Dow Jones Index: Cautious Optimism Following Strong PMI Report

Table of Contents

The Dow Jones Industrial Average (DJIA) experienced a surge in trading today, fueled by a surprisingly strong Purchasing Managers' Index (PMI) report. While the market shows cautious optimism, several factors suggest a more nuanced outlook for the Dow Jones Index in the coming weeks. This article will delve into the details of the PMI report, its impact on the Dow Jones, and what investors should consider moving forward. We will analyze the market's reaction and explore the potential implications for long-term investment strategies related to the Dow Jones Index.

The Strong PMI Report: A Detailed Look

The Purchasing Managers' Index (PMI) is a key economic indicator that tracks the activity levels of purchasing managers in the manufacturing and services sectors. A PMI reading above 50 generally signals expansion, while a reading below 50 indicates contraction. Today's report revealed a surprisingly robust PMI number of 55.5, significantly higher than the expected 53.0 and the previous month's 52.2. This signifies a strong expansion in both manufacturing and services.

- Specific PMI numbers and comparison to previous months/years: The 55.5 reading represents a considerable increase from last month's 52.2 and surpasses the average PMI for the past year. This strong growth hasn't been seen in several quarters, indicating a positive shift in the economic landscape.

- Impact on manufacturing and services sectors: Both sectors contributed to the higher-than-expected PMI. Manufacturing saw a particular surge, fueled by increased new orders and production output. The services sector also showed robust growth, suggesting a healthy consumer spending environment.

- Interpretation of the data and its overall economic health indication: The robust PMI data suggests a healthy and expanding US economy. This positive economic outlook often translates into increased investor confidence and potentially higher stock prices.

- Mention any unexpected surges or dips within specific sectors: While overall positive, the report indicated a slight dip in the construction sector, a factor that needs to be considered when assessing the complete picture.

Dow Jones Index Response to the PMI Data

The Dow Jones Index responded immediately to the positive PMI report with a noticeable upward swing. Following the release, the DJIA saw an increase of approximately 1.5%, showcasing a strong positive reaction from investors. This surge indicates a strong level of confidence in the economic data and its implications for corporate profits.

- Percentage increase/decrease in the Dow Jones immediately following the PMI report release: The 1.5% increase reflects a significant market response to the positive news. This signifies investor confidence and the positive impact of the PMI report on expectations for future growth.

- Mention any specific companies that performed exceptionally well or poorly: Companies in the manufacturing and consumer discretionary sectors showed particularly strong performance following the report's release, reflecting the PMI's impact on these industry sectors.

- Analyze the trading volume to show the intensity of the market reaction: The increased trading volume further underlines the market's strong reaction, indicating high investor participation driven by the PMI data.

- Discuss the overall market sentiment (bullish or bearish) after the initial spike: Following the initial surge, market sentiment remained predominantly bullish although investors remain cautious due to other market factors.

Factors Contributing to Cautious Optimism

Despite the positive PMI report, cautious optimism prevails. Several factors temper the enthusiasm and suggest a more nuanced outlook for the Dow Jones Index.

- Ongoing geopolitical tensions and their potential market impact: The ongoing conflict in Ukraine and rising tensions in other regions create significant uncertainty, potentially impacting global supply chains and investor sentiment. Geopolitical risks are major factors affecting the Dow Jones Index's trajectory.

