Elon Musk Net Worth Dips Under $300 Billion: Tesla Challenges And Tariff Concerns

Table of Contents

Tesla Stock Performance: A Major Contributor to the Net Worth Dip

Tesla's stock price has experienced a considerable downturn recently, directly impacting Elon Musk's overall net worth. This decline is multifaceted, stemming from several interconnected factors.

-

Increased Competition in the Electric Vehicle (EV) Market: The EV market is rapidly expanding, with established automakers and new entrants aggressively competing with Tesla. This increased competition is putting pressure on Tesla's market share and profitability. Keywords: Tesla stock price, Tesla market cap, EV competition, Tesla sales.

-

Concerns about Production and Delivery Timelines: Tesla has faced challenges in meeting its ambitious production targets and delivery schedules. Reports of production bottlenecks and delays have raised concerns among investors, contributing to the stock price decline. Keywords: Tesla production, Tesla delivery, supply chain issues.

-

Investor Sentiment and Market Volatility: Negative investor sentiment, fueled by concerns about Tesla's performance and Elon Musk's activities with other ventures, has further exacerbated the stock price drop. The broader market volatility has also played a significant role. Keywords: investor sentiment, Tesla stock volatility, market downturn.

-

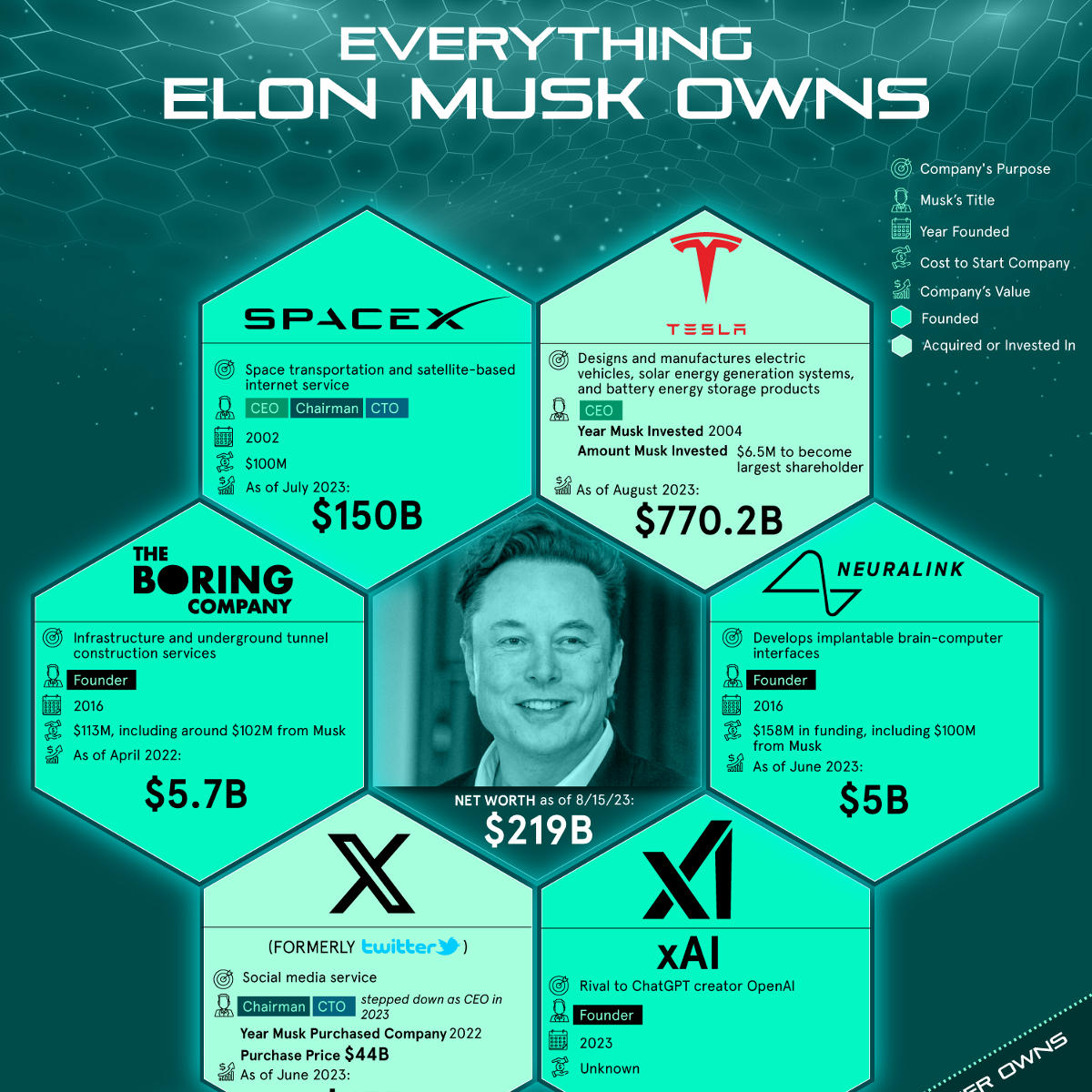

Impact of Elon Musk's Other Ventures: Musk's involvement with SpaceX and Twitter has diverted attention and resources, potentially impacting Tesla's focus and performance. Investors may be concerned about the allocation of Musk's time and energy. Keywords: Elon Musk SpaceX, Elon Musk Twitter, diversification of investments.

Data reveals a significant percentage drop in Tesla's stock price over the past [insert timeframe, e.g., quarter, year], resulting in a considerable decrease in its market capitalization. This directly translates to a reduction in Elon Musk's net worth, as his wealth is largely tied to his Tesla stock ownership.

The Impact of Tariffs and Global Trade Uncertainties

Tariffs and global trade uncertainties pose significant challenges to Tesla's operations and profitability, further contributing to the dip in Elon Musk's net worth.

-

