Estimating The Net Worth Decline Of Musk, Bezos, And Zuckerberg After Trump's Inauguration

Table of Contents

The inauguration of Donald Trump in 2017 sent shockwaves through global markets, significantly impacting the net worth of many prominent billionaires. This article analyzes the estimated decline in the net worth of three tech giants – Elon Musk, Jeff Bezos, and Mark Zuckerberg – following Trump's ascension to the presidency. We will examine the potential factors contributing to these fluctuations and explore the broader implications for wealth and market dynamics. Understanding the relationship between political climate and billionaire wealth is crucial for investors and anyone interested in understanding the complexities of the global economy.

Elon Musk's Net Worth Fluctuations Post-Trump Inauguration

Impact of Policy Changes on Tesla and SpaceX

Several Trump administration policies directly affected Tesla and SpaceX, influencing Elon Musk's net worth.

- Environmental Regulations: Trump's rollback of environmental regulations initially appeared positive for Tesla, potentially reducing compliance costs. However, this was offset by uncertainties surrounding future regulations and a shift in broader public sentiment towards environmental concerns. [Cite relevant sources on regulatory rollbacks and their impact on Tesla stock].

- Trade Tariffs: Trump's trade wars impacted Tesla's supply chain and sales, particularly in markets affected by tariffs. Increased costs and reduced demand negatively affected Tesla's stock price and, consequently, Musk's net worth. [Cite sources documenting the impact of tariffs on Tesla’s supply chain and sales].

- SpaceX Government Contracts: While SpaceX continued to secure government contracts under the Trump administration, the overall landscape of space exploration funding experienced fluctuations, leading to some uncertainty regarding future projects and their impact on SpaceX's valuation and Musk's wealth. [Cite reports on SpaceX contract wins and losses during the Trump era].

- Investor Sentiment: Investor sentiment regarding Tesla shifted throughout the Trump presidency. Initial optimism surrounding deregulation gave way to concerns about the long-term sustainability of Tesla's business model under fluctuating economic conditions and increased competition.

The Role of Twitter and Public Statements

Elon Musk's frequent and often controversial use of Twitter significantly impacted investor confidence and his net worth.

- Controversial Tweets: Numerous tweets, including those related to taking Tesla private, made unsubstantiated claims, or engaged in public spats, led to increased market volatility and negatively affected Tesla's stock price. [Cite examples of controversial tweets and their immediate market impact].

- Negative Publicity: The resulting negative publicity surrounding Musk's public statements often amplified market concerns, contributing to further declines in Tesla's stock price and his net worth. [Cite news articles discussing the impact of Musk's public statements on Tesla's stock].

- Correlation between Statements and Stock Price: A clear correlation existed between particularly controversial tweets and subsequent drops in Tesla's stock value, demonstrating the significant impact of Musk's public persona on his overall wealth. [Cite studies or analyses demonstrating this correlation].

