Ethereum Liquidations Surge To $67M: Is A Further Market Selloff Imminent?

Table of Contents

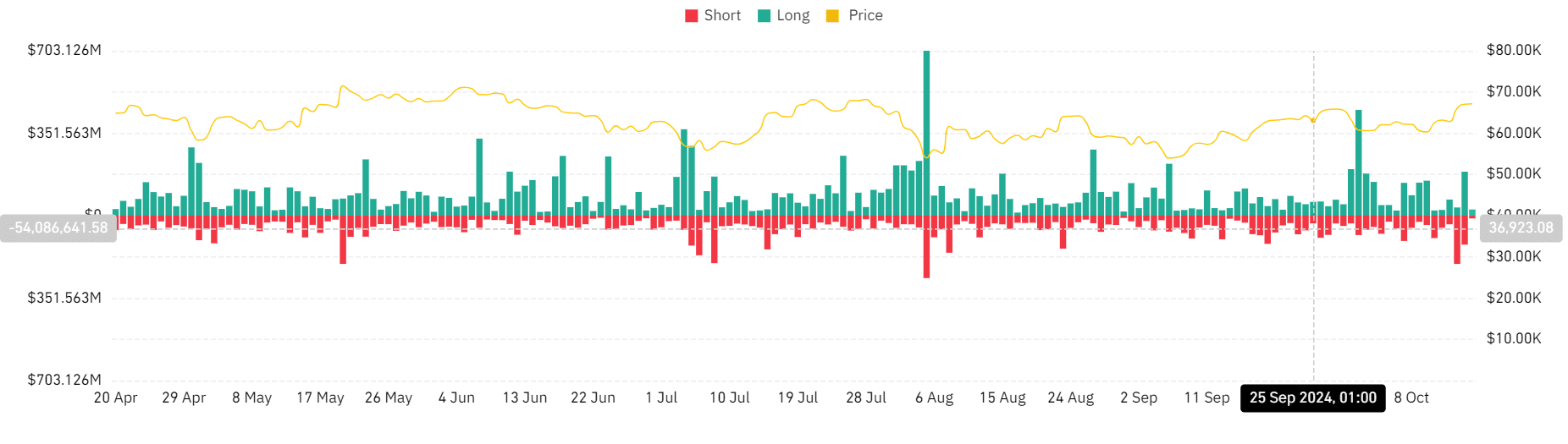

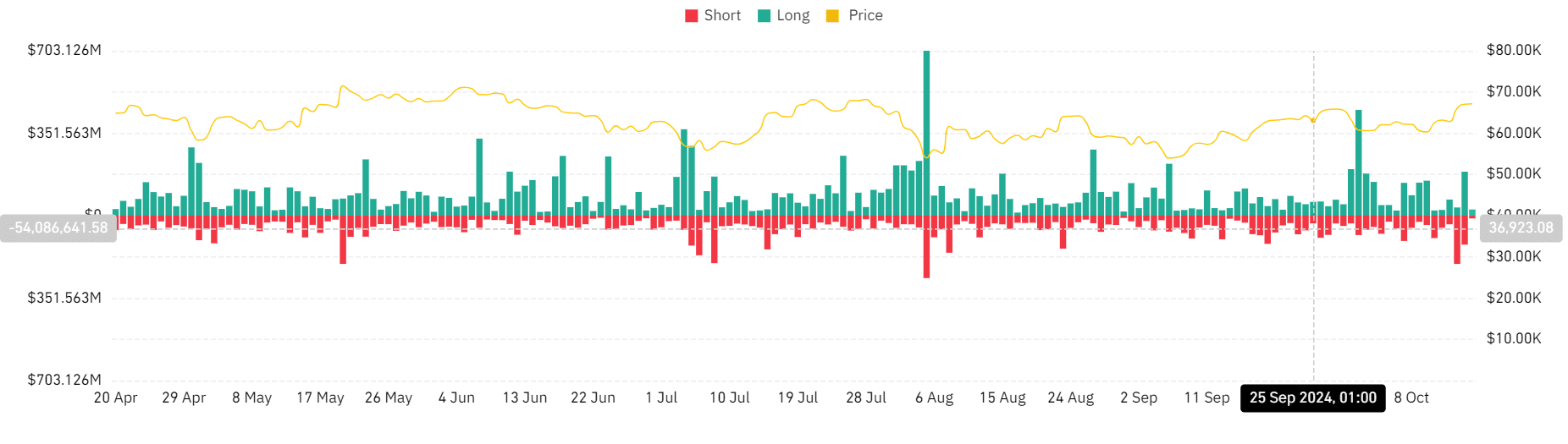

1. Understanding the Surge in Ethereum Liquidations

Defining Ethereum Liquidations

Ethereum liquidations, in simple terms, represent the forced selling of Ethereum (ETH) assets. This occurs when traders utilize leverage – borrowing funds to amplify potential profits – and the market moves against their positions. When the value of their collateral falls below a certain threshold (the margin call), their positions are automatically liquidated to cover the loan, resulting in a significant loss for the trader. Imagine a trader borrowing to buy ETH, hoping for a price increase. If the price drops sharply, the lender liquidates the ETH to recoup their loan, regardless of the trader's loss.

Factors Contributing to the $67M Surge

Several factors likely contributed to this massive wave of Ethereum liquidations:

- Increased Volatility: The inherent volatility of the cryptocurrency market creates a breeding ground for liquidations. Sharp price swings, even within short timeframes, can trigger margin calls.

- Market Downturn: A broader market downturn, often driven by macroeconomic factors or negative news affecting the crypto sector, can significantly increase the risk of liquidations. A general loss of confidence can lead to widespread selling pressure.

- Specific Events Impacting ETH Price: Negative news or events directly impacting Ethereum, such as a major security breach within the Ethereum ecosystem or a significant regulatory development, can also trigger a surge in liquidations.

- Leveraged Trading: The widespread use of leveraged trading inherently magnifies both profits and losses. This practice significantly amplifies the risk of liquidations, especially during periods of heightened volatility.

- DeFi Protocol Vulnerabilities: Exploits or vulnerabilities within decentralized finance (DeFi) protocols can cause sudden price drops and trigger massive liquidations across multiple platforms.

Data from [insert reputable source like CoinGlass or similar] shows that a significant portion of these liquidations occurred on [mention specific exchanges or DeFi platforms].

Analyzing the Affected Platforms

The $67 million figure represents a broad impact across multiple platforms. For example, [mention platform A] saw [amount] in liquidations, while [mention platform B] experienced [amount]. The concentration of liquidations on particular platforms could indicate vulnerabilities within those specific ecosystems, highlighting the potential for systemic risk. Further investigation is required to determine the full extent of the impact on these platforms and their stability.

