ECB Launches Task Force For Simpler Banking Rules

Table of Contents

The Need for Simpler Banking Rules

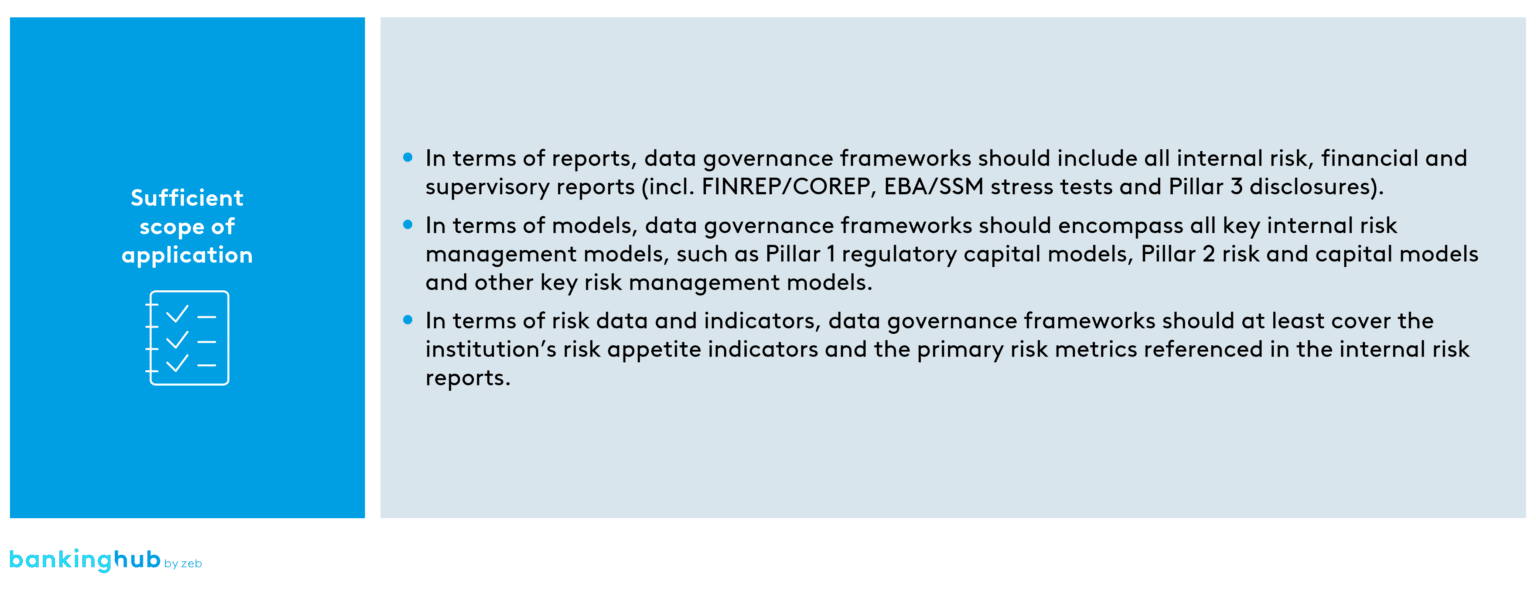

The regulatory burden on European banks is immense. Years of accumulating regulations, including the complexities of Basel III and CRD (Capital Requirements Directive), have created a compliance nightmare. This isn't merely a matter of paperwork; it has tangible negative consequences:

- Increased Compliance Costs: Banks spend millions annually navigating increasingly intricate regulations, diverting resources from core lending activities.

- Reduced Lending: The cost and complexity of compliance make lending to smaller businesses and individuals less profitable, restricting credit availability.

- Regulatory Arbitrage: Complex rules can be exploited by some banks, creating an uneven playing field and undermining the integrity of the financial system.

Specific examples of overly complex regulations include:

- The intricate calculations required for determining risk-weighted assets under Basel III.

- The numerous reporting requirements mandated by CRD, demanding significant administrative overhead.

