Elon Musk's Dogecoin Influence: Fact Vs. Fiction

Table of Contents

The Factual Influence: Musk's Tweets and Market Reactions

Analyzing the Correlation Between Musk's Tweets and Dogecoin Price Fluctuations

Numerous analyses demonstrate a strong correlation between Elon Musk's tweets mentioning Dogecoin and subsequent price movements. While correlation doesn't equal causation, the sheer magnitude of these price swings following his pronouncements is undeniable. This impact extends beyond simple price fluctuations; it significantly affects trading volume and overall market sentiment.

- Example Tweet 1 and its price impact: In [insert date], Musk tweeted "[insert tweet content]", leading to an immediate [percentage]% surge in Dogecoin's price within [timeframe].

- Example Tweet 2 and its price impact: A subsequent tweet mentioning "Doge" or showcasing a Doge-related image resulted in another significant price jump, highlighting the power of his social media presence.

- Statistical analysis of tweet frequency vs. price volatility: Studies using statistical methods have shown a statistically significant relationship between the frequency of Musk's Dogecoin-related tweets and the volatility of the cryptocurrency's price. (Cite reputable source here, e.g., a research paper or news article from a financial publication).

Musk's Public Endorsements and their Effect on Dogecoin Adoption

Musk's public endorsements, extending beyond casual tweets, have played a considerable role in Dogecoin's increased adoption. His statements, often amplified by his massive social media following, have attracted a wave of retail investors eager to participate in the "Dogecoin phenomenon."

- Mention specific instances of Musk endorsing Dogecoin: This includes mentions on his podcast appearances, interviews, and even Tesla's brief acceptance of Dogecoin as payment.

- Discuss increased trading volume following his endorsements: Each instance of public endorsement has correlated with a substantial increase in Dogecoin trading volume, indicating a clear link between Musk's actions and investor interest.

- Analyze the growth of Dogecoin's community after Musk's involvement: The growth of Dogecoin's online community and the increased engagement on social media platforms can be directly linked to Musk's involvement, creating a self-reinforcing cycle of hype and speculation.

The Fictional Influence: Separating Hype from Reality

Debunking the Myth of Direct Market Manipulation

While Elon Musk's influence on Dogecoin's price is undeniable, claims of direct market manipulation require careful scrutiny. It's crucial to differentiate between influencing market sentiment and directly manipulating prices.

- Explain the limitations of Musk's actual control over Dogecoin's price: Musk does not control Dogecoin's underlying technology or its supply. His influence is primarily through the power of his public statements and social media reach.

- Discuss regulatory scrutiny and potential consequences of market manipulation: Accusations of market manipulation carry severe legal and financial ramifications. Regulatory bodies closely monitor such activities, and evidence of deliberate price manipulation would lead to significant repercussions.

- Highlight the role of other factors affecting Dogecoin's price (e.g., market sentiment, technological developments): Dogecoin's price is affected by numerous factors beyond Musk's tweets, including broader cryptocurrency market trends, technological advancements within the Dogecoin ecosystem, and general investor sentiment.

The Impact of Social Media Hype and Speculation

Dogecoin's popularity is intrinsically linked to the "meme coin" phenomenon and the power of social media hype. This creates a cycle of FOMO (Fear Of Missing Out), driving investor behavior and price volatility.

- Explain the psychology behind meme coin investments: Meme coins often attract investors based on social media trends and community engagement rather than fundamental value analysis.

- Discuss the influence of social media influencers beyond Elon Musk: Other influencers and online communities play a significant role in shaping public opinion and driving price movements.

- Analyze the risks associated with investing based on hype: Investing based solely on hype and social media trends is incredibly risky, as price fluctuations can be extreme and unpredictable.

Conclusion

Elon Musk's influence on Dogecoin is multifaceted and undeniable. His tweets and public statements have a demonstrable impact on the cryptocurrency's price and adoption. However, it is crucial to avoid the misconception of direct market manipulation. His power lies largely in his ability to shape market sentiment and amplify existing trends, not in outright control of the cryptocurrency's price. The inherent volatility of Dogecoin is amplified by the interplay of various factors, including social media hype, broader market trends, and speculative investment behavior. Understanding Elon Musk's Dogecoin influence is crucial for navigating the volatile world of cryptocurrency. Do your research, understand the risks, and make informed decisions before investing.