2. Assessing the Risk of a Further Market Selloff

Correlation between Liquidations and Market Trends

Historically, large-scale liquidations often precede or accompany significant market downturns. The forced selling of assets puts additional downward pressure on prices, creating a feedback loop that can exacerbate the selloff. [Include a chart or graph illustrating the historical correlation between liquidations and price drops, citing the source].

Analyzing Current Market Sentiment

Current market indicators provide a mixed picture. Trading volume is [high/low], suggesting [interpretation]. Bitcoin's price is currently [stable/volatile], indicating [interpretation]. Overall investor sentiment, as measured by [mention specific metric, e.g., social media sentiment analysis, Fear & Greed Index], appears to be [bullish/bearish/neutral].

Potential Triggers for Further Selloffs

Several factors could trigger additional downward pressure on the Ethereum market:

- Regulatory Uncertainty: Unclear or unfavorable regulatory developments can lead to investor apprehension and further selling.

- Macroeconomic Factors: Global economic instability can negatively impact investor confidence in riskier assets like cryptocurrencies.

- Further DeFi Exploits: Additional security breaches or vulnerabilities within DeFi protocols could trigger another wave of liquidations.

- Major Ethereum Network Issues: Any significant disruptions or unexpected issues within the Ethereum network itself could negatively impact market sentiment and price.

3. Strategies for Navigating the Current Market Uncertainty

Risk Management for Ethereum Investors

To mitigate risk in this volatile market:

- Diversify Your Portfolio: Don't put all your eggs in one basket. Diversify your holdings across different assets to reduce your exposure to any single cryptocurrency.

- Reduce Leverage: Avoid excessively leveraged trading positions to minimize the risk of liquidations.

- Set Stop-Loss Orders: Implement stop-loss orders to automatically sell your assets if the price falls below a predetermined level.

- Thorough Due Diligence: Before investing in any DeFi protocol, carefully research its security, track record, and team.

Opportunities Amidst Volatility

For experienced investors comfortable with risk, the increased volatility can present buying opportunities. However, conducting thorough due diligence and careful risk assessment before investing is essential. This is not a recommendation to buy, but simply a recognition that volatility often creates dips in value.

