Ethereum's Future: Analyzing The Current Support Level And Potential Price Drop To $1500

Table of Contents

Current Ethereum Support Levels

Analyzing Ethereum's price requires a multifaceted approach, combining technical and on-chain analysis to understand the underlying strength of its support.

Identifying Key Support Zones

Technical analysis employs various indicators to identify potential support levels. Moving averages, such as the 20-day and 50-day exponential moving averages (EMAs), can reveal areas where buying pressure has historically been strong. Fibonacci retracements, based on the Fibonacci sequence, identify potential reversal points after a price decline. Currently, several key support zones for Ethereum can be observed. These include:

- $1700 - $1750: This zone represents a significant psychological support level and coincides with previous price consolidation areas. A break below this level could signal further downside.

- $1600 - $1650: This area aligns with several technical indicators and historical lows, making it another crucial support level to watch.

- $1500: This represents a psychologically significant level and a potential final line of defense before a more significant price drop.

[Insert chart/graph visually representing support levels here]

On-Chain Metrics and Their Impact

Beyond technical analysis, on-chain data provides valuable insights into investor sentiment and network activity. Metrics like active addresses, transaction volume, and exchange balances can reveal underlying trends that may precede price movements.

- Decreasing Active Addresses: A decline in the number of unique Ethereum addresses interacting with the network could signal waning interest and potential downward price pressure.

- Falling Transaction Volume: Lower transaction volume suggests reduced network activity and potentially weaker demand for Ethereum.

- Exchange Balances: High exchange balances may indicate a willingness to sell, potentially putting downward pressure on the price.

[Link to relevant on-chain data resources here, e.g., Glassnode, Etherscan]

Factors Contributing to a Potential Ethereum Price Drop to $1500

Several factors could contribute to a potential Ethereum price drop to $1500, ranging from macroeconomic conditions to market sentiment and competition.

Macroeconomic Factors

Broader economic conditions significantly influence cryptocurrency markets. Inflation, rising interest rates, and recessionary fears can lead to risk-off sentiment, causing investors to sell off assets like Ethereum.

- Inflation and Interest Rates: High inflation and rising interest rates increase the opportunity cost of holding cryptocurrencies, potentially prompting investors to move their funds to safer, higher-yielding investments.

- Regulatory Uncertainty: Regulatory uncertainty around cryptocurrencies can also create volatility and negatively affect investor confidence, leading to price declines.

- Institutional Investor Sentiment: Changes in the sentiment of large institutional investors can significantly impact Ethereum's price, causing substantial market swings.

Market Sentiment and Fear, Uncertainty, and Doubt (FUD)

Market sentiment plays a crucial role in price fluctuations. Negative news, speculation, and FUD can create sell-offs and drive prices lower.

- Social Media Sentiment: Negative sentiment on social media platforms can spread rapidly, influencing investor decisions and causing price drops.

- Analyst Opinions: Bearish predictions from prominent analysts can negatively affect market sentiment and drive selling pressure.

- Negative News Events: Significant negative news events, such as security breaches or regulatory crackdowns, can trigger sharp price declines.

Competition from Other Cryptocurrencies

Ethereum faces increasing competition from other blockchain platforms, which could impact its market share and price.

- Layer-1 Competitors: Rival layer-1 blockchains offer alternative solutions with potentially lower transaction fees or faster speeds, which can draw users away from Ethereum.

- Market Capitalization: The relative market capitalization of Ethereum compared to its competitors can affect investor confidence and price.

- Market Share Erosion: A loss of market share to competitors could negatively impact Ethereum's price.

Potential Scenarios and Mitigation Strategies

Several scenarios could unfold for Ethereum's price in the coming months.

Best-Case, Worst-Case, and Most Likely Scenarios

- Best-Case Scenario: Positive macroeconomic conditions, bullish market sentiment, and continued adoption of Ethereum could lead to a price recovery and potentially surpass current highs.

- Worst-Case Scenario: Negative macroeconomic conditions, bearish market sentiment, and increased competition could result in a price drop to $1500 or even lower.

- Most Likely Scenario: A moderate price correction is most likely, with the price potentially testing support levels around $1600-$1700 before stabilizing.

Strategies for Navigating a Potential Price Drop

Investors can take steps to mitigate the risks associated with a potential price correction:

- Diversification: Diversifying your investment portfolio across different assets can help reduce your risk exposure to any single cryptocurrency.

- Stop-Loss Orders: Implementing stop-loss orders can help limit potential losses if the price drops significantly.

- Dollar-Cost Averaging: Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of price, which can reduce the impact of short-term price volatility.

Conclusion

Analyzing the potential for an Ethereum price drop to $1500 requires considering both technical and fundamental factors. Current support levels around $1700-$1800 are crucial, but several factors, including macroeconomic conditions, market sentiment, and competition, could contribute to further price declines. While a drop to $1500 is a possibility, the future of Ethereum's price remains uncertain. To navigate this volatility, investors should monitor the Ethereum price, stay updated on Ethereum's future, and analyze the current Ethereum support levels carefully before making investment decisions. Conduct thorough research and consider the inherent risks associated with cryptocurrency investments.

