Euronext Amsterdam Sees 8% Stock Increase: Impact Of Trump's Tariff Action

Table of Contents

The recent 8% surge in Euronext Amsterdam stock has captivated market analysts and investors alike. This significant increase followed former President Trump's controversial tariff actions, sparking debate about the complex interplay between global trade policies and European market performance. Understanding the reasons behind this surge is crucial for investors navigating the volatile landscape of international finance. This article delves into the potential impact of Trump's tariffs on Euronext Amsterdam and explores the contributing factors behind its impressive stock growth. We will analyze the short-term effects and consider the long-term implications for Euronext Amsterdam's performance.

H2: Trump's Tariffs and Their Unintended Consequences on Euronext Amsterdam

Trump's trade protectionist policies, particularly his tariffs on various goods, created significant ripple effects across the global economy. While intended to protect American industries, these actions often had unintended consequences, impacting markets in unexpected ways. The impact on Euronext Amsterdam was particularly noteworthy.

-

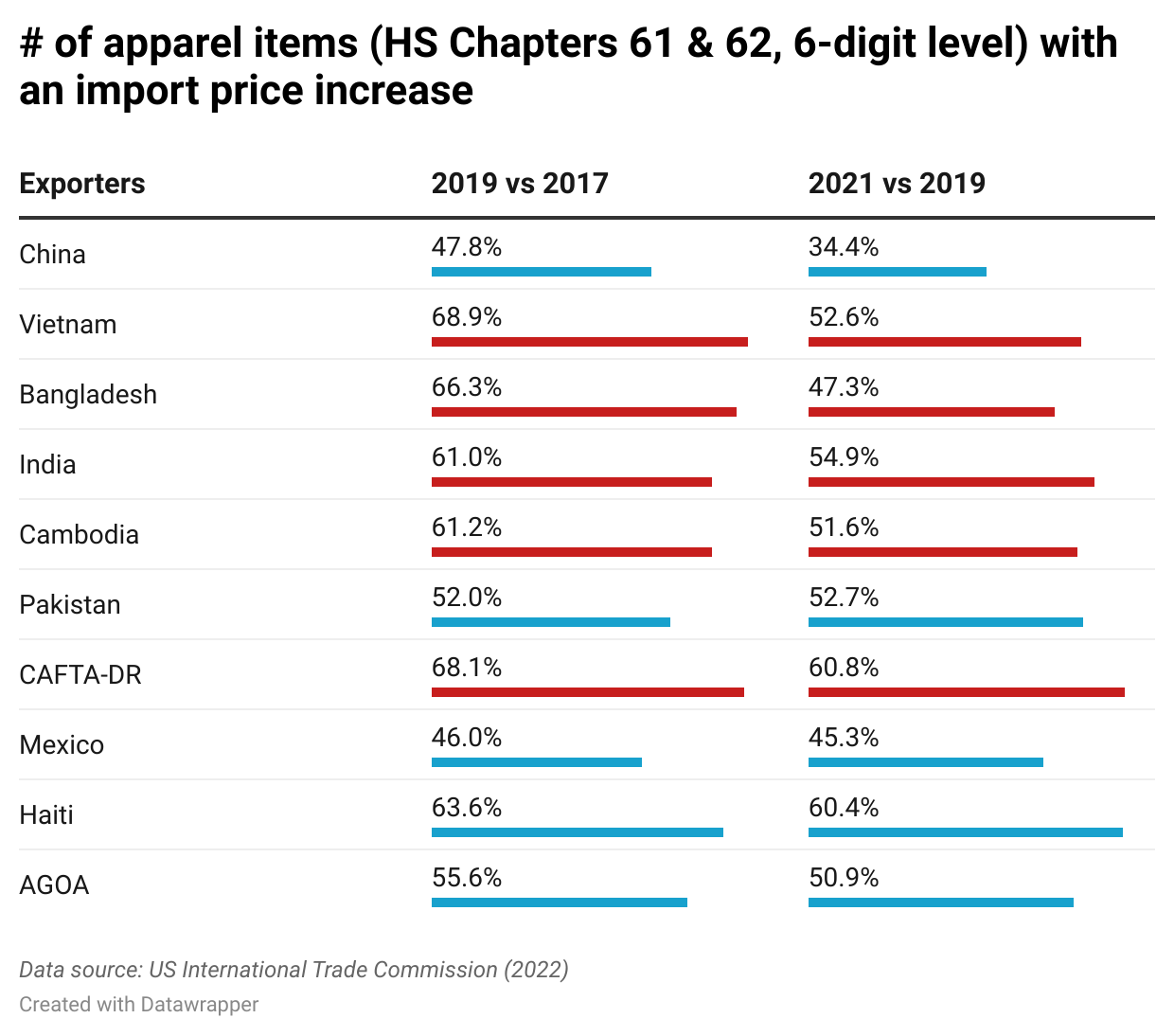

