Elon Musk's Billions Take A Hit: Tesla, Tariffs, And The Impact On Net Worth

Table of Contents

Tesla Stock Performance and its Correlation to Musk's Net Worth

Volatility in the Electric Vehicle Market

The electric vehicle (EV) market, while experiencing explosive growth, is also incredibly volatile. Tesla, as a market leader, is acutely susceptible to these fluctuations. Several factors contribute to this volatility:

- Competition from established automakers: Legacy automakers are aggressively entering the EV market, increasing competition and putting pressure on Tesla's market share.

- Supply chain disruptions: Global supply chain issues have impacted Tesla's production capacity, leading to delays and impacting profitability.

- Production delays: Ambitious production targets have occasionally fallen short, leading to disappointment amongst investors and affecting Tesla's stock price.

- Consumer demand fluctuations: Changes in consumer spending habits, economic downturns, and shifts in preferences can directly impact sales and therefore Tesla's financial performance.

These factors directly impact Tesla's stock price, and since a significant portion of Elon Musk's net worth is tied up in Tesla stock, his personal wealth is directly correlated to its performance. A drop in Tesla's share price translates directly into a reduction in Musk's net worth, and vice-versa. For example, significant drops in Tesla's stock price in 2022 directly correlated with a substantial decrease in Musk's overall net worth.

Investor Sentiment and Market Speculation

Tesla's stock price isn't solely driven by fundamentals; investor sentiment and market speculation play a crucial role. Positive news, such as new product launches (like the Cybertruck) or technological breakthroughs, can send the stock soaring. Conversely, negative news—production issues, regulatory scrutiny, or even Musk's own tweets—can cause significant drops.

- Positive news: Successful new product launches, groundbreaking technological advancements, strong quarterly earnings reports.

- Negative news: Production setbacks, recalls, negative media coverage, regulatory investigations, controversial statements from Elon Musk.

- Social media influence: Musk's active presence on social media can significantly influence investor perception and market sentiment, impacting Tesla’s stock price and consequently his net worth.

Musk's public persona and actions, therefore, have a direct and often immediate effect on investor confidence and, ultimately, his own financial standing. A single tweet can trigger significant market fluctuations, demonstrating the intertwined nature of his personal brand and Tesla's financial success.

The Impact of International Tariffs on Tesla's Global Operations

Trade Wars and their Effect on Tesla's Profitability

International trade disputes and tariffs significantly impact Tesla's profitability and global operations. Tariffs on imported goods increase manufacturing costs, potentially reducing profit margins and affecting Tesla’s competitiveness in international markets.

- Tariffs on raw materials: Tariffs on materials like lithium, cobalt, and aluminum, crucial for battery production, directly increase Tesla's production costs.

- Import/export taxes: Taxes on importing and exporting vehicles and parts add to the overall cost of doing business globally.

- Impact on different international markets: Tariffs and trade restrictions in major markets like China and Europe can significantly reduce sales volume and revenue.

These tariffs directly impact Tesla’s bottom line, reducing profitability and subsequently impacting Musk's net worth. The financial impact can be quantified by analyzing the cost increases due to tariffs and the resulting reduction in profits or sales in affected markets.

Navigating Geopolitical Risks and Regulatory Hurdles

Tesla's global operations face numerous geopolitical risks and regulatory hurdles. Political instability in key markets, changing regulations, and the potential for future tariff increases contribute to uncertainty and volatility.

- Political instability: Unpredictable political situations in countries where Tesla operates can disrupt production, sales, and overall business operations.

- Changing regulations: Evolving environmental regulations and safety standards in different regions add to the complexity and cost of operating globally.

- Potential for future tariff increases: The threat of escalating trade wars and further tariff increases creates ongoing uncertainty and risk for Tesla's financial performance.

These uncertainties contribute significantly to the volatility of Tesla's stock and, consequently, Musk’s wealth. Investors are less likely to invest in companies with high levels of geopolitical risk, impacting the company's valuation and Musk's net worth.

