Effective Use Of Proxy Statements (Form DEF 14A) In Investment Decisions

Table of Contents

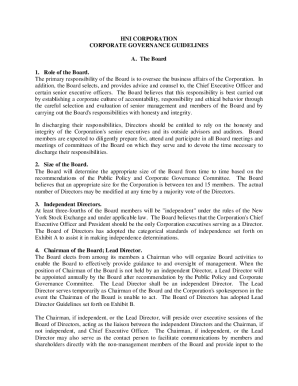

Understanding the Structure and Content of a Proxy Statement (Form DEF 14A)

Navigating a DEF 14A filing can seem daunting, but understanding its structure is key to effective analysis. These documents typically include several key sections, each providing vital information for investment research and due diligence. Learning to effectively read proxy statements is a crucial skill for any serious investor.

Key Sections and Insights:

-

Executive Compensation: This section details the compensation packages of the CEO and other executives. Scrutinize this closely. High executive pay, disproportionate to company performance, can be a red flag. Compare executive compensation to previous years and industry benchmarks. Look for excessive perks or questionable bonus structures.

-

Shareholder Proposals: This section outlines proposals submitted by shareholders. This reveals shareholder activism and potential areas of concern within the company. Pay close attention to the number of votes received by these proposals – high opposition may suggest underlying issues.

-

Board of Directors: Analyze the composition of the board, noting the independence of directors and their experience. A board lacking diversity or independent oversight might indicate poor corporate governance. Look for any conflicts of interest amongst board members.

-

Mergers and Acquisitions: If a merger or acquisition is proposed, this section will detail the terms and conditions. Carefully review the valuation, the rationale behind the deal, and the potential impact on shareholders.

-

Audit Information: This section provides information about the company's independent auditor and their findings. Any changes in auditors or significant audit qualifications should raise caution. Review the auditor’s report for any critical comments or concerns.

Utilizing Proxy Statements for Enhanced Due Diligence

Analyzing proxy statements significantly enhances your due diligence efforts, providing a deeper understanding of a company beyond what's found in financial statements alone. It's a powerful tool for identifying potential investment risks and assessing management quality.

Identifying Potential Risks:

- Conflicts of Interest: Look for instances where directors or executives have personal interests that may conflict with the company's best interests.

- Questionable Accounting Practices: Examine the notes to the financial statements for any unusual accounting treatments or inconsistencies.

- Poor Corporate Governance: Identify weaknesses in corporate governance, such as a lack of independent directors or inadequate internal controls.

Assessing Management Quality:

- Management's Track Record: Review management's history and performance in previous roles.

- Compensation Practices: Analyze executive compensation to assess alignment with shareholder interests.

- Shareholder Communication: Evaluate how effectively management communicates with shareholders.

Leveraging Proxy Statements in Specific Investment Strategies

Proxy statement analysis benefits various investment strategies, providing actionable insights for informed decision-making.

Applying Proxy Statement Analysis to Different Investment Strategies:

- ESG Investing: Analyze proxy statements for information on environmental, social, and governance (ESG) performance, aligning your investments with your values.

- Activist Investing: Identify companies with potential governance issues or undervalued assets, allowing for shareholder engagement opportunities.

- Value Investing: Uncover undervalued companies by rigorously analyzing financial data within the proxy statement, identifying discrepancies between market valuation and intrinsic value.

- Growth Investing: Identify companies with strong growth prospects by examining management's strategies and future plans detailed in the proxy statement.

Tools and Resources for Analyzing Proxy Statements

Accessing and analyzing proxy statements effectively requires the right tools.

Useful Resources:

- SEC EDGAR Database: The primary source for SEC filings, including proxy statements (Form DEF 14A). [Link to EDGAR Database]

- Commercial Data Providers: Several commercial providers offer enhanced search and analysis capabilities for proxy statements. These often include tools for comparing data across companies and over time. (Mention specific providers, if appropriate, with links)

Conclusion

Mastering the analysis of proxy statements (Form DEF 14A) significantly improves investment decision-making. By understanding their structure, utilizing them for enhanced due diligence, and applying their insights to various investment strategies, you gain a crucial competitive advantage. Start leveraging the power of proxy statements today, and improve your investment strategy with effective DEF 14A analysis. Unlock the hidden insights within proxy statements to make smarter investment choices and achieve better investment outcomes.

Featured Posts

-

Streaming Release Time Alexander Skarsgard In Murderbot

May 17, 2025

Streaming Release Time Alexander Skarsgard In Murderbot

May 17, 2025 -

Stay Updated Moto News Covering Gncc Mx Sx Flat Track And Enduro

May 17, 2025

Stay Updated Moto News Covering Gncc Mx Sx Flat Track And Enduro

May 17, 2025 -

Putin Dhe Presidenti I Eau Detajet E Bisedes Se Fundit Telefonike

May 17, 2025

Putin Dhe Presidenti I Eau Detajet E Bisedes Se Fundit Telefonike

May 17, 2025 -

Review Of Top Australian Crypto Casino Sites For 2025

May 17, 2025

Review Of Top Australian Crypto Casino Sites For 2025

May 17, 2025 -

The New York Knicks And Their Unexpected Depth A Brunson Less Success Story

May 17, 2025

The New York Knicks And Their Unexpected Depth A Brunson Less Success Story

May 17, 2025

Latest Posts

-

Will The Knicks Offense Recover Quickly After Brunsons Return

May 17, 2025

Will The Knicks Offense Recover Quickly After Brunsons Return

May 17, 2025 -

The Impact Of Jalen Brunsons Absence On New York Knicks Depth

May 17, 2025

The Impact Of Jalen Brunsons Absence On New York Knicks Depth

May 17, 2025 -

New York Knicks Exploring Team Depth Without Jalen Brunson

May 17, 2025

New York Knicks Exploring Team Depth Without Jalen Brunson

May 17, 2025 -

Jalen Brunsons Free Agency A Bigger Blow To The Mavericks Than A Luka Doncic Trade

May 17, 2025

Jalen Brunsons Free Agency A Bigger Blow To The Mavericks Than A Luka Doncic Trade

May 17, 2025 -

Did The Mavericks Make A Mistake Brunsons Departure Vs The Hypothetical Doncic Trade

May 17, 2025

Did The Mavericks Make A Mistake Brunsons Departure Vs The Hypothetical Doncic Trade

May 17, 2025