Dutch Stocks Slump Amidst Escalating US Trade War

Table of Contents

Impact of US Tariffs on Dutch Exports

The imposition of US tariffs on various goods has directly impacted several key Dutch export sectors. This has led to a decline in export volumes and significant financial losses for numerous Dutch companies.

Specific Sectors Affected:

- Agriculture: The Dutch agricultural sector, a major exporter of dairy products, flowers, and agricultural machinery, has been significantly impacted by US tariffs. Estimates suggest a 15% reduction in exports to the US in the last quarter. Companies like [Example Company Name], a major exporter of dairy products, have reported a substantial decrease in revenue.

- Manufacturing: The manufacturing sector, particularly companies specializing in high-tech equipment and industrial components, are also facing challenges. US tariffs have increased the cost of Dutch goods in the American market, impacting competitiveness and export volumes. A decline of approximately 10% in exports of machinery and equipment has been observed.

- Chemicals: The Dutch chemical industry, a significant exporter of specialized chemicals and petrochemicals, is also experiencing pressure due to increased US tariffs, leading to a projected 8% decrease in exports to the US market.

Decline in Dutch Export Volumes:

The reduction in exports has had a measurable impact on the Dutch GDP. Charts and graphs showing a clear downward trend in export volumes over the past six months illustrate the severity of the situation. Forecasts predict further decline unless the trade conflict is resolved. The Dutch government has announced some support measures for affected businesses, but their effectiveness remains to be seen.

Investor Sentiment and Market Volatility

The escalating trade war has severely impacted investor sentiment and created significant volatility in the Dutch stock market.

Decreased Foreign Investment:

The uncertainty surrounding the trade war is deterring foreign direct investment (FDI) in the Netherlands. Data indicates a noticeable decline in FDI commitments compared to the previous year. Several major investment projects have been delayed or cancelled due to concerns about the long-term economic outlook. This decreased investment further dampens economic growth prospects.

Stock Market Fluctuations:

The AEX index, the leading benchmark for Dutch equities, has reflected the anxieties surrounding the trade war, showing significant fluctuations in recent months. Analysis of historical stock market data reveals a clear correlation between negative trade war news and drops in the AEX. Experts predict continued volatility until a resolution is reached.

Potential Long-Term Economic Consequences for the Netherlands

The ongoing trade war poses significant risks to the long-term economic health of the Netherlands.

GDP Growth Projections:

Revised GDP growth forecasts for the Netherlands reflect the negative impact of the trade war. Reputable economic institutions have lowered their projections, anticipating a slower growth rate for the coming years. This slower growth will likely have ripple effects across various sectors, potentially leading to increased unemployment.

Government Response and Mitigation Strategies:

The Dutch government is actively trying to mitigate the negative effects. While fiscal stimulus packages are under consideration, their long-term impact remains uncertain. The government is also engaged in diplomatic efforts to find a resolution to the trade conflict. The effectiveness of these strategies will be crucial in determining the long-term economic outlook for the Netherlands.

Conclusion

The escalating US trade war is having a profound and negative impact on Dutch stocks and the wider Dutch economy. Specific sectors like agriculture and manufacturing are particularly vulnerable, experiencing significant drops in export volumes and revenue. Decreased foreign investment and stock market volatility further exacerbate the situation. The potential long-term consequences, including slower GDP growth, highlight the urgent need for a resolution to the trade conflict and effective government response.

Call to Action: Stay updated on the latest developments in the Dutch stock market and the US trade war. Monitor the impact of the US trade war on your Dutch stock portfolio and learn more about the strategies to mitigate risks associated with the US trade war affecting Dutch stocks. Conduct thorough research on specific companies and sectors before making any investment decisions.

