European Central Bank Highlights Fiscal Support's Role In Inflation

Table of Contents

The ECB's Stance on Fiscal Policy and its Impact on Inflation

The ECB acknowledges the crucial role of fiscal policy in supporting economic growth, particularly during crises. However, it also recognizes the potential for excessive government spending to fuel inflation. The ECB's official stance emphasizes the importance of fiscal sustainability and responsible spending to avoid exacerbating inflationary pressures. Fiscal stimulus, while beneficial in stimulating economic activity, can lead to demand-pull inflation if it surpasses the economy's productive capacity. This occurs when increased demand outstrips the supply of goods and services, driving up prices.

- Examples of fiscal measures: Many European countries implemented substantial fiscal stimulus packages during the COVID-19 pandemic, including direct cash transfers, wage subsidies, and investments in infrastructure.

- Impact on inflation rates: The impact of these measures varied across the Eurozone. Countries with larger stimulus packages and pre-existing supply chain bottlenecks experienced higher inflation rates than those with more restrained fiscal policies.

- ECB statements: The ECB's publications and press releases frequently highlight the need for fiscal prudence and the potential for fiscal policy to contribute to inflationary pressures. They often call for coordinated fiscal and monetary policies to achieve macroeconomic stability.

Analyzing the Mechanisms Linking Fiscal Support to Price Increases

Government spending can influence inflation through several key mechanisms. Increased aggregate demand, fuelled by government spending, can outpace the economy's ability to produce goods and services, leading to demand-pull inflation. Furthermore, fiscal policies can contribute to cost-push inflation by increasing the cost of production. For example, large-scale infrastructure projects might increase demand for construction materials, driving up their prices.

- Demand-pull inflation: This occurs when excessive demand pulls prices upward. Fiscal stimulus can significantly contribute to this, especially if supply chains are already strained.

- Cost-push inflation: This arises from increases in production costs, such as wages or raw materials. Government spending can indirectly contribute to this by increasing demand for labor and resources.

- Second-round effects: Initial price increases can lead to wage demands, creating a wage-price spiral and further fueling inflation. This is a significant concern for the ECB when analyzing the long-term effects of fiscal support.

The ECB's Monetary Policy Response to Fiscal-Driven Inflation

To counteract inflation driven by fiscal support, the ECB utilizes various monetary policy tools. The most prominent is adjusting interest rates. Raising interest rates makes borrowing more expensive, reducing aggregate demand and cooling down inflationary pressures. However, this carries the risk of slowing economic growth and potentially triggering a recession. The ECB must carefully balance the need to control inflation with the need to support economic activity.

- Interest rate setting: The ECB's Governing Council sets the main refinancing operations (MRO) rate, influencing lending rates across the Eurozone.

- Quantitative easing (QE): In the past, the ECB used QE, purchasing government bonds to inject liquidity into the market and lower long-term interest rates. While effective in stimulating the economy, QE can also contribute to inflation if not carefully managed.

- Effectiveness of past responses: The ECB's responses to previous inflationary periods have varied in effectiveness, depending on the specific circumstances and the nature of the inflationary pressures.

Case Studies: Specific Examples of Fiscal Policies and Inflationary Pressures in Europe

Examining specific countries provides valuable insights. For instance, some countries with large fiscal stimulus packages experienced significantly higher inflation than those with more moderate approaches. Comparing countries with differing fiscal policies and their resultant inflation rates allows for a better understanding of the link between fiscal support and price increases within the Eurozone.

- High fiscal spending and inflation: Countries with expansive fiscal programs and supply-side constraints saw pronounced inflationary pressures.

- Restrained fiscal policies and lower inflation: Countries that implemented more moderate fiscal stimulus experienced lower inflation rates.

- Comparative analysis: Cross-country comparisons within the Eurozone highlight the correlation between the scale of fiscal intervention and subsequent inflation rates, though other factors also play a crucial role.

Conclusion: Understanding the Interplay Between Fiscal Support and Inflation in the Eurozone

The European Central Bank's ongoing monitoring of the intricate relationship between fiscal support and inflation in the Eurozone is crucial. This article has demonstrated that while fiscal stimulus plays a vital role in supporting economic growth, excessive spending can indeed fuel inflationary pressures through various mechanisms. The ECB's monetary policy responses aim to strike a balance between controlling inflation and fostering economic growth. Understanding this complex interplay is essential for navigating the current economic climate. To stay informed about the ECB's ongoing efforts to control inflation and the complexities of fiscal policy's impact on the Eurozone economy, continue your research and follow the ECB's publications on "European Central Bank Highlights Fiscal Support's Role in Inflation" and related topics.

