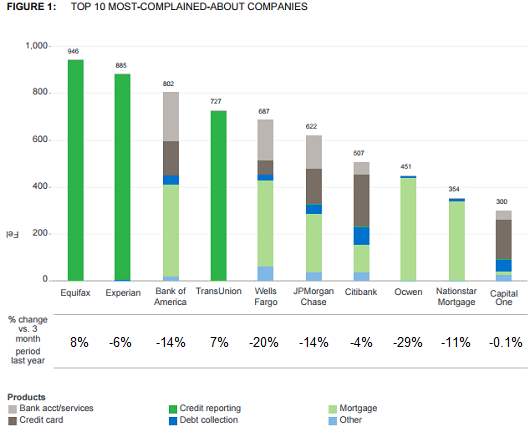

Equifax Reports Better-Than-Expected Profits, Maintains Macroeconomic Risk Assessment

Table of Contents

Equifax's Q3 2023 Financial Performance Exceeds Projections

Equifax's Q3 2023 results showcase strong financial performance across key metrics. The company demonstrated robust revenue growth and improved profit margins, defying broader economic headwinds.

Revenue Growth Analysis

Equifax reported a significant increase in revenue, exceeding expectations by [Insert Percentage] compared to Q3 2022. This growth can be attributed to several key factors:

- Strong growth in consumer lending: Increased demand for credit scoring and related services fueled substantial revenue growth in this segment.

- Increased adoption of fraud detection services: Businesses increasingly invested in Equifax's fraud prevention solutions, leading to higher revenue in this area.

- Expansion into new markets: Strategic expansion into emerging markets contributed to overall revenue diversification.

Specifically, revenue increased from [Insert Q3 2022 Revenue Figure] to [Insert Q3 2023 Revenue Figure], a substantial [Insert Percentage]% increase year-over-year. This strong revenue growth demonstrates the resilience of Equifax's core business even amidst macroeconomic uncertainty.

Profit Margin Improvement

Equifax also reported a marked improvement in profit margins, indicating enhanced operational efficiency. This improvement reflects:

- Effective cost-cutting measures: Implementing streamlined operations and optimizing internal processes led to significant cost savings.

- Increased market share: Gaining market share allowed Equifax to leverage economies of scale, contributing to higher profitability.

- Successful pricing strategies: Strategic pricing adjustments ensured the company maintained profitability while providing valuable services.

The net income increased from [Insert Q3 2022 Net Income Figure] to [Insert Q3 2023 Net Income Figure], resulting in an impressive [Insert Percentage]% increase in earnings per share (EPS). This positive trend highlights Equifax’s ability to enhance profitability while navigating a complex economic landscape.

Maintaining a Cautious Outlook: Equifax's Macroeconomic Risk Assessment

Despite the strong Q3 results, Equifax maintains a cautious outlook regarding the macroeconomic environment. The company acknowledges the persistence of several headwinds.

Persistent Economic Headwinds

Equifax's macroeconomic risk assessment acknowledges several significant challenges:

- High inflation: Persistent high inflation continues to impact consumer spending and business investment, creating uncertainty.

- Rising interest rates: Increased interest rates impact borrowing costs, potentially slowing economic growth and impacting consumer credit.

- Global economic slowdown: Concerns about a global recession continue to influence Equifax's risk assessment.

These factors are carefully considered in Equifax’s ongoing risk mitigation strategies. The company is closely monitoring relevant economic indicators, including consumer confidence indices and inflation rates, to adapt to evolving market conditions.

Strategic Initiatives to Mitigate Risk

To navigate the uncertain economic environment, Equifax has implemented several strategic initiatives:

- Diversification of revenue streams: Expanding into new markets and service offerings helps reduce reliance on any single sector.

- Investment in technology: Investing in advanced analytics and data security enhances the company's ability to manage risk and improve operational efficiency.

- Strengthened risk management practices: Proactive risk management procedures enhance Equifax’s ability to respond to challenges and protect its financial stability.

These proactive measures demonstrate Equifax's commitment to long-term financial stability and growth, despite macroeconomic uncertainties.

Equifax's Stock Performance and Investor Sentiment

The market reacted positively to Equifax's better-than-expected earnings report.

Market Reaction to the Earnings Report

The release of the Q3 earnings report resulted in:

- A significant increase in Equifax's stock price: The stock price increased by [Insert Percentage]% following the announcement.

- Increased trading volume: The news stimulated higher-than-average trading volume, reflecting investor interest.

- Positive analyst ratings: Several analysts upgraded their ratings for Equifax stock, reflecting confidence in the company's future performance.

This positive market reaction underscores investor confidence in Equifax's ability to deliver strong financial results even in a challenging economic environment.