Featured Posts

-

New Music Joy Crookes Shares Carmen

May 25, 2025

New Music Joy Crookes Shares Carmen

May 25, 2025 -

She Waits By The Phone A Tale Of Anticipation

May 25, 2025

She Waits By The Phone A Tale Of Anticipation

May 25, 2025 -

Your Guide To Buying Bbc Radio 1 Big Weekend 2025 Tickets

May 25, 2025

Your Guide To Buying Bbc Radio 1 Big Weekend 2025 Tickets

May 25, 2025 -

Tracking The Net Asset Value Of The Amundi Msci World Ex United States Ucits Etf

May 25, 2025

Tracking The Net Asset Value Of The Amundi Msci World Ex United States Ucits Etf

May 25, 2025 -

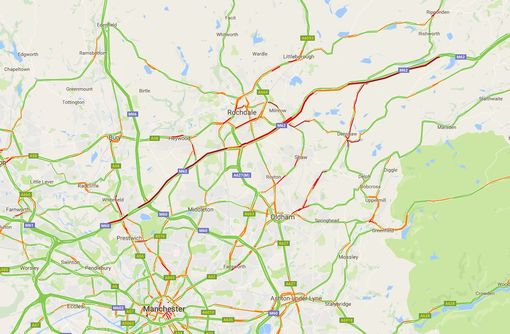

Roadworks M62 Westbound Closed Manchester To Warrington For Resurfacing

May 25, 2025

Roadworks M62 Westbound Closed Manchester To Warrington For Resurfacing

May 25, 2025

Latest Posts

-

The Week That Derailed Joe Bidens Post Presidency A Comprehensive Analysis

May 25, 2025

The Week That Derailed Joe Bidens Post Presidency A Comprehensive Analysis

May 25, 2025 -

How 10 New Orleans Inmates Pulled Off A Jailbreak

May 25, 2025

How 10 New Orleans Inmates Pulled Off A Jailbreak

May 25, 2025 -

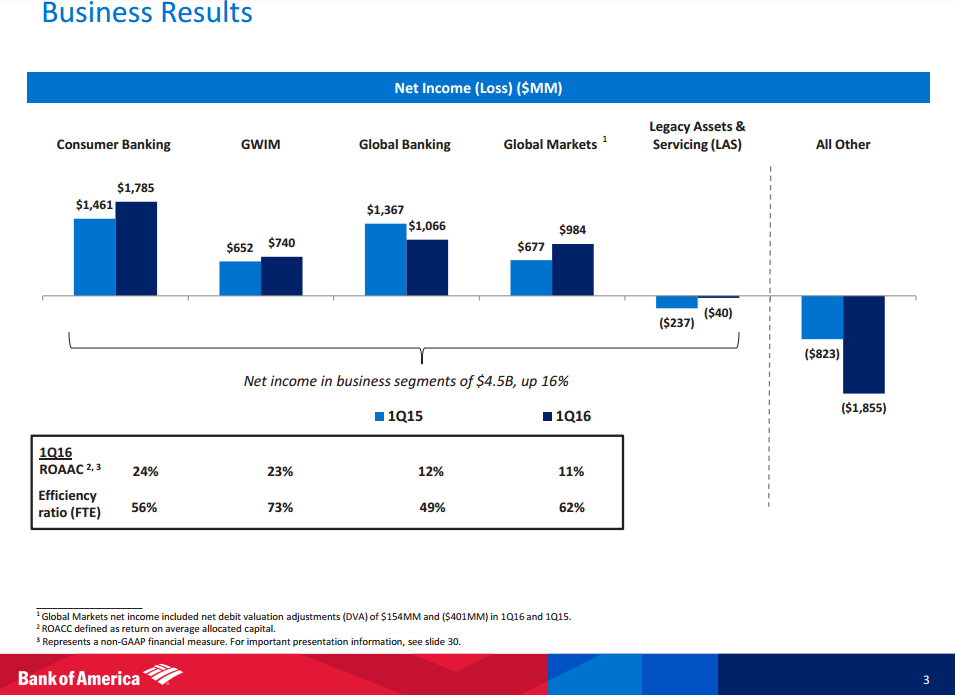

Stock Market Valuation Concerns Bof A Offers A Reassuring Perspective

May 25, 2025

Stock Market Valuation Concerns Bof A Offers A Reassuring Perspective

May 25, 2025 -

Public Reaction To Thames Waters Executive Bonus Payments

May 25, 2025

Public Reaction To Thames Waters Executive Bonus Payments

May 25, 2025 -

Thames Waters Executive Bonuses A Case Study In Corporate Governance

May 25, 2025

Thames Waters Executive Bonuses A Case Study In Corporate Governance

May 25, 2025