Elon Musk's SpaceX Stake Surges: Now Worth $43 Billion More Than Tesla Holdings

Table of Contents

SpaceX's Valuation Explosion: Drivers of Growth

SpaceX's valuation has skyrocketed, propelling it past Tesla in terms of Musk's personal stake. Several key factors have fueled this remarkable growth:

-

Starlink's Stellar Success: Starlink, SpaceX's satellite internet constellation, is a major contributor to its valuation. The rapid expansion of its subscriber base and successful deployments worldwide have generated significant revenue and investor confidence. The Starlink valuation alone is estimated to be a substantial portion of SpaceX's overall worth.

-

Starship Program Progress: The development of Starship, SpaceX's fully reusable launch system, represents a monumental leap forward in space technology. Successful test flights, though experiencing setbacks, continue to demonstrate progress towards a more affordable and efficient means of space travel. This progress fuels investor optimism regarding the future of SpaceX contracts and revenue generation.

-

Securing Lucrative Contracts: SpaceX has secured numerous lucrative contracts, both from government agencies like NASA and from commercial entities. These contracts, encompassing everything from launching satellites to transporting cargo and astronauts to the International Space Station, provide a steady stream of revenue and bolster the company's financial stability. The scale of these SpaceX contracts demonstrates the industry's trust in the company's capabilities.

-

Booming Space Exploration Investment: The space exploration sector is experiencing a surge in investment, with both public and private entities pouring resources into innovative projects. This increased investor interest in space exploration investment has significantly impacted SpaceX's valuation, reflecting a broader belief in the company's potential.

