Euronext Amsterdam Stock Market: 8% Surge After Trump's Tariff Plan Suspension

Table of Contents

The Impact of Trump's Tariff Suspension on Euronext Amsterdam

President Trump's proposed tariffs on European goods posed a significant threat to European businesses, many of which are listed on the Euronext Amsterdam Stock Market. These tariffs threatened to disrupt supply chains, increase production costs, and reduce consumer demand, leading to decreased profitability and potentially lower stock prices. The suspension of these plans, therefore, had a profound and immediate positive effect.

- Reduced trade uncertainty leading to investor confidence: The removal of the looming tariff threat significantly reduced uncertainty, boosting investor confidence and encouraging investment in European companies.

- Positive impact on specific sectors like technology and manufacturing: Sectors heavily reliant on international trade, such as technology and manufacturing, saw particularly strong gains. Companies exporting to the US experienced an immediate relief from potential tariff-related losses.

- Increased foreign investment flows into the Amsterdam market: The improved outlook for European businesses attracted increased foreign investment, further fueling the market's upward trajectory. This influx of capital contributed significantly to the 8% surge.

- Short-term gains versus long-term market stability: While the 8% surge represents a significant short-term gain, the long-term impact of the tariff suspension remains to be seen and depends on future trade policy developments.

The suspension directly benefited companies like ASML Holding (a major semiconductor equipment manufacturer), which saw its stock price increase significantly. Other companies in the technology and manufacturing sectors also experienced substantial gains, reflecting the market's positive response to the reduced trade uncertainty.

Analyzing the Market Reaction: Beyond the Headlines

While the tariff suspension was the primary catalyst for the 8% surge, other factors contributed to the market's strong reaction.

- Pre-existing market sentiment and investor expectations: Before the tariff announcement, market sentiment was already relatively positive, potentially amplifying the positive response to the news. Investor expectations also played a crucial role; the suspension likely exceeded many analysts' predictions.

- Strength of the Euro against the US dollar: A strong Euro against the US dollar can positively impact the value of European companies' earnings when converted to US dollars, making them more attractive to international investors.

- Global economic indicators and their influence: Positive global economic indicators, such as improving manufacturing data or increased consumer confidence, could have further strengthened the positive market sentiment.

- Speculation and market psychology playing a role: Market psychology and speculation also played a significant part. The rapid and significant increase in stock prices suggests a degree of market exuberance.

Analyzing pre- and post-announcement trading data, including volume and price changes, would provide a more comprehensive understanding of the market's reaction. (Ideally, this section would include relevant charts and graphs illustrating these changes).

Euronext Amsterdam Stock Market: Long-Term Implications and Outlook

The long-term implications of the tariff suspension for the Euronext Amsterdam Stock Market are complex and depend on various factors.

- Continued growth potential for the Amsterdam market: The reduced trade uncertainty should contribute to continued growth, attracting further investment and fostering economic expansion.

- Attractiveness of the Euronext Amsterdam Stock Market as a European hub: The Euronext Amsterdam Stock Market remains an attractive hub for European businesses, offering access to a diverse investor base and a stable regulatory environment.

- Risks and uncertainties that remain for the future: Geopolitical risks, potential future trade disputes, and economic downturns remain potential threats. The current positive sentiment is not a guarantee of continued growth.

- Importance of diversification within the portfolio: Diversification across sectors and geographies remains crucial to mitigate risks associated with investing in the Euronext Amsterdam Stock Market.

While the outlook is currently positive, investors should remain cautious and aware of potential future challenges. The long-term performance of the Euronext Amsterdam Stock Market will depend on a complex interplay of global and regional economic factors.

Investment Strategies Following the Market Surge

Investors considering the Euronext Amsterdam Stock Market should adopt a well-informed and cautious approach.

- Risk assessment and due diligence before investment: Thorough research and due diligence are crucial before making any investment decisions, especially following a significant market surge.

- Identifying undervalued stocks in the post-surge market: While some stocks may have become overvalued after the recent surge, others might still offer attractive investment opportunities. Identifying these undervalued stocks requires careful analysis.

- Understanding market volatility and managing risk: Investors should understand that market volatility is inherent, and even after a positive event like this, price fluctuations can occur. Managing risk through diversification is critical.

- Long-term investment strategies versus short-term trading: Long-term investment strategies, rather than short-term trading, are generally recommended for mitigating risks and achieving sustainable returns.

For novice investors, seeking professional financial advice is recommended. Experienced investors should refine their existing strategies to reflect the new market conditions.

Conclusion

The 8% surge in the Euronext Amsterdam Stock Market following the suspension of Trump's tariff plans demonstrates the profound impact of global trade policy on market sentiment. While the short-term gains are significant, investors should carefully consider both the opportunities and risks involved before making investment decisions. Understanding the nuances of the market and the potential impact of future events is key.

Call to Action: Understanding the dynamics of the Euronext Amsterdam Stock Market is crucial for navigating the complexities of global finance. Stay informed about market trends and consider diversifying your portfolio to mitigate risk. Learn more about investing in the Euronext Amsterdam Stock Market and making informed decisions for your financial future. Research specific companies listed on the Euronext Amsterdam and develop a robust investment strategy tailored to your risk tolerance and financial goals.

