Equifax (EFX) Exceeds Profit Expectations, Holds Steady On Economic Outlook

Table of Contents

Equifax's Q[Quarter] Earnings Results: A Detailed Breakdown

Exceeding Profit Expectations

Equifax's Q[Quarter] 2024 earnings significantly surpassed analyst predictions. The company reported [Insert actual EPS figure] in earnings per share (EPS), exceeding the consensus estimate of [Insert analyst estimate for EPS]. Revenue also came in stronger than expected at [Insert actual revenue figure], compared to the projected [Insert analyst estimate for revenue]. This positive performance can be attributed to several key factors:

- Strong growth in the US Information Solutions segment: This segment saw a [Insert percentage]% increase in revenue driven by increased demand for credit scoring and fraud prevention solutions.

- Successful cost-cutting initiatives: Equifax implemented effective cost-management strategies, leading to improved operating margins.

- Increased customer acquisition: The company added a significant number of new customers across its various product offerings.

- Improved operational efficiency: Streamlined processes and technological advancements contributed to increased productivity and reduced expenses.

Strong Performance Across Key Business Segments

Equifax's success wasn't limited to a single segment. While the US Information Solutions segment showed impressive growth, other areas also contributed significantly:

- US Information Solutions: [Insert detailed information about performance, including specific growth percentages and contributing factors.]

- International: [Insert detailed information about performance, including specific growth percentages and contributing factors, noting any regional differences.]

- Global Consumer and Commercial: [Insert detailed information about performance, including specific growth percentages and contributing factors, focusing on any significant trends.]

Each segment demonstrated resilience, contributing to the overall strong financial performance reported by Equifax.

Guidance for the Future

Equifax provided guidance for the upcoming quarter and the full year, projecting [Insert projected EPS and revenue figures]. While maintaining a positive outlook, the company acknowledged potential macroeconomic headwinds. This cautious optimism reflects the current uncertainties in the global economic environment. The updated projections represent a [Insert percentage]% increase compared to the previous forecast, signaling continued confidence in the company's growth trajectory despite market volatility.

Equifax's Economic Outlook: Cautious Optimism Amidst Uncertainty

Assessment of the Consumer Credit Market

Equifax's analysis of the consumer credit market reveals a mixed picture. While consumer spending remains relatively robust in certain sectors, there are signs of increasing caution.

- Consumer spending: [Insert details and data on consumer spending trends based on Equifax's report.]

- Debt levels: [Insert details and data on debt levels, including credit card debt, mortgage debt, and other forms of consumer debt.]

- Delinquency rates: [Insert details and data on delinquency rates, highlighting any significant increases or decreases.]

The impact of inflation and rising interest rates continues to be a key factor influencing consumer behavior and credit market dynamics.

Resilience of the Equifax Business Model

Equifax's business model demonstrates inherent resilience, even during economic downturns. This resilience stems from several key factors:

- Diversified revenue streams: Equifax’s revenue isn't concentrated in a single area, reducing its vulnerability to market fluctuations.

- Strong market position: The company's established position as a leading credit reporting agency provides a competitive advantage.

- Data and analytics capabilities: Equifax's advanced data analytics provide valuable insights to clients, making its services indispensable.

Potential Risks and Challenges

Despite its strong performance, Equifax faces potential challenges:

- Increased competition: The credit reporting industry is competitive, and new entrants or innovative technologies could impact Equifax's market share.

- Regulatory changes: Changes in regulations related to data privacy and consumer credit could affect Equifax's operations.

- Cybersecurity threats: Protecting sensitive consumer data is crucial; breaches could severely damage Equifax's reputation and financial performance.

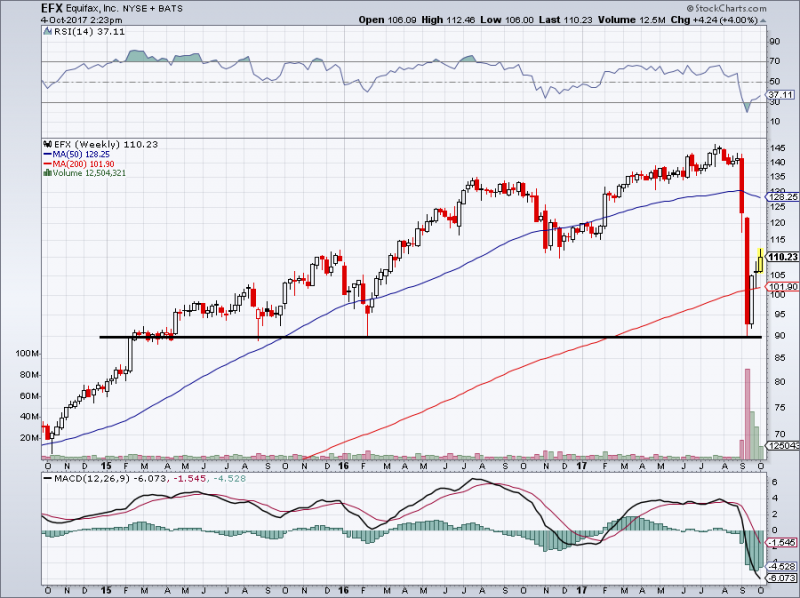

Investor Implications and Stock Performance

Market Reaction to the Earnings Report

The market reacted positively to Equifax's strong earnings report. EFX stock experienced a [Insert percentage]% increase in price immediately following the announcement, reflecting investor confidence in the company's performance and future prospects. This positive market sentiment suggests that investors view Equifax as a relatively safe and profitable investment.