Impact of Tariffs on Raw Materials and Components: Tesla relies on a global supply chain for raw materials and components. Tariffs and trade disputes increase the cost of these inputs, impacting Tesla's production costs and ultimately its profitability. Keywords: Tesla tariffs, import tariffs, raw materials costs.

-

Challenges in Navigating Trade Regulations in Different Markets: Tesla operates in various countries with differing trade regulations and import/export restrictions. Navigating this complex regulatory landscape adds to the company's operational costs and challenges. Keywords: global trade, trade regulations, export tariffs, supply chain disruption.

-

Potential Impact on Tesla's Expansion Plans: Tariffs and trade wars can disrupt Tesla's expansion plans into new markets. Uncertainty about future trade policies creates risks and challenges for international growth strategies. Keywords: Tesla expansion, international trade, geopolitical risks.

The current geopolitical climate, characterized by ongoing trade disputes and protectionist policies, adds another layer of complexity to Tesla's operations and contributes to the uncertainty surrounding its future performance.

The Broader Economic Context

The broader economic climate also plays a role in Tesla's performance and Elon Musk's net worth. Factors such as inflation, rising interest rates, and fears of a potential recession create a challenging environment for businesses. Investor sentiment is significantly affected by these macroeconomic factors, leading to increased market volatility and impacting stock prices, including Tesla's. Keywords: economic recession, inflation, interest rates, global economy, market volatility.

The Future of Elon Musk's Net Worth: Navigating Tesla's Challenges

In summary, the recent decline in Elon Musk's net worth is a consequence of several interconnected factors: Tesla's struggles with stock performance, the impact of tariffs and global trade uncertainties, and the broader macroeconomic environment. The future of Elon Musk's net worth is inextricably linked to Tesla's ability to overcome these challenges and navigate the complexities of the evolving EV market and global economy.

To stay informed about future developments concerning Elon Musk's net worth and Tesla's performance, monitor Tesla stock updates, follow the Elon Musk net worth story closely, and stay informed about the impact of global trade on billionaire fortunes. Follow reputable financial news sources for ongoing updates.

