Equifax (EFX): Strong Q[Quarter Number] Earnings, Economic Uncertainty Remains

![Equifax (EFX): Strong Q[Quarter Number] Earnings, Economic Uncertainty Remains Equifax (EFX): Strong Q[Quarter Number] Earnings, Economic Uncertainty Remains](https://hirschfeld-kongress.de/image/equifax-efx-strong-q-quarter-number-earnings-economic-uncertainty-remains.jpeg)

Table of Contents

H2: Strong Q3 Financial Performance for Equifax (EFX)

Equifax's Q3 2023 financial results exceeded expectations, demonstrating the company's ability to thrive even amidst economic uncertainty. This robust performance underscores the enduring demand for its credit reporting and data analytics services.

H3: Revenue Growth and Key Drivers:

Equifax reported a significant revenue increase of X% compared to Q3 2022 and Y% compared to Q2 2023. This growth can be attributed to several key factors:

- Increased consumer credit activity: Despite economic concerns, consumer borrowing remained relatively strong, fueling demand for Equifax's credit reporting services.

- Booming demand for data analytics solutions: Businesses continue to invest heavily in data-driven decision-making, leading to increased demand for Equifax's advanced analytics platforms. This includes growth in sectors like fraud detection and risk management.

- Successful new product launches: The introduction of new products and services, such as [mention specific examples of new products/services and their contributions to revenue], significantly contributed to the overall revenue growth.

H3: Profitability and Margins:

Equifax's profitability remained robust in Q3 2023. Net income showed a Z% increase year-over-year, resulting in an EPS of [mention EPS figure]. Operating margins also saw improvement, reaching [mention margin percentage], demonstrating efficient cost management and strong operational performance. These positive figures are a testament to Equifax's effective cost structure and efficient operations within the credit reporting industry.

H3: Guidance for Future Quarters:

Equifax provided positive guidance for the remaining quarters of 2023, projecting continued revenue growth driven by sustained demand for its core services and the success of its strategic initiatives. The company anticipates navigating the economic challenges effectively and maintaining its strong financial performance. They cited [mention any specific factors mentioned in their guidance, such as expected growth in specific sectors].

H2: Navigating Economic Uncertainty: Challenges and Opportunities for EFX

While Equifax demonstrated strong performance, the current economic climate presents both challenges and opportunities.

H3: Impact of Inflation and Recessionary Fears:

The persistent inflation and lingering recessionary fears pose potential risks to consumer spending and credit growth. These macroeconomic factors could impact demand for Equifax's services.

- Potential risks: Reduced consumer borrowing could lead to a slowdown in revenue growth, requiring strategic adaptation.

- Mitigation strategies: Equifax is actively mitigating these risks through diversification of its revenue streams, focusing on recurring revenue models, and investing in new technologies to enhance efficiency and improve its service offerings within the credit reporting industry.

H3: Strategic Initiatives and Investments:

Equifax is proactively addressing the economic uncertainty through strategic investments and initiatives:

- Technological advancements: Continued investments in data analytics and artificial intelligence to enhance its product offerings and improve operational efficiency.

- Market expansion: Exploring new markets and product lines to diversify its revenue streams and reduce dependence on any single sector within the credit reporting industry.

- Operational efficiencies: Implementing cost-cutting measures to improve margins and maintain profitability in a challenging economic environment.

H3: Competitive Landscape and Market Share:

Equifax maintains a leading position in the credit reporting industry, competing with [mention key competitors]. While competitive pressures exist, Equifax's strong brand reputation, comprehensive data sets, and innovative solutions contribute to its sustained market share.

H2: Equifax (EFX) Stock Performance and Investor Sentiment

Following the release of the Q3 earnings report, Equifax's stock price experienced [describe stock price movement – e.g., a modest increase]. Investor sentiment appears to be [describe investor sentiment – e.g., cautiously optimistic], reflecting confidence in the company's ability to navigate the economic challenges.

H3: Analyst Ratings and Price Targets:

Many leading financial analysts maintain a [mention overall rating - e.g., "buy" or "hold"] rating on Equifax (EFX) stock, with price targets ranging from [mention range of price targets].

3. Conclusion:

Equifax (EFX) delivered impressive Q3 2023 results, showcasing its strength and resilience in a challenging economic environment. The company's robust financial performance, strategic initiatives to mitigate economic risks, and positive outlook all point to a promising future. While economic uncertainty remains a factor, Equifax's proactive approach, coupled with its strong market position within the credit reporting industry, suggests continued growth. Stay tuned for updates on Equifax (EFX) and its ongoing response to economic uncertainty. For a deeper understanding of Equifax’s prospects, further research into the company's financial statements and investor relations materials is recommended.

![Equifax (EFX): Strong Q[Quarter Number] Earnings, Economic Uncertainty Remains Equifax (EFX): Strong Q[Quarter Number] Earnings, Economic Uncertainty Remains](https://hirschfeld-kongress.de/image/equifax-efx-strong-q-quarter-number-earnings-economic-uncertainty-remains.jpeg)

Featured Posts

-

Sf Giants Win Flores And Lee Key To Victory Against Brewers

Apr 23, 2025

Sf Giants Win Flores And Lee Key To Victory Against Brewers

Apr 23, 2025 -

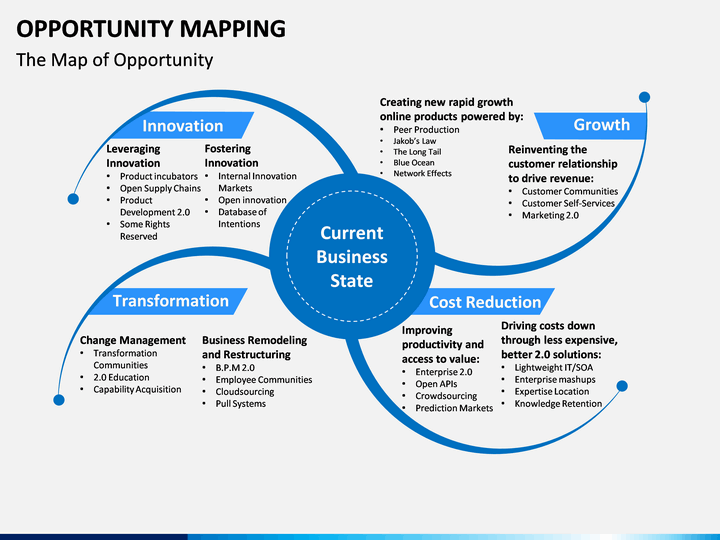

Investment Opportunities Mapping The Countrys Hottest New Business Areas

Apr 23, 2025

Investment Opportunities Mapping The Countrys Hottest New Business Areas

Apr 23, 2025 -

Remembering Bob Uecker Cory Provus Heartfelt Tribute

Apr 23, 2025

Remembering Bob Uecker Cory Provus Heartfelt Tribute

Apr 23, 2025 -

Performance Boursiere Solutions 30 Previsions Et Analyse

Apr 23, 2025

Performance Boursiere Solutions 30 Previsions Et Analyse

Apr 23, 2025 -

Complete 2025 Us Holiday Calendar Federal And Non Federal Observances

Apr 23, 2025

Complete 2025 Us Holiday Calendar Federal And Non Federal Observances

Apr 23, 2025