Economy In Focus: Trump And Powell's White House Discussion

Table of Contents

The Pressure on the Federal Reserve

Trump's criticism of the Fed's monetary policy

President Trump's public pronouncements frequently criticized the Federal Reserve's monetary policy, particularly its decisions regarding interest rate hikes. He viewed these increases as detrimental to economic growth, hindering his administration's economic agenda.

- Direct Attacks: Trump openly criticized Powell and the Fed's decisions through tweets, press conferences, and interviews, directly impacting market sentiment.

- Market Reactions: These criticisms often led to significant market volatility, with investors uncertain about the future direction of monetary policy under political pressure.

- Conflict of Interest Concerns: Many economists and political analysts raised concerns about the potential conflict of interest inherent in a president directly influencing the independent central bank. The perceived political pressure on the Fed raised questions about its ability to make objective decisions based solely on economic data.

Keywords: Federal Reserve interest rates, Trump economic policy, monetary policy, inflation, economic growth

The independence of the Federal Reserve

The independence of the Federal Reserve is a cornerstone of a healthy and stable US economy. Its autonomy allows the central bank to make unbiased decisions based on economic data, rather than political considerations.

- Historical Precedents: Historically, attempts to politicize the Fed have often resulted in negative economic consequences. Maintaining the Fed's independence safeguards against short-term political gains undermining long-term economic stability.

- Consequences of Interference: Direct political interference in the Fed's operations can erode public trust in the institution, leading to increased uncertainty and market volatility. It can also undermine the effectiveness of monetary policy tools designed to manage inflation and unemployment.

- Safeguarding Autonomy: Preserving the Federal Reserve's autonomy is crucial for maintaining economic stability and fostering investor confidence. Protecting the Fed from undue political pressure is paramount for the long-term health of the US economy.

Keywords: Central bank independence, political pressure, Federal Reserve autonomy, economic stability

Disagreements on Economic Indicators

Conflicting views on inflation and unemployment

Trump and Powell held fundamentally different views on interpreting key economic indicators, particularly inflation and unemployment. These differing interpretations shaped their policy recommendations.

- Inflation Targets: Trump often prioritized low unemployment, even if it risked higher inflation, while Powell emphasized maintaining price stability as the Fed's primary mandate. Their differing views on the optimal balance between these two goals frequently led to public disagreements.

- Unemployment Figures: While both acknowledged the importance of low unemployment, their interpretations of the data and its implications for policy differed. Trump often viewed unemployment figures more optimistically than Powell.

- Economic Data Interpretation: The differing perspectives on interpreting economic data highlighted the complexities involved in making policy decisions, as well as the inherent uncertainties in economic forecasting.

Keywords: inflation rate, unemployment figures, economic data interpretation, economic forecasting

The impact of trade wars on economic growth

Trump's trade policies, including the imposition of tariffs, significantly impacted the US economy and became a major point of contention between him and Powell.

- Tariff Impacts: The trade wars initiated by Trump led to increased costs for businesses and consumers, potentially slowing economic growth and increasing inflation. These effects were a source of considerable disagreement between the President and the Fed Chairman.

- Global Trade Disruption: The trade disputes disrupted global supply chains, impacting various sectors of the US economy and adding to economic uncertainty. The resulting market volatility became another source of friction between the two.

- Expert Opinions: Many economists warned that the trade wars could negatively impact US economic growth, and their concerns were often echoed by the Fed in its policy statements.

Keywords: trade wars, tariffs, economic impact of trade, global trade, economic sanctions

Long-Term Consequences of the Discussions

The effect on investor confidence and market volatility

The public disagreements between Trump and Powell created considerable uncertainty, influencing investor confidence and causing significant market volatility.

- Market Uncertainty: The constant back-and-forth between the White House and the Fed fostered an environment of economic uncertainty, impacting investor decisions and market stability.

- Stock Market Performance: The tension between Trump's economic policies and the Fed's monetary policy contributed to periods of heightened stock market volatility, with sharp swings in response to news and statements from both sides.

- Impact on Investment: The uncertainty surrounding the relationship between the President and the Federal Reserve caused many investors to adopt a more cautious approach, potentially slowing investment and economic growth.

Keywords: investor confidence, stock market volatility, market uncertainty, economic uncertainty

The legacy of the Trump-Powell relationship on future economic policy

The Trump-Powell interactions left a lasting impact on the relationship between the presidency and the Federal Reserve, influencing the future direction of economic policy.

- Presidential Influence: The episode highlighted the ongoing tension between a President’s desire to influence monetary policy for short-term political gains and the need for the Fed to maintain its independence to ensure long-term economic stability.

- Future Central Bank Relations: The events underscored the importance of clear communication and a respectful working relationship between the executive branch and the Federal Reserve to foster economic stability and public trust.

- Economic Policy Direction: The disagreements over economic indicators and policy responses raised questions about the optimal balance between stimulating short-term growth and maintaining long-term economic stability.