- The lack of clarity and consistency in the application of regulations across different EU member states.

These complexities necessitate a significant push for banking regulation simplification to alleviate the regulatory burden and its associated compliance costs.

The ECB Task Force: Goals and Objectives

The ECB's newly formed task force is tasked with a crucial mission: to streamline and clarify existing banking regulations. Its primary focus will be on identifying areas of unnecessary complexity and proposing solutions to improve efficiency and proportionality. Key objectives include:

- Streamlining regulatory processes to reduce administrative burdens on banks.

- Simplifying the language and structure of existing regulations to enhance clarity and understanding.

- Improving the proportionality of regulations, ensuring that rules are appropriately tailored to the size and risk profile of individual banks.

- Promoting greater consistency in the application of regulations across the EU.

The task force is expected to deliver its recommendations within a specific timeframe, though the exact timeline remains to be publicly confirmed. This ECB task force represents a substantial commitment to banking regulation reform and regulatory simplification.

Potential Benefits of Simplified Banking Rules

The potential benefits of simplified banking regulations are far-reaching, impacting banks, businesses, and consumers alike.

For banks:

- Lower compliance costs, freeing up resources for investment and lending.

- Improved operational efficiency, leading to increased profitability.

- A more level playing field, reducing the potential for regulatory arbitrage.

For businesses and consumers:

- Easier access to credit, fueling economic growth and job creation.

- Lower borrowing costs, benefiting both businesses and individuals.

- A more stable and resilient financial system.

These economic benefits of deregulation would manifest as improved lending and reduced borrowing costs, fostering a healthier and more dynamic economy.

Challenges and Potential Obstacles

Simplifying banking rules is not without its challenges. The task force will face several significant hurdles:

- Balancing simplicity with effective risk management: Regulations must be clear and concise while still ensuring adequate protection against financial instability.

- Ensuring regulatory consistency across the EU: Differences in national regulatory approaches can create complexities and inconsistencies.

- Navigating political hurdles: Reaching consensus among different stakeholders, including banks, regulators, and national governments, will be a significant undertaking.

Potential opposition from certain stakeholders, including banks resistant to change and lobbyists representing specific interests, presents additional regulatory challenges and political obstacles. Successfully navigating these banking regulation reform difficulties will be crucial for the task force's success.

The Future of Banking Regulation in the EU

The ECB's initiative marks a significant turning point in the evolution of EU banking regulation. The long-term implications are profound, potentially leading to:

- A more efficient and competitive banking sector.

- Increased lending and investment, stimulating economic growth.

- A more resilient and stable financial system.

The success of the task force will depend heavily on effective collaboration with other regulatory bodies, such as the European Banking Authority (EBA). This initiative will shape the future of banking within the EU and drive towards regulatory harmonization within the framework of EU banking regulations.

Conclusion: The Importance of Simplifying ECB Banking Rules

The ECB's establishment of a task force dedicated to simplifying banking rules is a crucial step toward fostering a more dynamic and resilient European economy. This initiative aims to address the considerable regulatory burden currently hindering the banking sector, unlocking the potential for improved lending, reduced costs, and enhanced economic growth. While challenges remain, the potential benefits of simpler banking rules and ECB banking reform are considerable. Stay informed about the task force's progress and the ongoing changes in ECB banking regulation—the future of European finance depends on it.

Featured Posts

-

Where To Buy Ariana Grande Lovenote Fragrance Set Online A Complete Guide

Apr 27, 2025

Where To Buy Ariana Grande Lovenote Fragrance Set Online A Complete Guide

Apr 27, 2025 -

Governments Autism Study Led By Known Anti Vaccination Activist

Apr 27, 2025

Governments Autism Study Led By Known Anti Vaccination Activist

Apr 27, 2025 -

Ariana Grandes Drastic Hair And Tattoo Transformation Professional Styling Insights

Apr 27, 2025

Ariana Grandes Drastic Hair And Tattoo Transformation Professional Styling Insights

