Essential Commodity Market Charts To Track This Week

Table of Contents

Energy Commodity Charts: Crude Oil & Natural Gas

H3: Crude Oil Price Charts: Crude oil, the lifeblood of the global economy, is highly susceptible to geopolitical events and OPEC decisions. Monitoring crude oil charts is crucial for understanding price trends and their implications. We primarily focus on two benchmarks: West Texas Intermediate (WTI) and Brent crude.

- Key factors influencing crude oil prices:

- OPEC+ production quotas and agreements

- Geopolitical instability in major oil-producing regions

- Global demand fluctuations, particularly from China and other major economies

- The strength of the US dollar (inverse relationship)

- Where to find reliable charts: TradingView, Bloomberg, and investing.com offer robust charting tools and historical data.

- Interpreting price trends: Look for support and resistance levels, identify trend lines, and utilize technical indicators like moving averages to predict future price movements. Pay close attention to the WTI crude oil price and Brent crude oil price for a comprehensive view. Use resources offering oil price forecasts to contextualize your analysis.

H3: Natural Gas Price Charts: Natural gas prices exhibit significant seasonality, influenced heavily by weather patterns. Monitoring natural gas price charts is essential, especially during winter and summer peaks.

- Factors affecting natural gas prices:

- Heating and cooling demands (seasonal variations)

- Natural gas storage levels in key regions

- Industrial demand from power generation and manufacturing

- LNG (liquefied natural gas) exports and global supply dynamics

- Chart analysis techniques: Focus on identifying seasonal patterns and correlating price movements with weather forecasts. Utilize technical analysis tools to gauge momentum and potential price reversals. Tracking natural gas futures contracts provides insight into future price expectations. Reliable sources for natural gas price charts include the same platforms as crude oil.

Agricultural Commodity Charts: Grains & Softs

H3: Grain Price Charts (Corn, Wheat, Soybeans): Grain prices directly impact food security and global economies. Careful observation of grain price charts is critical for understanding supply and demand dynamics.

- Key factors influencing grain prices:

- Weather conditions impacting crop yields (droughts, floods, extreme temperatures)

- Global supply and demand balances (export/import dynamics)

- Government policies related to agricultural subsidies and trade

- Biofuel demand (corn in particular)

- Chart interpretation techniques: Focus on seasonal patterns, anticipating harvest expectations and their impact on prices. Monitor the corn price chart, wheat price chart, and soybean price chart individually for nuanced insights, considering factors like grain futures.

H3: Soft Commodity Charts (Coffee, Sugar, Cocoa): Soft commodities present unique challenges due to their sensitivity to weather patterns and production cycles. Analyzing soft commodity prices requires an understanding of these factors.

- Factors affecting soft commodity prices:

- Weather conditions impacting harvests (e.g., frost damage to coffee crops)

- Production cycles and crop yields

- Consumer demand and global consumption patterns

- Geopolitical factors impacting production and trade

- Chart analysis: Consider seasonality and the unique characteristics of each crop. Monitor coffee price chart, sugar price chart, and cocoa price chart for individual insights. Pay attention to long-term trends in addition to short-term fluctuations.

