EU Weighs Options For Phasing Out Russian Gas Via Spot Market

Table of Contents

Challenges of Transitioning Away from Long-Term Contracts

The EU's historical reliance on long-term contracts with Russia for natural gas has created significant hurdles in its swift transition to alternative sources. This dependence has deeply ingrained itself into the energy infrastructure and supply chains of numerous member states.

Dependence on Pipeline Gas

The EU's extensive network of pipelines, historically designed to receive gas primarily from Russia, represents a significant challenge. This dependence creates a considerable inertia against rapid diversification.

- High initial investment costs: Shifting to alternative suppliers often requires substantial upfront investments in new infrastructure.

- Contract obligations: Existing long-term contracts with Russia present legal and financial complexities that make a complete and immediate break difficult.

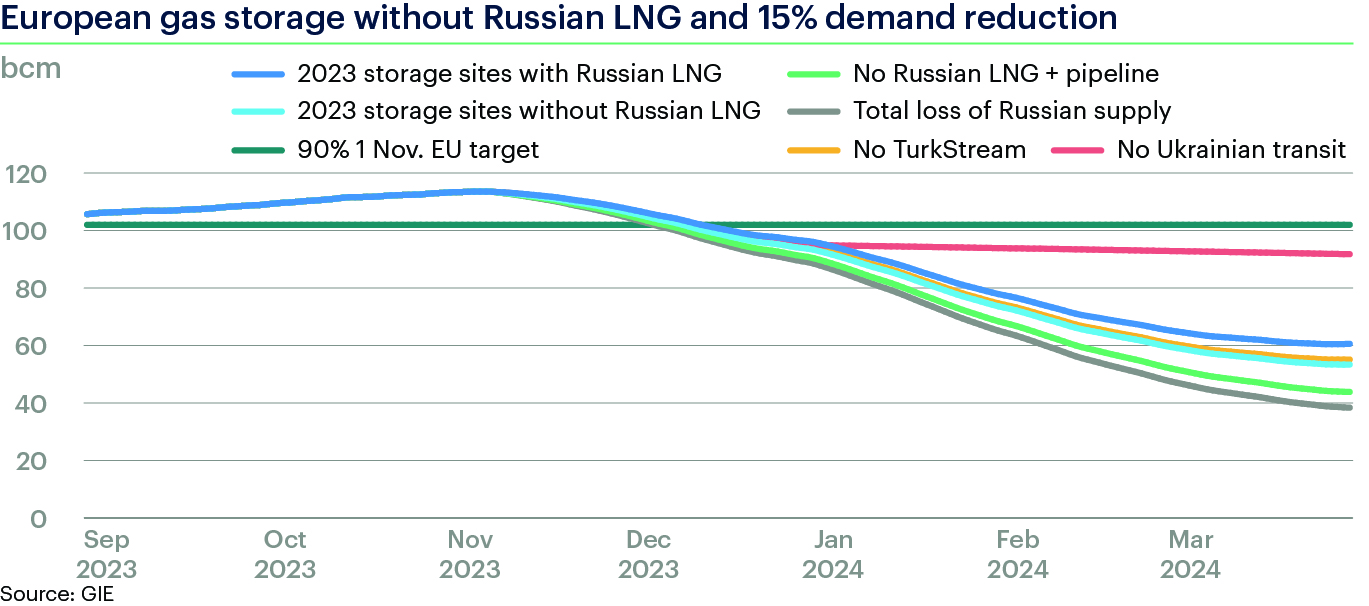

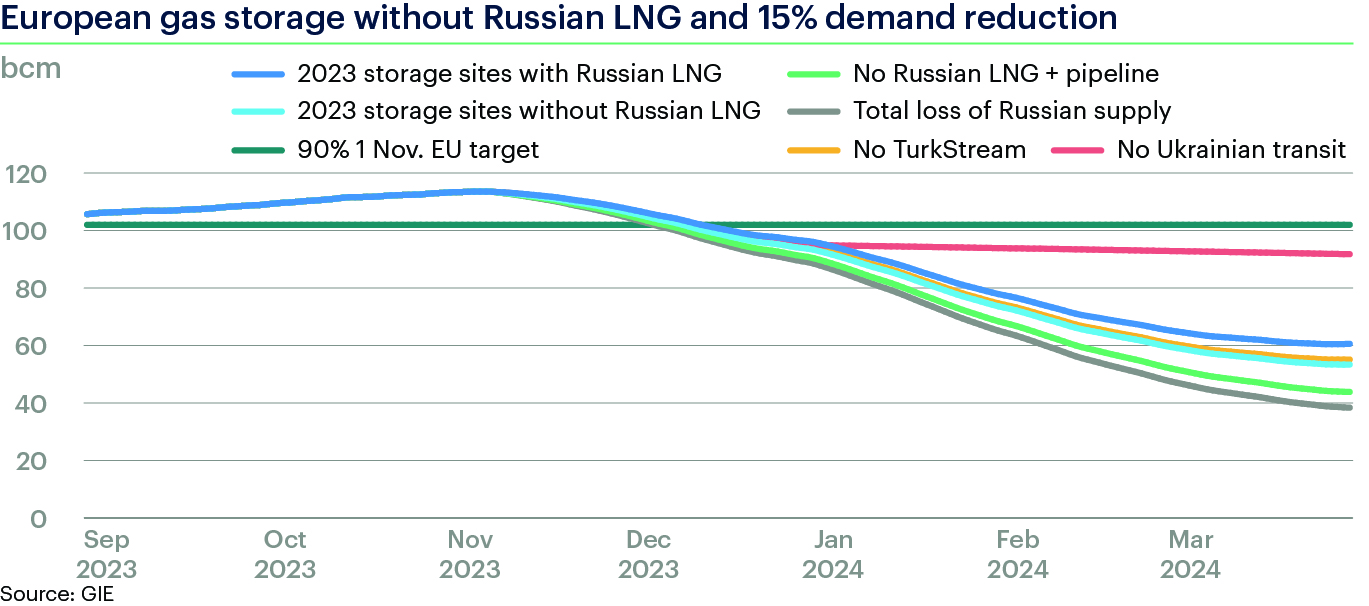

- Limited storage capacity: Several EU member states lack sufficient gas storage capacity to handle the transition smoothly, potentially leading to supply shortages during peak demand.

Breaking long-term contracts with Russia carries potential legal repercussions and substantial financial penalties. Navigating these complexities requires careful planning and diplomatic efforts, adding another layer of difficulty to the transition process.

Infrastructure Limitations

The current energy infrastructure is predominantly designed for pipeline gas from Russia. This presents a significant bottleneck in the EU's efforts to rapidly diversify its energy sources. Substantial investments are needed to adapt to alternative sources like liquefied natural gas (LNG).

- Need for increased LNG import capacity: Construction of new LNG terminals is crucial to receive gas from diverse global suppliers.

- Expansion of pipeline networks: Existing pipelines may require upgrades or new connections to integrate alternative sources efficiently.

- Upgrades to storage facilities: Modernizing and expanding storage capacities across the EU are essential to maintain supply security during periods of high demand or potential disruptions.