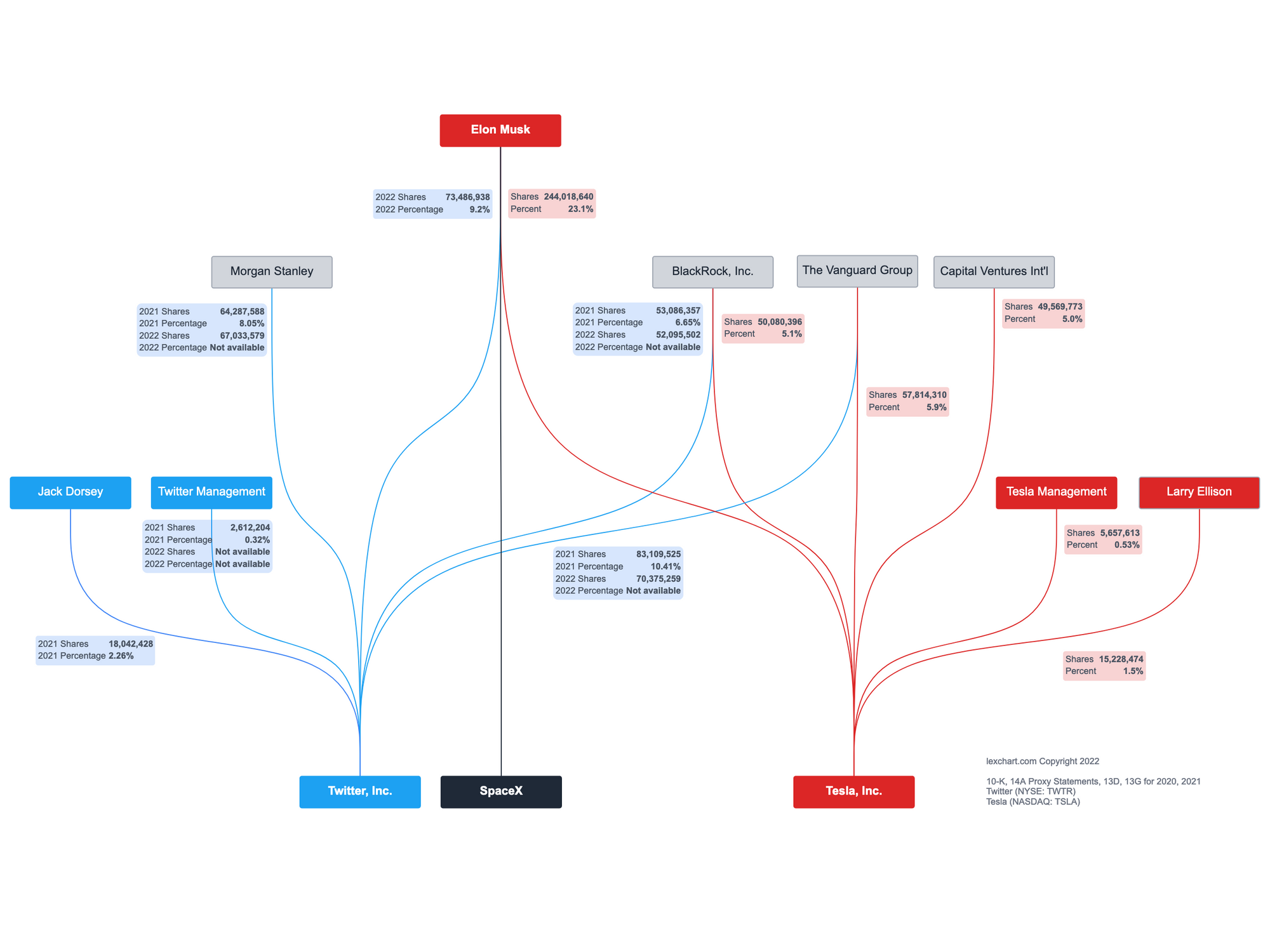

Tesla's Holding Still Significant, But SpaceX Closes the Gap

While Tesla remains a significant asset in Elon Musk's portfolio, the rapid growth of SpaceX has dramatically narrowed the gap between the two companies in terms of his personal stake. Tesla's market cap remains substantial, reflecting its dominance in the electric vehicle market. However, the factors influencing Tesla's stock price, such as fluctuating market conditions and competition, are distinct from those driving SpaceX's growth.

-

Market Valuation Comparison: A direct comparison of Tesla's market capitalization and SpaceX's newly-estimated valuation reveals the dramatic shift in Musk's holdings. While Tesla's stock price can experience volatility, SpaceX's valuation has shown remarkable upward trajectory.

-

Tesla Stock Performance: Tesla's stock performance, while generally strong, is subject to market forces and investor sentiment. Factors such as production output, regulatory changes, and competition impact its valuation.

-

Long-Term Growth Projections: Both SpaceX and Tesla have promising long-term growth projections. However, the current trajectory suggests SpaceX is experiencing a period of particularly rapid expansion, closing the gap with Tesla in Musk's overall portfolio.

Implications for Elon Musk's Net Worth and Future Investments

The surge in SpaceX's valuation has significantly boosted Elon Musk's net worth, solidifying his position as one of the world's wealthiest individuals. This increase in Elon Musk's net worth opens up new possibilities for future investments and ventures.

-

Net Worth Before and After: Analyzing Musk's net worth before and after the SpaceX valuation surge highlights the sheer magnitude of the change. This dramatic increase significantly alters his financial capacity for future undertakings.

-

Future Investment Priorities: The increased wealth could fuel further development of SpaceX, including advancements in Starship and Starlink. It could also lead to increased investment in other ventures, ranging from sustainable energy to artificial intelligence. Future investments will be closely watched by market analysts.

-

Business Impact: Musk's amplified financial power and influence resulting from the SpaceX valuation will undoubtedly reshape his standing in the business world. This increased influence will likely amplify his impact on various industries.

Conclusion: The Future of Elon Musk's SpaceX Stake and its Implications

The significant increase in SpaceX's valuation, surpassing that of Tesla in terms of Musk's personal stake, represents a pivotal moment in the history of both companies and the space exploration industry. The factors driving this growth, including Starlink's success and progress on the Starship program, point to a bright future for SpaceX. This surprising shift underscores the dynamism of the space exploration and electric vehicle sectors, highlighting the power of innovation and bold investments. To stay informed about further developments in Elon Musk's SpaceX stake and the ever-evolving landscape of space exploration, be sure to follow us for future updates.

Featured Posts

-

Ferrari Dq Scare Prompts Jeremy Clarksons F1 Intervention Plan

May 09, 2025

Ferrari Dq Scare Prompts Jeremy Clarksons F1 Intervention Plan

May 09, 2025 -

Trumps Houthi Truce Shippers Remain Skeptical

May 09, 2025

Trumps Houthi Truce Shippers Remain Skeptical

May 09, 2025 -

Muutoksia Britannian Kruununperimysjaerjestykseen Uusi Jaerjestys

May 09, 2025

Muutoksia Britannian Kruununperimysjaerjestykseen Uusi Jaerjestys

May 09, 2025 -

Living Legends Of Aviation Honors Firefighters And Other Heroes

May 09, 2025

Living Legends Of Aviation Honors Firefighters And Other Heroes

May 09, 2025 -

The Attorney General And Fox News A Daily Occurrence Worth Investigating

May 09, 2025

The Attorney General And Fox News A Daily Occurrence Worth Investigating

May 09, 2025