Estimating The Impact Of Trump's Tariffs On California's Revenue

Table of Contents

Impact on California's Key Export Sectors

Trump's tariffs significantly impacted California's key export sectors, leading to substantial revenue losses and economic disruption.

Agriculture

California's agricultural sector, a cornerstone of its economy, faced considerable challenges due to Trump's tariffs. Major exports like almonds, wine, and dairy products were directly affected.

- Almonds: Tariffs imposed by China, a significant importer of California almonds, resulted in a decrease in exports, impacting farmer incomes and related industries like processing and packaging. Data from the USDA show a [Insert Percentage]% drop in almond exports to China during [Time Period], leading to an estimated revenue loss of [Dollar Amount]. Keyword: California agriculture exports, Trump tariff impact on almonds.

- Wine: Tariffs on California wine imposed by the EU and other countries led to reduced exports and lower prices for producers. Industry reports suggest a [Insert Percentage]% decline in wine exports to [Country] resulting in [Dollar Amount] in lost revenue for California wineries. Keyword: wine export tariffs.

- Dairy: Increased tariffs on dairy products impacted exports to countries like [Country], affecting California dairy farmers and causing a decline in milk production and prices. The economic impact on dairy farmers was estimated at [Dollar Amount] according to [Source]. Keyword: California dairy exports.

Manufacturing

California's diverse manufacturing sector, encompassing aerospace, technology, and automotive industries, also felt the impact of the tariffs.

- Aerospace: Tariffs on imported components used in aircraft manufacturing disrupted supply chains, increasing production costs and potentially reducing competitiveness in the global aerospace market. This led to estimated job losses of [Number] in the aerospace sector in California according to [Source]. Keyword: California manufacturing, tariff impact on aerospace.

- Technology: Tariffs on imported components used in electronics and other tech products increased production costs for California technology companies, affecting profitability and potentially hindering innovation. This impacted corporate profits and revenue by approximately [Dollar Amount] according to [Source]. Keyword: technology sector tariffs.

- Automotive: Tariffs on imported auto parts increased costs for California's automotive sector, impacting production and potentially resulting in job losses. [Source] estimates a revenue loss of [Dollar Amount] due to disruptions in the automotive supply chain. Keyword: California automotive manufacturing.

Tourism

While less direct, the tariffs also had an indirect impact on California's vital tourism sector.

- International trade disputes can negatively affect consumer confidence and spending, leading to fewer international tourists visiting California. This decrease in tourism can lead to job losses in the hospitality and related industries.

- The uncertainty created by trade wars can deter international travelers, resulting in a decline in hotel bookings, restaurant revenue, and overall tourism-related spending.

- [Source] estimates a potential loss of [Dollar Amount] in tax revenue from decreased tourism due to trade-related uncertainty. Keyword: California tourism, tariff impact on tourism, international travel restrictions.

Changes in State Tax Revenue

The impact of Trump's tariffs extended beyond specific sectors, affecting California's overall state tax revenue.

Sales Tax

Reduced consumer spending and business activity due to the tariffs resulted in a decline in sales tax revenue for California.

- The relationship between economic activity and sales tax revenue is direct: slower economic growth leads to less consumer spending, thus reducing sales tax collection.

- Economic forecasts suggest a [Percentage]% decrease in sales tax revenue due to the impact of the tariffs, resulting in an estimated loss of [Dollar Amount] for the state budget. Keyword: California sales tax, tariff impact on consumer spending, state budget revenue.

Corporate Income Tax

The decreased profits in affected sectors led to a reduction in corporate income tax revenue for California.

- Companies with reduced profits due to tariffs paid less in corporate income tax.

- Estimates suggest a [Percentage]% decrease in corporate income tax revenue, resulting in a loss of [Dollar Amount] for the state. This revenue shortfall impacts state services and infrastructure projects. Keyword: California corporate tax, corporate profit reduction, tariff impact on corporate income tax.

Indirect Economic Effects and Multiplier Effects

The consequences of reduced revenue in specific sectors cascaded throughout California's economy.

- Job losses in export sectors resulted in reduced consumer spending and decreased demand for goods and services across various industries, creating a ripple effect.

- The multiplier effect amplified the initial economic shock, leading to a greater overall economic downturn than would be predicted from the direct impact of the tariffs alone.

- The decreased tax revenue impacted state social programs and public services, creating further economic and social consequences. Keyword: California economic impact, multiplier effect, indirect economic consequences, state social programs.

