ECB's New Initiative: Simplifying Banking Regulation

Table of Contents

This article provides a comprehensive overview of the ECB's initiative, outlining its key aspects, its impact on European banks, and potential challenges. We will explore how this initiative seeks to improve regulatory clarity, encourage the adoption of regulatory technology (RegTech), and ultimately contribute to a more robust and resilient financial system.

Key Aspects of the ECB's Simplification Initiative

The ECB's simplification initiative encompasses several crucial areas designed to reduce the regulatory burden on banks while maintaining robust financial stability.

Streamlining Reporting Requirements

One of the core focuses of the initiative is streamlining the reporting requirements for European banks. The current system often involves numerous forms, complex data fields, and inconsistencies across different jurisdictions. This complexity leads to significant administrative costs and diverts valuable resources from more strategic business functions. The ECB aims to alleviate this burden through:

- Reduced number of reporting forms: Consolidating various reports into fewer, more comprehensive ones.

- Simplified data fields: Removing redundant or unnecessary data points, making reporting more efficient.

- Harmonized reporting standards: Implementing consistent standards across the EU to minimize discrepancies and improve data comparability.

These changes will significantly reduce administrative costs, freeing up internal resources for banks to focus on core business activities, such as lending, investment, and customer service. This, in turn, should contribute to improved operational efficiency and greater competitiveness.

Clarifying Regulatory Guidance

The initiative also prioritizes clarifying existing regulatory guidance to improve understanding and reduce ambiguity. Many regulations are complex and open to interpretation, leading to inconsistencies in compliance and potential regulatory risks. The ECB's efforts in this area include:

- Enhanced explanations of capital requirements: Providing clear guidance on calculating and meeting capital adequacy ratios (CAR).

- Simplified liquidity ratio guidelines: Clarifying the requirements for maintaining sufficient liquidity to meet short-term obligations.

- Improved understanding of stress testing methodologies: Providing clearer guidelines and methodologies for conducting stress tests to assess resilience against economic shocks.

By clarifying these key areas, the initiative aims to improve regulatory compliance, enhance risk management practices, and reduce the potential for regulatory penalties.

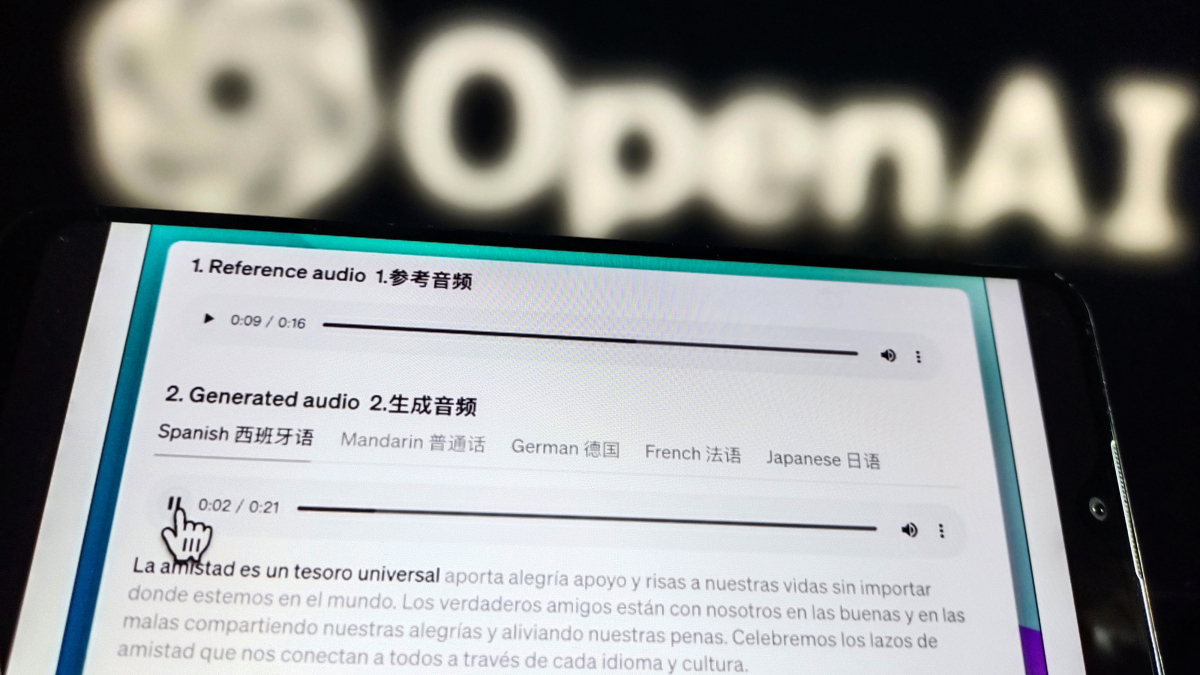

Enhancing Regulatory Technology (RegTech) Adoption

The ECB's initiative strongly encourages the adoption of RegTech solutions to improve regulatory compliance. RegTech encompasses various technologies that can automate compliance processes, improve data accuracy, and reduce operational risks. The ECB is promoting the use of:

- Artificial intelligence (AI) for automated reporting: AI can streamline data collection and analysis, ensuring accuracy and efficiency.