Featured Posts

-

Tragic Fate Of Americas First Nonbinary Person

May 09, 2025

Tragic Fate Of Americas First Nonbinary Person

May 09, 2025 -

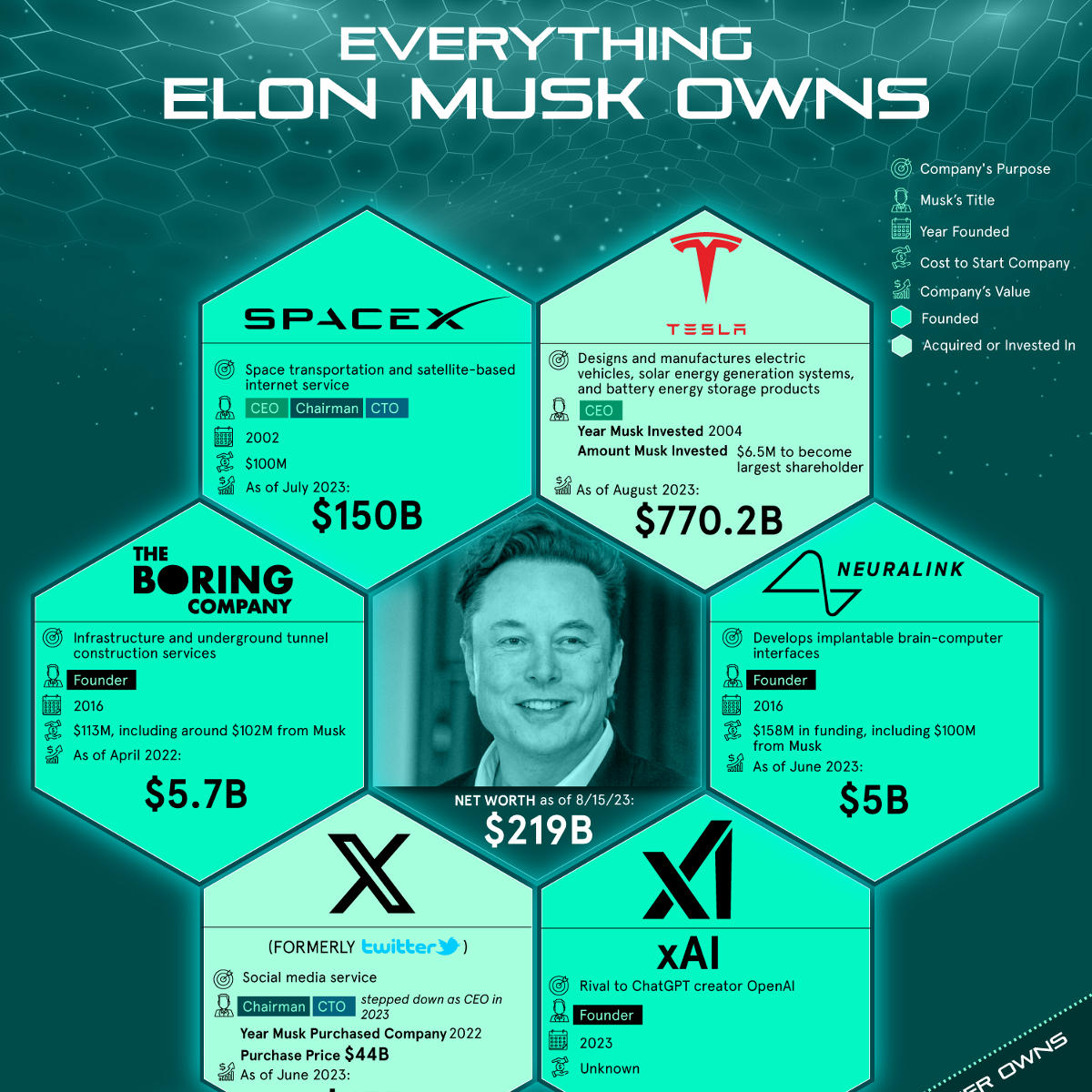

Updated Champions League Final Prediction From Rio Ferdinand Psg Or Arsenal

May 09, 2025

Updated Champions League Final Prediction From Rio Ferdinand Psg Or Arsenal

May 09, 2025 -

Analiza E Lojes Se Psg 11 Faktore Te Dominimit

May 09, 2025

Analiza E Lojes Se Psg 11 Faktore Te Dominimit

May 09, 2025 -

9 4000 360

May 09, 2025

9 4000 360

May 09, 2025 -

Makron I Tusk 9 Maya Analiz Predstoyaschego Oboronnogo Soglasheniya

May 09, 2025

Makron I Tusk 9 Maya Analiz Predstoyaschego Oboronnogo Soglasheniya

May 09, 2025