Metal Commodity Charts: Gold, Silver, and Base Metals

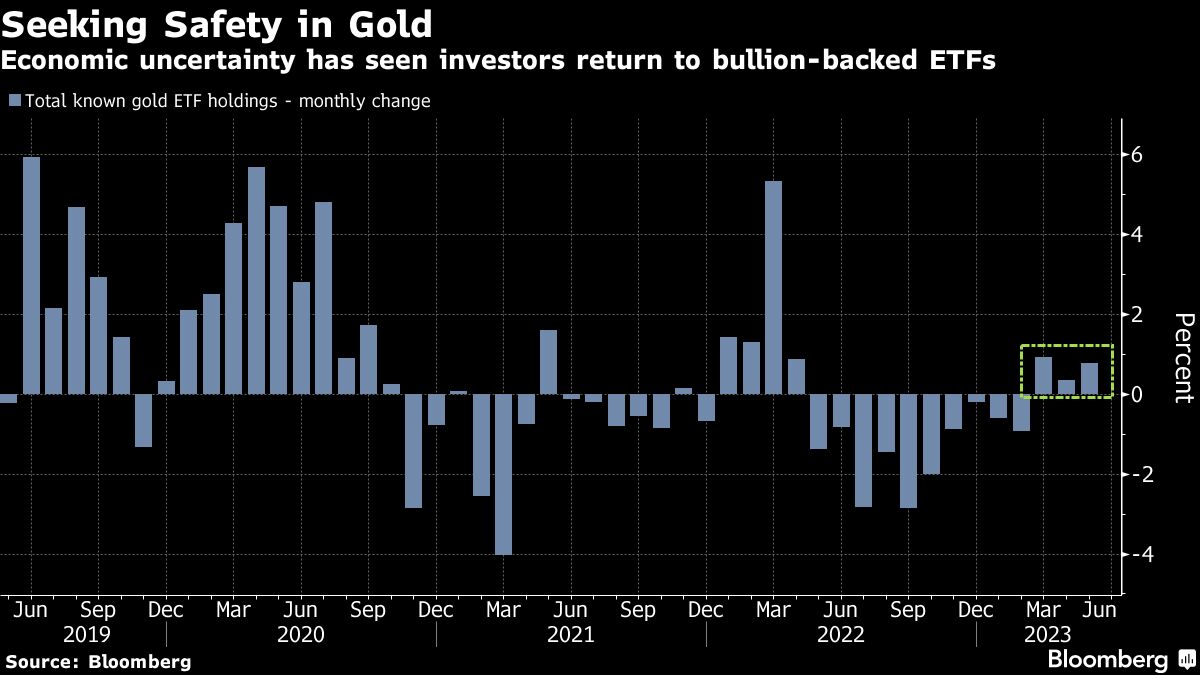

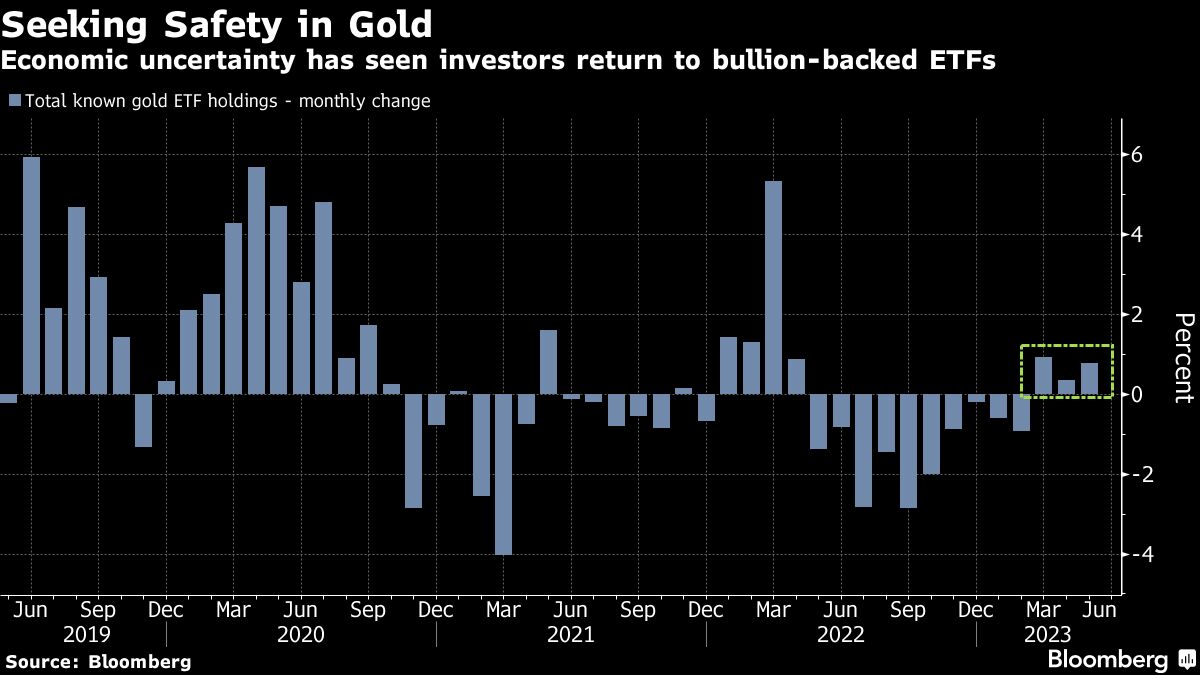

H3: Precious Metal Charts (Gold & Silver): Precious metals like gold and silver often serve as safe-haven assets, exhibiting inverse correlations to certain economic indicators. Analyzing precious metals charts helps in understanding market sentiment and risk appetite.