- Machine learning (ML) for risk assessment: ML algorithms can help identify and manage regulatory risks more effectively.

- Blockchain technology for secure data management: Blockchain can enhance data security and transparency within the regulatory reporting process.

By embracing these technologies, banks can significantly improve their regulatory compliance efficiency, reduce operational costs, and enhance the accuracy and reliability of their reporting.

Impact on European Banks

The ECB's simplification initiative is expected to have a significant positive impact on European banks across various dimensions.

Reduced Compliance Costs

The streamlined reporting requirements and clarified guidance will lead to substantial cost savings for banks. While precise quantification is challenging due to varying bank sizes and structures, estimates suggest that the initiative could reduce compliance costs by up to [insert percentage or range if available] for many institutions. This translates into freeing up capital for investment in core business activities and increasing profitability.

Improved Operational Efficiency

Simplified regulations will enhance operational efficiency by reducing administrative burdens and allowing banks to focus on their core business objectives. Improved data management, automated reporting, and clearer regulatory guidance will all contribute to smoother operations and faster turnaround times.

Increased Competitiveness

By reducing the compliance burden and freeing up resources, the initiative will help European banks compete more effectively in the global market. The improved efficiency and reduced costs will enhance their ability to innovate, invest, and offer competitive products and services, ultimately fostering growth and strengthening the European financial sector.

Challenges and Potential Drawbacks of the Initiative

While the ECB's initiative offers significant benefits, there are potential challenges and drawbacks to consider.

Implementation Difficulties

Implementing the new simplified regulations may present challenges for some banks. This includes updating internal systems, retraining staff, and adapting existing processes. The transition period will require significant investment in technology and human resources.

Unintended Consequences

While the aim is to simplify, there is a risk of unintended consequences. Some critics may argue that simplified regulations could inadvertently weaken certain protections or inadvertently create new loopholes. Careful monitoring and ongoing assessment are crucial to identify and mitigate any unforeseen issues.

Conclusion: ECB's New Initiative: Simplifying Banking Regulation – A Step Towards a More Efficient and Competitive European Banking Sector

The ECB's new initiative to simplify banking regulation represents a crucial step toward creating a more efficient, competitive, and resilient European banking sector. By streamlining reporting requirements, clarifying regulatory guidance, and encouraging RegTech adoption, the initiative aims to reduce compliance costs, improve operational efficiency, and enhance the competitiveness of European banks. While challenges in implementation and potential unintended consequences need to be addressed, the overall benefits of this initiative are significant. Stay informed about the ECB's ongoing efforts to simplify banking regulation and ensure a robust and efficient European banking sector. Visit the ECB website ([insert link here]) for further information and updates.

Featured Posts

-

New Cast And Source Material Details Revealed For The Perfect Couple Season 2

Apr 27, 2025

New Cast And Source Material Details Revealed For The Perfect Couple Season 2

Apr 27, 2025 -

La Fire Victims Face Price Gouging A Selling Sunset Star Speaks Out

Apr 27, 2025

La Fire Victims Face Price Gouging A Selling Sunset Star Speaks Out

Apr 27, 2025 -

The Alberta Anomaly How Oil Wealth Shaped Canadian Anti Trump Sentiment

Apr 27, 2025

The Alberta Anomaly How Oil Wealth Shaped Canadian Anti Trump Sentiment

Apr 27, 2025 -

How Professionals Helped Ariana Grande Achieve Her Drastic Hair And Tattoo Makeover

Apr 27, 2025

How Professionals Helped Ariana Grande Achieve Her Drastic Hair And Tattoo Makeover