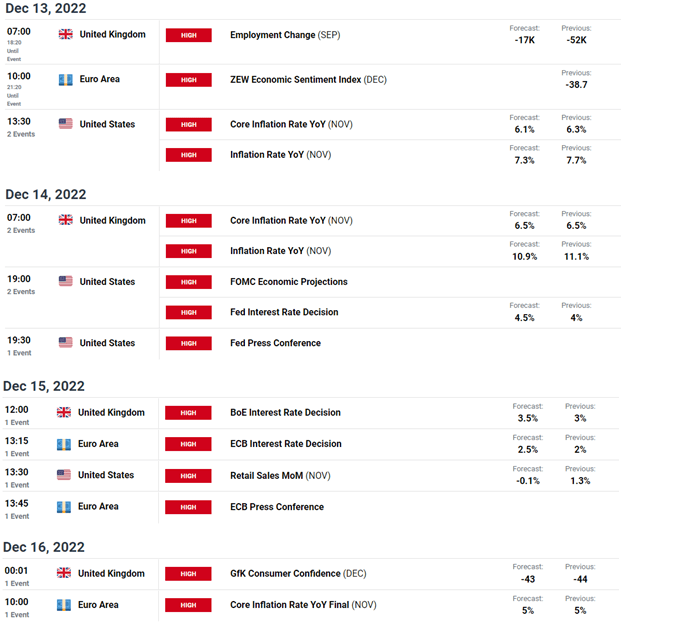

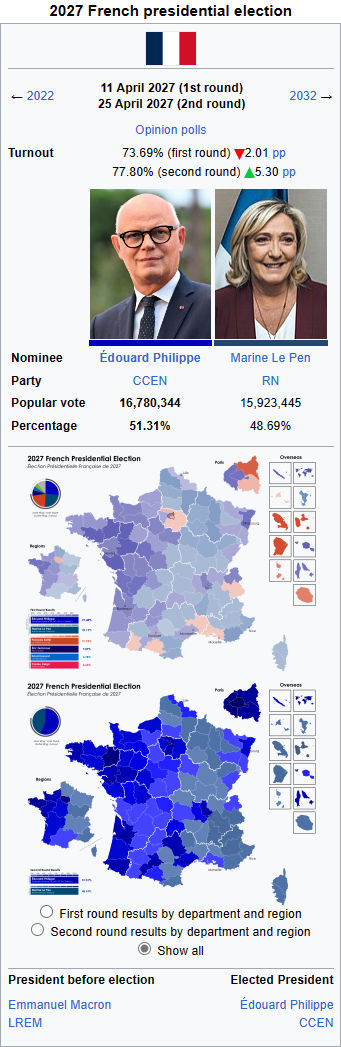

- Inflation rates and the Federal Reserve's actions: Persistent inflation remains a concern, prompting the Federal Reserve to continue considering interest rate hikes. These hikes could dampen economic growth and impact corporate earnings, counteracting the positive influence of the strong PMI.

- Potential interest rate hikes and their effect on business investments: Higher interest rates increase borrowing costs for businesses, potentially slowing down investment and economic expansion. This can affect future growth, creating uncertainty for the Dow Jones.

- Other potential economic headwinds affecting investor confidence: Other factors such as potential energy price shocks and supply chain disruptions continue to pose challenges and contribute to a more cautious outlook for investors analyzing the Dow Jones Index.

Analyzing Long-Term Implications for the Dow Jones Index

The strong PMI report provides a positive short-term outlook for the Dow Jones Index. However, the long-term implications depend heavily on how the various economic headwinds evolve.

- Predictions for the Dow Jones Index in the short and long term: While a short-term upward trend is likely, the long-term outlook hinges on successfully managing inflation and navigating geopolitical uncertainties. The Dow Jones could see further gains, but sustained growth will depend on mitigating these risks.

- Investment strategies for different risk tolerances: Investors with a higher risk tolerance might consider maintaining or increasing their exposure to the market. Conservative investors may prefer a more cautious approach, possibly diversifying their portfolios to reduce risk.

- Recommendations for investors based on the current market conditions: Close monitoring of economic indicators, geopolitical events, and Federal Reserve actions is crucial. Adjusting investment strategies based on these factors is essential for navigating the current market environment and achieving long-term success with Dow Jones Index investments.

Conclusion

The strong PMI report provided a significant boost to the Dow Jones Index, generating initial excitement. However, cautious optimism prevails due to various external factors that could impact future performance. Investors need to carefully assess the broader economic landscape and adjust their strategies accordingly.

Call to Action: Stay informed about the Dow Jones Index and related market indicators. Regularly monitor economic news and analyses to make informed investment decisions. Understanding the fluctuations of the Dow Jones Index is key to successful investing. Continue to follow our updates for further insights into the Dow Jones Index and market trends.

Featured Posts

-

2026 Porsche Cayenne Ev Spy Shots Design Details Unveiled

May 24, 2025

2026 Porsche Cayenne Ev Spy Shots Design Details Unveiled

May 24, 2025 -

She Still Waiting By The Phone My Experience

May 24, 2025

She Still Waiting By The Phone My Experience

May 24, 2025 -

Amundi Msci World Ex Us Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025

Amundi Msci World Ex Us Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025 -

Three Day Slump Amsterdam Stock Exchange Faces Significant Losses

May 24, 2025

Three Day Slump Amsterdam Stock Exchange Faces Significant Losses

May 24, 2025 -

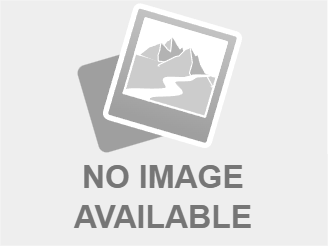

French Presidential Election 2027 Bardellas Path To Power

May 24, 2025

French Presidential Election 2027 Bardellas Path To Power

May 24, 2025

Latest Posts

-

Sean Penns Support For Woody Allen A Me Too Blind Spot

May 24, 2025

Sean Penns Support For Woody Allen A Me Too Blind Spot

May 24, 2025 -

Michael Caine Recalls Awkward Mia Farrow Sex Scene Bloody Hell

May 24, 2025

Michael Caine Recalls Awkward Mia Farrow Sex Scene Bloody Hell

May 24, 2025 -

Will Ronan Farrow Orchestrate Mia Farrows Entertainment Industry Return

May 24, 2025

Will Ronan Farrow Orchestrate Mia Farrows Entertainment Industry Return

May 24, 2025 -

Mia Farrows Comeback Is Ronan Farrow The Key

May 24, 2025

Mia Farrows Comeback Is Ronan Farrow The Key

May 24, 2025 -

Past Florida Film Festival Guests Mia Farrow Christina Ricci And Other Notable Stars

May 24, 2025

Past Florida Film Festival Guests Mia Farrow Christina Ricci And Other Notable Stars

May 24, 2025