecting The GOP Mega Bill: A Closer Look At Its Implications

Table of Contents

Tax Implications of the GOP Mega Bill

This section explores the significant tax changes introduced by the GOP Mega Bill, examining their potential impact on individuals and corporations alike. The bill's tax provisions are arguably its most contentious aspect, with ongoing debates about fairness and long-term economic consequences.

Impact on Corporate Taxes

The GOP Mega Bill significantly alters corporate tax rates.

- Lowered Corporate Tax Rates: The bill significantly lowers the corporate tax rate, potentially boosting corporate profits and incentivizing investment. However, critics argue this could disproportionately benefit large corporations at the expense of smaller businesses.

- Potential for Increased Corporate Profits: Proponents suggest lower tax rates will lead to increased investment, job creation, and higher wages. Opponents counter that these benefits might not trickle down to workers and could exacerbate income inequality.

- Impact on Small Businesses: The effect on small businesses is complex and debated. While some may benefit from simplified tax codes, others may find the changes disadvantageous, particularly if they rely on deductions eliminated by the bill.

- Possible Loopholes and Tax Avoidance: Concerns exist regarding the potential for loopholes and tax avoidance strategies that could negate the intended benefits of lower rates. Independent analysis is crucial to identify and address these potential issues.

Changes to Individual Income Tax

The GOP Mega Bill also introduces changes to individual income tax, affecting various income levels.

- Changes to Standard Deduction: The bill alters the standard deduction, potentially impacting taxpayers' overall tax liability. This change could benefit some low- and middle-income individuals, while others might see a negligible effect.

- Impact on Different Income Levels: The impact varies greatly across different income brackets. While some high-income earners may see significant tax cuts, others may experience only minimal changes or even small tax increases. Careful analysis of individual tax situations is crucial.

- Effects on Charitable Giving: Changes to itemized deductions could affect charitable giving, as the deductibility of certain contributions may be altered. This could have implications for non-profit organizations and philanthropic efforts.

- Potential for Tax Increases for Some Individuals: Despite overall tax cuts, some individuals, particularly those who previously benefitted from specific deductions or credits, might see their taxes increase under the new provisions of the GOP Mega Bill.

Long-Term Fiscal Projections

The long-term fiscal implications of the GOP Mega Bill are a major source of debate.

- Increased National Debt Predictions: Many economists predict the bill will significantly increase the national debt due to lower tax revenues. This could lead to future economic challenges and potential constraints on government spending.

- Potential for Future Tax Increases: To offset the projected revenue shortfall, future tax increases could become necessary. This could undermine the intended long-term benefits of the current tax cuts.

- Impact on Government Spending Programs: The increased national debt could necessitate cuts to government spending programs in the future, potentially impacting vital social services and infrastructure projects.

Healthcare Provisions within the GOP Mega Bill

The GOP Mega Bill contains provisions impacting the U.S. healthcare system, triggering significant debate and concern.

Changes to the Affordable Care Act (ACA)

The bill introduces various changes to the Affordable Care Act (ACA), also known as Obamacare.

- Changes to Health Insurance Coverage: The bill may alter the number of Americans with health insurance coverage, potentially increasing the uninsured population. The effects will vary greatly depending on individual circumstances and state-level regulations.

- Impact on Pre-existing Conditions: The bill's impact on protections for individuals with pre-existing conditions is a central point of contention. Concerns exist regarding potential increases in healthcare costs and limited access to care for those with pre-existing conditions.

- Effects on Access to Healthcare: The alterations made could affect access to healthcare, potentially leading to fewer people having access to affordable and comprehensive health insurance. This could particularly impact vulnerable populations.

- Potential for Rising Healthcare Costs: Changes to the ACA could lead to rising healthcare costs for consumers and increased burdens on the healthcare system as a whole.

Impact on Medicare and Medicaid

The GOP Mega Bill also affects Medicare and Medicaid, the major government healthcare programs.

- Changes to Medicare Benefits and Eligibility: The bill could change Medicare benefits and eligibility requirements, affecting access to care for senior citizens and individuals with disabilities. Potential changes include adjustments to premiums, deductibles and co-pays.