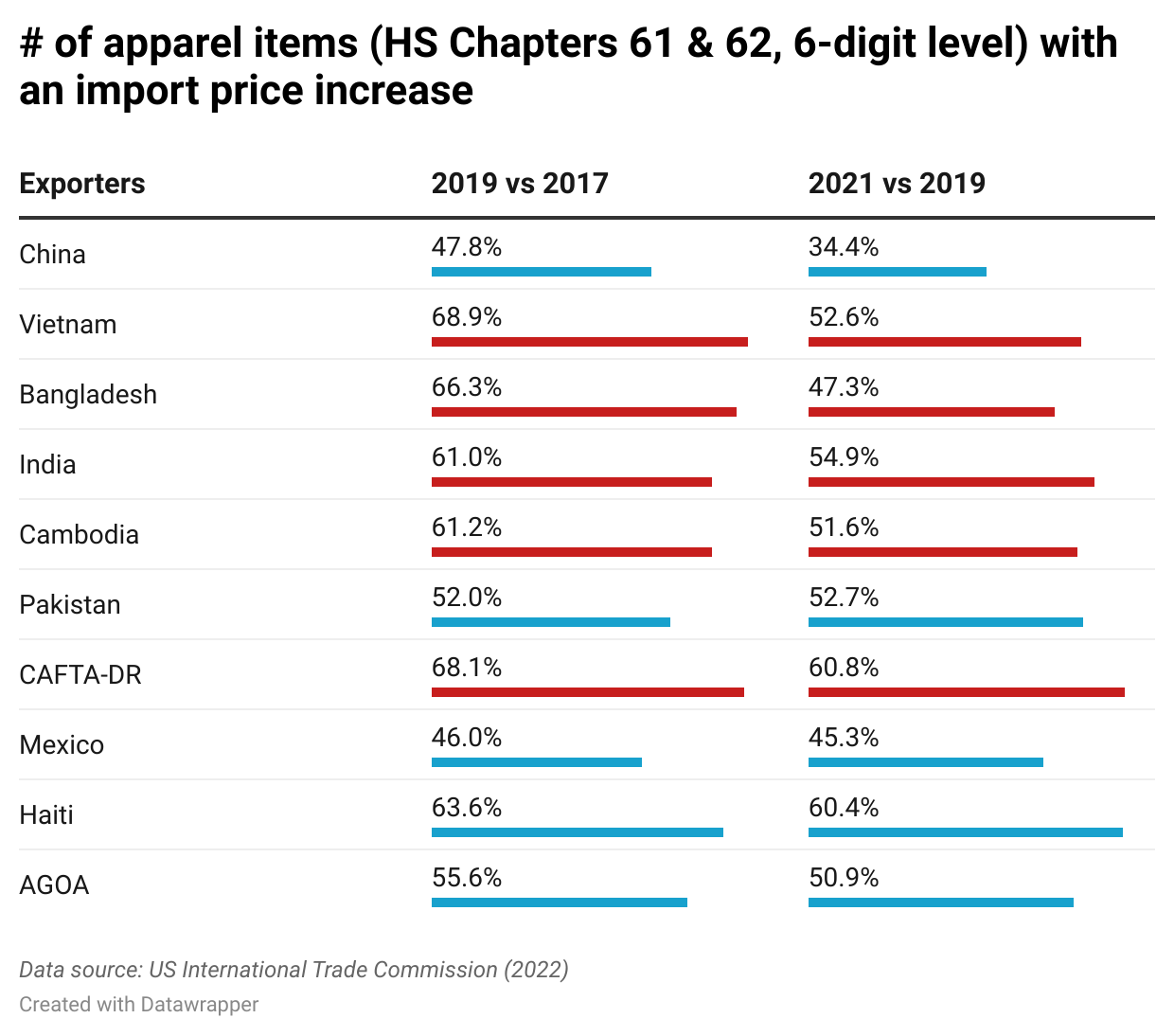

Increased European Competitiveness: Tariffs on goods from other regions, like China, inadvertently boosted the competitiveness of European companies listed on Euronext Amsterdam. This increased demand for European-made goods and services, creating a more favorable environment for businesses operating within the EU. This is especially true for sectors previously challenged by cheaper imports.

-

Shift in Global Trade Flows: The tariffs disrupted established supply chains, forcing companies to seek alternative sources and partners. This shift benefited European businesses, including those listed on Euronext Amsterdam, increasing their market share and strengthening their position in the global market. This redirection of trade flows had a direct and positive influence on Euronext Amsterdam's growth.

-

Safe-Haven Investment: Amidst the uncertainty caused by Trump's trade policies, investors might have sought safer havens for their investments. The relative stability of the European Union and the strong performance of certain companies listed on Euronext Amsterdam may have drawn increased investment, further contributing to the stock price increase. The perception of reduced risk within the EU market likely played a significant role.

