Entertainment Stock Dip: Analyst Buy Recommendation

Table of Contents

Understanding the Recent Entertainment Stock Dip

Several factors have contributed to the recent decline in entertainment stock prices. Market volatility is impacting the entire sector, but several industry-specific challenges exacerbate the situation. Keywords related to this section include market volatility, economic factors, industry challenges, streaming wars, inflation, and interest rates.

-

Increased Competition: The rise of streaming services has ignited fierce "streaming wars," leading to intense competition. This abundance of options fragments the audience and puts pressure on individual company profitability. Established players face the challenge of attracting and retaining subscribers in a crowded market, impacting their stock valuations.

-

Economic Headwinds: Inflation, rising interest rates, and the looming threat of a recession are significantly impacting consumer spending. Entertainment, often considered a discretionary expense, is one of the first areas where people cut back during economic uncertainty. This reduced demand directly translates to lower revenue and profit for entertainment companies.

-

Content Costs: Creating high-quality original content is incredibly expensive. The competition for talent and the escalating costs of production are squeezing profit margins for many entertainment companies. This pressure on profitability can negatively affect their stock prices.

-

Subscription Fatigue: Consumers are grappling with "subscription fatigue," juggling numerous streaming services and feeling overwhelmed by recurring monthly charges. This leads to increased churn (cancellation of subscriptions), impacting the sustainability of streaming business models.

Analyst Buy Recommendation: A Deeper Dive

Despite the current downturn, a leading analyst has issued a "buy" recommendation for several entertainment stocks. This bullish stance is based on several key factors. Keywords for this section include analyst report, buy rating, target price, growth potential, long-term investment, and risk assessment.

-

Undervalued Assets: The analyst argues that the current market downturn has created an opportunity to acquire high-quality entertainment stocks at prices below their intrinsic value. They believe the market is temporarily undervaluing the long-term growth potential of these companies.

-

Growth Projections: The analyst's report projects significant revenue and earnings growth within the entertainment sector over the next few years. They anticipate a recovery in consumer spending and a stabilization of the streaming market, leading to increased profitability for selected companies.

-

Risk Factors: The report acknowledges the inherent risks associated with investing in the entertainment industry, including ongoing competition, economic uncertainty, and the potential for unforeseen disruptions. However, the analyst believes that the potential rewards outweigh the risks, given the current low valuations.

-

Target Price: The analyst has set a target price for several key stocks, indicating a substantial upside potential from current market prices. The timeframe for reaching these target prices varies depending on the specific company and the analyst’s projections. For example, Company X has a projected target price of $50 within the next 18 months. (Disclaimer: This is hypothetical data for illustrative purposes only. Consult a financial advisor before making any investment decisions.)

Specific Entertainment Stocks to Consider

While we cannot offer specific financial advice, it’s important to note that the analyst's report highlights specific companies they believe are poised for growth. Conduct your own thorough research before making any investment decisions. Keywords here include stock symbols, company profiles, investment strategy, diversification, and due diligence.

-

Company A (Ticker: CMPA): A major player in the streaming space, known for its strong content library and growing subscriber base.

-

Company B (Ticker: ENTM): A diversified entertainment company with a presence in film, television, and theme parks, offering a more resilient investment profile.

-

Company C (Ticker: GAMCO): A smaller, yet rapidly growing company focused on niche entertainment markets.

Strategies for Investing in Entertainment Stocks

Investing in entertainment stocks requires a strategic approach focused on risk management and diversification. Keywords for this section include diversification, risk management, long-term investment, dollar-cost averaging, and portfolio strategy.

-

Diversification: Don't put all your eggs in one basket! Diversify your portfolio across different entertainment companies to mitigate risk. Exposure to various business models and market segments can help offset potential losses from individual companies underperforming.

-

Dollar-Cost Averaging (DCA): Instead of investing a lump sum, consider using dollar-cost averaging. This involves investing a fixed amount of money at regular intervals, regardless of the stock price. This helps to reduce the impact of market volatility.

-

Thorough Due Diligence: Before investing in any entertainment stock, conduct thorough research. Analyze the company's financial statements, understand its business model, and assess its competitive landscape.

Conclusion

The recent dip in entertainment stocks presents a potential buying opportunity for long-term investors. A leading analyst's buy recommendation, based on undervalued assets and growth projections, strengthens this viewpoint. However, remember that investing in the entertainment industry inherently carries risks. By carefully considering the factors discussed—conducting thorough due diligence, implementing diversification strategies, and using dollar-cost averaging—you can mitigate risks and potentially capitalize on this market shift. Don't miss this entertainment stock dip; research the mentioned stocks and consider adding them to your portfolio for potentially significant long-term gains. Remember to consult with a qualified financial advisor before making any investment decisions. [Link to relevant financial resources]

