Document AMF Kering (2025E1021784) - Publication Du 24 Février 2025

Table of Contents

Contenu Principal du Document AMF Kering (2025E1021784)

This section breaks down the core content of the Kering AMF document (2025E1021784), offering a comprehensive overview of its key findings.

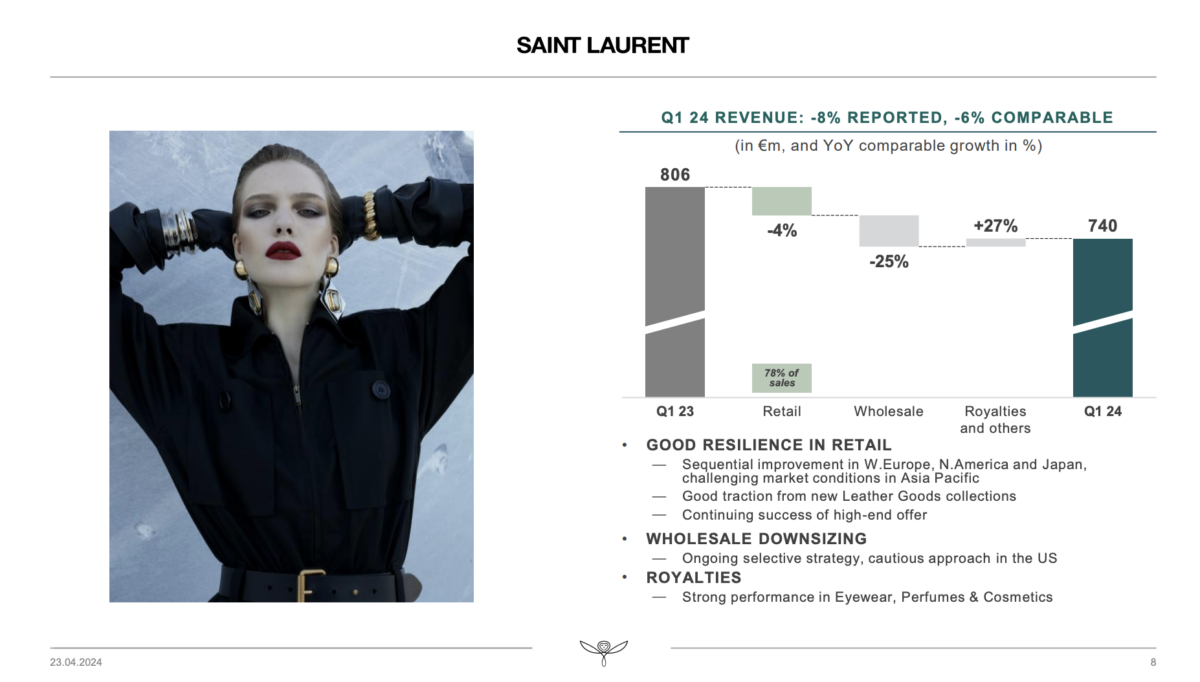

Informations Financières Clés

The financial information presented in the 2025E1021784 document offers a detailed snapshot of Kering's performance. This section analyzes the key financial results, comparing them to previous years and highlighting both strengths and weaknesses.

- Analyse des résultats financiers du groupe Kering: The document likely provides a breakdown of revenue, profits, and expenses across Kering's various luxury brands. Analyzing these figures reveals the overall financial health of the company.

- Points forts et points faibles de la performance financière: Identifying both positive and negative aspects of Kering's financial performance provides a balanced perspective. For example, strong growth in a particular brand could be offset by challenges in another area.

- Comparaison avec les résultats des années précédentes: Comparing the 2025 results to previous years allows for trend analysis, highlighting growth or decline in key performance indicators. This provides valuable context for assessing the company's long-term trajectory.

Bullet points: Chiffres clés de ventes, bénéfice net, marge bénéficiaire, etc.

