Dow Jones & S&P 500: Stock Market Analysis For May 26

Table of Contents

Dow Jones Industrial Average (DJIA) Performance on May 26: Dow Jones Today: A Deep Dive into May 26th's Performance

The Dow Jones Industrial Average experienced a volatile day on May 26th. Let's break down the key performance indicators:

- Opening: [Insert Opening Value]

- Closing: [Insert Closing Value]

- High: [Insert High Value]

- Low: [Insert Low Value]

- Percentage Change from Previous Day: [Insert Percentage Change - e.g., +1.2%]

This positive percentage change reflects a generally bullish sentiment, although the intraday volatility suggests some underlying uncertainty. Analyzing the sector-specific performance reveals further nuances:

- Top Performing Sectors:

- Technology: Strong earnings reports from several tech giants contributed to this sector's success.

- Financials: Positive economic data boosted investor confidence in the financial sector.

- Underperforming Sectors:

- Energy: Concerns about slowing global growth dampened energy stock performance.

- Consumer Staples: Investors rotated out of defensive sectors like consumer staples in favor of growth stocks.

A significant factor impacting the DJIA's movement was [Insert specific news event, e.g., a positive earnings surprise from a major component company like Apple or a significant regulatory announcement]. This news event contributed to [explain how the event impacted the DJIA's movement - e.g., a surge in buying activity or a sell-off]. [Insert chart/graph visualizing the DJIA's performance throughout the day].