Conclusion: Understanding the Impact of Trump's Tariffs on California's Revenue

Trump's tariffs imposed significant costs on California's economy. Our analysis reveals substantial revenue losses across key export sectors, impacting agriculture, manufacturing, and tourism. This translated into decreased sales tax and corporate income tax revenue, further straining the state budget and impacting public services. The indirect economic effects and multiplier effects exacerbated these challenges. Understanding the economic consequences of Trump's tariffs is crucial for informing future trade policy decisions. By analyzing the impact of tariffs on California's revenue, we can develop strategies to mitigate the effects of future trade wars and protect California's economic prosperity. We encourage further research into the long-term implications of these trade policies and urge active participation in discussions surrounding trade policy to safeguard California's economy. Continue researching and understanding the economic consequences of Trump's tariffs to help mitigate the effects of trade wars on California's economy.

Featured Posts

-

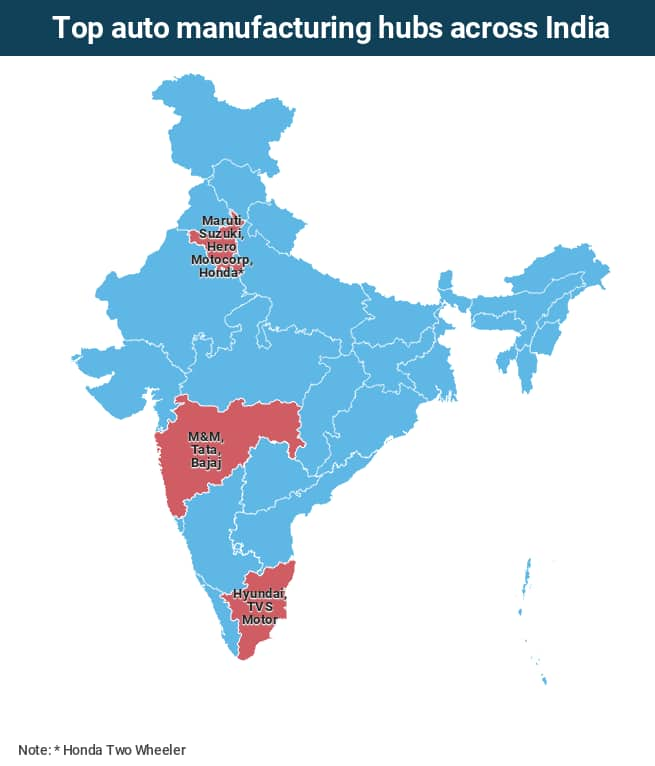

New Business Hubs Across The Country An Interactive Map

May 15, 2025

New Business Hubs Across The Country An Interactive Map

May 15, 2025 -

Padres Vs Pirates Prediction Picks And Odds For Todays Mlb Game

May 15, 2025

Padres Vs Pirates Prediction Picks And Odds For Todays Mlb Game

May 15, 2025 -

Dijital Veri Tabani Isguecue Piyasasi Ledra Pal Da Carsamba Rehberi

May 15, 2025

Dijital Veri Tabani Isguecue Piyasasi Ledra Pal Da Carsamba Rehberi

May 15, 2025 -

Carneys New Cabinet A Deep Dive For Business Leaders

May 15, 2025

Carneys New Cabinet A Deep Dive For Business Leaders

May 15, 2025 -

Egg Prices Decline Sharply 5 Dozen Nationwide In The Us

May 15, 2025

Egg Prices Decline Sharply 5 Dozen Nationwide In The Us

May 15, 2025

Latest Posts

-

2025 San Diego Padres Season Your Guide To Cable Free Viewing

May 15, 2025

2025 San Diego Padres Season Your Guide To Cable Free Viewing

May 15, 2025 -

How To Stream San Diego Padres Games Without Cable 2025 Season

May 15, 2025

How To Stream San Diego Padres Games Without Cable 2025 Season

May 15, 2025 -

Watch Padres Baseball In 2025 A Cord Cutters Guide

May 15, 2025

Watch Padres Baseball In 2025 A Cord Cutters Guide

May 15, 2025 -

San Diego Padres Baseball Best Cable Free Streaming Options 2025

May 15, 2025

San Diego Padres Baseball Best Cable Free Streaming Options 2025

May 15, 2025 -

Seven Game Skid On The Line Rockies Face Padres

May 15, 2025

Seven Game Skid On The Line Rockies Face Padres

May 15, 2025