Elon Musk's Net Worth: How US Policy Impacts Tesla's CEO Fortune

Table of Contents

Tax Policies and Their Effect on Elon Musk's Wealth

Elon Musk's immense wealth is heavily reliant on Tesla's stock performance. Therefore, US tax policies significantly impact his net worth.

Capital Gains Taxes

Capital gains taxes are a crucial factor. Musk's wealth is largely tied up in Tesla stock, and any sale of these shares would trigger capital gains taxes.

- Lower capital gains taxes: Benefit Musk significantly, allowing him to retain a larger portion of his wealth after selling shares. Lower taxes incentivize investment and can fuel further stock growth.

- Potential tax increases: Conversely, increases in capital gains tax rates could substantially reduce his net worth after selling shares. This could discourage future investment and potentially slow Tesla's growth.

- Political debate: The ongoing political debate surrounding capital gains tax rates directly impacts Musk's financial future and influences Tesla's investment strategies. Higher taxes could lead to changes in how Musk manages his Tesla stock holdings.

Tesla's stock price has experienced dramatic growth since its IPO. This growth is directly correlated with Musk's increasing net worth. For instance, a 10% increase in Tesla's stock price translates to a multi-billion dollar increase in Musk's net worth due to his significant stock ownership.

Corporate Tax Rates

Corporate tax rates profoundly influence Tesla's profitability, indirectly affecting Musk's wealth.

- Lower corporate taxes: Allow Tesla to reinvest more profits into research and development, expansion, and new initiatives, ultimately boosting its market value and Musk's stake.

- Higher corporate taxes: Reduce Tesla's profitability, potentially limiting its growth and impacting Musk’s wealth. Higher taxes could necessitate price increases or reduced investment.

- Impact on Tesla's investments: Corporate tax rates directly affect Tesla's ability to make strategic investments, impacting its competitiveness and long-term growth, and consequently Musk’s net worth.

Tesla's corporate tax payments are substantial, and their fluctuation based on profitability and the applicable tax rate directly translates to the company's bottom line and subsequently, Musk's personal wealth.

Environmental Regulations and Tesla's Growth

Government regulations play a pivotal role in shaping the electric vehicle market, significantly impacting Tesla's success and Elon Musk's net worth.

Incentives for Electric Vehicles

US government incentives for electric vehicles have been instrumental in boosting Tesla's sales.

- Tax credits and subsidies: These incentives make EVs more affordable, driving demand and increasing Tesla's market share.

- Impact on Tesla's profitability: Government support directly translates to increased sales, higher profitability, and a positive effect on Tesla's stock price, benefiting Musk directly.

- Phasing out incentives: The potential phasing out or alteration of these incentives could negatively impact Tesla's sales and, consequently, Musk's net worth.

Statistics show a strong correlation between the availability of EV tax credits and a surge in Tesla sales. A reduction or removal of these incentives could significantly impact the company's growth trajectory.

Emission Standards and Regulations

Stringent emission standards create a competitive advantage for Tesla.

- Stricter regulations: Benefit Tesla, as its electric vehicles inherently meet these standards, while competitors face greater challenges.

- Impact on Tesla's position: Stringent regulations level the playing field and increase Tesla’s market share, positively affecting Musk's wealth.

- Future regulations: The potential introduction of even stricter emissions regulations could further cement Tesla's position as a market leader, enhancing Musk's financial standing.

Data comparing Tesla's emissions to internal combustion engine vehicles highlight Tesla's advantage in meeting increasingly strict environmental standards, furthering its market position and enhancing Musk's net worth.

Infrastructure Development and its Impact on Tesla

Investment in infrastructure directly impacts Tesla's growth and consequently Elon Musk’s wealth.

Investment in Charging Infrastructure

Government investment in charging infrastructure is crucial for EV adoption.

- Public charging stations: The expansion of public charging infrastructure makes EV ownership more convenient, boosting demand and benefiting Tesla.

- Tesla's Supercharger network: While Tesla has its own Supercharger network, public charging infrastructure complements it, increasing overall EV adoption, benefiting Tesla indirectly.

- Correlation with EV adoption: Increased convenience through widespread charging infrastructure strongly correlates with higher EV adoption rates, positively impacting Tesla's sales and Musk's net worth.

The growth of Tesla's Supercharger network and the expansion of public charging stations are directly related; more public charging encourages wider EV adoption and reinforces the value of Tesla's extensive network.

Government Funding for Renewable Energy

Government funding for renewable energy research and development indirectly benefits Tesla.

- Battery technology advancements: Public funding supports advancements in battery technology, a core component of Tesla's vehicles. Improved battery technology leads to better vehicles and increased market share for Tesla.

- Indirect benefit to Tesla: Advancements in battery technology, driven by government funding, reduce costs, improve performance and further enhance Tesla's competitive edge.

- Impact on Tesla's competitiveness: This strengthens Tesla's competitive advantage and positively contributes to Musk's wealth.

Government spending on renewable energy research has significantly contributed to advancements in battery technology, a key factor in Tesla's success and the substantial increase in Elon Musk's net worth.