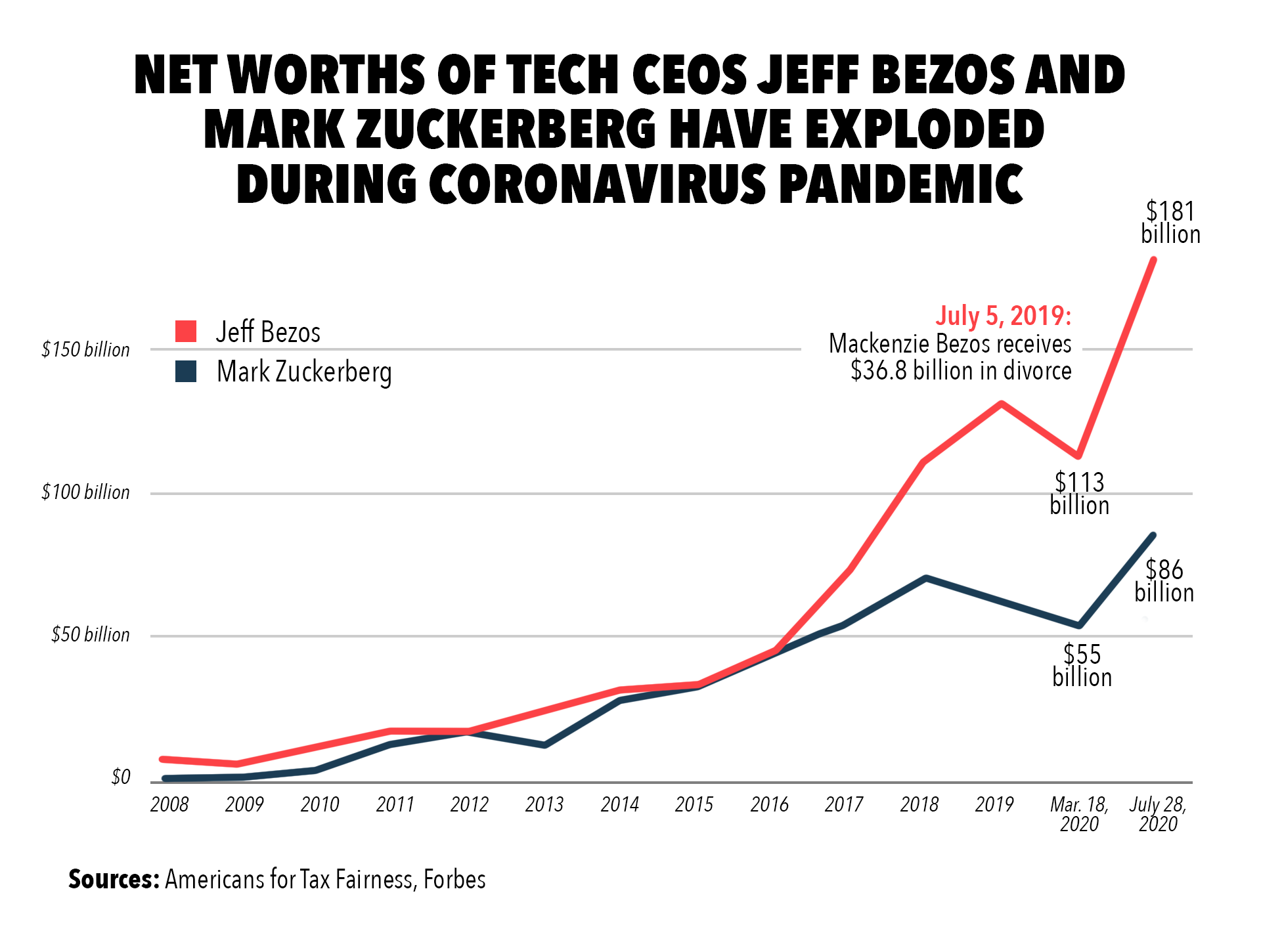

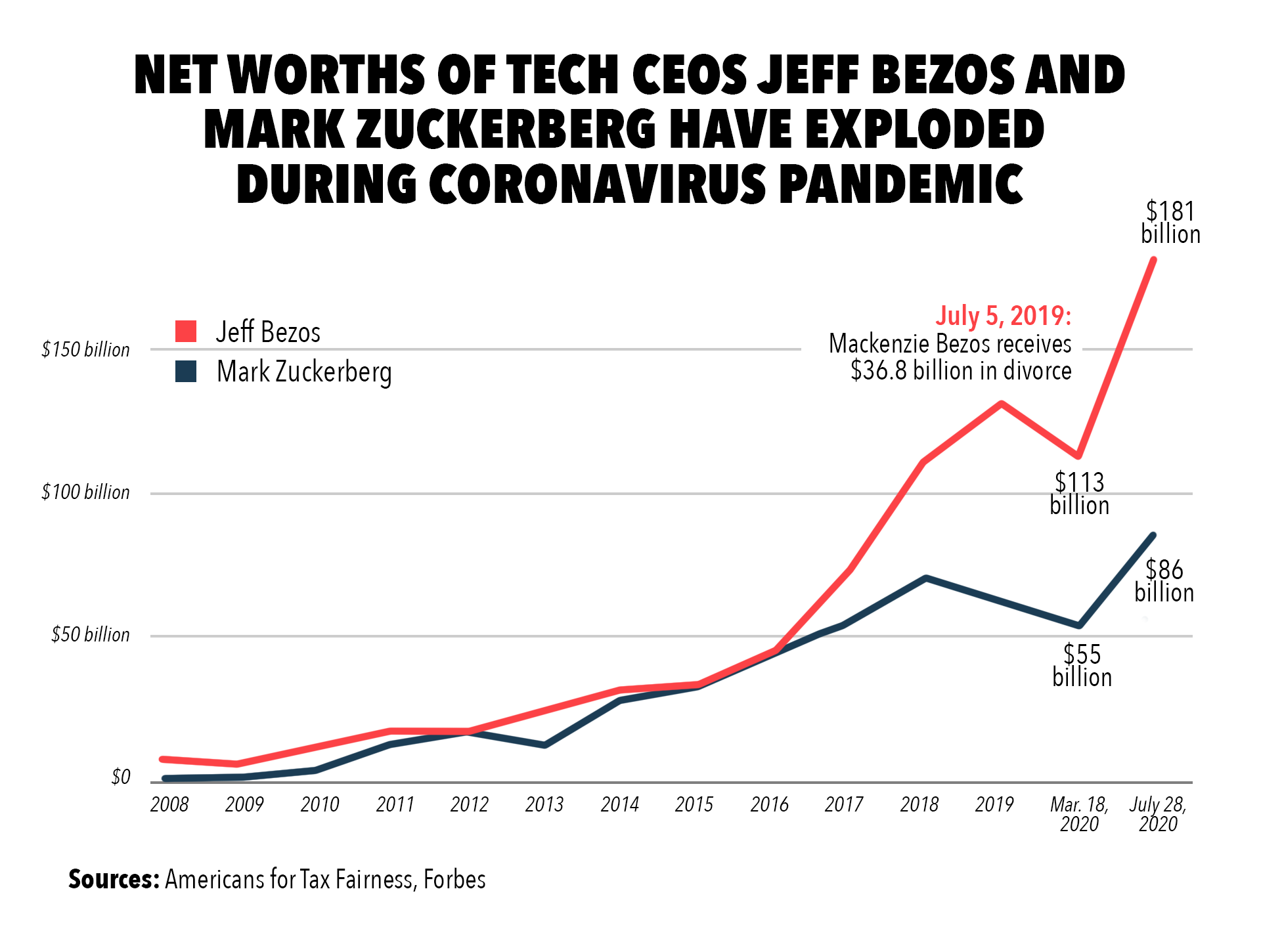

Jeff Bezos's Amazon and the Trump Presidency

Antitrust Concerns and Regulatory Scrutiny

Amazon faced increased antitrust scrutiny during the Trump administration, impacting its stock price and Bezos's net worth.

- Regulatory Investigations: Multiple investigations into Amazon's business practices, including allegations of anti-competitive behavior, created uncertainty and negatively impacted investor confidence. [Cite details of antitrust investigations and their timing].

- Impact on Stock Price: The threat of potential fines and regulatory changes contributed to periods of volatility in Amazon's stock price, impacting Bezos's overall wealth. [Provide data showing Amazon's stock performance during periods of increased regulatory scrutiny].

- Effects on Business Model: The regulatory pressure forced Amazon to make adjustments to its business model, potentially impacting its long-term profitability and Bezos's net worth. [Discuss any changes in Amazon's business practices in response to regulatory pressure].

Trade Wars and International Market Impact

Trump's trade policies significantly impacted Amazon's international operations and supply chains.

- Tariffs and Trade Disputes: Tariffs imposed during the trade wars increased the cost of goods for Amazon, affecting its profitability and stock price. [Provide data illustrating the impact of tariffs on Amazon's costs and revenue].