- Factors affecting precious metal prices:

- Inflationary pressures and interest rate changes

- Geopolitical uncertainty and risk aversion

- Investment demand and central bank holdings

- Currency fluctuations

- Chart analysis: Focus on identifying trends and breakouts. Observe the relationship between the gold price chart and silver price chart and other economic indicators. Examine gold futures and silver futures contracts to understand market expectations.

H3: Base Metal Charts (Copper, Aluminum, Nickel): Base metals are essential for industrial applications and their prices are directly linked to global economic growth. Tracking base metal prices reveals insights into the state of the global economy.

- Factors influencing base metal prices:

- Industrial production and manufacturing activity

- Global economic growth and infrastructure spending

- Supply chain disruptions and geopolitical risks

- Technological advancements and demand shifts

- Chart interpretation: Identify cyclical trends and understand the relationship between base metal prices and macroeconomic indicators. Examine the copper price chart, aluminum price chart, and nickel price chart for individual assessments.

Conclusion

Regularly monitoring these essential commodity market charts – from crude oil and natural gas to grains, soft commodities, precious metals, and base metals – is crucial for informed decision-making in various sectors. Remember to use multiple reliable sources for data and integrate both fundamental and technical analysis for a comprehensive understanding. To effectively manage investments and stay ahead of market movements, consistently track these commodity market charts. Master commodity market charts for optimal investment strategies and visit reputable financial websites like TradingView, Bloomberg, and investing.com for comprehensive data and analysis tools. Successfully tracking commodity markets effectively requires diligent monitoring and a holistic approach.

Featured Posts

-

Fallica Criticizes Trumps Subservience To Putin

May 05, 2025

Fallica Criticizes Trumps Subservience To Putin

May 05, 2025 -

Horror Franchise Reboot Vs Stephen King A Box Office Showdown

May 05, 2025

Horror Franchise Reboot Vs Stephen King A Box Office Showdown

May 05, 2025 -

Understanding The Logan County Jail Report A Guide For Families And Friends

May 05, 2025

Understanding The Logan County Jail Report A Guide For Families And Friends

May 05, 2025 -

How Lizzo Achieved Her Weight Loss Goals Inspiration And Practical Advice

May 05, 2025

How Lizzo Achieved Her Weight Loss Goals Inspiration And Practical Advice

May 05, 2025 -

Strategii Igrokov S Sh A Protiv Evropy

May 05, 2025

Strategii Igrokov S Sh A Protiv Evropy

May 05, 2025

Latest Posts

-

Find The Celtics Vs Suns Game Time Tv Channel And Streaming Options April 4th

May 06, 2025

Find The Celtics Vs Suns Game Time Tv Channel And Streaming Options April 4th

May 06, 2025 -

Celtics Vs Suns Basketball Game Date Time Tv Channel And Streaming Details April 4th

May 06, 2025

Celtics Vs Suns Basketball Game Date Time Tv Channel And Streaming Details April 4th

May 06, 2025 -

Celtics Vs Knicks Prediction Game 1 Playoffs Betting Preview And Picks

May 06, 2025

Celtics Vs Knicks Prediction Game 1 Playoffs Betting Preview And Picks

May 06, 2025 -

Nba Playoffs 2024 Knicks Vs Celtics Game 1 Predictions And Picks

May 06, 2025

Nba Playoffs 2024 Knicks Vs Celtics Game 1 Predictions And Picks

May 06, 2025 -

Celtics Vs Suns April 4th Game Time Tv Schedule And Live Streaming Info

May 06, 2025

Celtics Vs Suns April 4th Game Time Tv Schedule And Live Streaming Info

May 06, 2025