Entertainment Stock: Buy The Dip According To Analysts

Table of Contents

Why Analysts Recommend Buying the Dip in Entertainment Stocks

Several factors lead analysts to recommend a "buy the dip" strategy for carefully selected entertainment stocks.

Undervaluation Due to Market Corrections

Recent market corrections have disproportionately impacted entertainment stocks, leading to undervaluation in several promising companies. Many stocks are currently trading below their intrinsic value, presenting a compelling buying opportunity for long-term investors. This undervaluation is often due to:

- Temporary subscriber drops: Streaming services, for example, may experience temporary dips in subscriber growth due to economic uncertainty or increased competition.

- Streaming wars impact: The intense competition in the streaming landscape has put pressure on some companies' stock prices, creating opportunities for strategic investors.

- Inflation concerns: Rising inflation and interest rates have impacted consumer spending, affecting the entertainment sector's short-term performance.

Examples of potentially undervalued stocks (always conduct thorough research before investing) include companies that have experienced temporary setbacks but possess strong underlying fundamentals and future growth potential.

Strong Growth Potential in the Long Term

Despite short-term challenges, the long-term growth prospects for the entertainment industry remain exceptionally strong. The increasing global adoption of streaming services, the booming gaming market, and the rise of immersive experiences all contribute to this positive outlook. Investing in entertainment stocks now positions you to capitalize on this future growth, potentially yielding significant returns. Key growth drivers include:

- Increasing global internet penetration: As internet access expands globally, the potential audience for streaming services and online gaming dramatically increases.

- Technological advancements: Innovations in VR/AR, AI, and other technologies are transforming the entertainment landscape, creating new opportunities and experiences.

- Rising disposable income: In many parts of the world, rising disposable incomes are fueling increased spending on entertainment and leisure activities.

Specific Entertainment Stock Sectors Showing Promise

While the entire entertainment sector offers potential, some areas show more promise than others.

- Gaming Companies: The gaming industry continues to expand rapidly, driven by the popularity of esports, mobile gaming, and metaverse experiences. Companies like Activision Blizzard (ATVI) and Electronic Arts (EA) are worth investigating.

- Streaming Services: Despite competition, successful streaming platforms with strong content libraries and subscriber bases are likely to maintain robust growth. Consider established players and emerging companies in this sector.

- Theme Parks: Theme park operators benefit from pent-up demand for leisure activities and a return to pre-pandemic travel patterns. Major players in this space warrant careful consideration.

Remember, this is not financial advice; thorough due diligence is crucial before investing in any individual stock.

Risks Associated with Buying the Dip

While the potential rewards are substantial, it's crucial to acknowledge the risks associated with investing in entertainment stocks, particularly during market volatility.

Market Volatility and Uncertainty

The stock market is inherently volatile, and entertainment stocks are no exception. Several factors can negatively impact stock prices:

- Economic recession: A broader economic downturn could significantly reduce consumer spending on entertainment.

- Changes in consumer spending habits: Shifts in consumer preferences and spending patterns can affect the performance of individual companies.

- Geopolitical events: Unforeseen global events can also impact market sentiment and stock prices.

Company-Specific Risks

Individual entertainment companies face unique challenges that can impact their stock performance.

- Competition: Intense competition within the industry can squeeze profit margins and limit growth potential.

- Content licensing issues: Securing the rights to popular content can be expensive and challenging, potentially impacting profitability.

- Production delays: Delays in film and television production can negatively impact a company's revenue and stock price.

Strategies for Investing in Entertainment Stocks

To mitigate the risks and maximize your potential returns, consider these strategies:

Diversification to Mitigate Risk

Diversifying your investment portfolio across multiple entertainment stocks and other asset classes is crucial. This reduces the impact of any single company's underperformance.

- Invest in ETFs: Exchange-traded funds (ETFs) that track the entertainment industry offer diversified exposure to multiple companies.

