Economic Concerns Push Gas Prices Down: National Average Nears $3

Table of Contents

Recession Fears and Reduced Demand

The most significant factor driving down gas prices is the growing fear of a recession. This economic uncertainty is directly impacting consumer behavior and subsequently, the demand for gasoline.

Impact of Economic Uncertainty

The specter of a recession is dampening consumer confidence. People are tightening their belts, reducing discretionary spending, and this includes driving less.

- Decreased consumer confidence leads to less disposable income being spent on non-essential items, including fuel for leisure trips.

- Businesses are reducing travel expenses due to uncertainty and a focus on cost-cutting measures. This translates to fewer company vehicles on the road.

- Potential job losses further exacerbate the situation, impacting consumer behavior and reducing overall demand for gasoline.

Lower Oil Prices

The decreased demand for gasoline directly correlates with lower oil prices. Oil is the primary component of gasoline, meaning that a drop in oil prices inevitably translates to lower gas prices.

- The relationship between oil and gas prices is intrinsically linked. Crude oil prices are the biggest determinant of what consumers pay at the pump.

- Statistics show a significant drop in oil prices in recent weeks, mirroring the decline in gasoline prices. (Specific data and sources would be inserted here in a published article).

- The potential impact of a global economic slowdown on oil production is also a contributing factor. Reduced global economic activity leads to lower demand for oil, further depressing prices.

Federal Reserve Policies and Their Influence

The Federal Reserve's aggressive monetary policy to combat inflation also plays a significant role in the falling gas prices.

Interest Rate Hikes

The Federal Reserve's strategy of raising interest rates aims to curb inflation by slowing down economic growth. This, however, impacts consumer spending and borrowing.

- Higher interest rates reduce borrowing and investment. This makes it more expensive for businesses and individuals to take out loans, impacting spending and investment.

- This reduction in borrowing and investment directly affects consumer spending, further dampening demand for gasoline.

- The relationship between interest rates and economic activity is complex, but generally, higher rates slow down the economy.

Potential Impact on Future Gas Prices

The Federal Reserve's policies will continue to shape future gas price trends.

- Future gas price scenarios depend heavily on future economic data and the effectiveness of the Fed's actions in controlling inflation.

- Expert opinions on the long-term outlook are varied, but many predict continued price volatility in the short to medium term.

- The potential for price volatility remains high, given the interconnectedness of the global economy and the sensitivity of oil prices to various factors.

Geopolitical Factors and Their Role

Global events and geopolitical tensions significantly influence oil and, consequently, gas prices.

Global Market Instability

Uncertainties in the global political landscape can create instability in oil markets, leading to price fluctuations.

- Specific examples of current geopolitical events (e.g., the war in Ukraine) impacting oil prices would be detailed here with appropriate sourcing.

- Analysis of how these events affect the supply and demand dynamics of oil would be included.

- The potential for unexpected price swings due to instability in global oil markets is always present.

Alternative Energy Sources

The growing adoption of alternative energy sources is a long-term factor that may gradually impact gasoline demand and prices.

- The growth in renewable energy sources, such as solar and wind power, is steadily increasing.

- Government incentives for sustainable energy are further promoting the transition away from fossil fuels.

- Potential future shifts in energy consumption patterns may lead to reduced reliance on gasoline over the long term.

Conclusion

The decrease in gas prices is a complex phenomenon driven by a confluence of factors. Recession fears reducing demand, Federal Reserve policies curbing economic growth, and geopolitical instability all contribute to lower oil and gas prices. Understanding these interconnected forces is crucial for navigating the fluctuating fuel market. Staying informed about the latest developments in falling gas prices and how economic factors continue to shape their future trajectory is essential for consumers and businesses alike. Monitor reputable sources for up-to-date information on falling gas prices and adapt your driving habits accordingly.