Conclusion

US policy significantly influences Elon Musk's net worth, primarily through its impact on Tesla's success. Tax policies, environmental regulations, and infrastructure development are all interwoven, shaping the landscape for Tesla's growth and directly affecting the value of Musk's considerable Tesla stock holdings. Understanding the interconnectedness of US policy and Tesla's success is crucial for comprehending the future of the electric vehicle industry. Stay informed about upcoming policy changes that could significantly affect both Tesla and Elon Musk's fortune.

Featured Posts

-

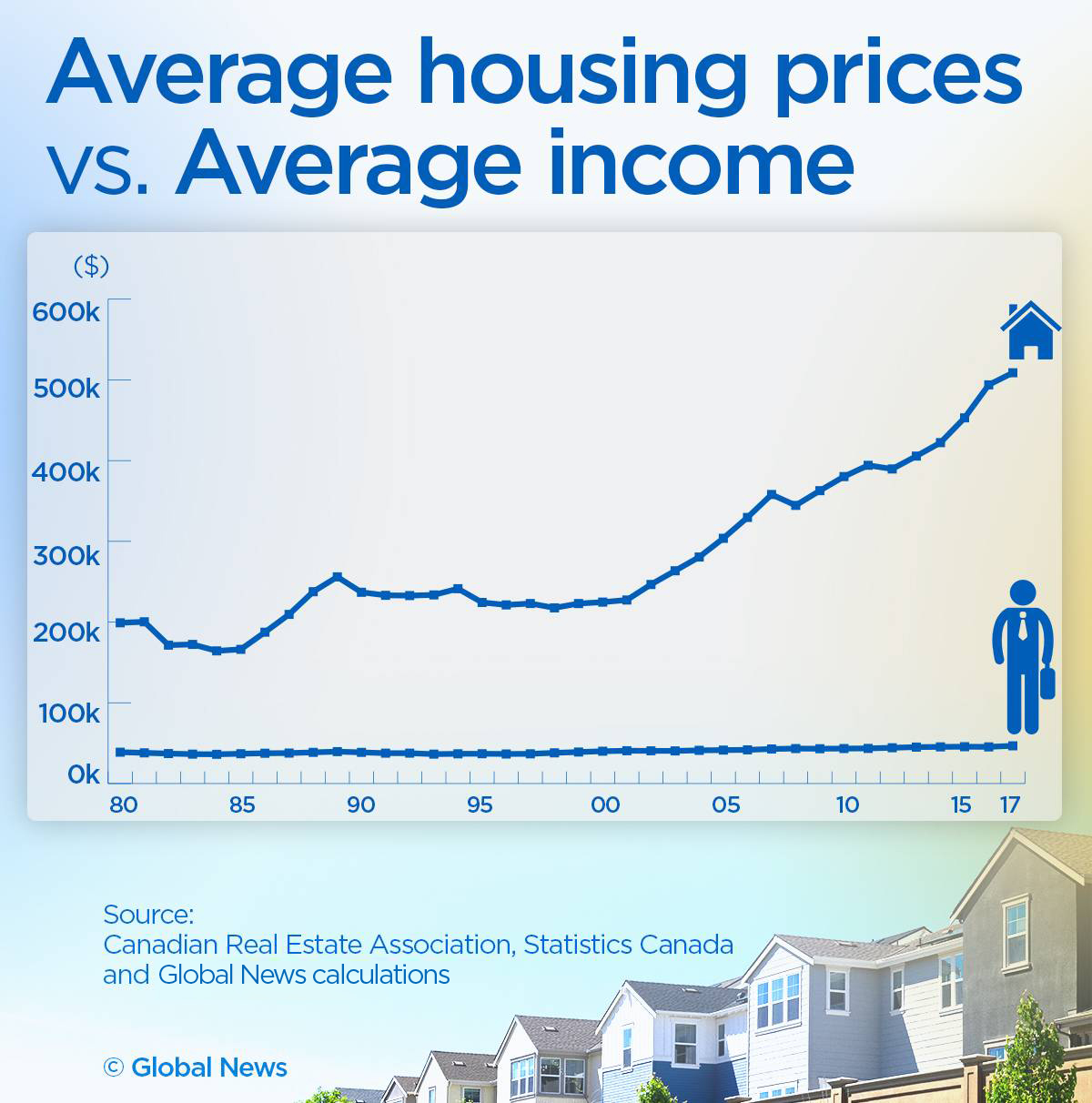

Canadas Housing Crisis The Impact Of Steep Down Payments

May 09, 2025

Canadas Housing Crisis The Impact Of Steep Down Payments

May 09, 2025 -

Tougher Uk Immigration Rules Impact On English Language Requirements

May 09, 2025

Tougher Uk Immigration Rules Impact On English Language Requirements

May 09, 2025 -

Nottingham Attack Data Breach Reveals 90 Nhs Staff Viewed Victim Records

May 09, 2025

Nottingham Attack Data Breach Reveals 90 Nhs Staff Viewed Victim Records

May 09, 2025 -

The Snl Impression That Upset Harry Styles

May 09, 2025

The Snl Impression That Upset Harry Styles

May 09, 2025 -

Live Music And Events Your Easter Weekend Guide To Lake Charles

May 09, 2025

Live Music And Events Your Easter Weekend Guide To Lake Charles

May 09, 2025