- Spread your investments: Don't put all your eggs in one basket. Spread your investments across different companies and sectors within the entertainment industry.

Dollar-Cost Averaging

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the stock price. This strategy reduces the risk of investing a large sum at a market peak.

Long-Term Investment Horizon

Entertainment stocks are best viewed as long-term investments. Focusing on the long-term growth potential of the industry can help you weather short-term market fluctuations.

Conclusion: Capitalizing on the Entertainment Stock Dip

Analysts believe that the current market downturn presents a valuable opportunity to buy the dip in entertainment stocks. While risks exist, the long-term growth potential of the industry makes it an attractive investment sector for those willing to conduct thorough research and diversify their holdings. Don't miss the opportunity to buy the dip in entertainment stocks. Start building your entertainment stock portfolio today by researching promising companies and implementing sound investment strategies. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Ipa Apozimiosi 5 Ekatommyrion Dolarion Stin Oikogeneia Thymatos Toy Kapitolioy

May 29, 2025

Ipa Apozimiosi 5 Ekatommyrion Dolarion Stin Oikogeneia Thymatos Toy Kapitolioy

May 29, 2025 -

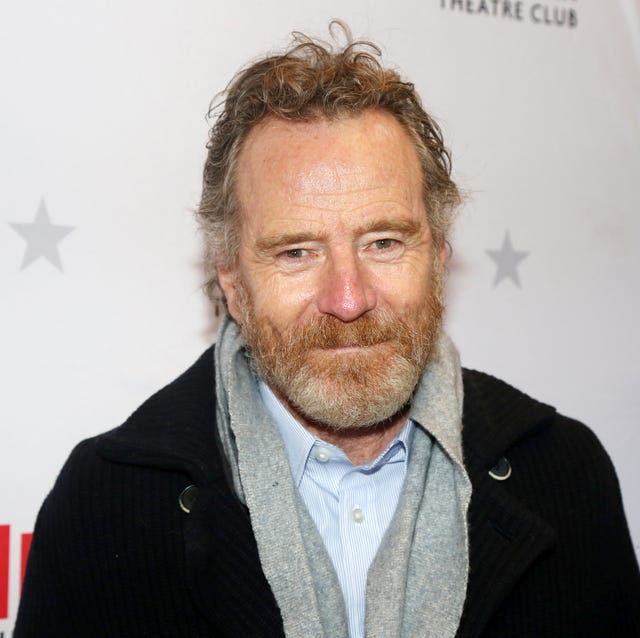