Featured Posts

-

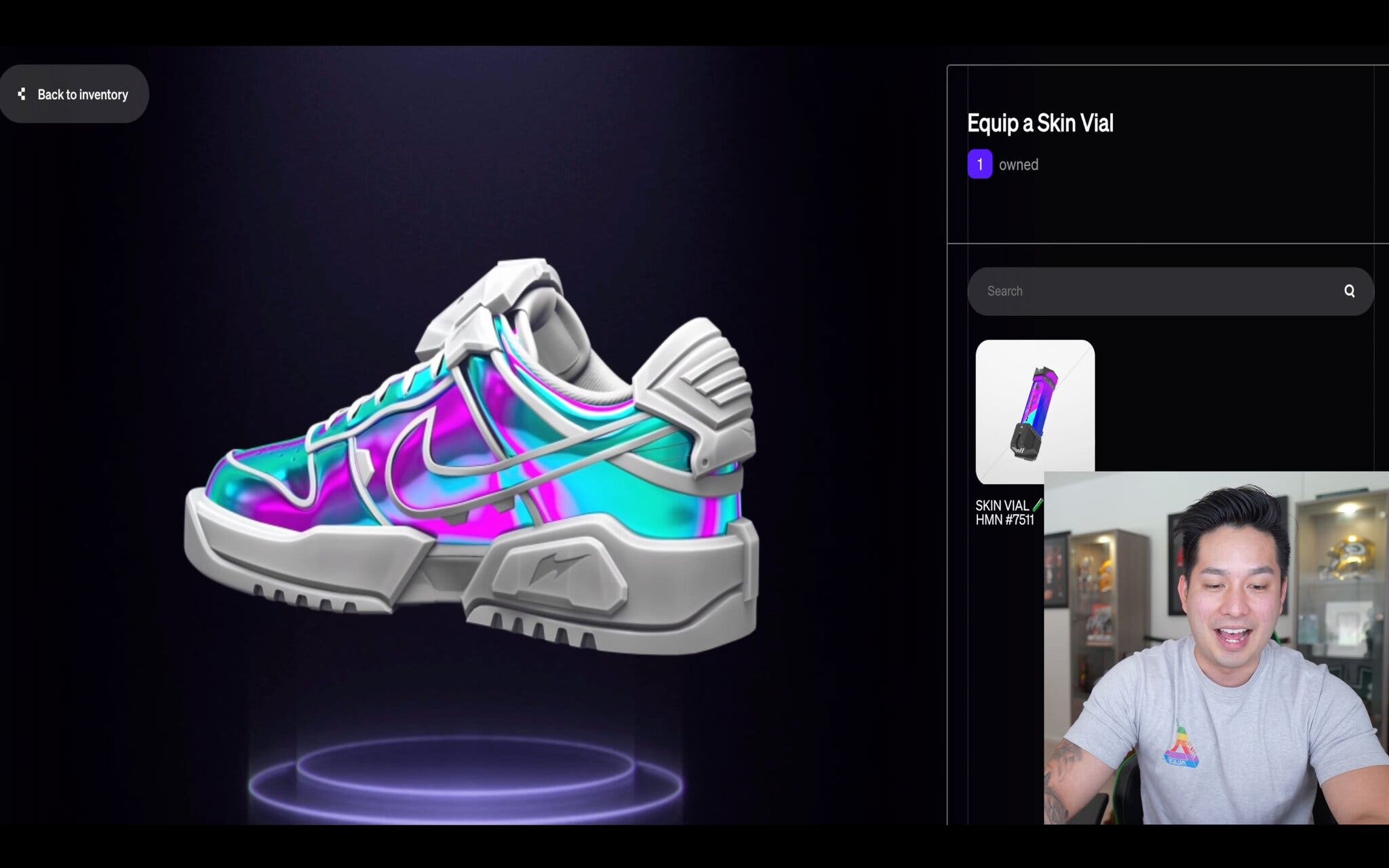

Gugatan Rp 84 Miliar Menimpa Pembeli Nft Nike

May 29, 2025

Gugatan Rp 84 Miliar Menimpa Pembeli Nft Nike

May 29, 2025 -

After 15 Years Whats App Launches I Pad App

May 29, 2025

After 15 Years Whats App Launches I Pad App

May 29, 2025 -

Regi Targyak Hatalmas Ertek Szazezreket Erhetnek

May 29, 2025

Regi Targyak Hatalmas Ertek Szazezreket Erhetnek

May 29, 2025 -

Getting To Know Claude The Netherlands Eurovision 2025 Participant

May 29, 2025

Getting To Know Claude The Netherlands Eurovision 2025 Participant

May 29, 2025 -

Building On Arcanes Success The Future Of Runeterra In Spinoffs

May 29, 2025

Building On Arcanes Success The Future Of Runeterra In Spinoffs

May 29, 2025

Latest Posts

-

Rajinikanth On Ilaiyaraaja Celebrating An Indian Musical Icon

May 30, 2025

Rajinikanth On Ilaiyaraaja Celebrating An Indian Musical Icon

May 30, 2025 -

Indias Musical Pride Rajinikanths Praise For Ilaiyaraajas Legacy

May 30, 2025

Indias Musical Pride Rajinikanths Praise For Ilaiyaraajas Legacy

May 30, 2025 -

The Ilaiyaraaja Rajinikanth Moment A Celebration Of Indian Music

May 30, 2025

The Ilaiyaraaja Rajinikanth Moment A Celebration Of Indian Music

May 30, 2025 -

Rajinikanth And Ilaiyaraaja A Conversation On Indian Musical Excellence

May 30, 2025

Rajinikanth And Ilaiyaraaja A Conversation On Indian Musical Excellence

May 30, 2025 -

Ilaiyaraaja Honored By Rajinikanth A Moment Of National Pride

May 30, 2025

Ilaiyaraaja Honored By Rajinikanth A Moment Of National Pride

May 30, 2025