Dragon Den: Unexpected Twist As Entrepreneur Snubs Two Offers

Table of Contents

The Entrepreneur's Bold Pitch and Innovative Business Idea

Anya Sharma's EcoChic presented a compelling vision for the future of fashion. Her business model focuses on creating high-end, sustainable clothing using AI-powered design software and entirely recycled materials. This innovative approach addresses the growing demand for eco-conscious fashion while leveraging cutting-edge technology.

Key features of EcoChic's business model include:

- AI-driven design: The platform uses AI to optimize designs for sustainability and minimize waste.

- Traceable supply chain: Complete transparency ensures ethical and sustainable sourcing of recycled materials.

- Made-to-order model: Reduces overproduction and minimizes inventory waste.

- Direct-to-consumer sales: Cuts out intermediaries and maximizes profit margins.

EcoChic projects a significant market share within the rapidly expanding sustainable fashion market, estimated to be worth billions. Anya presented robust financial projections, demonstrating impressive potential for growth and profitability, further solidifying her pitch's strength.

The Dragons' Competing Offers and Their Rationale

Impressed by EcoChic's potential, two Dragons, Deborah Meaden and Peter Jones, made competing offers. Deborah offered £250,000 for a 20% equity stake, highlighting EcoChic's strong brand and scalable business model. Peter, known for his shrewd investment strategies, offered £200,000 for a 15% stake, emphasizing the potential for rapid international expansion.

- Deborah's rationale: She saw the strong brand and sustainable ethos as key selling points, believing EcoChic could easily dominate the market.

- Peter's rationale: He focused on EcoChic's scalability and international potential, envisioning a global fashion powerhouse.

Both Dragons acknowledged the risks inherent in a relatively new market, but their offers underscored their belief in EcoChic's disruptive potential. As Peter Jones stated (paraphrased), "This isn't just about clothes; it's about a revolution in the fashion industry."

The Unexpected Rejection: Why Did the Entrepreneur Say No?

Anya's rejection sent shockwaves through the Dragon's Den. Her decision wasn't based on dissatisfaction with the offers themselves; rather, it stemmed from a strategic long-term vision. Anya believed that accepting either offer would compromise her control over the company's direction and ultimately hinder its ambitious growth trajectory.

Potential reasons for Anya's rejection include:

- Desire for higher valuation: Anya may have believed EcoChic was worth significantly more than the offered valuations.

- Control and autonomy: She may have prioritized maintaining full control over the brand's identity and strategic direction.

- Alternative funding options: Anya may have already secured, or had access to, alternative funding sources.

- Long-term vision: She might have been willing to forgo immediate capital injection to retain complete control and execute her own long-term growth plans.

Analyzing the Strategic Implications of the Decision

Anya's decision carries both significant risks and rewards. While rejecting lucrative offers may delay expansion, it preserves her vision and autonomy. The potential downsides include slower growth and missed opportunities for leveraging the Dragons' expertise and networks. However, the upside includes maintaining complete control, a higher potential valuation in future funding rounds, and preserving her brand's integrity. Alternative funding options, such as angel investors or venture capital, remain open to Anya. The impact of this decision on her brand is currently uncertain, but her bold move has certainly generated significant media attention, creating valuable brand awareness.

Conclusion: Lessons Learned from the Dragon's Den Rejection

Anya Sharma's unexpected rejection in the Dragon's Den highlights the crucial strategic considerations entrepreneurs face when navigating investment opportunities. The unexpected nature of her decision underscores the importance of aligning personal goals with investment terms. Securing funding is a crucial step for any business, but maintaining control and adhering to a long-term vision can prove equally vital. What would you have done in this Dragon's Den situation? Share your thoughts using #DragonsDen #Entrepreneurship. Learn more about navigating investment offers and succeeding in the world of entrepreneurship by exploring more articles on [website/platform].