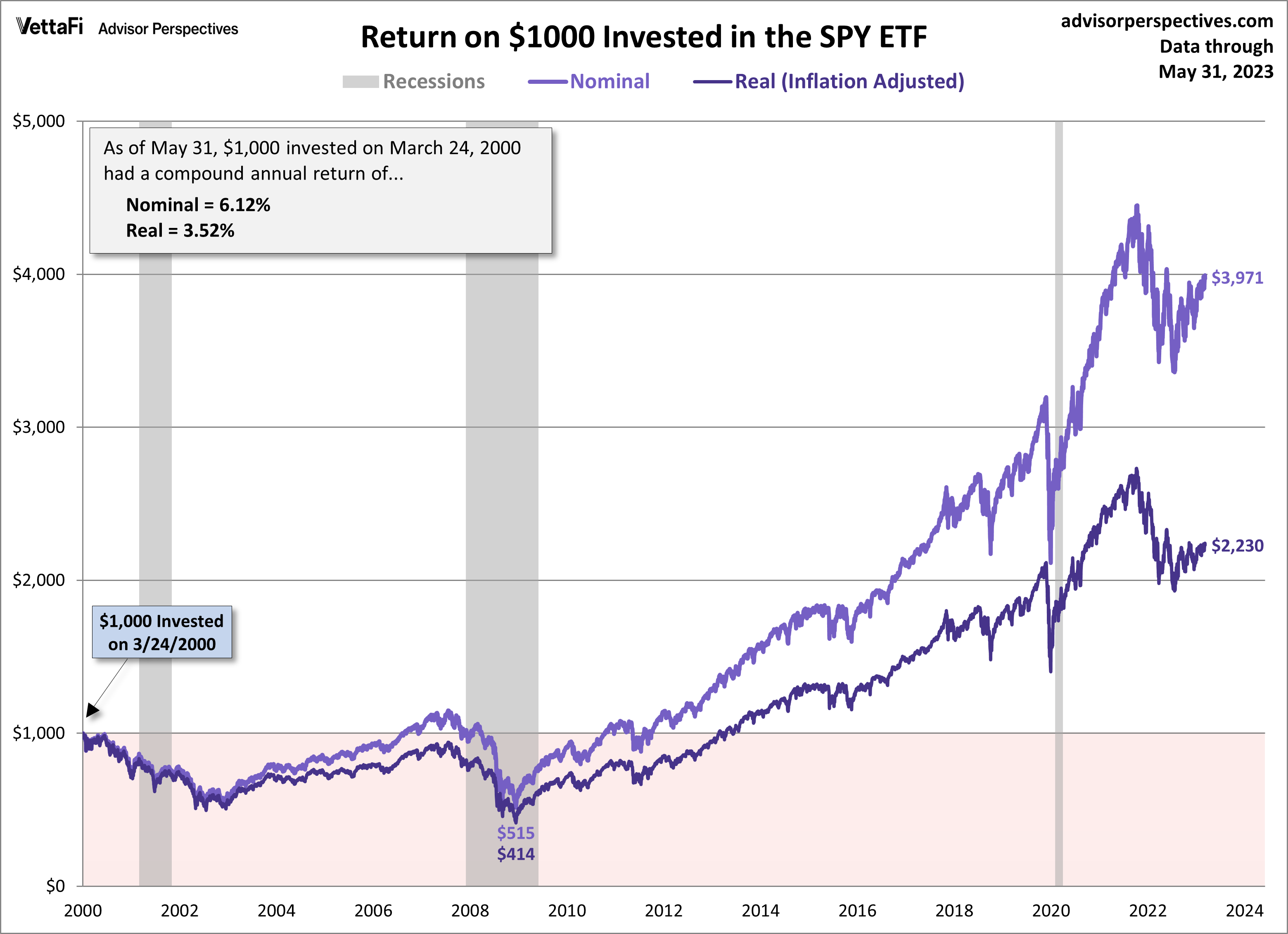

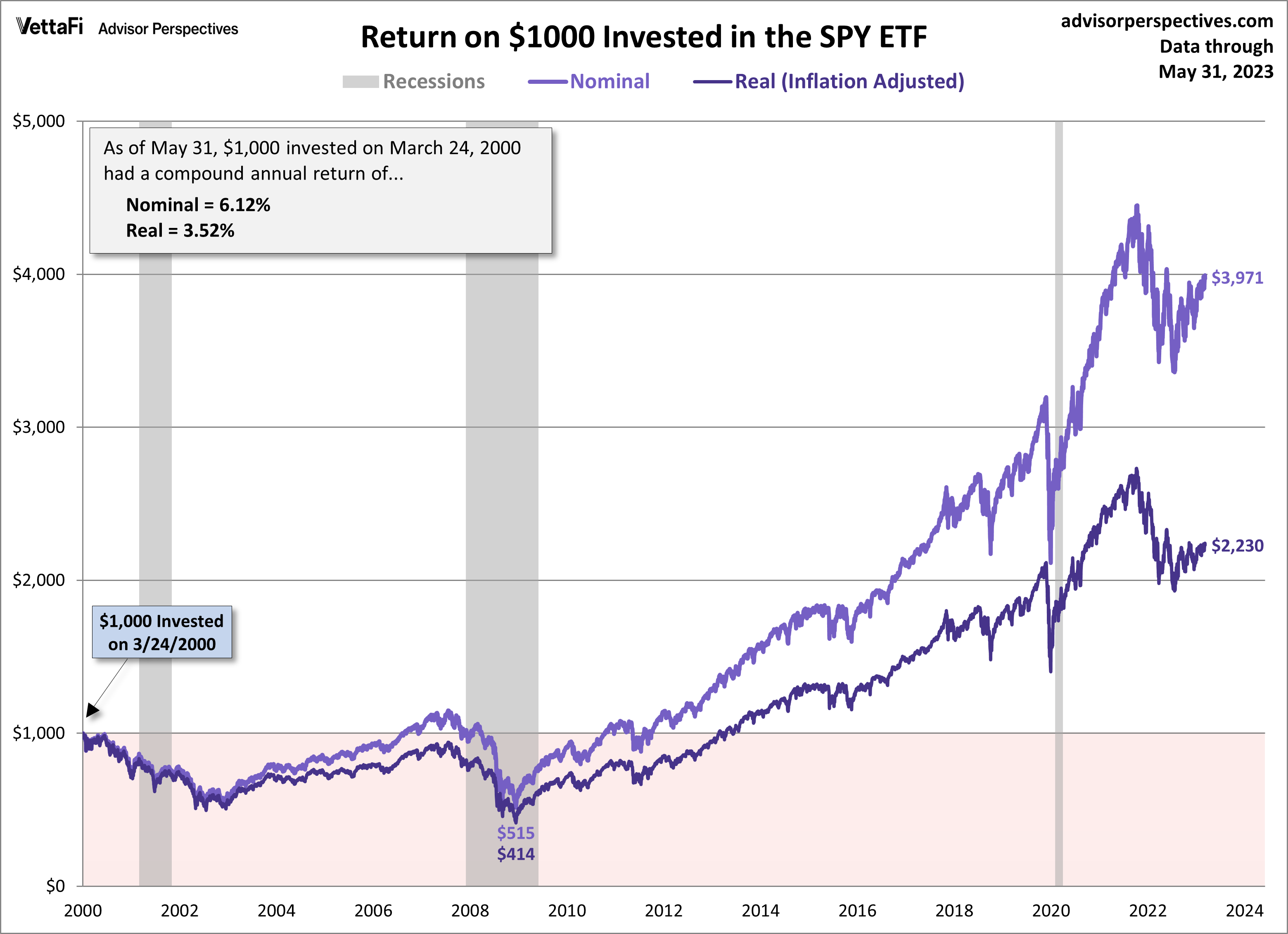

S&P 500 Index Analysis: May 26th Market Trends

The S&P 500, a broader market index, mirrored some of the DJIA's behavior but exhibited distinct characteristics on May 26th.

