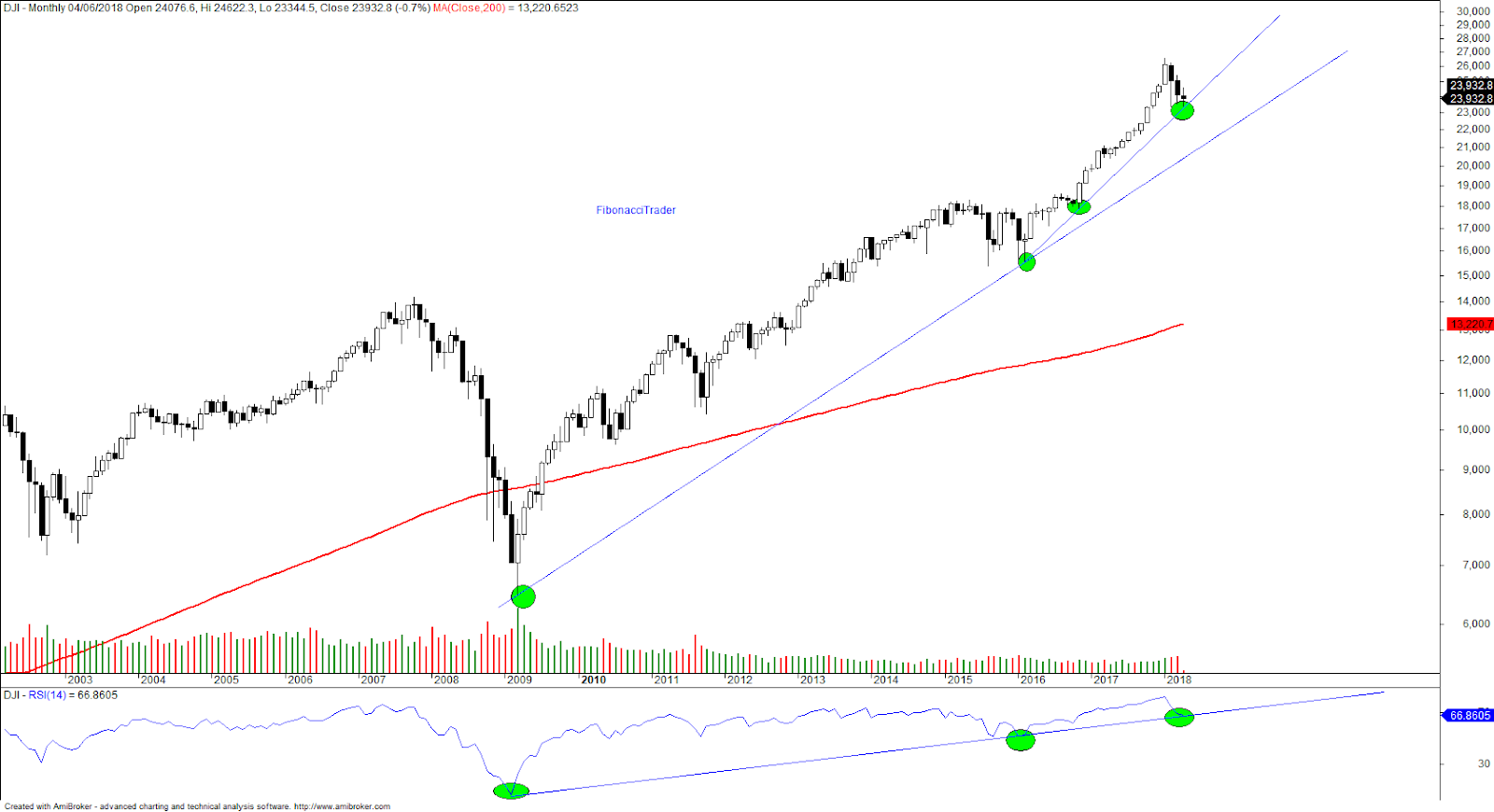

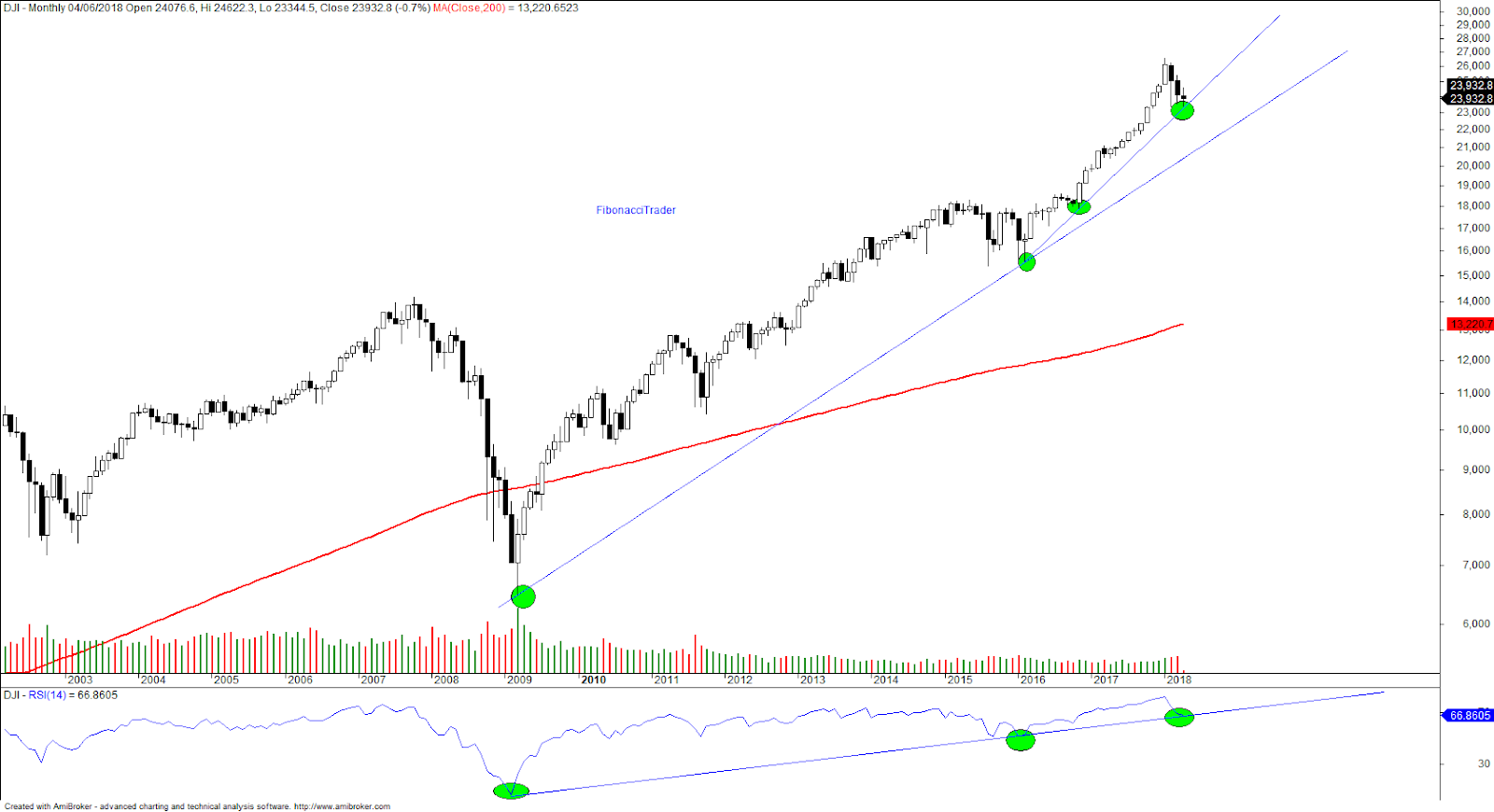

Dow Jones' Cautious Uptrend Continues: Analysis Of Recent PMI Data

Table of Contents

Recent PMI Data and its Significance

The Purchasing Managers' Index (PMI) is a leading economic indicator that tracks the activity levels of purchasing managers in the manufacturing and services sectors. It's a crucial barometer of economic health, providing valuable insights into the direction of overall economic growth. A PMI above 50 generally signals expansion, while a reading below 50 indicates contraction.

-

Latest PMI Figures: The most recent data reveals a mixed picture. The Manufacturing PMI registered [insert latest Manufacturing PMI data and source], indicating [expansion/contraction]. Conversely, the Services PMI showed [insert latest Services PMI data and source], suggesting [expansion/contraction].

-

Implications for Economic Growth: The divergence between Manufacturing and Services PMI suggests [explain the overall economic outlook based on the combined data – e.g., a slowing but still positive growth]. This nuanced picture requires careful consideration when analyzing its impact on the Dow Jones.