- Sales: €[Insert Sales Figure from Document] - [Year-on-Year Growth Percentage]%

- Net Income: €[Insert Net Income Figure from Document] - [Year-on-Year Growth Percentage]%

- Operating Margin: [Insert Operating Margin Percentage from Document]%

- Earnings Per Share (EPS): [Insert EPS Figure from Document]

Déclarations Importantes et Annonces

This section focuses on significant announcements and strategic statements made within the AMF filing. These declarations often provide insight into Kering's future plans and direction.

- Présentation des nouvelles stratégies d'entreprise de Kering: The document may outline new strategies aimed at achieving growth, such as expansion into new markets or product categories.

- Développement de nouvelles marques ou acquisitions potentielles: Information regarding the development of new brands or potential acquisitions can indicate Kering's long-term vision and investment priorities. This can also affect the company's market valuation and investor interest.

- Informations concernant la gouvernance d'entreprise: Details concerning corporate governance, including board changes or new initiatives, can influence investor confidence and perception of risk.

Bullet points: Points importants à retenir des déclarations officielles.

- [Insert Key Announcement 1 from the Document]

- [Insert Key Announcement 2 from the Document]

- [Insert Key Announcement 3 from the Document]

Analyse des Risques et Opportunités

A thorough assessment of risks and opportunities is crucial in understanding the overall outlook for Kering. The AMF filing likely addresses these key factors.

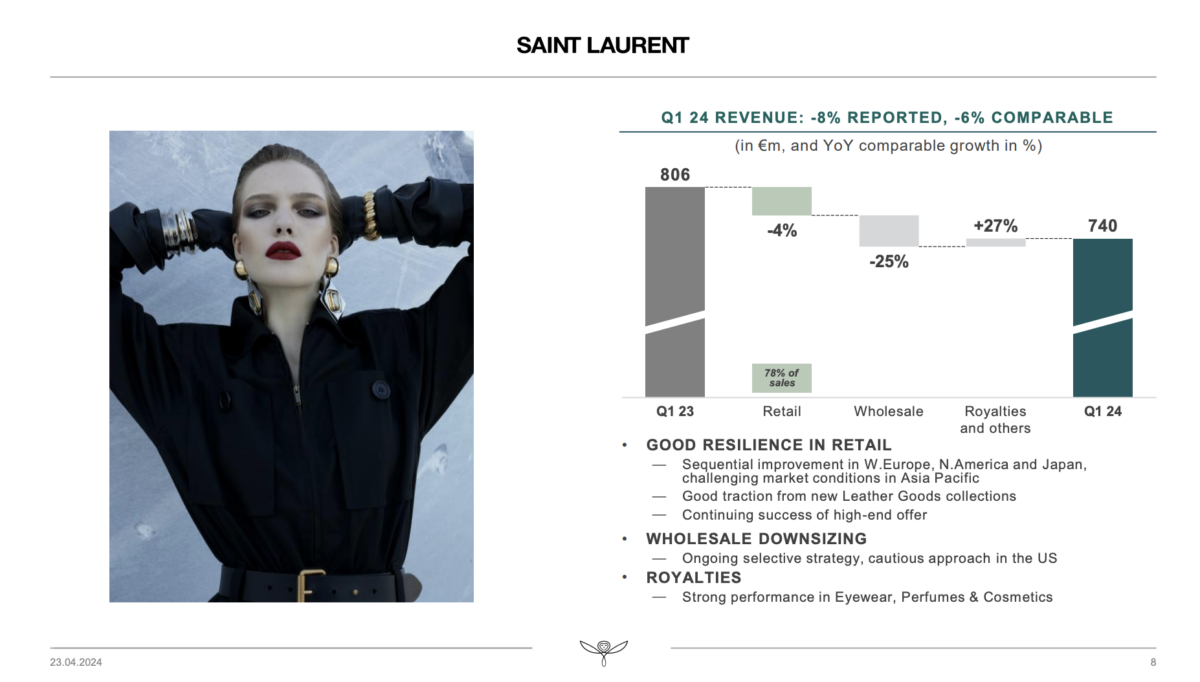

- Identification des principaux risques et défis auxquels Kering est confronté: This section identifies potential threats to Kering's business, such as economic downturns, geopolitical instability, or increased competition.

