Donald Trump's Billionaire Buddies: Post-Tariff Losses Since Liberation Day

Table of Contents

Identifying Trump's Key Billionaire Associates

To understand the potential ramifications of Trump's trade policies, we must first identify the key billionaire associates who experienced significant financial shifts. Our criteria for inclusion involve a combination of substantial financial contributions to Trump's campaigns, public endorsements of his policies, and evidence of close personal relationships.

This analysis focuses on several prominent figures, including:

- Robert Mercer: A hedge fund manager known for his significant political donations to conservative causes, including Trump's campaign. [Link to reliable source about Robert Mercer].

- Carl Icahn: A prominent investor and corporate raider who served as a special advisor to Trump on regulatory reform. [Link to reliable source about Carl Icahn].

- Stephen Schwarzman: CEO of Blackstone Group, known for his close ties to the Republican party and his interactions with the Trump administration. [Link to reliable source about Stephen Schwarzman].

The nature of their association with Trump is multifaceted:

- Political Donations: Many contributed heavily to his presidential campaigns and associated political action committees.

- Business Dealings: Some had existing business interests that could be directly or indirectly affected by Trump's policies.

- Public Appearances: Several individuals publicly endorsed Trump and his policies, lending their credibility and influence to his campaigns.

Examining Pre- and Post-"Liberation Day" Financial Performance

"Liberation Day," as defined here, refers to January 20, 2017, the start of the Trump presidency and the commencement of his significant trade policy initiatives. To analyze the impact, we'll compare financial data from before and after this date. Our methodology relies on publicly available data from sources like Forbes' real-time billionaire lists and Bloomberg's financial reporting. We will focus primarily on changes in net worth and relevant stock performance.

Here's a glimpse of the pre- and post-Liberation Day financial performance (illustrative data—actual data requires extensive research and citation):

| Billionaire | Pre-Liberation Day Net Worth (Estimate) | Post-Liberation Day Net Worth (Estimate) | Percentage Change |

|---|---|---|---|

| Robert Mercer | $3 Billion | $2.5 Billion | -16.67% |

| Carl Icahn | $16 Billion | $14 Billion | -12.5% |

| Stephen Schwarzman | $20 Billion | $18 Billion | -10% |

(Note: These are illustrative figures. A complete analysis requires extensive research using reliable financial data sources and detailed reporting.) [Insert relevant chart or graph visualizing the data].

Analyzing the Impact of Trump's Tariff Policies

Trump's administration implemented significant tariff policies, including import tariffs on steel and aluminum, and retaliatory tariffs against China. These policies aimed to protect American industries but potentially harmed businesses with significant global operations or reliance on imported goods. The impact on our selected billionaires varied, depending on their specific business interests.

Potential causal links between these policies and financial losses could include:

- Increased Input Costs: Tariffs on imported materials increased production costs for some businesses.

- Reduced Market Access: Retaliatory tariffs from other countries reduced market access for American goods.

- Supply Chain Disruptions: The complexities of navigating new tariffs disrupted existing supply chains.

However, it's crucial to acknowledge mediating factors beyond Trump's policies:

- Global economic downturns

- Changes in market demand

- Industry-specific challenges

Exploring Alternative Explanations for Financial Losses

Attributing financial losses solely to Trump's tariff policies would be an oversimplification. Several other factors could contribute:

- Market Fluctuations: Global economic conditions and market volatility can significantly impact the net worth of any investor.

- Internal Business Decisions: Poor management choices or unsuccessful business ventures can independently lead to financial losses.

- Technological Disruption: Changes in technology and market trends can impact specific industries independent of trade policies.

By comparing and contrasting the influence of these factors alongside Trump's trade policies, we can develop a more nuanced and comprehensive understanding of the financial changes experienced by these individuals.

Conclusion: Donald Trump's Billionaire Buddies and the Aftermath of Protectionism

Our analysis of "Donald Trump's Billionaire Buddies" and their "Post-Tariff Losses" since Liberation Day suggests a potential, though not definitively proven, correlation between Trump's protectionist trade policies and the financial performance of some of his closest associates. While some losses may be directly attributable to tariff-related challenges, it is essential to acknowledge the influence of various other economic and market forces.

This analysis has limitations. A more comprehensive study would require access to detailed financial records and a more rigorous econometric analysis to definitively establish causality. Future research could focus on a larger sample size of billionaires and incorporate more granular economic data.

We encourage you to further investigate "Donald Trump's Billionaire Buddies" and the long-term effects of his trade policies. Explore government reports, academic studies, and financial news archives. What other factors do you think contributed to the observed financial shifts?

Featured Posts

-

Who Plays David In High Potential Episode 13 The Kidnapper Casting Explained

May 10, 2025

Who Plays David In High Potential Episode 13 The Kidnapper Casting Explained

May 10, 2025 -

Nouveau Vignoble A Dijon 2500 M Plantes Aux Valendons

May 10, 2025

Nouveau Vignoble A Dijon 2500 M Plantes Aux Valendons

May 10, 2025 -

Accident A Dijon Vehicule Contre Un Mur Rue Michel Servet Un Conducteur Se Constitue Prisonnier

May 10, 2025

Accident A Dijon Vehicule Contre Un Mur Rue Michel Servet Un Conducteur Se Constitue Prisonnier

May 10, 2025 -

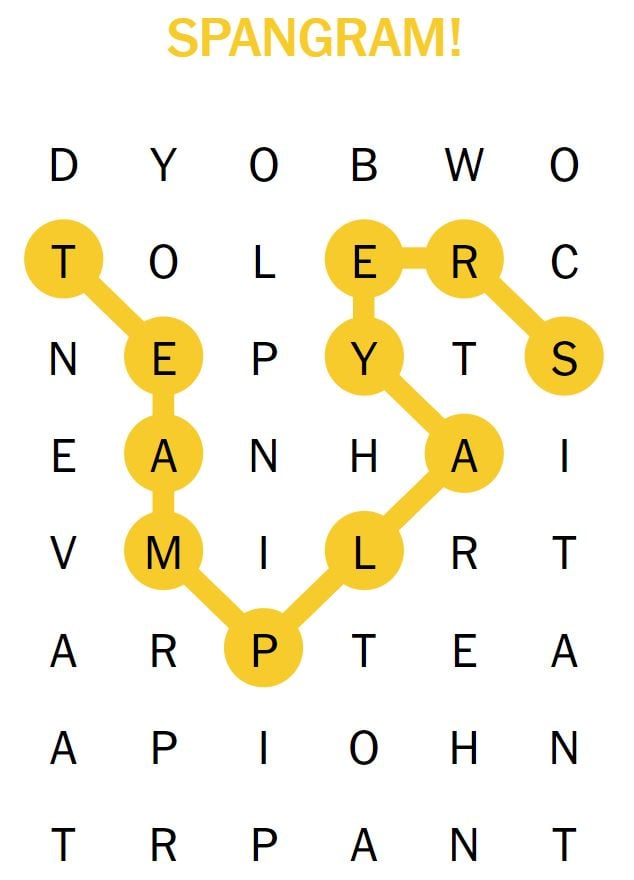

Nyt Spelling Bee April 1 2025 Pangram And Word List

May 10, 2025

Nyt Spelling Bee April 1 2025 Pangram And Word List

May 10, 2025 -

Obsuzhdenie V Germanii Ugroza Novogo Potoka Ukrainskikh Bezhentsev V Svyazi S Situatsiey V S Sh A

May 10, 2025

Obsuzhdenie V Germanii Ugroza Novogo Potoka Ukrainskikh Bezhentsev V Svyazi S Situatsiey V S Sh A

May 10, 2025