Ethereum Price Analysis: Bullish Signals And Potential Targets

Table of Contents

Analyzing Current Market Trends for Ethereum (ETH)

The overall cryptocurrency market sentiment remains cautiously optimistic, though recent events have introduced uncertainty. At the time of writing, Ethereum is trading at [Insert Current Ethereum Price and Date]. Its recent performance has been [Describe recent performance – e.g., "a steady climb after a period of consolidation," or "a volatile period with both significant gains and losses"].

[Insert relevant chart/graph visualizing Ethereum's price movement over the past few weeks/months].

- Key Support and Resistance Levels: Current support is observed around [Price Level], while resistance sits at [Price Level]. A breakout above this resistance could signal a significant bullish move.

- Trading Volume: Increased trading volume alongside price increases confirms the strength of the bullish momentum. Conversely, declining volume despite price rises suggests weakening strength. [Insert chart/graph showing trading volume].

- Significant News Events: Recent upgrades to the Ethereum network (e.g., [mention specific upgrades like Shanghai upgrade, etc.]) have positively impacted investor confidence and contributed to price appreciation. [Mention any relevant partnerships or regulatory developments].

Identifying Bullish Signals in the Ethereum Market

Several technical indicators suggest a bullish outlook for Ethereum.

- Moving Averages: The 50-day moving average has crossed above the 200-day moving average (a "golden cross"), a classic bullish signal. [Insert chart showing moving averages].

- Relative Strength Index (RSI): The RSI is currently above [Value], suggesting the asset is not overbought and further upside potential remains. [Insert chart showing RSI].

- MACD (Moving Average Convergence Divergence): A bullish crossover of the MACD lines is visible, indicating strengthening bullish momentum. [Insert chart showing MACD].

- Bollinger Bands: The price is currently trading above the lower Bollinger Band, suggesting potential for a price increase towards the upper band. [Insert chart showing Bollinger Bands].

On-chain data also supports a bullish narrative. Increasing active addresses and rising transaction fees indicate growing network adoption and usage.

Potential Price Targets for Ethereum in the Short-Term and Long-Term

Based on technical analysis and current market sentiment, several potential price targets can be considered.

- Short-Term (Weeks/Months): A price target of [Price Level] is possible in the short term if bullish momentum continues and resistance levels are broken.

- Long-Term (Years): Considering Ethereum's technological advancements and growing adoption, a long-term price target of [Price Level] is conceivable, but highly dependent on broader market conditions and technological developments.

These predictions are, however, subject to change based on various factors, including:

- Increased adoption rate within the DeFi and NFT sectors.

- Positive regulatory developments or clarity surrounding cryptocurrencies.

- Continued improvements and upgrades to the Ethereum network's scalability and efficiency.

Risks and Considerations for Ethereum Investors

Despite the bullish signals, it's crucial to acknowledge the risks involved in investing in Ethereum.

- Regulatory Uncertainty: Government regulations concerning cryptocurrencies remain volatile and could significantly impact the price of Ethereum.

- Competition from other Cryptocurrencies: The emergence of competing blockchain technologies poses a potential challenge to Ethereum's dominance.

- Technical Vulnerabilities: Smart contract vulnerabilities or network security breaches could trigger price drops.

- Market Manipulation: The possibility of market manipulation by large players cannot be ignored.

Conclusion: Summarizing Ethereum Price Analysis and Call to Action

This Ethereum price analysis has revealed several bullish signals, including positive technical indicators, increased on-chain activity, and recent network upgrades. Potential price targets range from [Short-term Target] in the short term to [Long-term Target] in the long term. However, investors must carefully consider the inherent risks associated with cryptocurrency investments. Remember to conduct thorough due diligence before investing in any cryptocurrency. Stay informed about future Ethereum price analysis to make well-informed investment decisions. Learn more about navigating the Ethereum market and identifying bullish signals to maximize your investment strategy.

Featured Posts

-

Barcelona Vs Inter Milan Six Goal Thriller In Champions League Semi Final

May 08, 2025

Barcelona Vs Inter Milan Six Goal Thriller In Champions League Semi Final

May 08, 2025 -

Behind The Scenes Of Andor Cast Insights Into The Rogue One Prequels Final Season

May 08, 2025

Behind The Scenes Of Andor Cast Insights Into The Rogue One Prequels Final Season

May 08, 2025 -

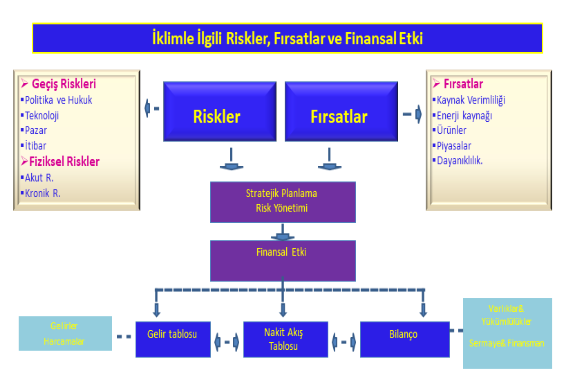

Kripto Para Yatirimcilari Icin Kripto Lider Analizi Riskler Ve Firsatlar

May 08, 2025

Kripto Para Yatirimcilari Icin Kripto Lider Analizi Riskler Ve Firsatlar

May 08, 2025 -

Andor Season 2 A Recap Of Season 1 And What To Expect

May 08, 2025

Andor Season 2 A Recap Of Season 1 And What To Expect

May 08, 2025 -

April 16 2025 Lotto Winning Numbers

May 08, 2025

April 16 2025 Lotto Winning Numbers

May 08, 2025