Dollar Rises As Trump's Criticism Of Fed Chair Powell Eases

Table of Contents

Trump's Previous Criticism and its Impact on the Dollar

President Trump's frequent criticism of Jerome Powell and the Federal Reserve's monetary policies created considerable market volatility. His public pronouncements, often delivered via Twitter, frequently targeted Powell's interest rate decisions, accusing him of raising rates too quickly and hindering economic growth. This consistent negative commentary injected uncertainty into the financial markets.

- Examples of specific instances of Trump's criticism: Numerous instances exist where President Trump publicly criticized Powell's handling of interest rates, often linking it to his own re-election prospects. Specific examples, along with dates and relevant quotes, can be found in major news outlets' archives.

- Data showing the negative correlation between Trump's statements and the dollar's performance: Statistical analysis, comparing the timing of Trump's critical remarks with subsequent movements in the US Dollar Index (USDX), would likely reveal a negative correlation. Studies showing this correlation could be cited from reputable financial research firms.

- Expert opinions on the market's response to the criticism: Financial analysts and economists widely commented on the negative impact of Trump’s statements. Many voiced concerns that the President's actions undermined the Fed's independence, a cornerstone of a stable financial system, increasing uncertainty and negatively impacting investor confidence. This lack of confidence directly contributed to decreased demand for the dollar.

The Shift in Tone and its Market Implications

Recently, a noticeable shift in Trump's rhetoric towards Powell has been observed. While the reasons behind this change are multifaceted, they likely involve a confluence of factors including shifting political priorities and a reassessment of the economic landscape. This calmer approach has dramatically improved investor sentiment.

- Specific quotes or actions indicating a change in Trump's stance: While direct quotes might not completely reverse previous criticism, the absence of overt attacks and a more muted tone signals a change. This subtle change can be documented by comparing the frequency and intensity of past and recent pronouncements.

- Analysis of market reactions following the shift in rhetoric: The US Dollar Index (USDX) reacted positively to the reduced uncertainty. Charts and graphs illustrating the correlation between the shift in Trump's rhetoric and the subsequent increase in the dollar's value would provide compelling visual evidence.

- Charts and graphs illustrating the rise in the dollar's value: Visual representations, showing the USDX's increase following the change in Trump's tone, would strengthen the analysis. These charts should clearly label axes and data sources.

Factors Beyond Trump's Statements Influencing the Dollar

While Trump's changing stance played a significant role, other factors contributed to the recent dollar rise. Global economic uncertainty often drives investors towards the dollar as a safe-haven asset. Interest rate differentials between the US and other countries also play a crucial role.

- Explanation of each contributing factor: Global economic uncertainty, coupled with the relative strength of the US economy compared to others, increases demand for US dollars. Interest rate differentials make US assets more attractive to foreign investors.

- Data supporting the influence of these factors: Economic indicators like GDP growth rates, inflation data, and interest rate spreads between the US and other major economies can be used to support this analysis.

- Expert opinions on the interplay of these factors: Economists and financial analysts offer insights into the relative importance of each of these factors and how they interact.

Future Outlook for the US Dollar

Predicting the future trajectory of the dollar is inherently challenging, yet analyzing current trends and potential risks allows for informed speculation. Future Fed policy decisions, coupled with the potential impact of continued trade negotiations, will heavily influence the dollar's performance.

- Possible scenarios for the dollar's future performance: Several scenarios could unfold, depending on various domestic and global factors. These scenarios should be presented along with a probability assessment based on current market conditions.

- Factors that could influence future movements (e.g., trade wars, interest rate changes): Geopolitical events, trade wars, and changes in US monetary policy all significantly impact the dollar's value.

- Expert forecasts on the dollar's future: Incorporating forecasts from reputable economic institutions and financial analysts adds credibility and context.

Conclusion

The recent rise in the dollar's value is a complex phenomenon. While the easing of Trump's criticism of Fed Chair Powell significantly contributed to reduced market uncertainty and a subsequent increase in investor confidence, it’s crucial to acknowledge other factors, including global economic conditions and interest rate differentials. Understanding the interplay of these forces is essential for navigating the ever-evolving forex market.

Call to Action: Stay informed about the latest developments influencing the value of the dollar. Follow our blog for regular updates on the "dollar rises," "Trump's impact on the market," and "Fed Chair Powell's monetary policies." Understanding the dynamics of the US dollar is crucial for informed investment decisions.