The Broader Economic Context and its Influence on Musk's Net Worth

Macroeconomic Factors and Market Downturns

Broader macroeconomic trends significantly influence the valuation of Tesla and other tech companies. Recessions, inflation, and interest rate hikes impact consumer spending and investor behavior.

- Impact of inflation on consumer spending: High inflation reduces disposable income, potentially impacting demand for luxury goods like Tesla vehicles.

- Interest rate hikes affecting investment: Higher interest rates increase borrowing costs and can reduce investment in growth stocks like Tesla.

- General market volatility: Overall market downturns often lead to investors selling off growth stocks, impacting Tesla's share price.

These macroeconomic forces influence investor behavior, often leading to market corrections that can significantly impact Musk's net worth. A downturn in the broader economy often translates to lower valuations for even the most successful companies.

Diversification of Assets and Risk Management

While Tesla constitutes a major portion of Musk's wealth, his other ventures, particularly SpaceX, provide a degree of diversification. SpaceX's success and future revenue streams can help mitigate the risk associated with Tesla's performance.

- Value of SpaceX: SpaceX, a private company, has a substantial valuation, although not publicly traded. Its growth and success reduce the reliance on Tesla alone for Musk's financial stability.

- Other investments: Musk's investments in other companies and assets contribute to a more diversified portfolio, reducing overall risk.

- Potential for future revenue streams: The success of SpaceX and other potential ventures could significantly enhance Musk's overall net worth, even if Tesla experiences setbacks.

Diversification of assets plays a key role in buffering the impact of Tesla's fluctuations on Musk’s overall wealth. This diversification, while still heavily weighted towards Tesla, offers some protection against severe financial losses due to Tesla's performance alone.

Conclusion

Elon Musk's net worth is significantly impacted by a complex interplay of factors: Tesla's stock performance, the effects of international tariffs, and broader macroeconomic conditions. The interconnectedness of these elements highlights the volatility inherent in his financial standing. Tesla's success in a competitive EV market, the company's ability to navigate geopolitical risks and tariff challenges, and the broader economic climate all play crucial roles in shaping Musk's billions.

Call to Action: Stay informed about the ongoing developments in the electric vehicle market, global trade policies, and macroeconomic trends to better understand the future fluctuations in Elon Musk’s net worth and the performance of Tesla. Follow our updates on Elon Musk’s net worth and Tesla's performance for continued analysis and insights into this dynamic and ever-changing financial landscape.

Featured Posts

-

Oboronniy Soyuz Frantsii I Polshi Novye Realii Geopolitiki

May 09, 2025

Oboronniy Soyuz Frantsii I Polshi Novye Realii Geopolitiki

May 09, 2025 -

Elon Musks Net Worth Falls Below 300 Billion Tesla Troubles And Tariff Impacts

May 09, 2025

Elon Musks Net Worth Falls Below 300 Billion Tesla Troubles And Tariff Impacts

May 09, 2025 -

New Young Thug Song Snippet Hints At Relationship Commitment

May 09, 2025

New Young Thug Song Snippet Hints At Relationship Commitment

May 09, 2025 -

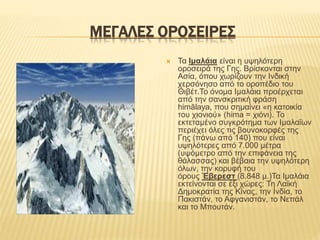

Sta Xamilotera Epipeda 23 Eton Ta Xionia Ton Imalaion Anisyxia Gia Tis Epiptoseis

May 09, 2025

Sta Xamilotera Epipeda 23 Eton Ta Xionia Ton Imalaion Anisyxia Gia Tis Epiptoseis

May 09, 2025 -

Analyzing Doohans Path Forward Jolyon Palmers Take On The Alpine Lineup

May 09, 2025

Analyzing Doohans Path Forward Jolyon Palmers Take On The Alpine Lineup

May 09, 2025