Future Outlook and Guidance

Equifax provided guidance for future quarters, suggesting continued growth despite the macroeconomic headwinds. The company anticipates:

- Sustained revenue growth: Equifax projects continued growth in its core business segments.

- Stable profit margins: The company expects to maintain strong profit margins through continued operational efficiency.

- Careful management of macroeconomic risks: Equifax emphasizes its ongoing commitment to effective risk management and mitigation.

This positive outlook, coupled with the strong Q3 results, reinforces confidence in Equifax's long-term growth prospects.

Conclusion: Equifax's Strong Q3 Results Highlight Resilience Amidst Macroeconomic Risk

Equifax’s Q3 2023 results exceeded expectations, demonstrating the company's resilience amidst significant macroeconomic uncertainty. The strong revenue growth, improved profit margins, and positive market reaction highlight Equifax's effective strategic planning and robust risk management practices. While maintaining a cautious outlook regarding persistent economic headwinds, Equifax's commitment to diversification, technological innovation, and proactive risk mitigation positions it favorably for continued success. Stay informed about Equifax's performance and its approach to navigating macroeconomic risk by visiting their investor relations website. Understanding Equifax's ongoing macroeconomic risk assessment is crucial for investors and stakeholders alike.

Featured Posts

-

Preventing Breast Cancer Learning From Tina Knowles Experience With A Missed Mammogram

Apr 23, 2025

Preventing Breast Cancer Learning From Tina Knowles Experience With A Missed Mammogram

Apr 23, 2025 -

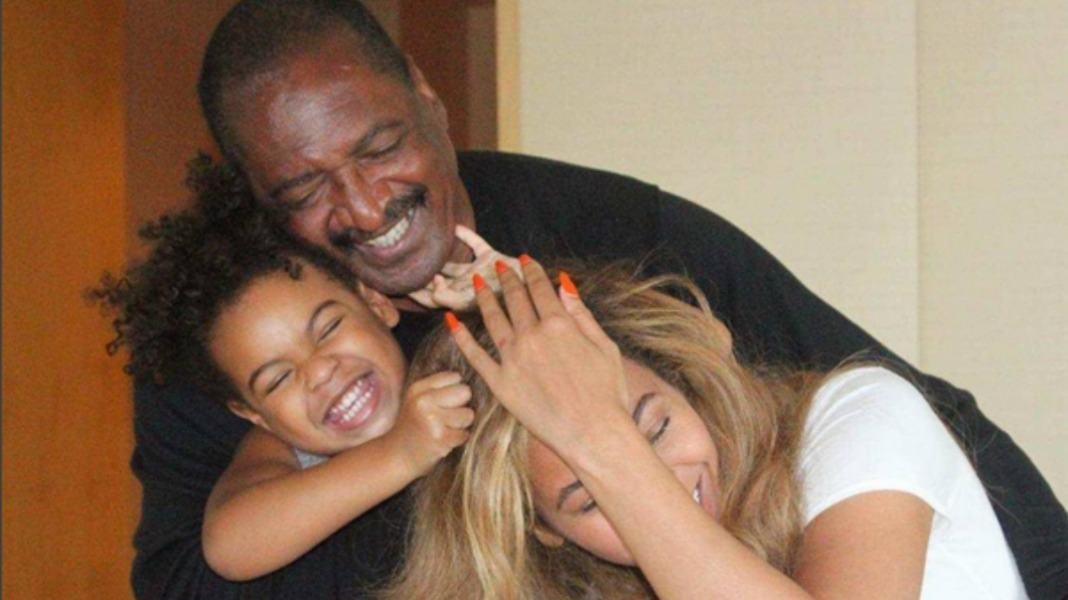

Pazartesi Dizileri 7 Nisan Tam Program Ve Yayin Saatleri

Apr 23, 2025

Pazartesi Dizileri 7 Nisan Tam Program Ve Yayin Saatleri

Apr 23, 2025 -

2025 Yankees Nine Homers In One Game Judges Historic Performance

Apr 23, 2025

2025 Yankees Nine Homers In One Game Judges Historic Performance

Apr 23, 2025 -

Ankara Da 3 Mart 2024 Pazartesi Iftar Ve Sahur Vakitleri

Apr 23, 2025

Ankara Da 3 Mart 2024 Pazartesi Iftar Ve Sahur Vakitleri

Apr 23, 2025 -

Izmir De Okullar Tatil Oldu Mu 24 Subat Pazartesi Guencel Bilgiler

Apr 23, 2025

Izmir De Okullar Tatil Oldu Mu 24 Subat Pazartesi Guencel Bilgiler

Apr 23, 2025