EToro Targets $500 Million In New IPO Funding

Table of Contents

Reasons Behind eToro's $500 Million IPO Funding Drive

eToro's pursuit of $500 million in IPO funding is a strategic move aimed at accelerating its growth and solidifying its position in the competitive online brokerage landscape. The company plans to utilize these funds to fuel several key initiatives:

-

Aggressive Growth Strategy: eToro's expansion plans are far-reaching. This significant influx of capital will allow them to execute these ambitious goals more effectively.

-

Strategic Resource Allocation: The $500 million will be strategically allocated to various areas, including:

- Increased investment in research and development: This will focus on creating innovative trading tools and improving the overall user experience. Expect to see advancements in AI-driven trading strategies and improved mobile app functionalities.

- Expansion into new geographical markets: eToro aims to broaden its reach globally, tapping into new and emerging markets with high growth potential. This includes targeted marketing campaigns and localized platform adaptations.

- Strategic acquisitions: Acquiring smaller fintech companies with complementary technologies or strong market presence will allow eToro to enhance its service offerings and expand its capabilities.

- Enhancement of existing platform features and security measures: This includes investing in robust security infrastructure and advanced encryption technologies to further enhance user trust and data protection.

eToro's Current Market Position and Competitive Landscape

eToro operates in a dynamic and fiercely competitive online brokerage industry. While it has established a strong presence with its unique social trading features, it faces stiff competition from established players like Robinhood and Webull.

- Market Share Analysis: eToro holds a considerable market share, particularly in regions with a strong interest in social trading. However, the competitive landscape is constantly shifting.

- Fees and Commission Structures: eToro's pricing model, often characterized by its transparent fee structure, is a key competitive advantage, but competitors are constantly adapting their offerings.

- User Experience and Platform Features: eToro's user-friendly platform and innovative social trading features contribute to its popularity, but rivals are constantly upgrading their user interfaces and functionalities.

- Regulatory Compliance and Security: eToro's commitment to regulatory compliance and robust security measures is crucial in building trust and attracting investors, but it's a continually evolving aspect of the business.

Potential Implications of the Successful $500 Million IPO Funding

A successful eToro IPO and the subsequent $500 million funding injection could have profound implications:

- Impact on eToro's Growth Trajectory: The funding will likely accelerate eToro's growth, enabling faster expansion into new markets and the development of innovative products.

- Effects on the Fintech Market: A successful eToro IPO could invigorate the fintech market, attracting more investment and fostering further innovation in online trading and investing.

- Potential for Job Creation and Economic Growth: The expansion plans fuelled by the IPO funding could create significant job opportunities and contribute to economic growth in various regions.

- Positive Outcomes:

- Increased market capitalization and valuation.

- Potential for further innovation and technological advancements in online trading.

- Enhanced brand awareness and global reach.

- Attraction of top talent and increased investment in the company.

Risks and Challenges Associated with the eToro IPO

Despite the potential benefits, the eToro IPO faces several risks and challenges:

- Market Volatility: Fluctuations in the stock market could negatively impact investor sentiment and the overall success of the IPO.

- Regulatory Hurdles: Navigating the complex regulatory landscape in various jurisdictions could prove challenging. Stringent compliance requirements could delay the IPO process.

- Competition: Intense competition from established players in the fintech industry could limit eToro's market share gains.

- Integration Challenges: Successfully integrating any acquired companies will require careful planning and execution.

Conclusion: The Future of eToro After Securing $500 Million in IPO Funding

eToro's ambitious $500 million IPO funding target represents a significant step in its growth strategy. While the path is fraught with challenges, a successful IPO could dramatically reshape the online trading landscape, boosting innovation and competition. The funding's potential impact on job creation and economic growth is also substantial. Stay tuned for updates on the eToro IPO and explore the exciting world of online trading with eToro! Learn more about the eToro IPO and how you can potentially benefit from this groundbreaking fintech investment.

Featured Posts

-

Lindts Central London Chocolate Shop A Sweet Escape

May 14, 2025

Lindts Central London Chocolate Shop A Sweet Escape

May 14, 2025 -

Fitzgeralds Hot Streak Powers Giants To Victory

May 14, 2025

Fitzgeralds Hot Streak Powers Giants To Victory

May 14, 2025 -

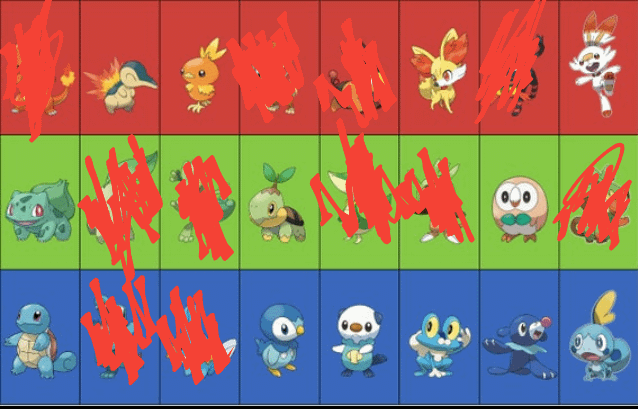

The Ultimate Guide To Choosing The Best Starter Pokemon In Each Generation

May 14, 2025

The Ultimate Guide To Choosing The Best Starter Pokemon In Each Generation

May 14, 2025 -

Haiti Flights Postponed Jet Blue Cites Safety Concerns Due To Unrest

May 14, 2025

Haiti Flights Postponed Jet Blue Cites Safety Concerns Due To Unrest

May 14, 2025 -

Lindts New Central London Chocolate Shop A Sweet Escape

May 14, 2025

Lindts New Central London Chocolate Shop A Sweet Escape

May 14, 2025