- Alterations to Medicaid Funding: The bill's impact on Medicaid funding is a source of considerable controversy. Reduced funding could lead to decreased access to care for low-income individuals and families, potentially exacerbating existing health disparities.

Environmental Impact of the GOP Mega Bill

The GOP Mega Bill also has significant implications for environmental protection and regulations.

Changes to Environmental Regulations

The bill contains provisions impacting environmental regulations, leading to concerns about their long-term effects.

- Impact on Air and Water Quality: Rollbacks of environmental regulations could lead to negative consequences for air and water quality, potentially impacting public health and the environment.

- Effects on Climate Change Initiatives: Changes to environmental regulations could impede progress on climate change mitigation and adaptation efforts, potentially exacerbating the effects of global warming.

- Consequences for Endangered Species Protection: The bill could weaken protections for endangered species and their habitats, accelerating biodiversity loss and harming ecosystems.

Funding for Environmental Programs

The bill's funding provisions for environmental protection are a key area of concern.

- Reduced Funding for Environmental Agencies: Decreased funding for environmental agencies could limit their ability to enforce regulations and protect natural resources effectively.

- Impact on Conservation Programs: Reduced funding for conservation programs could hinder efforts to protect natural habitats and biodiversity, exacerbating environmental degradation.

- Potential Effects on National Parks: Funding cuts could negatively affect the maintenance and preservation of national parks, potentially impacting tourism and recreational opportunities.

Conclusion

The GOP Mega Bill is a multifaceted piece of legislation with far-reaching consequences. Its impact on taxes, healthcare, and the environment will likely be felt for years to come. Understanding its intricate provisions is vital for informed participation in the ongoing national conversation. By analyzing the various aspects of this bill, we can better anticipate and address its potential effects. To further your understanding of the intricacies of the GOP Mega Bill, we encourage you to engage with independent analyses and continue researching its implications for your community and the nation. Stay informed about the GOP Mega Bill and its ongoing effects, and participate in the ongoing dialogue about its impact.