Featured Posts

-

M56 Traffic Delays Live Updates Following Crash

May 25, 2025

M56 Traffic Delays Live Updates Following Crash

May 25, 2025 -

Investigating Burys Missing M62 Link Road

May 25, 2025

Investigating Burys Missing M62 Link Road

May 25, 2025 -

Sinatras Four Marriages An Examination Of His Personal Life

May 25, 2025

Sinatras Four Marriages An Examination Of His Personal Life

May 25, 2025 -

Can Jordan Bardella Revitalize The French Right Wing

May 25, 2025

Can Jordan Bardella Revitalize The French Right Wing

May 25, 2025 -

Vehicle Subsystem Issue Forces Blue Origin To Postpone Rocket Launch

May 25, 2025

Vehicle Subsystem Issue Forces Blue Origin To Postpone Rocket Launch

May 25, 2025

Latest Posts

-

The 2 2 Million Treatment One Fathers Extraordinary Rowing Story

May 25, 2025

The 2 2 Million Treatment One Fathers Extraordinary Rowing Story

May 25, 2025 -

Rowing For A Cure A Fathers Race Against Time For His Sons 2 2 Million Treatment

May 25, 2025

Rowing For A Cure A Fathers Race Against Time For His Sons 2 2 Million Treatment

May 25, 2025 -

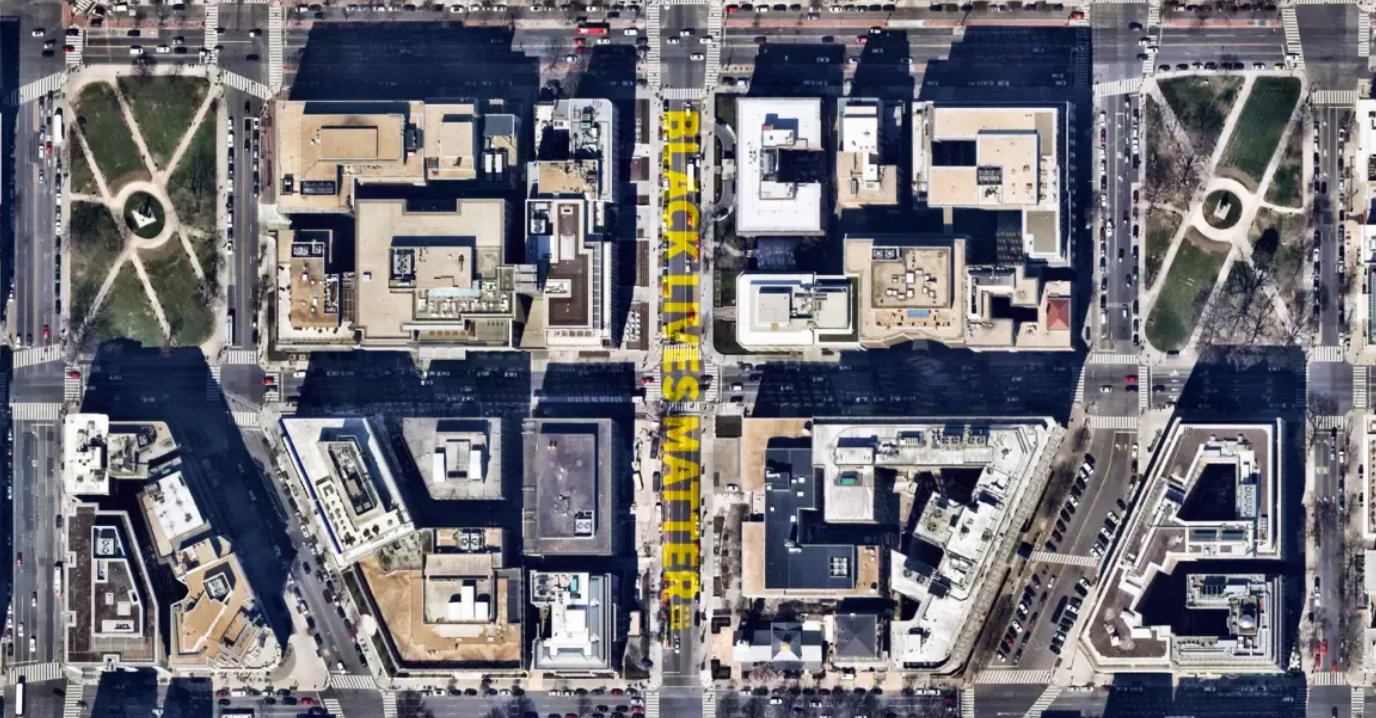

The Black Lives Matter Plaza Its Significance And Erasure

May 25, 2025

The Black Lives Matter Plaza Its Significance And Erasure

May 25, 2025 -

Fathers Desperate Rowing Journey To Fund Sons 2 2 Million Treatment

May 25, 2025

Fathers Desperate Rowing Journey To Fund Sons 2 2 Million Treatment

May 25, 2025 -

Hair Trimmers Used In Attempted Jailbreak Louisiana Inmates Escape Plan

May 25, 2025

Hair Trimmers Used In Attempted Jailbreak Louisiana Inmates Escape Plan

May 25, 2025