New Hope For Malcolm In The Middle Fans Bryan Cranston Offers Update On Revival

May 29, 2025

New Hope For Malcolm In The Middle Fans Bryan Cranston Offers Update On Revival

May 29, 2025 -

Suzuka Test Ends In Heavy Crash For Hondas Luca Marini

May 29, 2025

Suzuka Test Ends In Heavy Crash For Hondas Luca Marini

May 29, 2025 -

Invest In Growth Mapping The Countrys Top New Business Areas

May 29, 2025

Invest In Growth Mapping The Countrys Top New Business Areas

May 29, 2025 -

Ella Mills On Switching Off A Journey Towards Better Wellbeing

May 29, 2025

Ella Mills On Switching Off A Journey Towards Better Wellbeing

May 29, 2025

Latest Posts

-

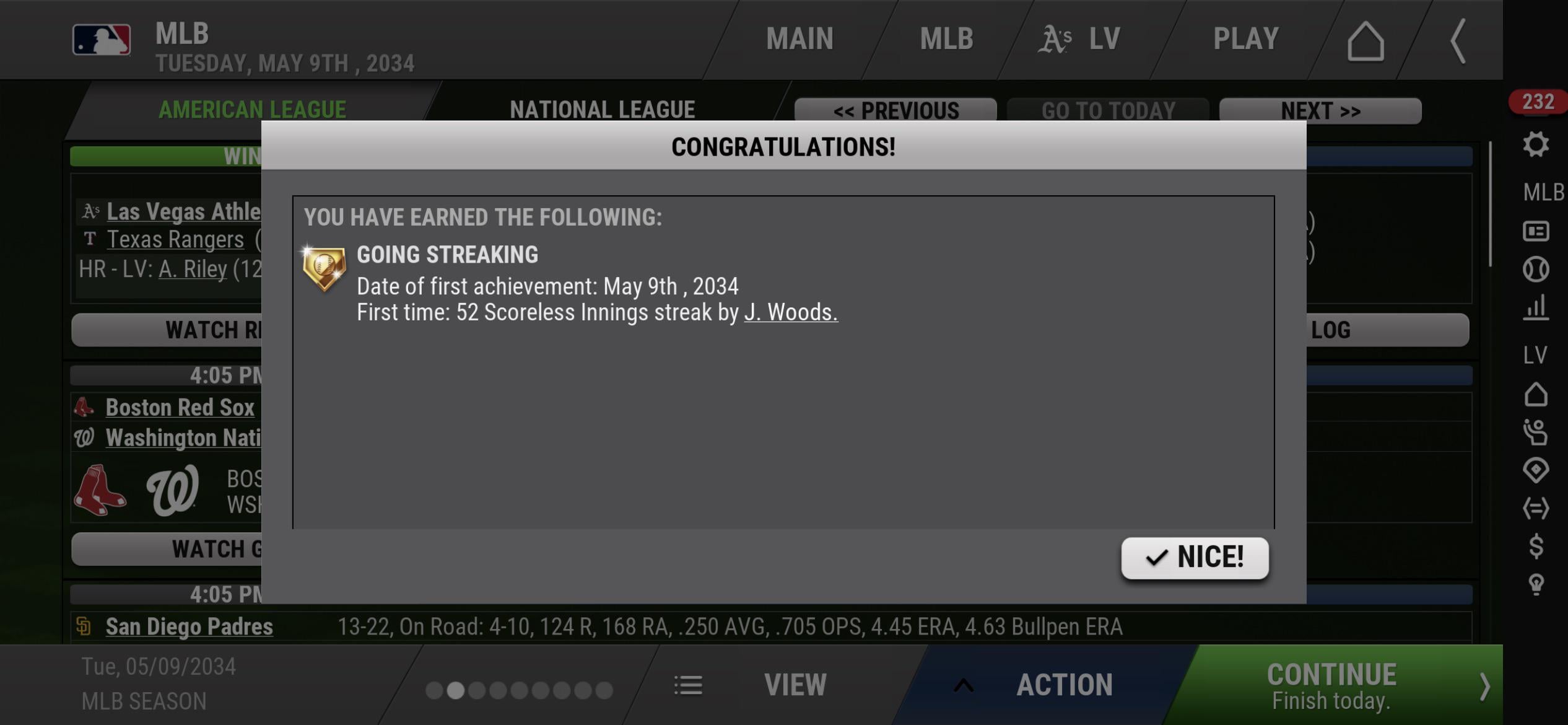

Chase Lees May 12th Mlb Return A Scoreless Inning Performance

May 31, 2025

Chase Lees May 12th Mlb Return A Scoreless Inning Performance

May 31, 2025 -

Mlb Roll Call Chase Lee Pitches Scoreless Inning In Return May 12 2025

May 31, 2025

Mlb Roll Call Chase Lee Pitches Scoreless Inning In Return May 12 2025

May 31, 2025 -

Mlb Betting Yankees Vs Tigers Under Over Analysis

May 31, 2025

Mlb Betting Yankees Vs Tigers Under Over Analysis

May 31, 2025 -

Yankees At Tigers Game Prediction And Moneyline Odds

May 31, 2025

Yankees At Tigers Game Prediction And Moneyline Odds

May 31, 2025 -

Chase Lees Scoreless Mlb Return Roll Call May 12 2025

May 31, 2025

Chase Lees Scoreless Mlb Return Roll Call May 12 2025

May 31, 2025