- Opening: [Insert Opening Value]

- Closing: [Insert Closing Value]

- High: [Insert High Value]

- Low: [Insert Low Value]

- Percentage Change from Previous Day: [Insert Percentage Change - e.g., +0.8%]

While also positive, the S&P 500's percentage change was slightly lower than the DJIA's, indicating a potential divergence in market sentiment. This difference might be attributed to:

- Sectoral Weightings: The S&P 500 has a different weighting of sectors compared to the DJIA, leading to varied responses to market events.

- Underlying Economic Factors: Different sectors within the S&P 500 might have been more or less sensitive to the economic data released on May 26th.

Key factors influencing the S&P 500's movement included:

- The release of strong economic data.

- Ongoing speculation about future interest rate hikes by the Federal Reserve.

- Corporate earnings announcements from key companies within the index.

[Insert chart/graph visualizing the S&P 500's performance throughout the day].

Dow Jones & S&P 500 Correlation: Interpreting the May 26th Data

On May 26th, the Dow Jones and S&P 500 exhibited a [positive/negative] correlation, indicating that the two indices generally moved in the [same/opposite] direction. However, the magnitude of their respective movements differed slightly, suggesting subtle variations in market sentiment across different market segments. This divergence warrants further investigation into specific sector performances and underlying economic drivers. Broad market trends observed on May 26th included increased volatility and a rotation towards growth stocks. While the day ended on a positive note, the underlying uncertainty calls for cautious optimism regarding the immediate future. This implies that investors should maintain diversified portfolios and carefully monitor market developments.

Conclusion: Key Takeaways and Future Market Analysis of the Dow Jones & S&P 500

In summary, both the Dow Jones and S&P 500 showed positive growth on May 26th, although the magnitude of the gains differed slightly. The correlation between the two indices was [positive/negative], but subtle divergences highlight the importance of analyzing individual sectors and economic factors for a comprehensive market understanding. The day’s performance suggests a blend of positive economic sentiment and underlying market anxieties.

Stay informed about future market movements by regularly checking back for our daily Dow Jones and S&P 500 analyses! Subscribe to our newsletter or follow us on social media for up-to-the-minute insights into stock market trends and investment strategies. Understanding the Dow Jones and S&P 500 is crucial for navigating the complexities of the stock market.

Featured Posts

-

The Complete Guide To Studios Apple Tv Release Schedule

May 27, 2025

The Complete Guide To Studios Apple Tv Release Schedule

May 27, 2025 -

Reddit Buzz Nora Fatehis 100 Noras Comment And Its Possible Connection To Rasha Thadani

May 27, 2025

Reddit Buzz Nora Fatehis 100 Noras Comment And Its Possible Connection To Rasha Thadani

May 27, 2025 -

Understanding Yellowstones Magma Reservoir Implications For Future Eruptions

May 27, 2025

Understanding Yellowstones Magma Reservoir Implications For Future Eruptions

May 27, 2025 -

Nora Fatehis Oscar Party Look A Golden Moment

May 27, 2025

Nora Fatehis Oscar Party Look A Golden Moment

May 27, 2025 -

Regularisations De Charges Exorbitantes A Saint Ouen Le Deblocage D Un Fonds D Aide

May 27, 2025

Regularisations De Charges Exorbitantes A Saint Ouen Le Deblocage D Un Fonds D Aide

May 27, 2025

Latest Posts

-

Hujan Lebat Dan Petir Update Prakiraan Cuaca Jawa Timur 29 Maret

May 29, 2025

Hujan Lebat Dan Petir Update Prakiraan Cuaca Jawa Timur 29 Maret

May 29, 2025 -

Waspada Hujan Petir Di Jawa Timur Prakiraan Cuaca 29 Maret 2024

May 29, 2025

Waspada Hujan Petir Di Jawa Timur Prakiraan Cuaca 29 Maret 2024

May 29, 2025 -

Info Cuaca Jawa Timur Hujan Di Beberapa Wilayah 24 3

May 29, 2025

Info Cuaca Jawa Timur Hujan Di Beberapa Wilayah 24 3

May 29, 2025 -

Cuaca Jawa Timur Hari Ini Dan Besok 24 Maret Peringatan Hujan

May 29, 2025

Cuaca Jawa Timur Hari Ini Dan Besok 24 Maret Peringatan Hujan

May 29, 2025 -

Prediksi Cuaca Besok 24 Maret 2024 Di Jawa Timur Waspada Hujan

May 29, 2025

Prediksi Cuaca Besok 24 Maret 2024 Di Jawa Timur Waspada Hujan

May 29, 2025