Staying Informed about Ethereum Market Developments

Staying informed is key to making informed investment decisions. Monitor news, market data, and expert analysis to gain a better understanding of market trends and potential risks associated with Ethereum liquidations and market movements.

Conclusion

The recent surge in Ethereum liquidations, reaching $67 million, highlights the significant risks associated with leveraged trading in a volatile market. This event underscores the potential for further market selloffs. Key takeaways include the importance of understanding the mechanics of liquidations, recognizing the factors contributing to their occurrence, and implementing sound risk management strategies. Monitor Ethereum liquidations closely, understand the risks of Ethereum trading, and stay updated on Ethereum market news from reputable sources to protect your investments. For detailed market analysis, refer to [link to reputable market analysis website].

Featured Posts

-

Nba Star Jayson Tatum Welcomes Son With Singer Ella Mai

May 08, 2025

Nba Star Jayson Tatum Welcomes Son With Singer Ella Mai

May 08, 2025 -

Navigating The Crypto World Why Reliable News Is Crucial

May 08, 2025

Navigating The Crypto World Why Reliable News Is Crucial

May 08, 2025 -

Fetterman Responds To Questions About His Health

May 08, 2025

Fetterman Responds To Questions About His Health

May 08, 2025 -

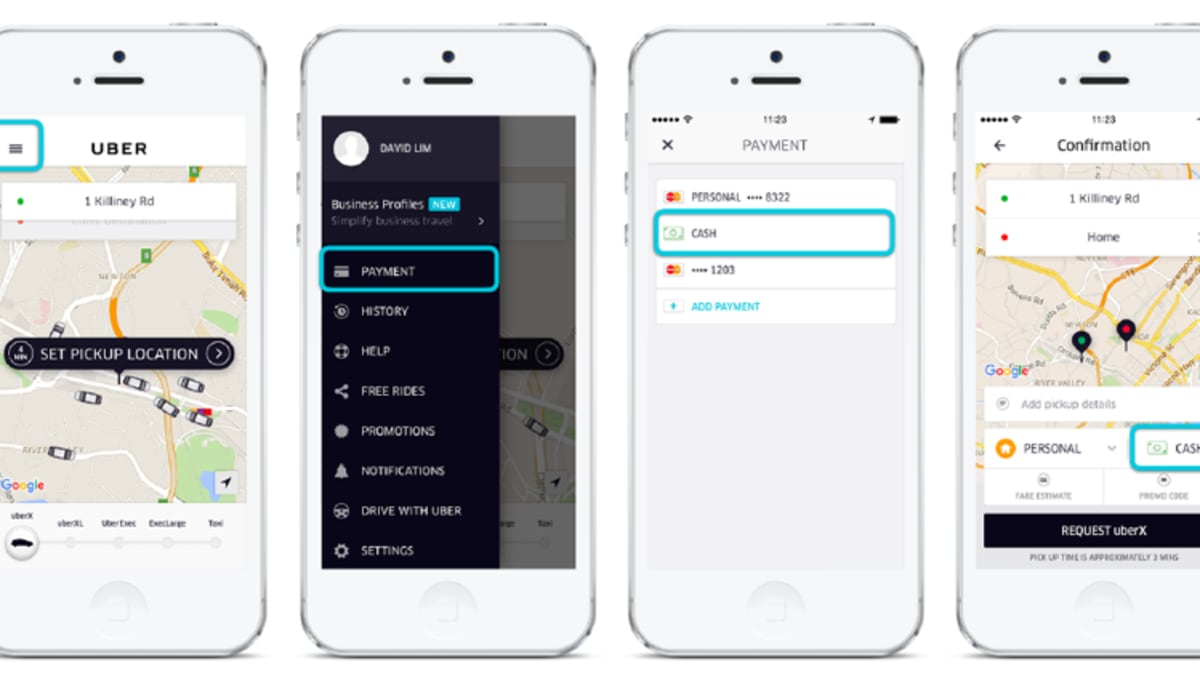

No More Cash On Uber Auto Upi Payments Explained

May 08, 2025

No More Cash On Uber Auto Upi Payments Explained

May 08, 2025 -

Ethereum Price Crucial Support Level Holds Is A Drop To 1500 Imminent

May 08, 2025

Ethereum Price Crucial Support Level Holds Is A Drop To 1500 Imminent

May 08, 2025