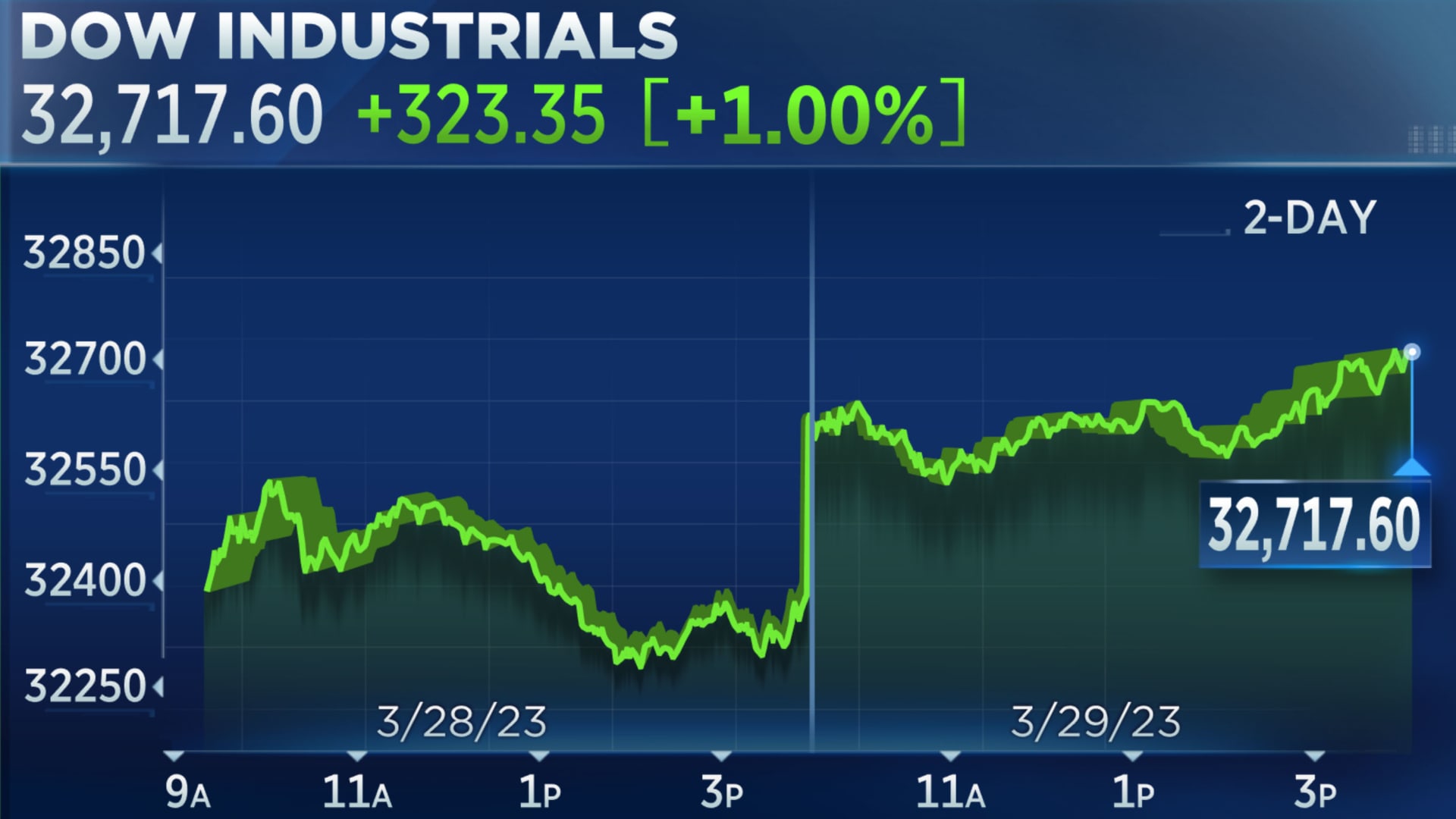

Dow Rallies 1000 Points: Stock Market Update & Analysis

Table of Contents

Understanding the 1000-Point Dow Rally

This unprecedented 1000-point rally in the Dow Jones Industrial Average occurred on [Insert Date], marking a significant shift in market sentiment. While the exact timeframe of the surge needs to be specified (e.g., a single day, a few days), the sheer magnitude of the increase is noteworthy. For instance, let's assume the Dow opened at [Insert Opening Value] and closed at [Insert Closing Value], representing a percentage increase of [Insert Percentage Change]. This dramatic movement warrants a deep dive into its contributing factors. The rally wasn't uniform across all sectors; certain industries experienced significantly more substantial gains. For example, the technology sector, fueled by [mention specific tech company performance], saw a considerable increase, alongside strong performances in the energy and financial sectors.

- Specific stocks driving the rally: [List specific examples, e.g., Apple, Microsoft, ExxonMobil, etc., and briefly explain their contribution].

- Significant news events: [Mention any relevant news events, e.g., positive economic data releases, announcements from the Federal Reserve, geopolitical developments, etc.].

Analyzing the Factors Behind the Rally

Several interconnected factors likely contributed to this remarkable Dow rally. Understanding these nuances is crucial for informed investment decisions.