Keywords: economic policy, future economic outlook, presidential influence, central bank relations

Conclusion: Economy in Focus: Analyzing the Trump-Powell Discussions

The Trump-Powell discussions revealed fundamental disagreements regarding economic policy, highlighting the pressure on the Federal Reserve, conflicting views on key economic indicators like inflation and unemployment, and the significant impact of trade wars on economic growth. The public nature of these disagreements created significant market volatility and raised concerns about the long-term consequences for the US economy. The legacy of this period underscores the critical importance of maintaining the independence of the Federal Reserve and fostering a productive working relationship between the executive branch and the central bank.

Key Takeaways: The Trump-Powell meetings demonstrated the potential for political pressure to influence monetary policy, highlighting the importance of the Fed's independence. The disagreements over economic indicators and the impact of trade policies underscored the complexities of economic decision-making and their far-reaching consequences. The resulting market volatility and uncertainty serve as a cautionary tale about the need for clear communication and collaboration between the President and the Federal Reserve.

Stay informed on future developments by following leading economic news sources and continuing your research on the impact of the Trump-Powell discussions on the US economy. Understanding these interactions is crucial to navigating the complexities of the economic landscape.

Featured Posts

-

Securite En Mer Conseils Essentiels Pour Un Jour En Mer

May 31, 2025

Securite En Mer Conseils Essentiels Pour Un Jour En Mer

May 31, 2025 -

Elon Musks Return From Dogecoin To Business Empire

May 31, 2025

Elon Musks Return From Dogecoin To Business Empire

May 31, 2025 -

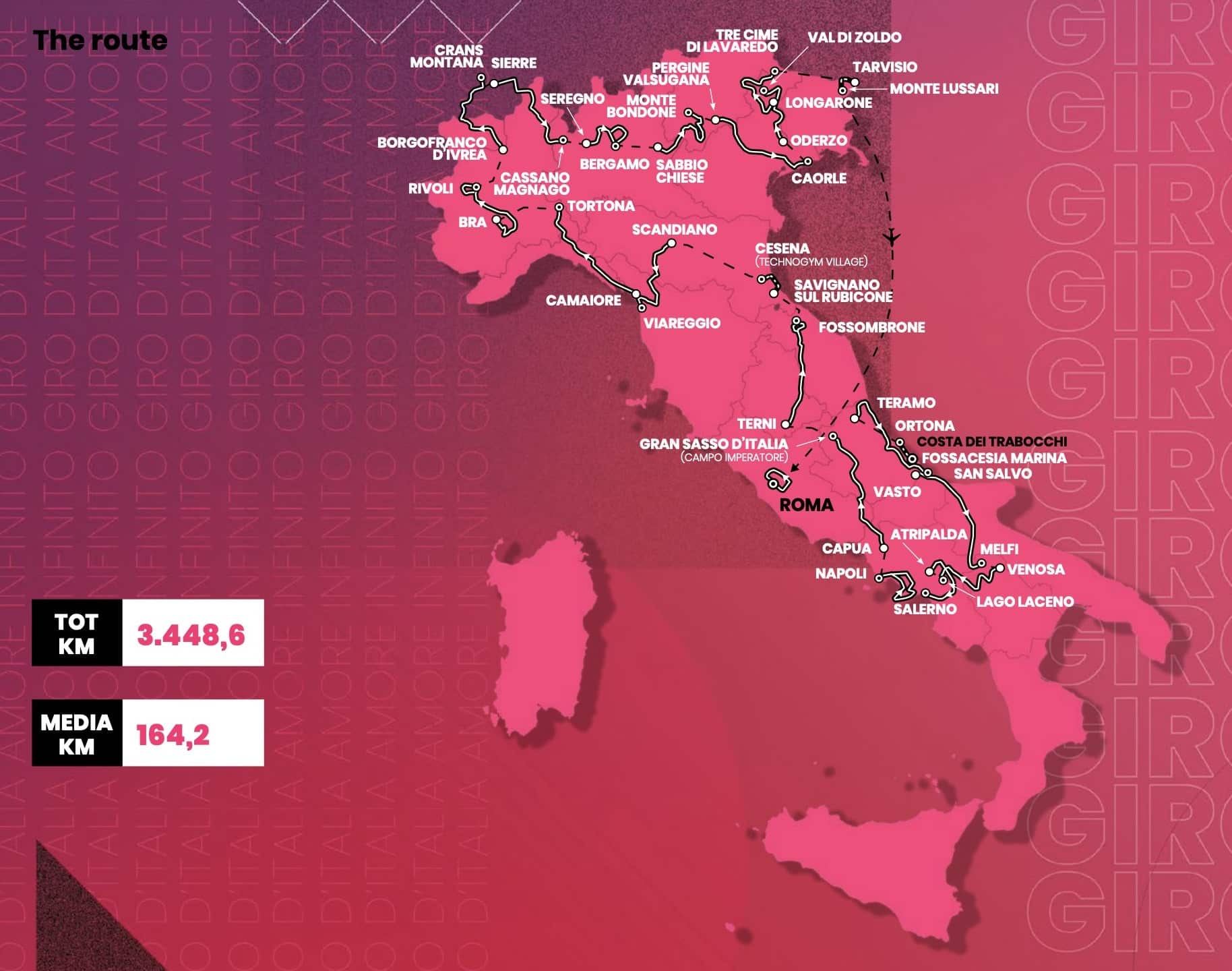

Watch The Giro D Italia Online Free Streaming Guide 2024

May 31, 2025

Watch The Giro D Italia Online Free Streaming Guide 2024

May 31, 2025 -

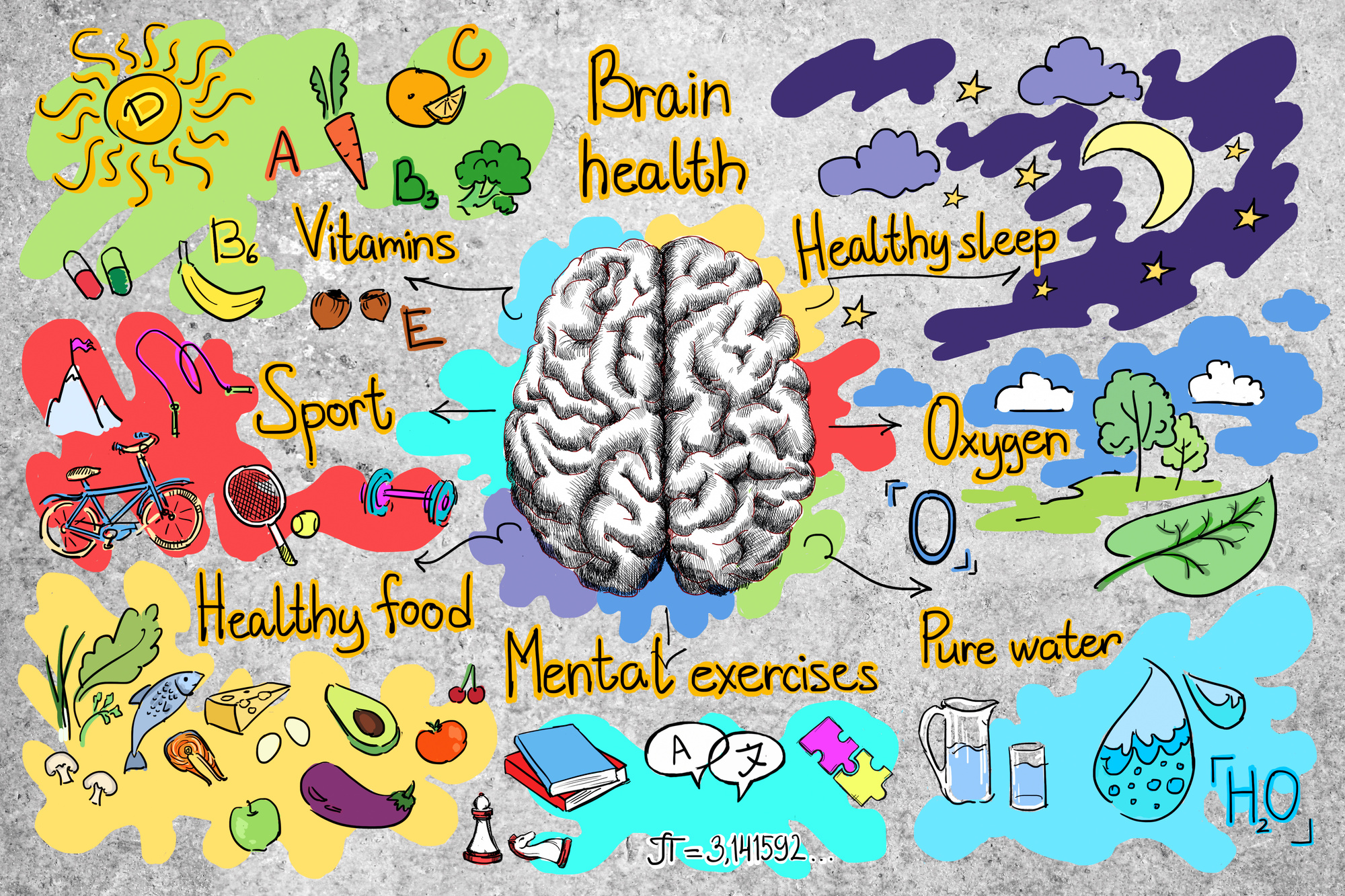

Understanding The Good Life A Holistic Approach To Wellbeing

May 31, 2025

Understanding The Good Life A Holistic Approach To Wellbeing

May 31, 2025 -

Sanofis Respiratory Pipeline Asthma Advances And Copd Clinical Trial Plans

May 31, 2025

Sanofis Respiratory Pipeline Asthma Advances And Copd Clinical Trial Plans

May 31, 2025