Apr 27, 2025 -

Charleston Open Kalinskayas Stunning Victory Over Keys

Apr 27, 2025

Charleston Open Kalinskayas Stunning Victory Over Keys

Apr 27, 2025 -

Top Seed Pegula Triumphs Over Collins In Charleston Final

Apr 27, 2025

Top Seed Pegula Triumphs Over Collins In Charleston Final

Apr 27, 2025

Latest Posts

-

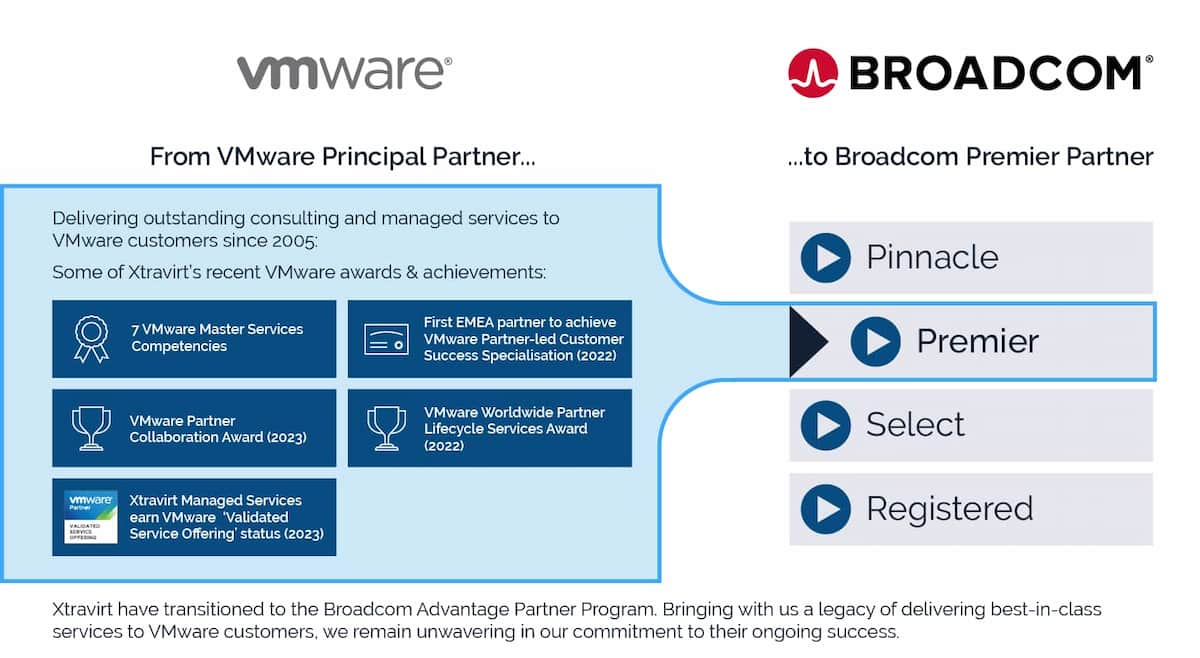

The Broadcom V Mware Deal An Extreme Price Hike Of 1 050 For At And T

Apr 28, 2025

The Broadcom V Mware Deal An Extreme Price Hike Of 1 050 For At And T

Apr 28, 2025 -

At And T Raises Alarm Over Extreme V Mware Price Hike After Broadcom Deal

Apr 28, 2025

At And T Raises Alarm Over Extreme V Mware Price Hike After Broadcom Deal

Apr 28, 2025 -

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase Concerns

Apr 28, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase Concerns

Apr 28, 2025 -

1 050 Price Hike At And T Challenges Broadcoms V Mware Acquisition Proposal

Apr 28, 2025

1 050 Price Hike At And T Challenges Broadcoms V Mware Acquisition Proposal

Apr 28, 2025 -

Assessing The Us Economy The Immediate Effects Of A Canadian Travel Boycott

Apr 28, 2025

Assessing The Us Economy The Immediate Effects Of A Canadian Travel Boycott

Apr 28, 2025