Long-Term Investment Outlook

The long-term investment outlook for Equifax remains positive, considering its strong financial performance, diversified business model, and resilient position in a critical industry. However, investors should carefully consider the potential risks mentioned earlier. The company's ability to adapt to evolving market dynamics and technological advancements will be crucial for its continued success. A long-term investment in EFX presents both significant rewards and potential risks that need careful evaluation.

Conclusion

Equifax's (EFX) recent earnings report showcased strong financial performance, exceeding profit expectations and demonstrating resilience in a dynamic economic environment. The company’s cautiously optimistic outlook on the consumer credit market, coupled with its diversified business model and robust data analytics capabilities, positions it well for continued growth. Understanding the Equifax (EFX) earnings report is crucial for informed investment decisions in the evolving financial landscape. Stay informed about Equifax's (EFX) performance and future updates by regularly checking our website for the latest financial news and analysis on Equifax and other leading credit reporting companies.

Featured Posts

-

One Run Losses Plague Reds Resulting In Unprecedented Mlb Record

Apr 23, 2025

One Run Losses Plague Reds Resulting In Unprecedented Mlb Record

Apr 23, 2025 -

Chat Gpt And Open Ai The Ftc Investigation Explained

Apr 23, 2025

Chat Gpt And Open Ai The Ftc Investigation Explained

Apr 23, 2025 -

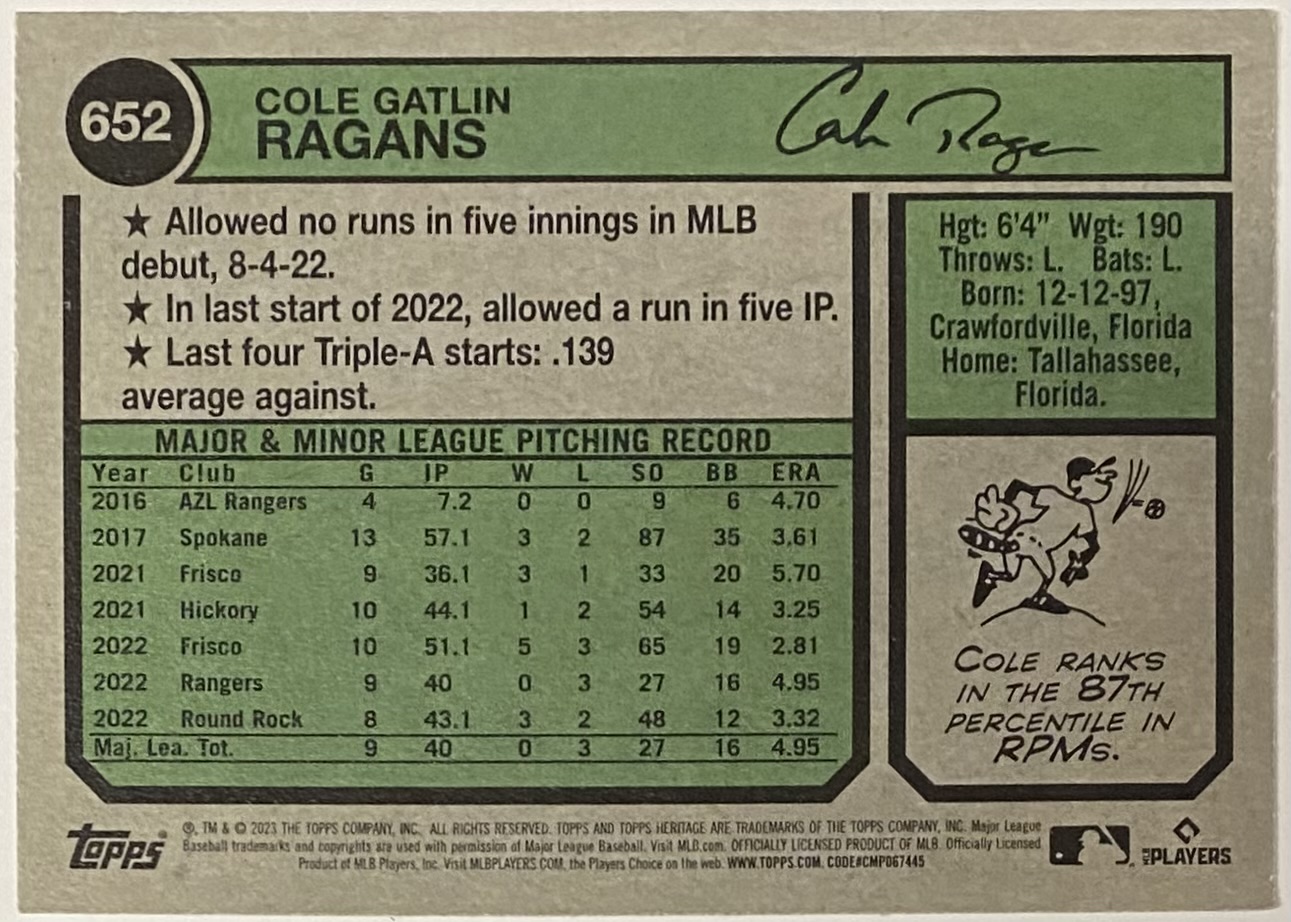

Kansas City Royals Bullpen Featuring Cole Ragans Triumphs Over Milwaukee Brewers

Apr 23, 2025

Kansas City Royals Bullpen Featuring Cole Ragans Triumphs Over Milwaukee Brewers

Apr 23, 2025 -

350 Kata Kata Bijak Senin Pagi Semangat Baru Di Awal Pekan

Apr 23, 2025

350 Kata Kata Bijak Senin Pagi Semangat Baru Di Awal Pekan

Apr 23, 2025 -

Remembering Bob Uecker Cory Provus Heartfelt Tribute

Apr 23, 2025

Remembering Bob Uecker Cory Provus Heartfelt Tribute

Apr 23, 2025