Featured Posts

-

Is Google Fis 35 Unlimited Plan Worth It

Apr 24, 2025

Is Google Fis 35 Unlimited Plan Worth It

Apr 24, 2025 -

White House Announces Drop In Illegal Border Crossings Between U S And Canada

Apr 24, 2025

White House Announces Drop In Illegal Border Crossings Between U S And Canada

Apr 24, 2025 -

5 Essential Dos And Don Ts Succeeding In The Private Credit Job Market

Apr 24, 2025

5 Essential Dos And Don Ts Succeeding In The Private Credit Job Market

Apr 24, 2025 -

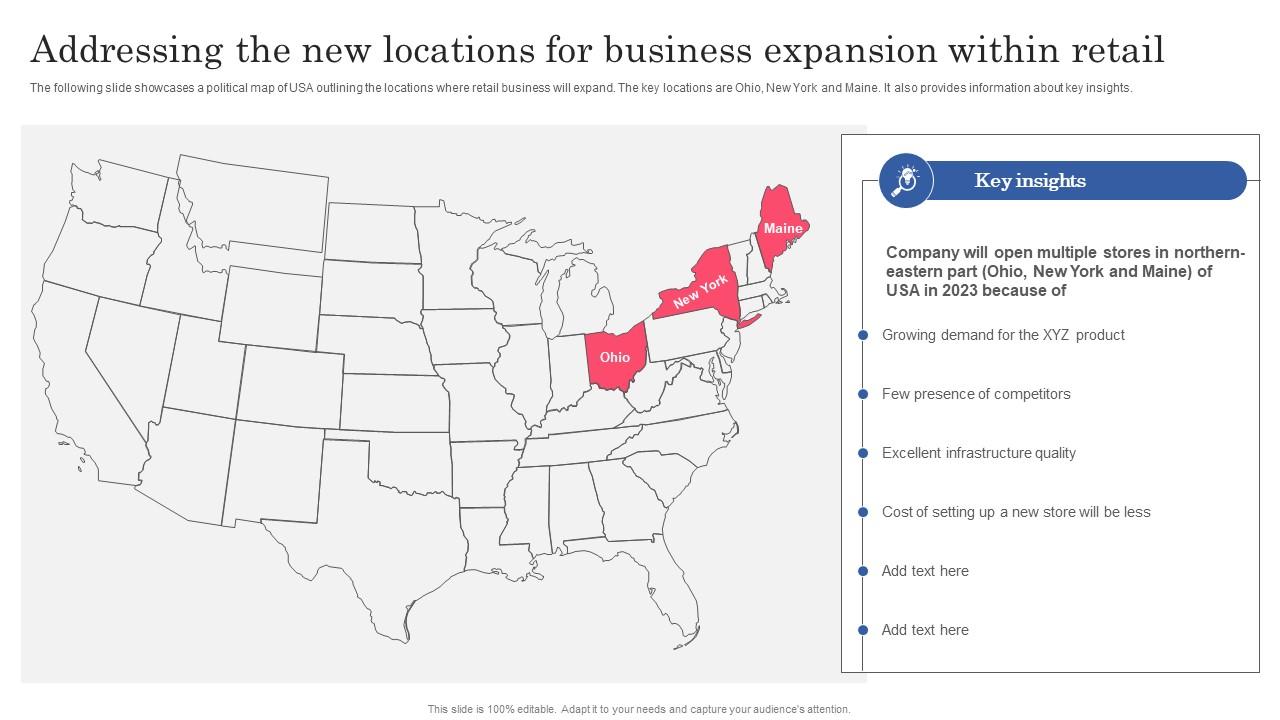

Mapping The Countrys Hottest New Business Locations

Apr 24, 2025

Mapping The Countrys Hottest New Business Locations

Apr 24, 2025 -

The Countrys Emerging Business Hubs A Geographic Analysis

Apr 24, 2025

The Countrys Emerging Business Hubs A Geographic Analysis

Apr 24, 2025

Latest Posts

-

Marjolein Faber Plans Legal Action After Hitler Mustache Photo Shared

May 11, 2025

Marjolein Faber Plans Legal Action After Hitler Mustache Photo Shared

May 11, 2025 -

Legislators Condemn Influx Of Undocumented Migrant Workers

May 11, 2025

Legislators Condemn Influx Of Undocumented Migrant Workers

May 11, 2025 -

Asylum Volunteer Recognition Faber Announces Full Support For Royal Honors

May 11, 2025

Asylum Volunteer Recognition Faber Announces Full Support For Royal Honors

May 11, 2025 -

An In Depth Look At Debbie Elliotts Work

May 11, 2025

An In Depth Look At Debbie Elliotts Work

May 11, 2025 -

Asylum Minister Faber Survives No Confidence Vote

May 11, 2025

Asylum Minister Faber Survives No Confidence Vote

May 11, 2025