Eramet To Benefit From China's Curbs On Lithium Technology Exports

Table of Contents

China's Export Restrictions and Their Global Impact

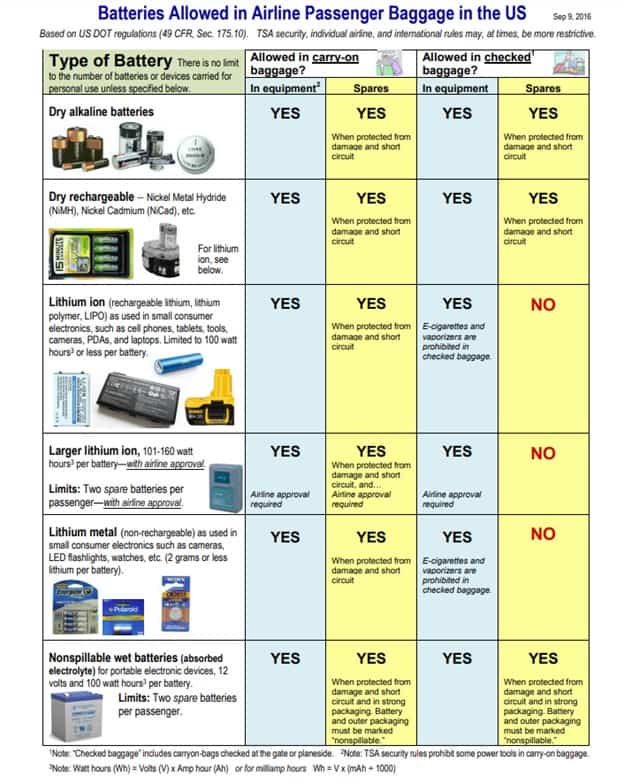

The strategic importance of lithium-ion batteries and their components cannot be overstated. These batteries are crucial for the burgeoning electric vehicle (EV) industry, renewable energy storage, and numerous portable electronic devices. China's recent export restrictions, targeting key materials and technologies vital for lithium-ion battery production, represent a significant geopolitical move. Specific restrictions include limitations on the export of certain lithium-based chemicals and advanced battery manufacturing equipment.

The strategic importance of lithium-ion batteries and their components

The demand for lithium-ion batteries is exploding, driven primarily by the global transition to cleaner energy sources and the rapid growth of the electric vehicle market. This dependence on a limited number of key materials and manufacturing technologies makes the sector highly vulnerable to geopolitical shifts.

Details of the newly imposed export restrictions by the Chinese government

China's restrictions are designed to protect its domestic battery industry and secure its technological advantage. The impact is already being felt globally.

- Impact on global supply chains: The restrictions disrupt established supply chains, forcing companies to seek alternative sources of lithium and battery components.

- Increased demand for lithium outside of China: The restrictions dramatically increase the demand for lithium sourced from outside China, creating a significant opportunity for companies with robust lithium mining and processing capabilities.

- Price fluctuations and market volatility: The restrictions have introduced uncertainty into the market, leading to price fluctuations and increased volatility.

- Geopolitical implications of China's move: China's actions underscore the growing geopolitical competition for control of critical minerals and technologies.

Eramet's Strategic Positioning and Competitive Advantages

Eramet, with its established presence in lithium mining and processing, is ideally positioned to benefit from this market disruption. The company operates several significant lithium projects, including its activities in Australia and elsewhere.

Eramet's existing lithium mining and processing operations

Eramet possesses a vertically integrated business model, giving it control over the entire lithium value chain, from mining to processing. This vertical integration provides a crucial competitive advantage in the current environment.

Eramet's expansion plans and investments in lithium refining and processing capabilities

Eramet is actively investing in expanding its lithium refining and processing capacity to meet the growing global demand. These investments are further enhancing its already strong position in the market.

- Eramet's vertically integrated business model: This allows Eramet to control costs, quality, and supply, reducing its vulnerability to market fluctuations.