Featured Posts

-

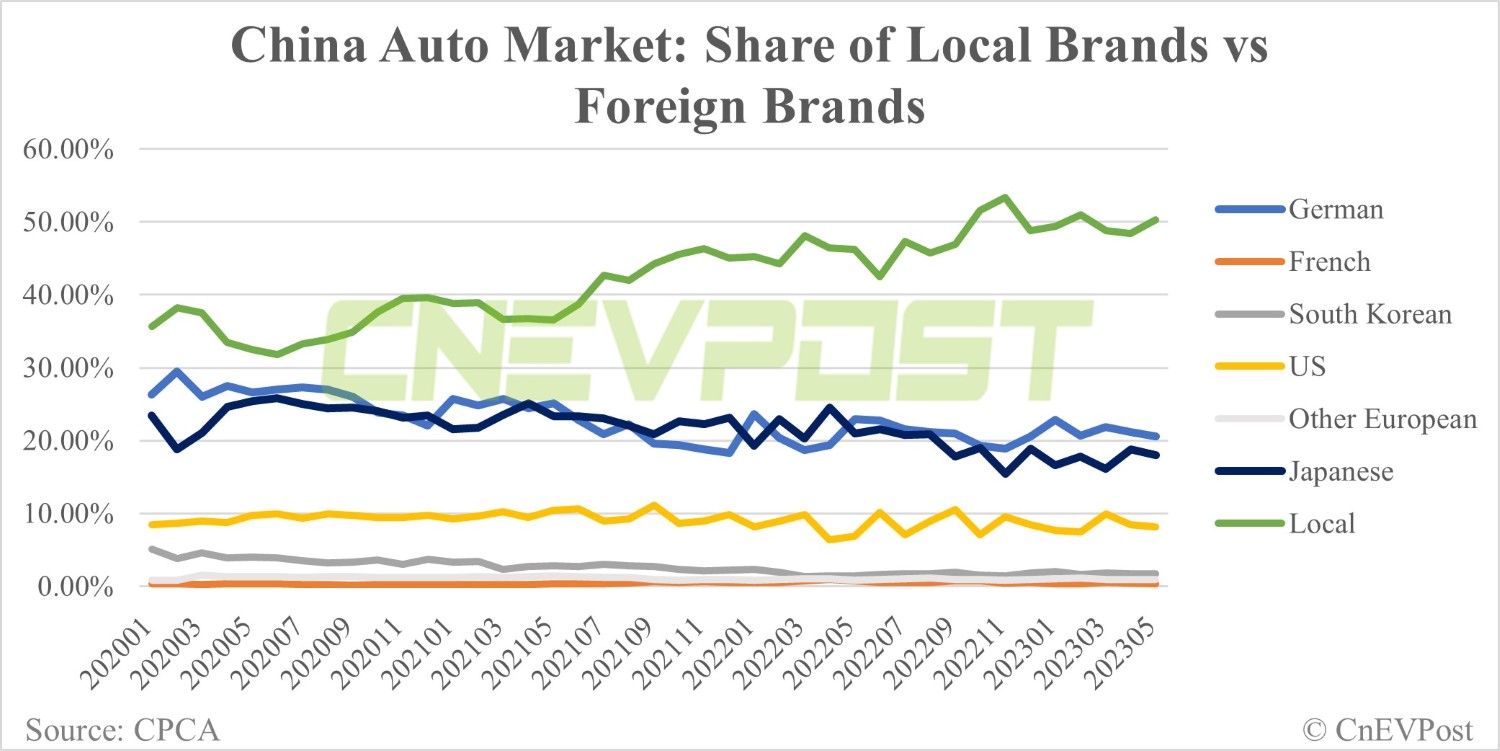

The China Factor Analyzing Automotive Market Difficulties For Premium Brands

May 22, 2025

The China Factor Analyzing Automotive Market Difficulties For Premium Brands

May 22, 2025 -

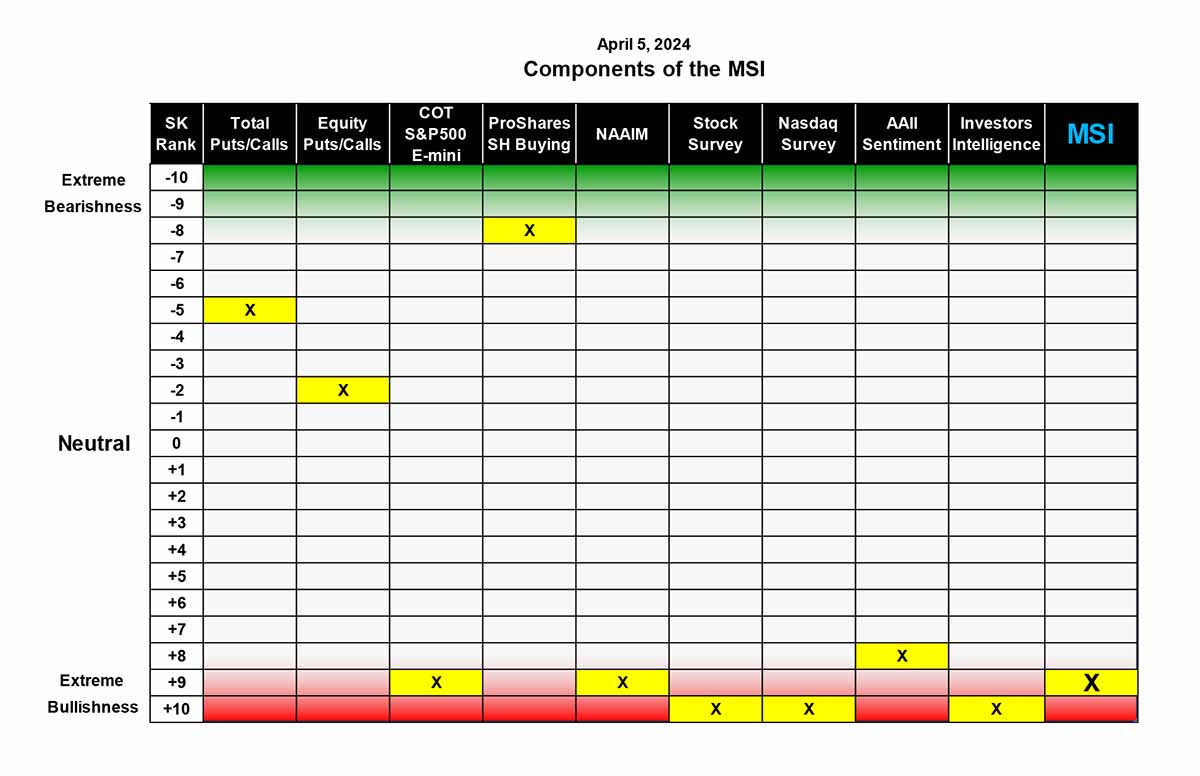

Assessing Googles Ai Capabilities A Look At Investor Sentiment

May 22, 2025

Assessing Googles Ai Capabilities A Look At Investor Sentiment

May 22, 2025 -

Un Serial Netflix Cu O Distributie De Vis Ce Asteptari Putem Avea

May 22, 2025

Un Serial Netflix Cu O Distributie De Vis Ce Asteptari Putem Avea

May 22, 2025 -

Shooting In Lancaster County Police Release Update On Investigation

May 22, 2025

Shooting In Lancaster County Police Release Update On Investigation

May 22, 2025 -

Hieu Ro Hai Lo Vuong Nho Tren Dau Noi Usb Cua Ban

May 22, 2025

Hieu Ro Hai Lo Vuong Nho Tren Dau Noi Usb Cua Ban

May 22, 2025

Latest Posts

-

Finaleto Na Ln Shpani A A Sovlada Khrvatska Po Penali

May 22, 2025

Finaleto Na Ln Shpani A A Sovlada Khrvatska Po Penali

May 22, 2025 -

Ligata Na Natsii Zhdrepkata Gi Odredi Protivnitsite Na Makedoni A

May 22, 2025

Ligata Na Natsii Zhdrepkata Gi Odredi Protivnitsite Na Makedoni A

May 22, 2025 -

Shpani A Slavi Pobeda Vo Ln Preku Penali Protiv Khrvatska

May 22, 2025

Shpani A Slavi Pobeda Vo Ln Preku Penali Protiv Khrvatska

May 22, 2025 -

Liga De Naciones Concacaf La Batalla De Memes Entre Canada Y Mexico

May 22, 2025

Liga De Naciones Concacaf La Batalla De Memes Entre Canada Y Mexico

May 22, 2025 -

Fudbal Makedoni A I Ne Zinite Rivali Vo Ligata Na Natsii

May 22, 2025

Fudbal Makedoni A I Ne Zinite Rivali Vo Ligata Na Natsii

May 22, 2025