Featured Posts

-

Cardinal Claims New Evidence Exposes Prosecutorial Misconduct In The Trial Of The Century

Apr 30, 2025

Cardinal Claims New Evidence Exposes Prosecutorial Misconduct In The Trial Of The Century

Apr 30, 2025 -

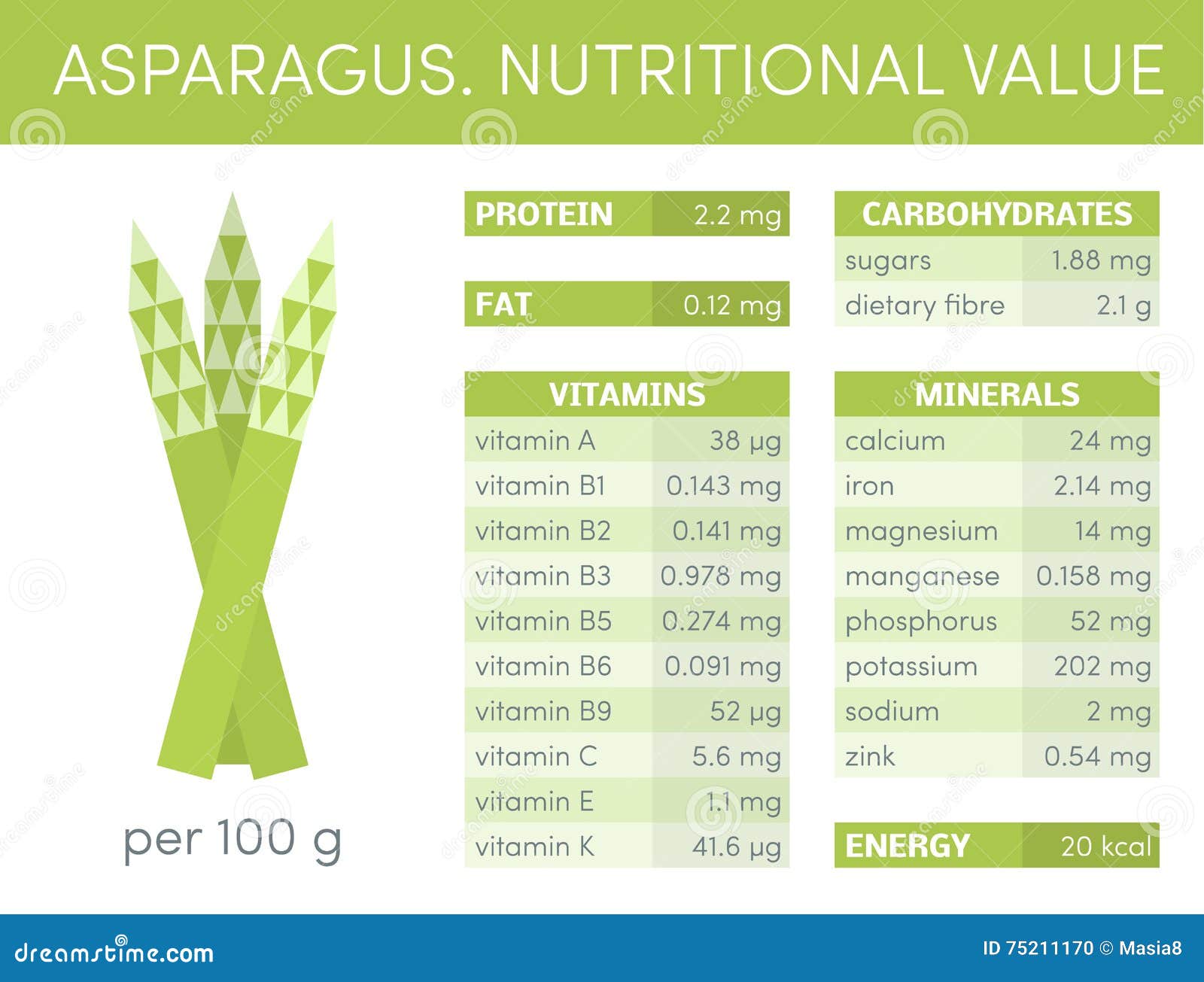

Understanding The Nutritional Value And Health Impacts Of Asparagus

Apr 30, 2025

Understanding The Nutritional Value And Health Impacts Of Asparagus

Apr 30, 2025 -

Defenses Anti Aeriennes Europeennes Pour L Ukraine L Engagement Crucial Des Etats Unis

Apr 30, 2025

Defenses Anti Aeriennes Europeennes Pour L Ukraine L Engagement Crucial Des Etats Unis

Apr 30, 2025 -

Tramb Yhdhr Mstqbl Knda Mrtbt Baldem Alamryky

Apr 30, 2025

Tramb Yhdhr Mstqbl Knda Mrtbt Baldem Alamryky

Apr 30, 2025 -

Cavs Jarrett Allens Le Bron Esque Dunk Highlights Big Win Over Knicks

Apr 30, 2025

Cavs Jarrett Allens Le Bron Esque Dunk Highlights Big Win Over Knicks

Apr 30, 2025