Dutch Stock Market Slump Deepens: US Trade Tensions Intensify

Table of Contents

Impact of US Trade Tensions on the Dutch Economy

The Dutch and US economies are deeply intertwined, with significant trade relationships spanning various sectors. The Netherlands, being a major trading hub in Europe, is particularly vulnerable to disruptions caused by US trade policies. The escalating trade disputes have created significant uncertainty, impacting both large corporations and small businesses alike.

-

Key Trade Relationships: The Netherlands is a significant exporter of agricultural products, high-tech equipment, and manufactured goods to the US. Conversely, the US is a major source of imports for the Netherlands, creating a complex web of interdependence.

-

Heavily Impacted Sectors:

- Agriculture: Dutch agricultural exports, including flowers, dairy products, and horticultural goods, are facing increased tariffs, leading to decreased competitiveness in the US market.

- Technology: The technology sector, a significant contributor to the Dutch economy, is experiencing challenges due to restrictions on technology exports and intellectual property concerns.

- Manufacturing: Dutch manufacturing companies relying on US components or exporting finished goods to the US are seeing reduced profitability due to tariffs and trade barriers.

-

Decreased Exports and Investment: The imposition of tariffs and trade barriers by the US has directly led to a decrease in Dutch exports to the US. This, in turn, is discouraging foreign direct investment into the Netherlands, creating a ripple effect throughout the economy.

-

Ripple Effect on Smaller Businesses and Employment: The reduced export volume and investment are affecting smaller businesses disproportionately, impacting employment numbers within the Netherlands. This is particularly concerning for those businesses heavily reliant on the US market. Keywords: Dutch exports, US tariffs, trade barriers, Dutch investment, economic impact, employment in Netherlands

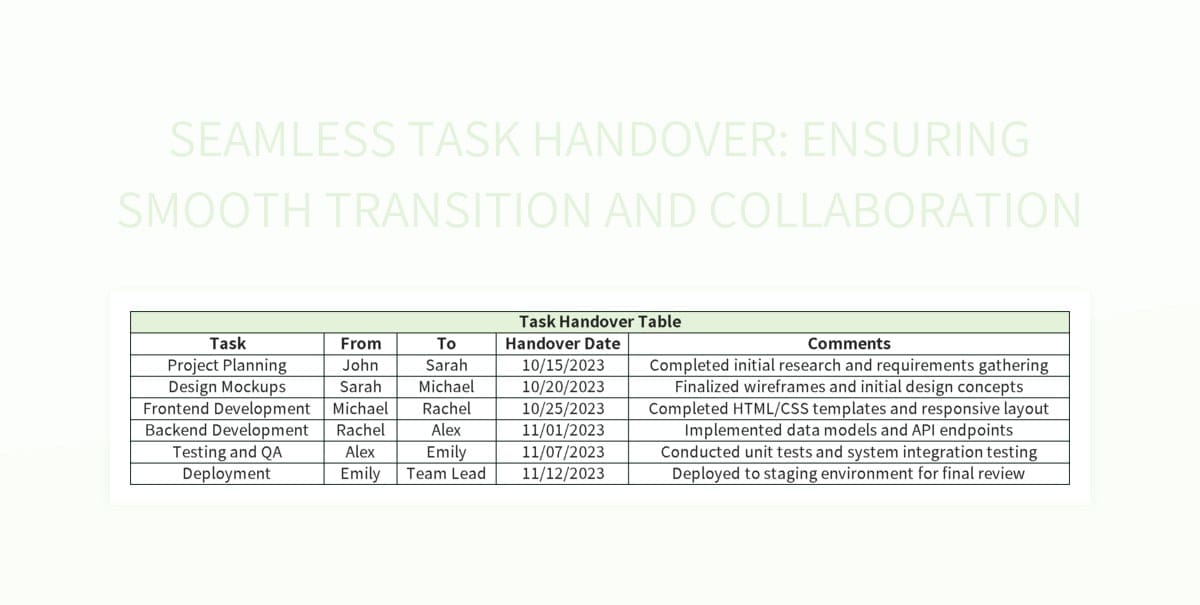

Analysis of the Dutch Stock Market Performance

The Dutch stock market, as measured by the AEX index, has shown a significant decline reflecting the broader economic concerns. Trading volume has increased, indicating heightened market activity driven by uncertainty and volatility.

