Elon Musk's Return To Form: Positive Impacts On Tesla Stock

Table of Contents

2. Renewed Focus on Operations and Product Development

Elon Musk's recent emphasis on streamlining Tesla's operations and accelerating product development has significantly contributed to the positive shift in Tesla's stock price. This renewed focus manifests in two key areas: improved operational efficiency and exciting new product launches.

H3: Streamlined Management and Efficiency

Tesla has demonstrably improved its internal operations, leading to increased production efficiency and a more robust supply chain. This operational excellence is directly impacting the bottom line.

- Increased Model Y Production: Tesla has significantly ramped up production of its highly popular Model Y, meeting strong consumer demand and boosting overall revenue.

- Reduced Reliance on Specific Suppliers: By diversifying its supply chain, Tesla has mitigated risks associated with single-source dependencies, ensuring a more stable production process.

- Cost Reduction Initiatives: Internal improvements have led to cost reductions across various aspects of the business, improving profitability and margins. This focus on operational efficiency is crucial for long-term sustainable growth.

H3: Innovation and New Product Launches

Tesla's commitment to innovation continues to drive investor confidence. Exciting developments and announcements consistently fuel positive market sentiment.

- Cybertruck Updates: While delayed, updates on the Cybertruck's development and anticipated launch continue to generate significant buzz and anticipation among potential buyers and investors alike.

- Advancements in Autonomous Driving Technology (FSD): Continued progress in Tesla's Full Self-Driving (FSD) technology is a key factor driving investor confidence in the company's future technological leadership. This cutting-edge technology remains a significant selling point for Tesla vehicles.

- Future Product Roadmap: The promise of future innovative vehicles and technologies further solidifies Tesla's position as a market leader in the electric vehicle (EV) sector, attracting investors seeking long-term growth potential.

2. Improved Investor Sentiment and Market Confidence

The positive shift in Tesla's stock price is also significantly driven by improved investor sentiment and a renewed market confidence in the company's future. This positive change is reflected in media coverage and strengthened strategic partnerships.

H3: Positive Media Coverage and Public Perception

The narrative surrounding Elon Musk and Tesla has shifted in recent months, with more positive media coverage and a generally improved public perception.

- Positive News Articles: Numerous reputable news outlets have highlighted Tesla's operational improvements and positive financial results, contributing to a more positive public image.

- Social Media Trends: Social media trends have reflected this shift, with increased positive sentiment towards Tesla and Elon Musk's leadership.

- Analyst Reports: Many financial analysts have upgraded their price targets for Tesla stock, reflecting renewed confidence in the company's future performance. These reports often cite operational improvements and strong financial results as key justifications for the upgrades.

H3: Strategic Partnerships and Investments

Strategic partnerships and investments further contribute to market confidence and Tesla's enhanced financial stability.

- [Insert Example of a Positive Partnership Here]: (e.g., A strategic alliance with a major battery supplier strengthens Tesla's supply chain and reduces production costs.)

- [Insert Example of a Positive Investment Here]: (e.g., Investments in renewable energy infrastructure bolster Tesla's commitment to sustainability and attract environmentally conscious investors.)

- Positive Investor Relations: Proactive communication and transparency with investors have built trust and improved the overall relationship between Tesla and the financial community.

3. Strong Financial Performance and Earnings Reports

Tesla's recent financial performance has been exceptionally strong, contributing directly to the positive trend in its stock price. Solid revenue growth and increased profitability are key factors.

H3: Increased Revenue and Profitability

Tesla's recent earnings reports have showcased impressive revenue growth and significantly improved profit margins.

- [Insert Specific Revenue Figures and Growth Percentage]: (e.g., "Tesla's Q[Quarter] revenue increased by X% compared to the same period last year, reaching $Y billion.")

- [Insert Specific Profit Margin Data]: (e.g., "Profit margins have improved by Z%, demonstrating increasing operational efficiency and cost controls.")

- Strong Demand: High demand for Tesla's vehicles, especially the Model Y and Model 3, is a key driver of this strong financial performance.

H3: Positive Future Outlook and Projections

Analysts predict continued growth for Tesla, based on the current positive trends.

- Target Price Increases: Many analysts have significantly increased their price targets for Tesla stock, reflecting a positive outlook for the company's future.

- Positive Future Outlook: The combination of strong operational performance, robust product innovation, and positive market sentiment paints a bright picture for Tesla's future growth prospects.

3. Conclusion

In summary, Elon Musk's renewed focus on operational efficiency, product innovation, and improved investor relations has significantly contributed to the positive trajectory of Tesla's stock price. The strong financial performance, positive media coverage, and promising future outlook all point to a sustained period of growth for the company. Key takeaways include the importance of streamlined operations, continuous product development, and the crucial role of positive investor sentiment in driving stock performance. Stay tuned for further updates on how Elon Musk's leadership continues to shape Tesla's trajectory and impact its stock performance. Follow us for more analysis on Elon Musk's return to form and its effect on Tesla stock. Understanding Elon Musk's impact on Tesla is key to navigating this dynamic market.

