EToro's $500 Million IPO: Resuming After Pause

Table of Contents

The Initial Pause: Understanding the Delay

The initial delay of eToro's $500 million IPO sparked speculation and concern among potential investors. Several factors likely contributed to this postponement.

-

Market Conditions: Global economic uncertainty and volatility in the tech sector played a significant role. The IPO market can be highly sensitive to broader economic trends, and periods of uncertainty often lead to delays or cancellations of public offerings. The initial wave of tech company IPOs showed some signs of cooling, prompting eToro to reassess the timing of their own offering. This cautious approach is common practice, aiming to secure optimal pricing and investor interest.

-

Regulatory Hurdles: Navigating the complex regulatory landscape of the financial industry is a significant challenge for any company going public. eToro likely encountered some regulatory hurdles or compliance issues that required additional time and effort to resolve. These could involve satisfying specific reporting requirements, addressing any concerns from regulatory bodies, or finalizing necessary legal agreements. The precise nature of these hurdles is often kept confidential for competitive and strategic reasons.

-

Impact on Investor Sentiment: The delay inevitably impacted investor sentiment. Uncertainty surrounding the IPO's timing might have decreased investor confidence temporarily. However, this also gave eToro an opportunity to demonstrate resilience and address any underlying concerns. A well-managed delay can, in some cases, improve the long-term outlook for a successful IPO.

The Resumption: Factors Contributing to the Renewed Momentum

The resumption of eToro's IPO signals a renewed confidence in the company's prospects and a more favorable market environment. Several factors likely contributed to this positive shift.

-

Improved Market Conditions: A stabilization or improvement in global economic conditions and a return of investor appetite for tech stocks likely played a crucial role. Positive economic indicators and a more optimistic outlook on the future of the fintech industry could have influenced this decision.

-

Strategic Improvements: eToro might have implemented strategic changes during the delay period to strengthen its position and increase investor interest. This could involve streamlining operations, enhancing its platform features, or improving its financial performance.

-

Positive Financial Performance: Strong financial performance, perhaps exceeding initial projections, would have significantly bolstered investor confidence and justified the resumption of the IPO. This might involve increased user growth, higher trading volumes, or improved profitability. Demonstrating robust and sustainable growth is key to attracting investors.

eToro's Strengths and Investment Appeal

eToro's appeal as an investment lies in its unique platform and its position within the rapidly growing fintech sector.

-

Social Trading and Copy Trading: eToro's platform offers social trading and copy trading features, allowing users to follow and copy the trades of successful investors. This innovative approach differentiates it from traditional brokerage platforms and significantly broadens its appeal.

-

Target Market and Growth Potential: eToro targets both experienced and novice investors, providing a user-friendly interface and educational resources. Its growth potential within the expanding fintech industry is significant, as more people adopt online trading and investment platforms.

-

Competitive Advantages: eToro's social trading capabilities, combined with its regulated status and diverse asset offerings, give it a competitive edge in the market. This differentiates it from many other platforms focusing solely on traditional trading methods.

Potential Risks and Challenges

While eToro presents exciting investment opportunities, potential investors should carefully consider the associated risks.

-

Market Volatility: The stock market is inherently volatile, and even successful companies like eToro are subject to fluctuations in stock price. Market downturns can negatively impact investment returns.

-

Competition: The fintech sector is highly competitive, and eToro faces competition from established players and new entrants. Maintaining a competitive edge requires continuous innovation and adaptation.

-

Regulatory Risks: The regulatory landscape for fintech companies is constantly evolving, and eToro might face future regulatory challenges or changes in compliance requirements.

Conclusion

The resumption of eToro's $500 million IPO marks a significant development in the fintech sector. While the initial delay raised concerns, improved market conditions and eToro's strategic adjustments have contributed to renewed investor confidence. Understanding both the potential rewards and associated risks is crucial for prospective investors. Thorough due diligence and research are essential before making any investment decisions.

Call to Action: Stay informed on the latest developments regarding the eToro IPO and consider researching the company thoroughly before making any investment decisions. Learn more about the eToro $500 million IPO and its implications for the future of social trading. Consider consulting with a financial advisor before making any investment choices related to the eToro IPO or any other investment opportunity.

Featured Posts

-

Pokemon Tcg Pocket Charizard Ex A2b 010 Deck Strategies And Counter Plays

May 14, 2025

Pokemon Tcg Pocket Charizard Ex A2b 010 Deck Strategies And Counter Plays

May 14, 2025 -

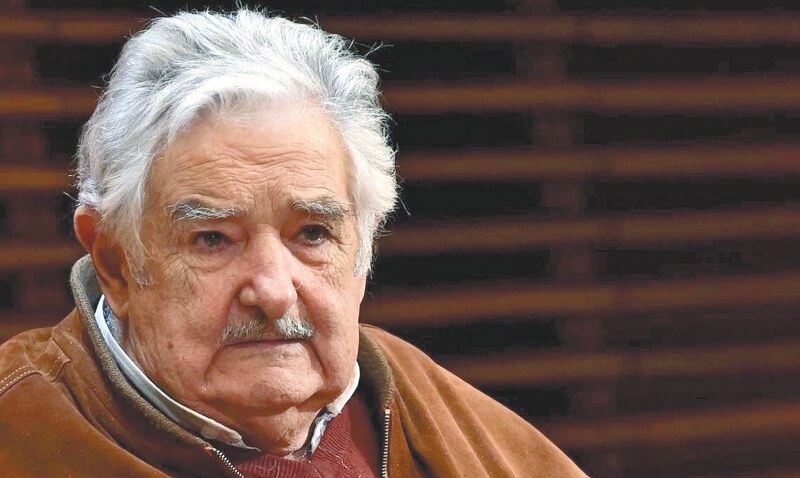

Jose Mujica El Legado Del Expresidente Uruguayo

May 14, 2025

Jose Mujica El Legado Del Expresidente Uruguayo

May 14, 2025 -

Neljae Laehes Puolen Miljoonan Euron Eurojackpot Voittoa Voittopaikat Julkistettu

May 14, 2025

Neljae Laehes Puolen Miljoonan Euron Eurojackpot Voittoa Voittopaikat Julkistettu

May 14, 2025 -

Resultats Du T1 D Eramet Impact Sur Les Objectifs De Production 2025

May 14, 2025

Resultats Du T1 D Eramet Impact Sur Les Objectifs De Production 2025

May 14, 2025 -

Budapest Tommy Fury Visszaterese Es Uezenete Jake Paulnak Kepekkel

May 14, 2025

Budapest Tommy Fury Visszaterese Es Uezenete Jake Paulnak Kepekkel

May 14, 2025