H3: Specific Sectors Affected by the Shift

The impact of Trump's tariffs wasn't uniform across all sectors. Some sectors saw a more pronounced benefit than others. Understanding these sector-specific impacts is key to understanding the broader Euronext Amsterdam performance.

-

Technology Sector: European tech companies, often competing with large American and Asian players, experienced a surge in demand as supply chains shifted. Reduced reliance on imports created opportunities for domestic tech firms.

-

Manufacturing: Companies producing goods previously imported from tariff-affected regions saw a boost in domestic demand. This increased local production created new jobs and bolstered the performance of related companies listed on Euronext Amsterdam.

-

Agricultural Sector: Depending on the specific tariffs, certain agricultural products saw increased market share as competitors were impacted. This sector-specific impact highlights the nuanced effects of trade policies on different parts of the European economy.

H2: Other Contributing Factors to Euronext Amsterdam's Stock Increase

While Trump's tariffs played a significant role, it's important to acknowledge other factors contributing to the 8% increase in Euronext Amsterdam's stock. A holistic view requires consideration of these additional elements.

-

Overall Market Sentiment: Positive global economic indicators and investor confidence could have independently contributed to the stock's rise. A generally positive market environment amplified the positive impact of other factors.

-

Specific Company Performance: Strong individual company earnings and positive growth projections could also have driven the stock increase. Individual company analysis would be necessary to fully assess this aspect. Strong fundamentals within specific companies listed on Euronext Amsterdam further contributed to overall growth.

-

Currency Fluctuations: Changes in the Euro's value against the US dollar and other major currencies could also affect the market valuation of Euronext Amsterdam. Currency movements can impact the relative value of investments, contributing to overall market fluctuations.

H3: The Role of Investor Sentiment and Speculation

Investor perception and speculation play a crucial role in market movements. Positive news and expectations surrounding Euronext Amsterdam, potentially amplified by the impact of Trump's tariffs, contributed to the surge. Positive media coverage and analyst predictions likely further fueled this surge.

H2: Analyzing the Long-Term Implications

The 8% increase reflects a short-term impact. The long-term effects of Trump's tariffs and their influence on Euronext Amsterdam remain to be seen. Continued analysis and monitoring of global trade dynamics are crucial for predicting future performance. Sustained growth will depend on continued market stability and the ongoing performance of individual companies.

Conclusion:

The 8% increase in Euronext Amsterdam stock following Trump's tariff actions highlights the complex and often unpredictable nature of global trade policies. While the tariffs played a significant role by increasing the competitiveness of European businesses and shifting global trade flows, other factors, including overall market sentiment and individual company performance, also contributed. Understanding these interconnected influences is vital for investors seeking to navigate the intricacies of the Euronext Amsterdam market. Further research into specific companies listed on Euronext Amsterdam and ongoing monitoring of global trade policies are recommended for a complete understanding of the market's future trajectory. Stay informed about the impact of global trade on Euronext Amsterdam to make informed investment decisions. Understanding the nuances of Euronext Amsterdam's performance is crucial for successful investing.

Featured Posts

-

When To Fly For The Best Memorial Day Deals In 2025

May 25, 2025

When To Fly For The Best Memorial Day Deals In 2025

May 25, 2025 -

Fresh R And B Sounds Leon Thomas And Flos New Music

May 25, 2025

Fresh R And B Sounds Leon Thomas And Flos New Music

May 25, 2025 -

Tim Cooks Tariff Announcement Triggers Apple Stock Sell Off

May 25, 2025

Tim Cooks Tariff Announcement Triggers Apple Stock Sell Off

May 25, 2025 -

Drapers Historic Indian Wells Victory First Atp Masters 1000 Title

May 25, 2025

Drapers Historic Indian Wells Victory First Atp Masters 1000 Title

May 25, 2025 -

Porsche Macan Buying Guide Find The Perfect Macan For You

May 25, 2025

Porsche Macan Buying Guide Find The Perfect Macan For You

May 25, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025 -

Actress Mia Farrow Demands Trumps Arrest For Venezuelan Deportation Policy

May 25, 2025

Actress Mia Farrow Demands Trumps Arrest For Venezuelan Deportation Policy

May 25, 2025 -

Actress Mia Farrow Seeks Trumps Imprisonment Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Trumps Imprisonment Regarding Venezuelan Deportations

May 25, 2025 -

From Fame To Shame 17 Celebrities Who Lost It All

May 25, 2025

From Fame To Shame 17 Celebrities Who Lost It All

May 25, 2025 -

The Downfall 17 Celebrities Whose Careers Imploded

May 25, 2025

The Downfall 17 Celebrities Whose Careers Imploded

May 25, 2025