Featured Posts

-

Best Nike Running Shoes 2025 By Type And Running Style

May 26, 2025

Best Nike Running Shoes 2025 By Type And Running Style

May 26, 2025 -

Journaliste Belge Hugo De Waha Remporte La Prestigieuse Bourse Payot

May 26, 2025

Journaliste Belge Hugo De Waha Remporte La Prestigieuse Bourse Payot

May 26, 2025 -

Saksikan Moto Gp Inggris 2025 Jadwal Race Live Streaming Trans7 And Spotv Dan Klasemen

May 26, 2025

Saksikan Moto Gp Inggris 2025 Jadwal Race Live Streaming Trans7 And Spotv Dan Klasemen

May 26, 2025 -

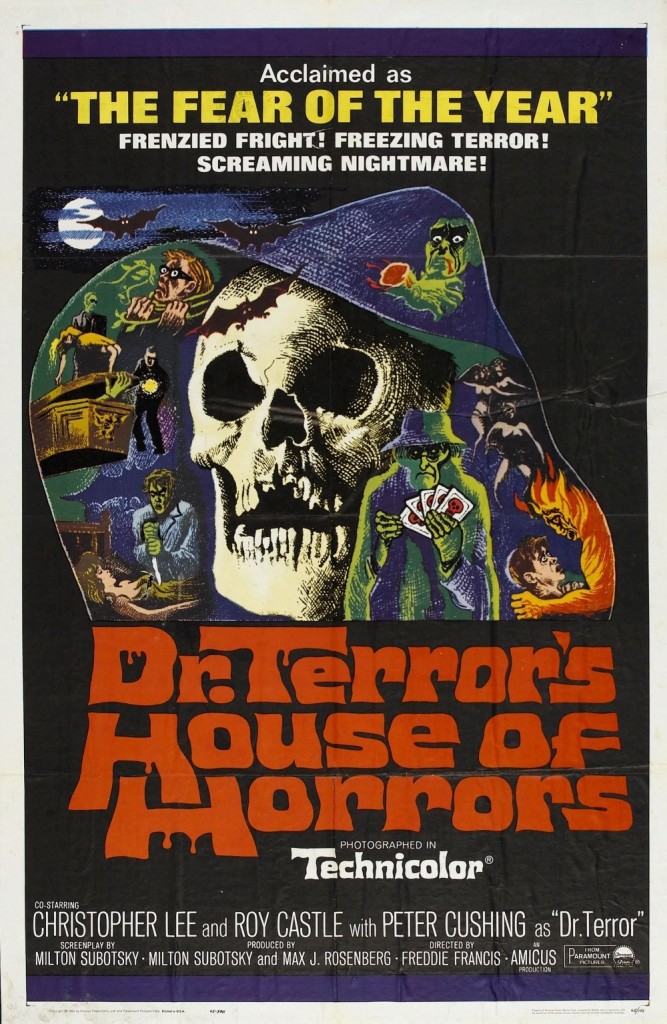

Dr Terrors House Of Horrors Is It Right For You A Detailed Look

May 26, 2025

Dr Terrors House Of Horrors Is It Right For You A Detailed Look

May 26, 2025 -

Fanatik Gazetesi Ile Atletico Madrid Barcelona Macini Canli Izleyin

May 26, 2025

Fanatik Gazetesi Ile Atletico Madrid Barcelona Macini Canli Izleyin

May 26, 2025

Latest Posts

-

Rwyt Mstqblyt Llshrakt Aljzayryt Alamrykyt Fy Snaet Altyran

May 27, 2025

Rwyt Mstqblyt Llshrakt Aljzayryt Alamrykyt Fy Snaet Altyran

May 27, 2025 -

Shrakt Jzayryt Amrykyt Najht Fy Mjal Altyran Nmadhj Wtjarb

May 27, 2025

Shrakt Jzayryt Amrykyt Najht Fy Mjal Altyran Nmadhj Wtjarb

May 27, 2025 -

Alteawn Aljzayry Alamryky Nhw Tfrt Nweyt Fy Qtae Altyran

May 27, 2025

Alteawn Aljzayry Alamryky Nhw Tfrt Nweyt Fy Qtae Altyran

May 27, 2025 -

Drast Mtemqt Lshrakt Altyran Byn Aljzayr Walwlayat Almthdt Alamrykyt

May 27, 2025

Drast Mtemqt Lshrakt Altyran Byn Aljzayr Walwlayat Almthdt Alamrykyt

May 27, 2025 -

Ahm Almelwmat Hwl Msabqt Twzyf Bryd Aljzayr 2025

May 27, 2025

Ahm Almelwmat Hwl Msabqt Twzyf Bryd Aljzayr 2025

May 27, 2025