These infrastructure projects demand significant time and substantial financial investments. Identifying and overcoming potential bottlenecks will be critical to ensure the timely completion of necessary upgrades and expansions.

Exploring the Spot Market as a Solution

While transitioning away from long-term contracts presents challenges, the EU Russian Gas Spot Market offers a degree of flexibility. This approach allows the EU to diversify its gas supply and potentially reduce its reliance on a single supplier. However, it comes with its own set of complexities.

Increased Price Volatility

The spot market is inherently volatile, meaning gas prices fluctuate significantly based on global supply and demand. This volatility poses a serious risk to energy security and affordability.

- Price fluctuations dependent on global supply and demand: Geopolitical events and unexpected supply disruptions can trigger dramatic price swings.

- Risk of price spikes impacting consumers and industries: High price volatility can impact household budgets and industrial competitiveness.

Understanding the mechanisms that influence spot market pricing is crucial for developing effective EU energy policies to mitigate these risks. Hedging strategies and other risk management tools will be critical in this context.

Diversification of Suppliers

The spot market offers the EU the opportunity to diversify its gas supply beyond Russia, exploring partnerships with various countries including Norway, the US, Qatar, and other LNG exporters.

- Negotiating short-term contracts with multiple suppliers: This approach reduces dependence on any single supplier, enhancing security.

- Establishing strategic partnerships with diverse energy providers: Long-term partnerships are beneficial for price stability and secure supplies.

Diversifying gas imports through the spot market has both advantages and risks. While it enhances security, it also requires robust market monitoring and careful negotiation to secure favorable terms.

Role of EU Energy Platforms

The EU is actively promoting the development of robust and transparent energy trading platforms to facilitate the smooth transition to a diversified gas market.

- Improved market integration: Efficient platforms ensure a streamlined gas trading process.