Featured Posts

-

Trump Tariffs And Their 16 Billion Impact On Californias Finances

May 16, 2025

Trump Tariffs And Their 16 Billion Impact On Californias Finances

May 16, 2025 -

Muncy Speaks Out Addressing The Arenado Dodgers Trade Rumors

May 16, 2025

Muncy Speaks Out Addressing The Arenado Dodgers Trade Rumors

May 16, 2025 -

Stock Market Valuation Concerns Expert Analysis From Bof A

May 16, 2025

Stock Market Valuation Concerns Expert Analysis From Bof A

May 16, 2025 -

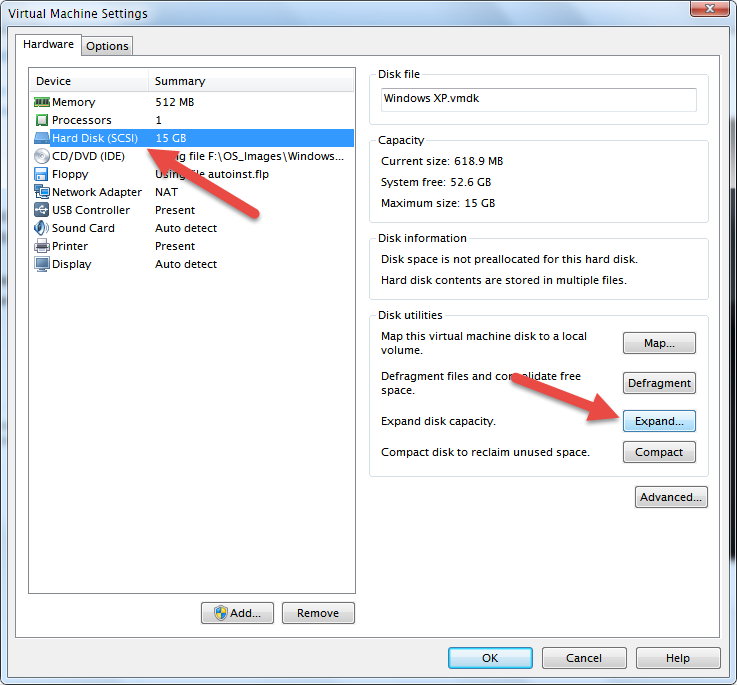

Sharp Increase In V Mware Costs At And T Highlights Broadcoms 1050 Price Hike

May 16, 2025

Sharp Increase In V Mware Costs At And T Highlights Broadcoms 1050 Price Hike

May 16, 2025 -

Hondas Ev Ambitions Slowed 15 Billion Ontario Plant On Hold

May 16, 2025

Hondas Ev Ambitions Slowed 15 Billion Ontario Plant On Hold

May 16, 2025

Latest Posts

-

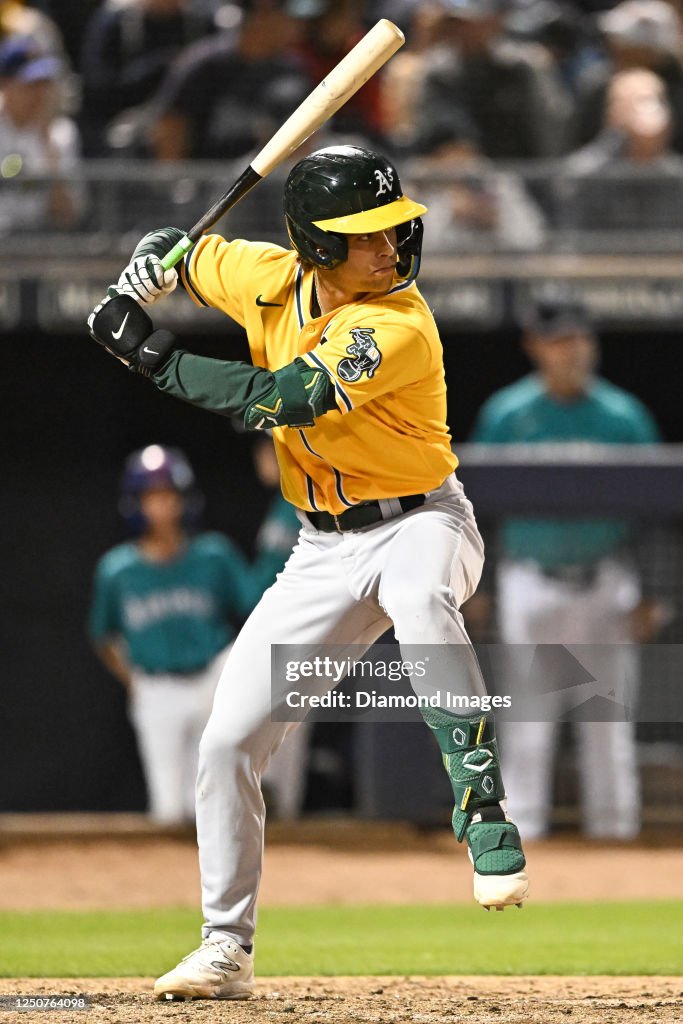

Oakland Athletics Roster News Muncys Debut At Second Base

May 16, 2025

Oakland Athletics Roster News Muncys Debut At Second Base

May 16, 2025 -

Historic 8 0 Defeat For Dodgers Ohtanis Walk Off Home Run

May 16, 2025

Historic 8 0 Defeat For Dodgers Ohtanis Walk Off Home Run

May 16, 2025 -

Cody Poteet Completes Abs Challenge Earns Spring Training Victory

May 16, 2025

Cody Poteet Completes Abs Challenge Earns Spring Training Victory

May 16, 2025 -

Oakland As Lineup Change Muncy Starts At Second

May 16, 2025

Oakland As Lineup Change Muncy Starts At Second

May 16, 2025 -

Chicago Cubs Pitcher Cody Poteet Wins First Spring Training Abs Challenge

May 16, 2025

Chicago Cubs Pitcher Cody Poteet Wins First Spring Training Abs Challenge

May 16, 2025