Ethereum Nears $2,700: Wyckoff Accumulation Analysis

Table of Contents

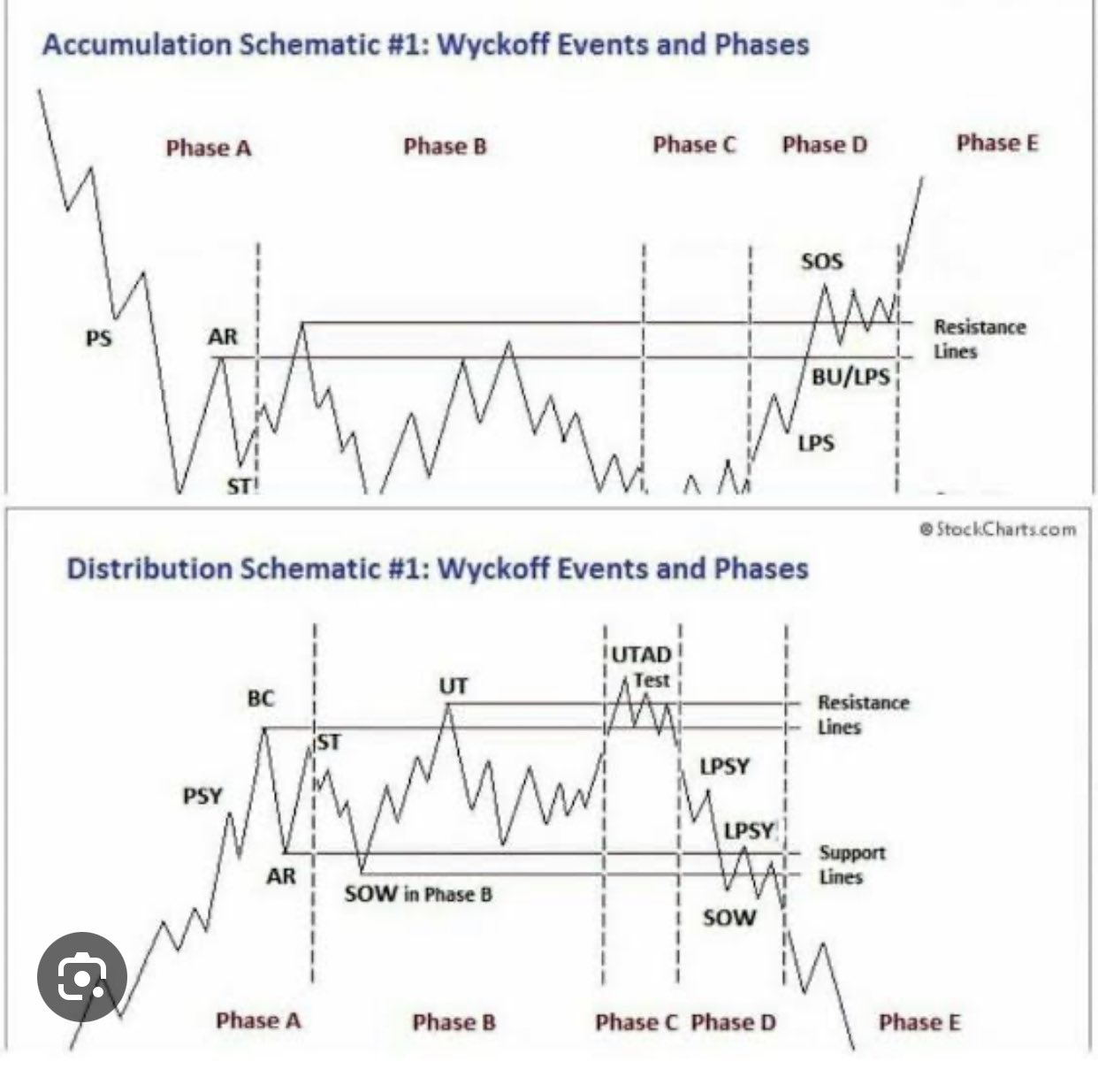

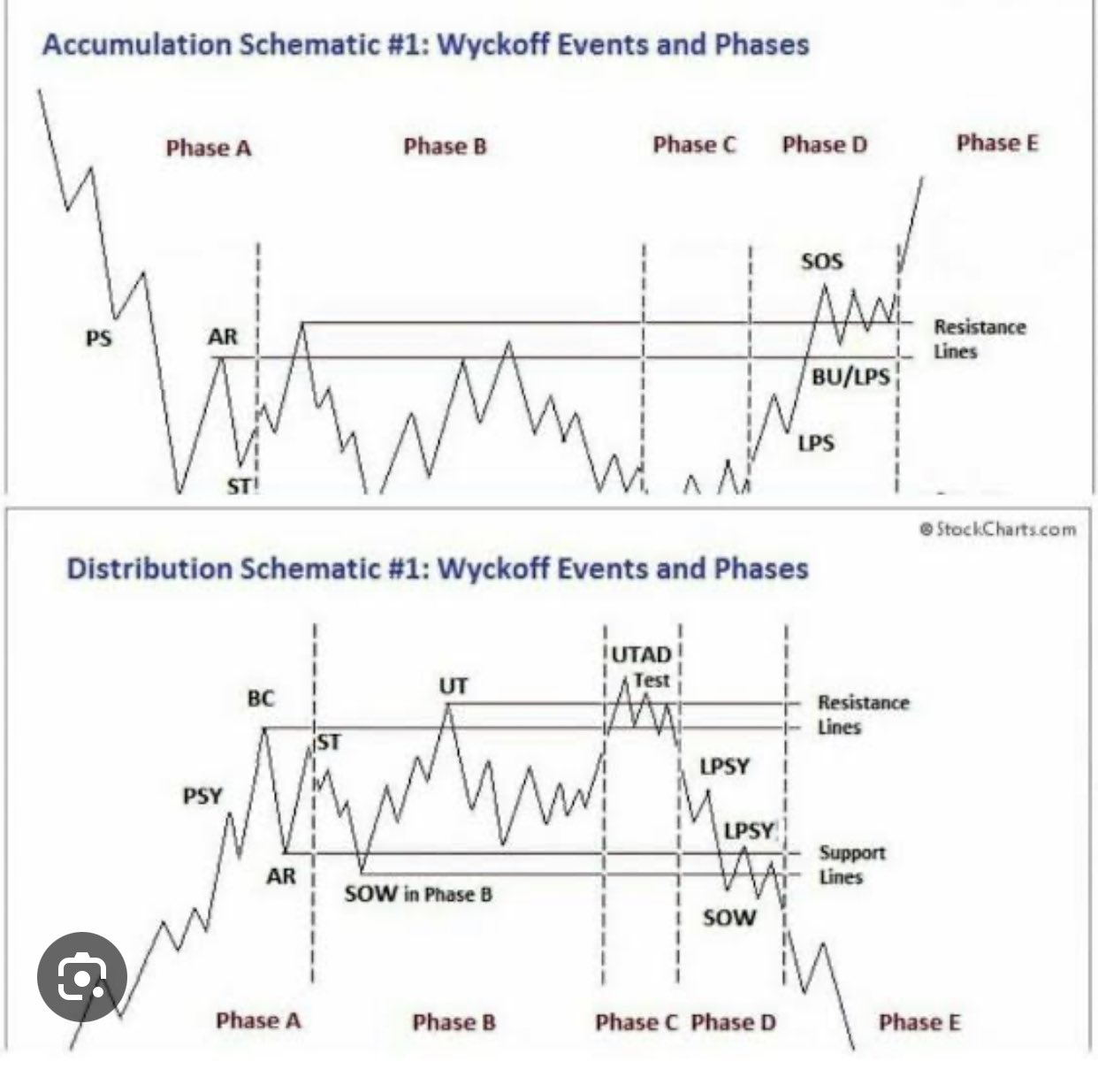

Understanding the Wyckoff Accumulation Pattern

The Wyckoff method is a powerful tool for identifying market manipulation and predicting significant price movements. It focuses on understanding the phases of accumulation, where large market players quietly amass positions before a substantial price increase. This differs from other technical analyses focusing solely on price and volume. The core principle is identifying the subtle shifts in price and volume that signal a change in market sentiment. The Wyckoff accumulation pattern typically unfolds in distinct phases:

- Spring: A small price decline designed to shake out weak holders. Volume often decreases during a spring.

- Sign of Weakness (SoW): A further price drop, usually accompanied by increased volume, confirming the selling pressure.

- Test: A retest of the previous low, often with lower volume than the SoW, demonstrating a lack of further selling pressure. This is crucial for identifying potential support levels.

- Markup: The final phase, where buying pressure dominates, leading to a significant price increase. Volume typically increases significantly during the markup phase.