-

Discrepancies and their Impact: The discrepancy between the Manufacturing and Services PMI highlights the uneven nature of the current economic recovery. [Explain the implications of this discrepancy for specific sectors within the Dow Jones]. For example, a weaker manufacturing PMI could negatively impact industrial stocks within the DJIA.

[Insert relevant chart or graph visually representing the PMI data. Clearly label the axes and source the data.]

Impact of PMI on Dow Jones Performance

While the PMI doesn't directly dictate the Dow Jones' daily movements, there's a demonstrable correlation between the two. A consistently strong PMI generally supports a positive outlook, influencing investor confidence and potentially driving the Dow Jones upwards. However, the relationship isn't always linear.

-

Factors Beyond PMI: Numerous other factors influence the Dow Jones, including geopolitical events (e.g., the war in Ukraine), interest rate hikes by the Federal Reserve, and persistent inflationary pressures. These factors can sometimes overshadow the impact of PMI data.

-

Dow Jones Component Performance: The performance of individual Dow Jones components often reflects the sectoral trends indicated by the PMI. For instance, a strong Services PMI might positively impact consumer discretionary stocks, while a weak Manufacturing PMI could negatively affect industrial giants within the index.

-

Positive and Negative Impacts:

- Positive Impacts: Strong PMI data generally boosts investor confidence, leading to increased investment and potentially higher stock prices across the board. Sectors directly linked to manufacturing and services often see the most significant gains.

- Negative Impacts: Weak PMI data can trigger sell-offs, especially if it signals a broader economic slowdown. Sectors sensitive to economic downturns are often hit the hardest.

Analyzing the "Cautious Uptrend" – Factors Contributing to Slow Growth

The Dow Jones' cautious uptrend reflects a complex interplay of economic forces. While positive economic indicators like the PMI suggest growth, several factors temper this progress.

-

Persistent Inflation: High inflation erodes purchasing power and increases uncertainty, leading to cautious investor behavior and potentially hindering significant market rallies.

-

Supply Chain Disruptions: Ongoing supply chain issues continue to constrain economic activity and increase input costs for businesses, affecting corporate profitability and investor sentiment.

-

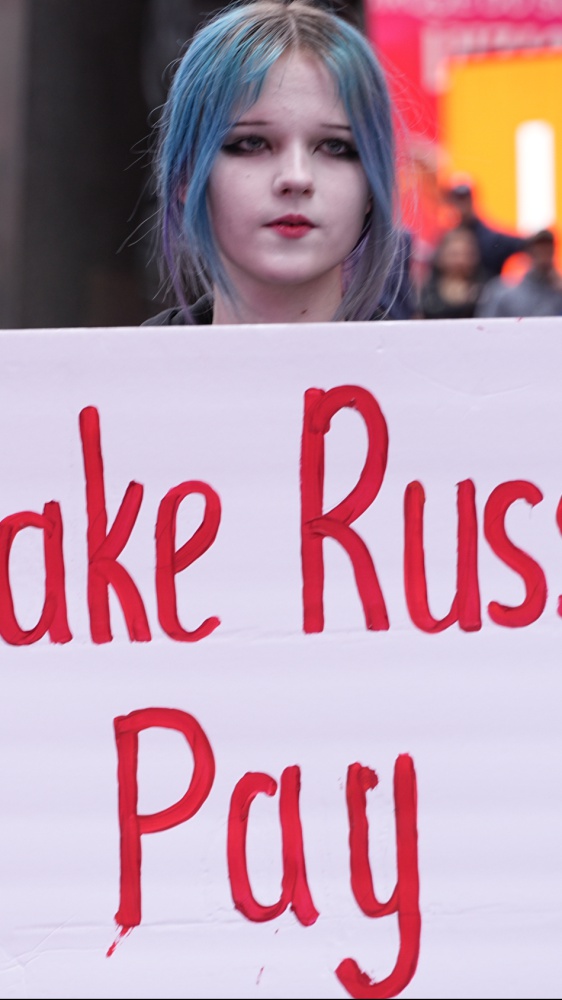

Geopolitical Uncertainty: Geopolitical risks, such as the ongoing conflict in Ukraine and rising tensions in other regions, inject uncertainty into the market, impacting investor confidence and driving volatility.

-

Federal Reserve Interest Rate Decisions: The Federal Reserve's interest rate decisions play a critical role. While rate hikes aim to curb inflation, they can also slow economic growth, impacting corporate earnings and investor sentiment.