- Positive Economic Indicators: Strong employment numbers, exceeding expectations, often signal a healthy economy, boosting investor confidence. Similarly, positive GDP growth reinforces this positive outlook.

- Monetary Policy Shifts: Changes in interest rates implemented by the Federal Reserve can significantly influence market behavior. Lower interest rates, for example, often stimulate borrowing and investment, contributing to market rallies.

- Geopolitical Developments: Easing of global tensions or positive diplomatic resolutions can significantly impact investor sentiment, leading to increased market activity and higher valuations.

- Exceeding Earnings Expectations: When major corporations release better-than-expected earnings reports, it boosts investor confidence in the overall market's health and potential for future growth.

- Increased Investor Sentiment: A shift in overall investor sentiment, from pessimism to optimism, can trigger significant market movements, as investors become more willing to buy and hold assets.

[Include a relevant chart or graph here visually representing some of the above data, if possible.]

Implications for Investors: Navigating the Post-Rally Market

The 1000-point Dow rally presents both opportunities and challenges for investors. The long-term effects remain to be seen, but understanding the current landscape is vital for making sound investment choices. Should investors buy, sell, or hold? The answer depends on individual risk tolerance and investment goals.

- Risk Mitigation Strategies: In a volatile market, diversification is key. Spreading investments across different asset classes (stocks, bonds, real estate, etc.) helps reduce the impact of market fluctuations on your portfolio.

- Portfolio Diversification: Consider diversifying geographically, investing in both domestic and international markets, to mitigate risk further. Sector diversification, avoiding over-exposure to any single industry, is also crucial.

- Long-Term vs. Short-Term Strategies: A long-term investment horizon generally allows for weathering short-term market corrections. Short-term trading, while potentially lucrative, carries significantly higher risk.

Dow Rally: A Look Ahead – Future Market Predictions & Trends

Predicting future market performance is inherently challenging, yet analyzing current trends and potential risks is essential for informed decision-making. While the 1000-point Dow rally offers a positive short-term outlook, several factors could influence future performance.

-

Inflationary Pressures: High inflation can erode purchasing power and potentially dampen economic growth, impacting market performance.

-

Supply Chain Disruptions: Ongoing supply chain issues can constrain economic activity and increase uncertainty in the market.

-

Geopolitical Instability: Geopolitical events remain a significant source of uncertainty, capable of triggering market volatility.

-

Potential Catalysts for Further Growth: [Mention potential positive factors such as continued economic growth, technological advancements, or positive regulatory changes].

-

Key Economic Indicators to Watch: [List key indicators like inflation rates, unemployment figures, consumer confidence indices, etc.].

-

Expert Opinions: [Cite reputable sources and their forecasts, acknowledging that predictions are not guarantees].

Conclusion: The 1000-Point Dow Rally – What Now?

The 1000-point Dow rally, driven by a confluence of positive economic indicators, policy shifts, and investor sentiment, presents a complex picture for investors. While the short-term outlook might seem positive, understanding the potential risks and long-term implications is crucial. Stay updated on Dow Jones fluctuations and remember that informed investment decisions require a careful assessment of market trends and personal risk tolerance. Learn more about navigating stock market rallies and develop a robust investment strategy to capitalize on Dow Jones opportunities. Consult with a financial advisor before making any significant investment decisions.

Featured Posts

-

Upcoming Bold And The Beautiful Liams Promise Hopes Crisis And Lunas Rising Stakes

Apr 24, 2025

Upcoming Bold And The Beautiful Liams Promise Hopes Crisis And Lunas Rising Stakes

Apr 24, 2025 -

Nbas Investigation Of Ja Morant Timeline And Potential Consequences

Apr 24, 2025

Nbas Investigation Of Ja Morant Timeline And Potential Consequences

Apr 24, 2025 -

William Watson Scrutinizing The Liberal Platform Before You Vote

Apr 24, 2025

William Watson Scrutinizing The Liberal Platform Before You Vote

Apr 24, 2025 -

Selling Sunset Star Accuses Landlords Of Price Gouging Amid La Fires

Apr 24, 2025

Selling Sunset Star Accuses Landlords Of Price Gouging Amid La Fires

Apr 24, 2025 -

Sophie Nyweide Child Actor In Mammoth And Noah Dies At 24

Apr 24, 2025

Sophie Nyweide Child Actor In Mammoth And Noah Dies At 24

Apr 24, 2025

Latest Posts

-

The Conor Mc Gregor Fox News Interviews What To Expect

May 12, 2025

The Conor Mc Gregor Fox News Interviews What To Expect

May 12, 2025 -

Fox News And Conor Mc Gregor A Complex Relationship

May 12, 2025

Fox News And Conor Mc Gregor A Complex Relationship

May 12, 2025 -

Conor Mc Gregor On Fox News Controversies And Headlines

May 12, 2025

Conor Mc Gregor On Fox News Controversies And Headlines

May 12, 2025 -

Conor Mc Gregors Latest Fox News Appearance A Critical Analysis

May 12, 2025

Conor Mc Gregors Latest Fox News Appearance A Critical Analysis

May 12, 2025 -

Nba Predictions Cavaliers Vs Knicks Odds And Winning Picks February 21

May 12, 2025

Nba Predictions Cavaliers Vs Knicks Odds And Winning Picks February 21

May 12, 2025