Understanding the interplay of price and volume across these phases is critical for identifying a genuine Wyckoff Accumulation. [Insert a chart illustrating the Wyckoff Accumulation pattern here]. Keywords: Wyckoff accumulation chart, Wyckoff phases, Wyckoff volume analysis, Wyckoff price action.

Ethereum Price Analysis: Applying the Wyckoff Method

Let's analyze Ethereum's recent price action through the lens of the Wyckoff method. [Insert a chart of the Ethereum price action here, ideally covering a period relevant to the analysis]. Observing the recent price movements of ETH, we can tentatively identify potential phases:

- Potential Spring: A minor dip below a specific support level, perhaps around $2500, with decreasing volume could be interpreted as a spring.

- Potential Sign of Weakness: A subsequent drop, maybe to $2400, with higher volume might confirm selling pressure.

- Potential Test: A retest of the $2400 level with comparatively lower volume would support the accumulation theory.

- Absence of Markup: Currently, a clear markup phase is absent. Further confirmation is needed.

Analyzing technical indicators like RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) alongside volume can further support this analysis. A bullish divergence on the RSI or MACD could strengthen the case for accumulation. Key support and resistance levels must be carefully identified on the Ethereum chart analysis. Keywords: Ethereum chart analysis, ETH technical analysis, Ethereum support resistance, Ethereum RSI, Ethereum MACD, Ethereum volume.

Signs of Accumulation in Ethereum

Several factors could suggest potential accumulation in the Ethereum market:

- Large Buy Orders: Observing large buy orders on exchanges could indicate significant institutional interest.

- Decreasing Volume During Price Drops: If the price drops, but the volume decreases significantly, it suggests that sellers are not aggressively pushing the price down, possibly indicative of accumulation.

- Sideways Price Action (Consolidation): Extended periods of sideways trading or consolidation can be a characteristic of the accumulation phase.

However, it's crucial to acknowledge potential weaknesses. The current analysis is tentative. The absence of a clear markup phase is a key consideration. Alternative interpretations, such as a continuation of a bearish trend, are equally possible. Keywords: Ethereum buy orders, Ethereum volume analysis, Ethereum sideways trading, Ethereum price consolidation.

Potential Implications and Risks

If the pattern confirms as a Wyckoff Accumulation, a significant price increase could follow the markup phase. Potential price targets would need to be determined based on the pattern’s projected height. However, trading based on this analysis involves significant risks:

- Market Volatility: The cryptocurrency market is notoriously volatile, and predictions can easily be incorrect.

- False Signals: Wyckoff patterns can be difficult to identify with certainty, and false signals are possible.

Therefore, thorough risk management is essential. Never invest more than you can afford to lose. Keywords: Ethereum price target, Ethereum trading risks, Ethereum market volatility, Ethereum trading strategy.

Conclusion: Ethereum's Path Forward – Wyckoff Accumulation and Beyond

Our analysis suggests the possibility of a Wyckoff Accumulation pattern forming in the Ethereum market, but it remains tentative. While the price nearing $2700 and certain indicators suggest potential accumulation, the absence of a clear markup phase warrants caution. Potential price targets remain speculative at this stage, heavily dependent on the successful completion of the pattern. Remember, conducting thorough research and understanding the risks involved is paramount before making any trading decisions. To further your understanding, continue learning about the Wyckoff method and explore more in-depth Ethereum technical analysis to develop your own informed trading strategies. [Link to further resources on Wyckoff analysis and Ethereum trading]. Keywords: Ethereum future price, Wyckoff analysis Ethereum, Ethereum trading, ETH investment.

Featured Posts

-

Sufians Acknowledgement Of Gcci Presidents Role In Expo 2025

May 08, 2025

Sufians Acknowledgement Of Gcci Presidents Role In Expo 2025

May 08, 2025 -

Affordable Ways To Watch Los Angeles Angels Baseball In 2025

May 08, 2025

Affordable Ways To Watch Los Angeles Angels Baseball In 2025

May 08, 2025 -

March 7th Thunder Vs Trail Blazers Game Time Tv And Streaming Info

May 08, 2025

March 7th Thunder Vs Trail Blazers Game Time Tv And Streaming Info

May 08, 2025 -

Trump Media And Crypto Com New Etf Partnership Sends Cro Soaring

May 08, 2025

Trump Media And Crypto Com New Etf Partnership Sends Cro Soaring

May 08, 2025 -

January 6th Hearings Witness Cassidy Hutchinson To Publish Memoir

May 08, 2025

January 6th Hearings Witness Cassidy Hutchinson To Publish Memoir

May 08, 2025