-

AEX Index Performance: The AEX index has experienced a notable drop in recent months, signaling a decline in investor confidence. This is further compounded by decreased trading volumes in specific sectors, particularly those most impacted by the US trade tensions.

-

Stock Price Drops: Several major Dutch companies, particularly those with significant US market exposure, have seen steep declines in their stock prices. This reflects investor concerns about future earnings and profits given the current trade environment.

-

Comparison to Previous Downturns: The current downturn is significant when compared to previous market corrections, highlighting the severity of the situation and its potential long-term implications for the Dutch economy.

-

Market Volatility and Uncertainty: The Dutch stock market is exhibiting increased volatility, reflecting the uncertainty surrounding the future direction of US trade policy and its impact on the Dutch economy. This volatility makes it extremely difficult for investors to predict short-term market movements. Keywords: AEX index, stock price drops, market volatility, trading volume, Dutch stock market performance

Investor Sentiment and Future Outlook

Investor confidence in the Dutch stock market has understandably decreased due to the ongoing US trade tensions and the resulting economic uncertainty. This has led to risk-averse behavior amongst many investors.

-

Investor Confidence and Behavior: Investors are adopting more cautious strategies, opting for less risky investments and potentially reducing their exposure to the Dutch market. This shift in sentiment is directly reflected in the declining stock prices and reduced trading activity.

-

Risk Mitigation Strategies: Diversification is key to mitigating risk. Investors are considering diversifying their portfolios across different asset classes and geographical regions to reduce their reliance on the Dutch stock market.

-

Potential Scenarios and Market Forecast: The future outlook for the Dutch stock market depends heavily on the resolution (or escalation) of US trade tensions. Positive developments in US-Dutch trade relations could lead to a market recovery, while further escalation would likely exacerbate the downturn. Expert forecasts vary, but many anticipate a period of continued volatility.

-

Expert Opinions and Forecasts: Economic analysts and market experts are closely monitoring the situation, providing forecasts and insights that help investors make informed decisions. Their projections vary, ranging from cautious optimism to more pessimistic outlooks depending on the anticipated resolution of the trade disputes. Keywords: investor confidence, risk mitigation, market forecast, Dutch economic recovery, stock market outlook

Conclusion: The deepening slump in the Dutch stock market is undeniably linked to intensifying US trade tensions, impacting various sectors and eroding investor confidence. Understanding these complexities is crucial for navigating the current market volatility. While the outlook remains uncertain, informed decision-making, based on careful analysis of the Dutch stock market's performance and future projections, is paramount. Investors should carefully monitor developments in the US-Dutch trade relationship and consider diversification strategies to mitigate risks associated with this Dutch stock market downturn. Remember to consult with financial professionals for personalized advice regarding your investments in the Dutch market. Keywords: Dutch stock market, market downturn, investment strategies, financial advice, US-Dutch trade.

Featured Posts

-

Trump Uitstel Leidt Tot Beursherstel Winst Voor Alle Aex Bedrijven

May 24, 2025

Trump Uitstel Leidt Tot Beursherstel Winst Voor Alle Aex Bedrijven

May 24, 2025 -

A Relaxing Escape To The Country Considerations For A Smooth Transition

May 24, 2025

A Relaxing Escape To The Country Considerations For A Smooth Transition

May 24, 2025 -

How To Get Tickets For Bbc Radio 1s Big Weekend

May 24, 2025

How To Get Tickets For Bbc Radio 1s Big Weekend

May 24, 2025 -

Royal Philips Announces 2025 Annual General Meeting Agenda

May 24, 2025

Royal Philips Announces 2025 Annual General Meeting Agenda

May 24, 2025 -

Amsterdam Stock Exchange Aex Index Experiences Significant Drop

May 24, 2025

Amsterdam Stock Exchange Aex Index Experiences Significant Drop

May 24, 2025

Latest Posts

-

Actress Mia Farrow Demands Trumps Imprisonment Regarding Venezuelan Deportations

May 24, 2025

Actress Mia Farrow Demands Trumps Imprisonment Regarding Venezuelan Deportations

May 24, 2025 -

Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 24, 2025

Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 24, 2025 -

Actress Mia Farrow Trump Should Be Jailed For Venezuelan Deportation Policy

May 24, 2025

Actress Mia Farrow Trump Should Be Jailed For Venezuelan Deportation Policy

May 24, 2025