Featured Posts

-

How Saturday Night Live Launched Counting Crows To Success

May 08, 2025

How Saturday Night Live Launched Counting Crows To Success

May 08, 2025 -

Dwp Alters Universal Credit Verification Process Key Details

May 08, 2025

Dwp Alters Universal Credit Verification Process Key Details

May 08, 2025 -

Dembele Injury Significant Implications For Arsenals Season

May 08, 2025

Dembele Injury Significant Implications For Arsenals Season

May 08, 2025 -

Are You Due A Universal Credit Refund Dwp Payments Explained April May

May 08, 2025

Are You Due A Universal Credit Refund Dwp Payments Explained April May

May 08, 2025 -

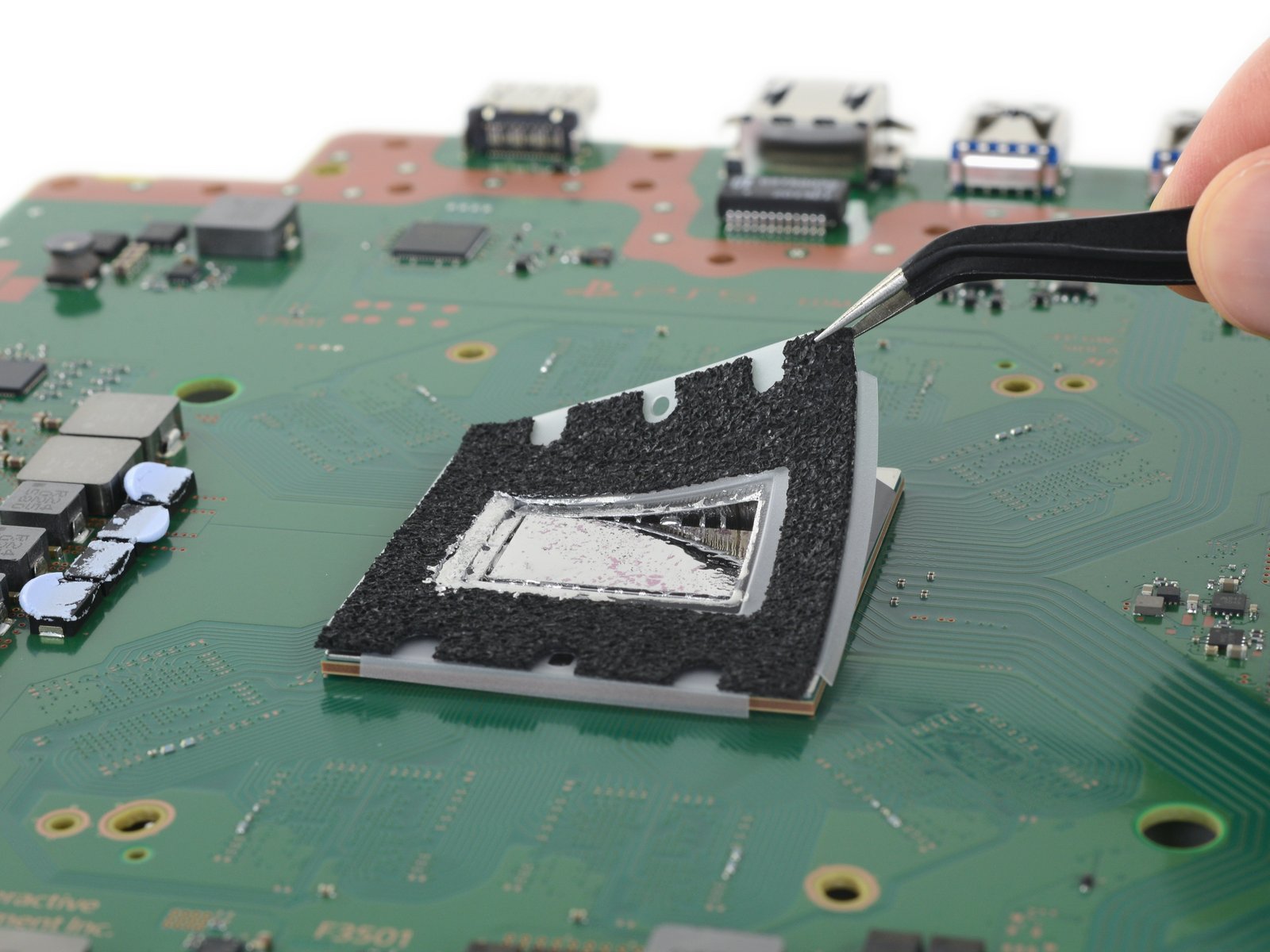

Sony Ps 5 Pro Teardown Liquid Metal Cooling System Revealed

May 08, 2025

Sony Ps 5 Pro Teardown Liquid Metal Cooling System Revealed

May 08, 2025