- Impact on International Operations: Trade disputes disrupted Amazon's international supply chains, leading to delays and increased costs. [Discuss the impact on specific international markets and Amazon’s operational responses].

- Quantifying Financial Losses: Estimating the precise financial losses attributable to trade wars is complex, but analyses suggest significant negative impacts on Amazon's revenue and, consequently, Bezos's net worth. [Cite economic analyses estimating the impact of trade wars on Amazon].

Mark Zuckerberg's Facebook and the Trump Era

Regulation of Social Media and Data Privacy

Facebook faced increased regulatory pressure concerning data privacy and misinformation during the Trump era.

- Data Privacy Regulations: New regulations like GDPR in Europe and increasing scrutiny in the US led to significant fines and increased compliance costs for Facebook. [Cite specific regulations and their impact on Facebook].

- Impact on Stock Price: These regulatory actions and the resulting negative publicity contributed to periods of volatility in Facebook's stock price, affecting Zuckerberg's net worth. [Provide data illustrating Facebook's stock performance during regulatory crackdowns].

- Public Perception: The perception of Facebook's role in the spread of misinformation and its handling of user data negatively impacted its reputation and valuation, affecting Zuckerberg's wealth. [Discuss public opinion polls and their correlation with Facebook's stock price].

Political Advertising and Campaign Influence

The issue of political advertising on Facebook and its influence on elections generated significant controversy.

- Political Advertising Revenue: While political advertising contributed to Facebook's revenue, the controversies surrounding its role in influencing elections created negative publicity and regulatory pressure. [Discuss the financial contribution of political advertising to Facebook's revenue].

- Impact on Valuation: The debates regarding political influence and the regulation of political advertising on social media platforms impacted Facebook's overall valuation and, consequently, Zuckerberg's net worth. [Analyze how these debates impacted investor confidence and Facebook's stock price].

- Financial Effect of Regulations: Changes in regulations concerning political advertising could have a significant financial impact on Facebook's revenue model, potentially affecting Zuckerberg’s net worth in the long term. [Discuss potential future regulatory impacts on Facebook's revenue from political advertising].

Conclusion

This article analyzed the estimated decline in the net worth of Elon Musk, Jeff Bezos, and Mark Zuckerberg following Trump's inauguration. We explored the impact of various factors, including policy changes, regulatory scrutiny, market volatility, and public perception. The findings highlight the complex interplay between political climate, economic conditions, and the fortunes of prominent individuals. Understanding the interplay between these factors is crucial for investors and anyone seeking to analyze the shifting dynamics of wealth in the modern global economy.

Call to Action: Understanding the impact of political events on billionaire net worth is crucial for investors and policymakers alike. Further research is needed to fully grasp the long-term consequences. Continue learning about the fluctuating net worth of Musk, Bezos, and Zuckerberg and the impact of political events by exploring related articles and resources. Stay informed about the factors influencing billionaire net worth and their broader economic implications.

Featured Posts

-

Scaling Tech And Innovation In Edmonton The Unlimited Strategy

May 09, 2025

Scaling Tech And Innovation In Edmonton The Unlimited Strategy

May 09, 2025 -

Stiven King I Ego Kritika Trampa I Maska Chto Proizoshlo

May 09, 2025

Stiven King I Ego Kritika Trampa I Maska Chto Proizoshlo

May 09, 2025 -

E Bays Liability For Banned Chemicals A Section 230 Case Study

May 09, 2025

E Bays Liability For Banned Chemicals A Section 230 Case Study

May 09, 2025 -

Understanding Elon Musks Financial Success Strategies And Investments

May 09, 2025

Understanding Elon Musks Financial Success Strategies And Investments

May 09, 2025 -

Arctic Comic Con 2025 Photos Of Characters Connections And The Ectomobile

May 09, 2025

Arctic Comic Con 2025 Photos Of Characters Connections And The Ectomobile

May 09, 2025