Featured Posts

-

Artfae Daks Alalmany Mwshr Ela Teafy Alaqtsad Alawrwby

May 25, 2025

Artfae Daks Alalmany Mwshr Ela Teafy Alaqtsad Alawrwby

May 25, 2025 -

Trumps Hardball Tactics Securing A Republican Agreement

May 25, 2025

Trumps Hardball Tactics Securing A Republican Agreement

May 25, 2025 -

Amsterdam City Hall Faces Lawsuit Tik Tok Influx Overwhelms Local Snack Bar

May 25, 2025

Amsterdam City Hall Faces Lawsuit Tik Tok Influx Overwhelms Local Snack Bar

May 25, 2025 -

Flash Flood Warning Bradford And Wyoming Counties Until Tuesday

May 25, 2025

Flash Flood Warning Bradford And Wyoming Counties Until Tuesday

May 25, 2025 -

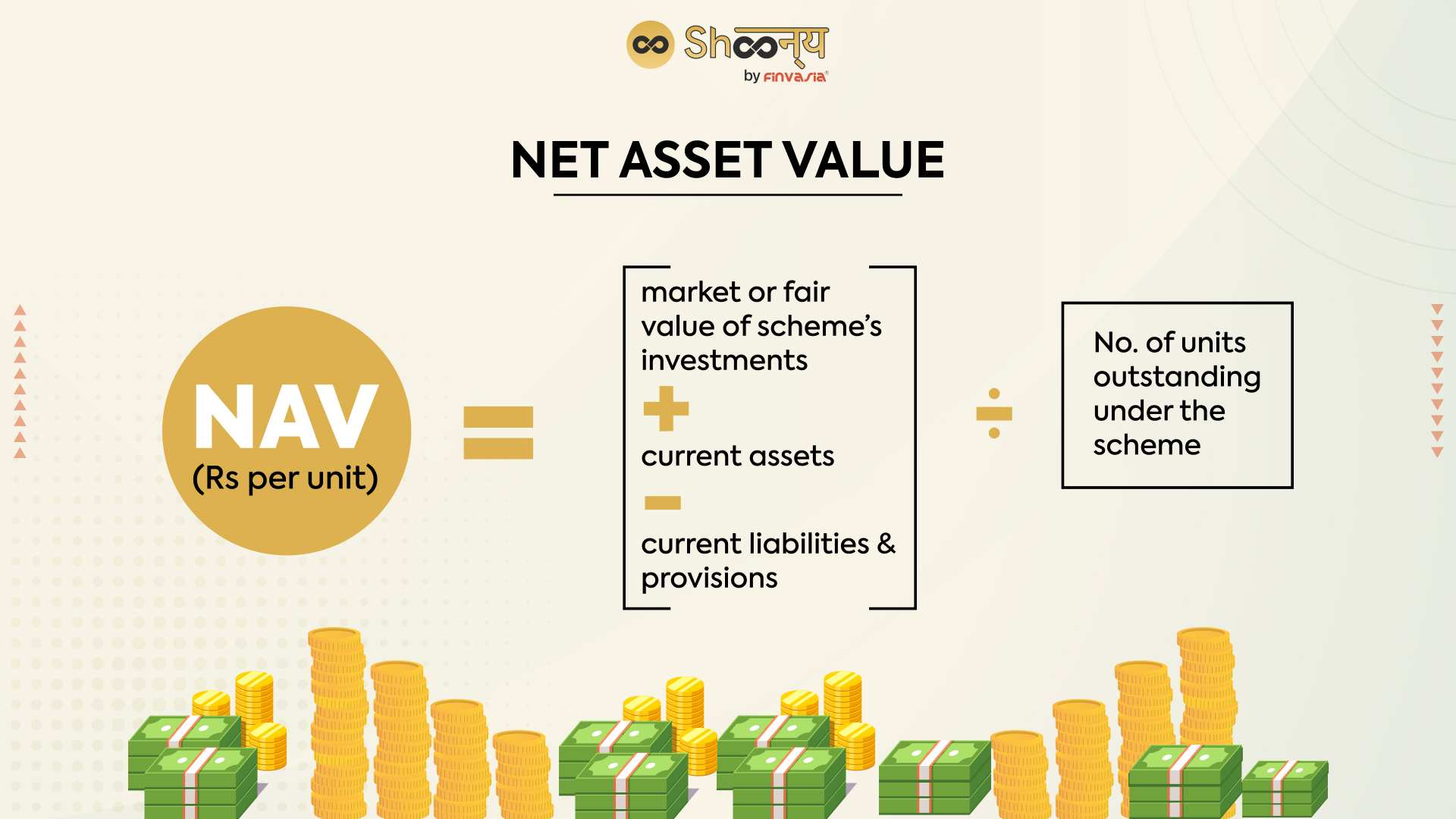

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist An In Depth Analysis

May 25, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist An In Depth Analysis

May 25, 2025

Latest Posts

-

Atletico Madrid In Zaferi 3 Maclik Durgunluk Asildi

May 25, 2025

Atletico Madrid In Zaferi 3 Maclik Durgunluk Asildi

May 25, 2025 -

3 Maclik Bekleyis Sonlandi Atletico Madrid Kazandi

May 25, 2025

3 Maclik Bekleyis Sonlandi Atletico Madrid Kazandi

May 25, 2025 -

Atletico Madrid 3 Maclik Korkulu Film Son Buldu

May 25, 2025

Atletico Madrid 3 Maclik Korkulu Film Son Buldu

May 25, 2025 -

Atletico Madrid In 3 Maclik Hasreti Sona Erdi

May 25, 2025

Atletico Madrid In 3 Maclik Hasreti Sona Erdi

May 25, 2025 -

Atletico Madrid 3 Maclik Galibiyetsizligi Kirildi

May 25, 2025

Atletico Madrid 3 Maclik Galibiyetsizligi Kirildi

May 25, 2025