- Enhanced price discovery mechanisms: Transparent platforms lead to fairer pricing and reduced manipulation.

- Increased data transparency: Better data access enables informed decision-making by all stakeholders.

The EU's efforts to improve energy market regulation and functioning are vital for establishing a secure and competitive gas market. These improvements enhance transparency and ensure a level playing field for all participants.

Mitigation Strategies for Spot Market Risks

While the spot market offers flexibility, managing its inherent risks is crucial for ensuring energy security and affordability. Several strategies can mitigate these risks:

Strategic Gas Reserves

Building and maintaining adequate strategic gas reserves is essential to buffer against potential supply disruptions and price shocks.

- Increased storage capacity: Expansion of underground gas storage facilities is crucial for maintaining supply security.

- Coordination of national reserves: Collaboration between member states on reserve management is vital for efficient utilization.

- Emergency response plans: Well-defined emergency protocols are needed to handle unforeseen supply interruptions.

Having sufficient gas reserves provides a critical safety net, enabling the EU to weather short-term supply fluctuations without significant economic impact.

Promoting Energy Efficiency and Conservation

Reducing overall gas consumption through increased energy efficiency is crucial for lessening reliance on gas imports, regardless of the source.

- Incentivizing energy efficiency upgrades: Policies encouraging energy-efficient buildings and appliances can significantly reduce demand.

- Investment in renewable energy sources: Transitioning to renewable energy sources like solar and wind power reduces dependence on fossil fuels.

- Public awareness campaigns: Educating the public about energy conservation can encourage behavioral changes that lower consumption.

Promoting energy efficiency and conservation is not merely a supplementary strategy but a fundamental element for achieving long-term energy independence and reducing reliance on volatile markets.

Conclusion

The EU's transition away from Russian gas through the EU Russian Gas Spot Market presents a complex but necessary undertaking. A multifaceted approach combining diversification of gas supplies, substantial infrastructure investments, effective management of price volatility, and a strong focus on energy efficiency is needed. The success of this transition hinges significantly on the EU's continued development of transparent and efficient energy trading platforms. Understanding the nuances of the EU Russian Gas Spot Market is paramount for all stakeholders. By adopting comprehensive and proactive strategies, the EU can progress towards a more secure, diversified, and sustainable energy future.

Featured Posts

-

Impact Of Us Tariffs Chinas Growing Reliance On Middle Eastern Lpg

Apr 24, 2025

Impact Of Us Tariffs Chinas Growing Reliance On Middle Eastern Lpg

Apr 24, 2025 -

Sophie Nyweide Child Actor In Mammoth And Noah Dies At 24

Apr 24, 2025

Sophie Nyweide Child Actor In Mammoth And Noah Dies At 24

Apr 24, 2025 -

The Future Of Luxury Cars In China Lessons From Bmw And Porsches Experience

Apr 24, 2025

The Future Of Luxury Cars In China Lessons From Bmw And Porsches Experience

Apr 24, 2025 -

Ella Bleu Travolta 24 Unveils A Bold New Image In Fashion Magazine Spread

Apr 24, 2025

Ella Bleu Travolta 24 Unveils A Bold New Image In Fashion Magazine Spread

Apr 24, 2025 -

Tarantinov Stav Prema Filmu S Travoltom Neocekivani Razlog

Apr 24, 2025

Tarantinov Stav Prema Filmu S Travoltom Neocekivani Razlog

Apr 24, 2025

Latest Posts

-

The Implications Of A Thomas Mueller Departure From Bayern Munich

May 12, 2025

The Implications Of A Thomas Mueller Departure From Bayern Munich

May 12, 2025 -

25 Years At Allianz Arena Thomas Muellers Poignant Farewell

May 12, 2025

25 Years At Allianz Arena Thomas Muellers Poignant Farewell

May 12, 2025 -

Thomas Muellers Bayern Future Uncertain Reactions From Players Fans And Experts

May 12, 2025

Thomas Muellers Bayern Future Uncertain Reactions From Players Fans And Experts

May 12, 2025 -

Bayern Legend Thomas Mueller Bids Emotional Farewell After 25 Years

May 12, 2025

Bayern Legend Thomas Mueller Bids Emotional Farewell After 25 Years

May 12, 2025 -

The Thomas Mueller Situation Bayern Munichs Response And Fan Sentiment

May 12, 2025

The Thomas Mueller Situation Bayern Munichs Response And Fan Sentiment

May 12, 2025