-

Key Challenges and Opportunities:

- Challenges: Inflation, supply chain bottlenecks, and geopolitical instability represent significant headwinds.

- Opportunities: Sectors adapting to the changing economic landscape, such as those focusing on sustainable practices or technological innovation, may present attractive investment opportunities.

Investment Strategies in Light of Current Data

Given the Dow Jones' cautious uptrend and the mixed signals from the PMI data, a diversified and carefully managed investment strategy is crucial.

-

Diversification: Spreading investments across different asset classes (stocks, bonds, real estate) and sectors mitigates risk and improves portfolio resilience.

-

Risk Management: Thorough risk assessment and appropriate risk tolerance are paramount. Investors should consider their risk appetite and adjust their portfolios accordingly.

-

Suitable Asset Classes: Considering the current economic climate, a balanced portfolio incorporating both growth and defensive assets might be appropriate. Defensive sectors, such as utilities and consumer staples, might offer some stability in a period of uncertainty.

-

Key Recommendations:

- Monitor PMI Data: Regularly review PMI reports and other key economic indicators to gauge the overall economic health and make informed investment decisions.

- Sectoral Analysis: Focus on sectors that are showing resilience despite the challenges.

- Diversify Your Portfolio: Spread investments across multiple assets and sectors to mitigate risk.

- Rebalance Regularly: Rebalance your portfolio periodically to maintain your desired asset allocation.

Conclusion

The Dow Jones' cautious uptrend reflects a complex economic environment. While recent PMI data provides some positive signs, persistent inflation, supply chain issues, and geopolitical risks continue to temper growth. Understanding the interplay between the PMI and the Dow Jones' performance, along with other influential factors, is crucial for effective investment decision-making. Investors should adopt a diversified strategy, focusing on risk management and monitoring key economic indicators like the PMI. Stay informed about the latest economic data and its impact on the Dow Jones. Regularly monitor the PMI and other crucial indicators to make informed decisions about your investment strategy. Understanding the nuances of the Dow Jones' cautious uptrend and its connection to PMI data can give you an edge in today's dynamic market. Continue to analyze the Dow Jones and PMI reports for optimal investment success.

Featured Posts

-

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Its Net Asset Value

May 25, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Its Net Asset Value

May 25, 2025 -

Porsche 356 Dari Zuffenhausen Sebuah Penjelajahan Sejarah Di Jerman

May 25, 2025

Porsche 356 Dari Zuffenhausen Sebuah Penjelajahan Sejarah Di Jerman

May 25, 2025 -

Memorial Day 2025 Air Travel Peak Days And How To Find Cheaper Flights

May 25, 2025

Memorial Day 2025 Air Travel Peak Days And How To Find Cheaper Flights

May 25, 2025 -

Trillery I Pavel I Vzglyad Fedora Lavrova Na Tyagu K Ostrym Oschuscheniyam

May 25, 2025

Trillery I Pavel I Vzglyad Fedora Lavrova Na Tyagu K Ostrym Oschuscheniyam

May 25, 2025 -

Paris Faces Financial Challenges Impact Of Luxury Goods Market Downturn March 7 2025

May 25, 2025

Paris Faces Financial Challenges Impact Of Luxury Goods Market Downturn March 7 2025

May 25, 2025

Latest Posts

-

Amsterdam City Hall Faces Lawsuit Tik Tok Influx Overwhelms Local Snack Bar

May 25, 2025

Amsterdam City Hall Faces Lawsuit Tik Tok Influx Overwhelms Local Snack Bar

May 25, 2025 -

Minacce Di Ritorsine Senza Limiti La Ue Risponde Ai Nuovi Dazi

May 25, 2025

Minacce Di Ritorsine Senza Limiti La Ue Risponde Ai Nuovi Dazi

May 25, 2025 -

Dazi Ue Le Borse Crollano La Ue Promette Una Risposta Decisa

May 25, 2025

Dazi Ue Le Borse Crollano La Ue Promette Una Risposta Decisa

May 25, 2025 -

La Caduta Delle Borse In Seguito Ai Dazi Ue Analisi E Previsioni

May 25, 2025

La Caduta Delle Borse In Seguito Ai Dazi Ue Analisi E Previsioni

May 25, 2025 -

Crisi Dazi Ue Impatto Sulle Borse E Possibili Reazioni

May 25, 2025

Crisi Dazi Ue Impatto Sulle Borse E Possibili Reazioni

May 25, 2025