Apr 27, 2025 -

Canadas Tourism Industry Thriving While The Us Lags

Apr 27, 2025

Canadas Tourism Industry Thriving While The Us Lags

Apr 27, 2025

Latest Posts

-

Investigation Into Lingering Toxic Chemicals Following Ohio Train Derailment

Apr 28, 2025

Investigation Into Lingering Toxic Chemicals Following Ohio Train Derailment

Apr 28, 2025 -

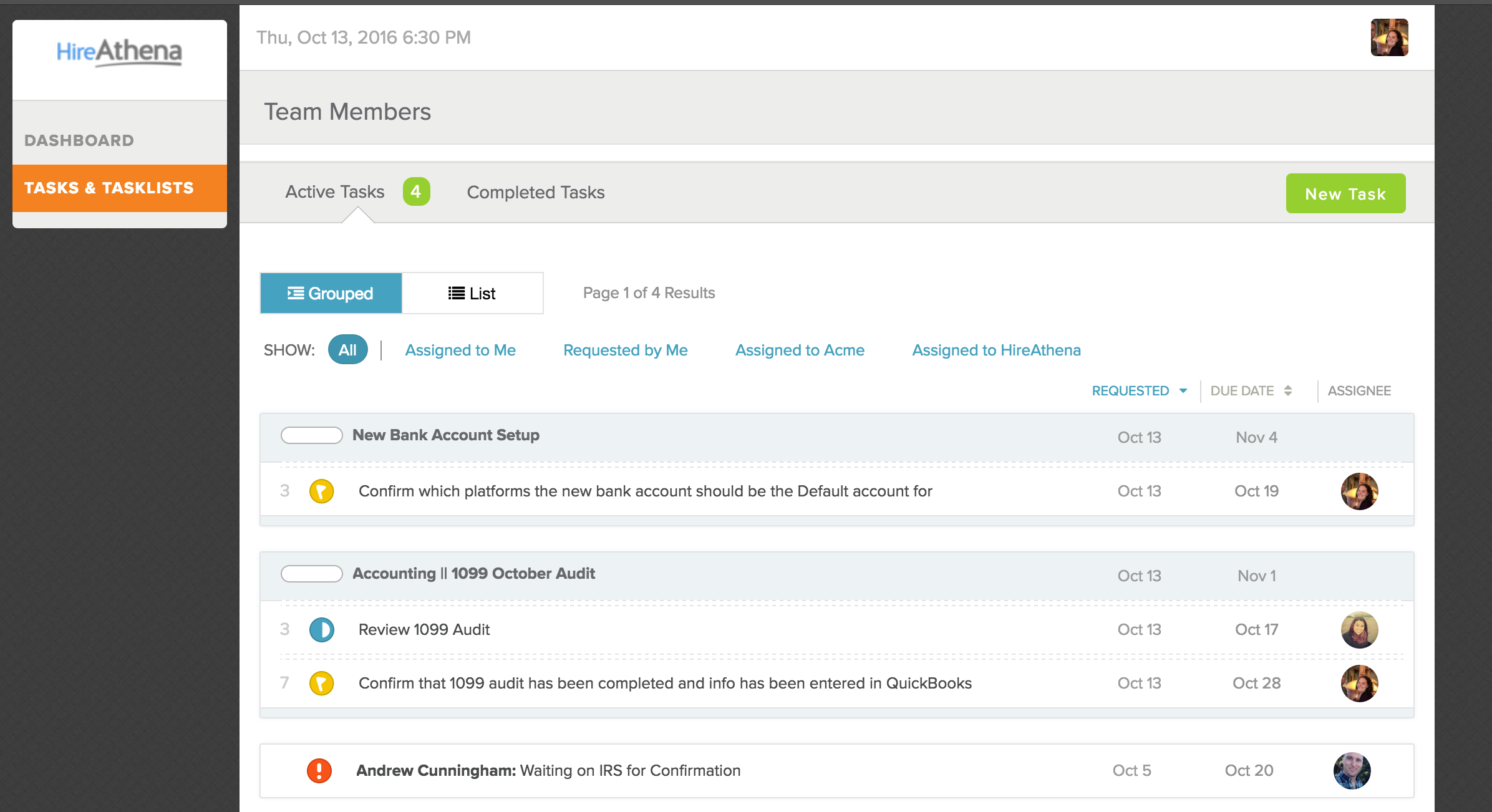

Voice Assistant Creation Simplified Key Announcements From Open Ais 2024 Event

Apr 28, 2025

Voice Assistant Creation Simplified Key Announcements From Open Ais 2024 Event

Apr 28, 2025 -

Open Ai Unveils Streamlined Voice Assistant Development Tools

Apr 28, 2025

Open Ai Unveils Streamlined Voice Assistant Development Tools

Apr 28, 2025 -

Three Years Of Data Breaches Cost T Mobile 16 Million In Fines

Apr 28, 2025

Three Years Of Data Breaches Cost T Mobile 16 Million In Fines

Apr 28, 2025 -

Podcast Power Ais Role In Processing Repetitive Scatological Documents

Apr 28, 2025

Podcast Power Ais Role In Processing Repetitive Scatological Documents

Apr 28, 2025