- Focus on sustainable and responsible mining practices: Eramet's commitment to sustainability and responsible mining strengthens its brand reputation and attracts environmentally conscious customers.

- Technological advancements and partnerships in lithium extraction and processing: Eramet is constantly innovating to improve the efficiency and sustainability of its lithium production processes.

- Strong relationships with key customers in the EV and battery industries: These established relationships provide Eramet with a reliable customer base and secure access to key markets.

Increased Demand and Market Opportunities for Eramet

The global demand for electric vehicles (EVs) and energy storage solutions continues to grow exponentially. This presents a significant opportunity for Eramet to expand its market share and increase its revenue.

The growing global demand for electric vehicles (EVs) and energy storage solutions

The transition to electric mobility is driving an unprecedented increase in demand for lithium-ion batteries, and Eramet is well-positioned to supply this growing market.

How Eramet can capitalize on the increased demand for lithium outside of China

Eramet can capitalize on this increased demand by expanding its production capacity, securing new supply agreements, and entering into strategic partnerships.

- Potential for increased sales and revenue: The increased demand for lithium translates directly into increased sales and revenue for Eramet.

- Expansion into new markets and partnerships: Eramet can expand its reach into new markets and forge strategic partnerships to further enhance its market position.

- Opportunities for strategic acquisitions and joint ventures: The current market conditions present opportunities for Eramet to make strategic acquisitions and joint ventures to strengthen its position.

- Attracting new investments and funding due to market conditions: Eramet's strong position in the lithium market makes it an attractive investment target.

Challenges and Mitigation Strategies for Eramet

Despite the significant opportunities, Eramet faces potential challenges, including increased competition from other lithium producers. However, Eramet is actively implementing strategies to mitigate these risks and ensure sustainable growth.

Potential challenges posed by increased competition from other lithium producers

The lithium market is becoming increasingly competitive, with numerous companies vying for market share. This necessitates careful planning and strategic decision-making.

Strategies for mitigating risks and ensuring sustainable growth

Eramet is employing various strategies to navigate the challenges and maintain its competitive edge.

- Price volatility management strategies: Eramet is implementing strategies to mitigate the risks associated with price volatility in the lithium market.

- Diversification of supply chains and customer base: Diversifying its supply chains and customer base reduces Eramet's vulnerability to disruptions.

- Investment in research and development to improve efficiency and reduce costs: Continuous investment in R&D is crucial for improving efficiency and reducing production costs.

- Addressing environmental and social concerns related to lithium mining: Eramet is committed to environmentally responsible and socially conscious mining practices.

Conclusion: Eramet's Bright Future in a Changing Lithium Market

China's curbs on lithium technology exports create a significant opportunity for Eramet. The company's strategic positioning, vertically integrated business model, and focus on sustainable practices give it a strong competitive advantage. Eramet is well-positioned to capitalize on the increased global demand for lithium, leading to substantial growth and increased market share. Invest in Eramet, learn more about Eramet's lithium strategy, and discover how Eramet is benefiting from the shift in the lithium market. Explore the exciting potential of Eramet lithium benefits today!

Featured Posts

-

Ash Ketchums 10 Best Pokemon Teams Definitive Ranking

May 14, 2025

Ash Ketchums 10 Best Pokemon Teams Definitive Ranking

May 14, 2025 -

Walmart Recalls Electric Ride On Toys And Portable Phone Chargers

May 14, 2025

Walmart Recalls Electric Ride On Toys And Portable Phone Chargers

May 14, 2025 -

World Cup Qualification Crucial For Nigeria Ahmed Musas Warning

May 14, 2025

World Cup Qualification Crucial For Nigeria Ahmed Musas Warning

May 14, 2025 -

Rte And Bbc Face Eurovision Boycott Demands From Protesters

May 14, 2025

Rte And Bbc Face Eurovision Boycott Demands From Protesters

May 14, 2025 -

Is Parker Mc Collum The Next George Strait A Rising Stars Ambitious Goal

May 14, 2025

Is Parker Mc Collum The Next George Strait A Rising Stars Ambitious Goal

May 14, 2025