- Évaluation des opportunités de croissance pour l'entreprise: Identifying potential growth opportunities, like new market penetration or technological advancements, provides a balanced view of Kering's prospects.

- Impact des conditions économiques mondiales sur l'activité de Kering: This section explores how global economic conditions may affect Kering's performance, considering factors such as inflation, currency fluctuations, and consumer spending.

Bullet points: Liste des risques (géographiques, économiques, concurrentiels, etc.) et des opportunités.

- Risks: Geopolitical instability, economic slowdown, currency fluctuations, increased competition.

- Opportunities: Expansion into new markets, development of sustainable practices, technological innovation.

Implications pour les Investisseurs

This section analyzes the implications of the Kering AMF document (2025E1021784) for investors.

Impact sur le Cours de Bourse

The AMF publication is likely to influence Kering's stock price. This section explores the potential impact.

- Analyse de l'influence du document AMF sur la valeur des actions Kering: This involves examining the market reaction to the information disclosed in the report.

- Prévisions concernant l'évolution du cours de bourse à la suite de la publication: Based on the information revealed, predictions about future price movements can be made (with the usual caveats about market unpredictability).

Bullet points: Fluctuations du cours de bourse avant et après la publication.

- [Insert Stock Price Data Before Publication]

- [Insert Stock Price Data After Publication] (Note: This will need to be updated after the actual publication date.)

Recommandations d'Investissement

Based on the analysis, this section offers potential investment recommendations.

- Avis sur la situation financière de Kering suite à l'analyse du document: A considered opinion on Kering's financial health is presented.

- Recommandations pour les investisseurs à court terme et à long terme: Specific advice on investment strategy is provided, considering both short-term and long-term goals.

Bullet points: Acheter, vendre, ou maintenir la position en actions Kering.

- [Investment Recommendation based on analysis – e.g., "Buy" , "Hold", or "Sell"] (Disclaimer: This is for illustrative purposes only and should not be considered financial advice.)

Accès au Document AMF et Ressources Supplémentaires

This section provides links to the official document and additional resources.

Lien vers le Document Officiel

- [Insert direct link to the AMF document 2025E1021784 here once available]

Ressources Additionnelles

- [Insert links to Kering's financial reports and press releases]

- [Insert links to relevant financial analysis from reputable sources]

Conclusion

The AMF Kering document (2025E1021784), published on February 24th, 2025, offers crucial information regarding Kering's financial performance and strategic direction. This analysis highlighted key aspects of the document, its implications for investors, and Kering's future prospects. For a comprehensive understanding of Kering's financial situation, consult the complete AMF document and the additional resources provided above. Stay informed about future AMF publications concerning Kering to make well-informed investment decisions. Remember to always conduct thorough research and consider seeking professional financial advice before making any investment decisions related to Kering or any other company.

Featured Posts

-

Kamala Harris New Responsibilities New Challenges

Apr 30, 2025

Kamala Harris New Responsibilities New Challenges

Apr 30, 2025 -

Police Watchdogs Ofcom Complaint The Chris Kaba Panorama Episode

Apr 30, 2025

Police Watchdogs Ofcom Complaint The Chris Kaba Panorama Episode

Apr 30, 2025 -

Analysis The Surge In Global Military Spending Amidst The Russian Threat

Apr 30, 2025

Analysis The Surge In Global Military Spending Amidst The Russian Threat

Apr 30, 2025 -

Daily Horoscope For April 17 2025 Your Zodiac Signs Predictions

Apr 30, 2025

Daily Horoscope For April 17 2025 Your Zodiac Signs Predictions

Apr 30, 2025 -

Chris Kaba Panorama Police Complaints Body Challenges Bbc To Ofcom

Apr 30, 2025

Chris Kaba Panorama Police Complaints Body Challenges Bbc To Ofcom

Apr 30, 2025