Featured Posts

-

Chargers To Kick Off 2025 Season In Brazil With Justin Herbert

Apr 29, 2025

Chargers To Kick Off 2025 Season In Brazil With Justin Herbert

Apr 29, 2025 -

Key Republican Groups Opposing Trumps Tax Bill

Apr 29, 2025

Key Republican Groups Opposing Trumps Tax Bill

Apr 29, 2025 -

Examining The Ccp United Front Work Departments Operations In Minnesota

Apr 29, 2025

Examining The Ccp United Front Work Departments Operations In Minnesota

Apr 29, 2025 -

Ray Epps Sues Fox News For Defamation Jan 6th Allegations At The Center

Apr 29, 2025

Ray Epps Sues Fox News For Defamation Jan 6th Allegations At The Center

Apr 29, 2025 -

How Musks X Debt Sale Reshaped The Companys Finances

Apr 29, 2025

How Musks X Debt Sale Reshaped The Companys Finances

Apr 29, 2025

Latest Posts

-

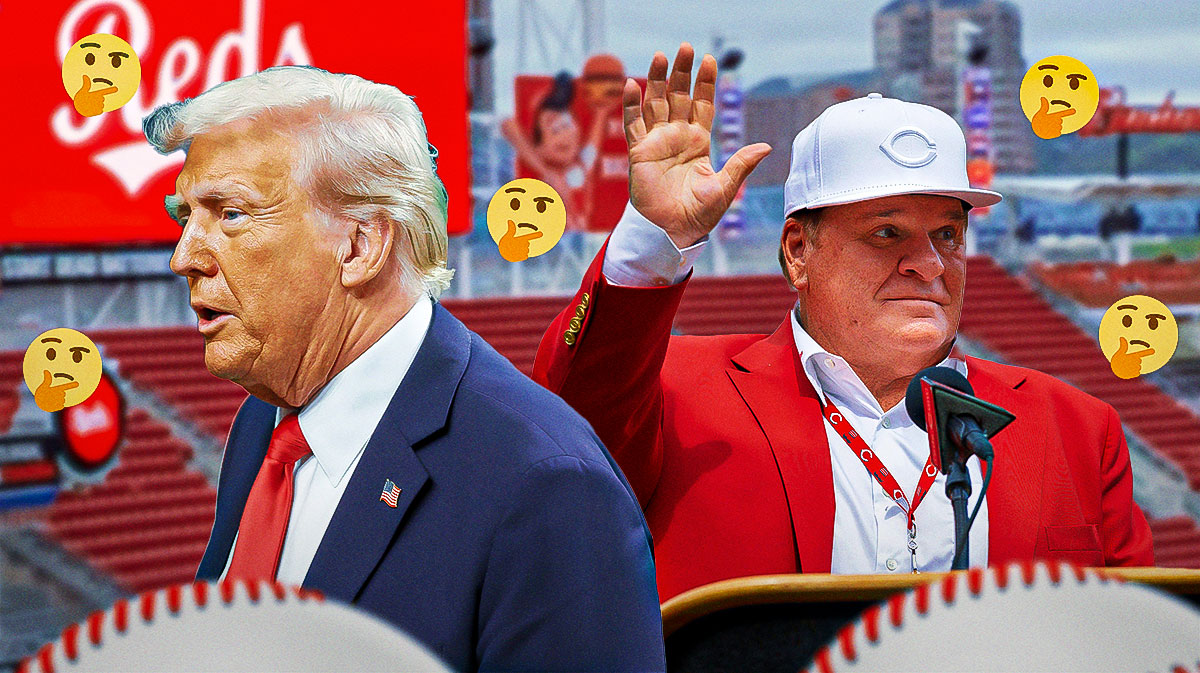

Trump To Pardon Pete Rose After His Death Analyzing The Announcement

Apr 29, 2025

Trump To Pardon Pete Rose After His Death Analyzing The Announcement

Apr 29, 2025 -

Will Pete Rose Receive A Posthumous Pardon From Trump

Apr 29, 2025

Will Pete Rose Receive A Posthumous Pardon From Trump

Apr 29, 2025 -

Pete Rose Pardon Trumps Statement And Its Implications

Apr 29, 2025

Pete Rose Pardon Trumps Statement And Its Implications

Apr 29, 2025 -

Trumps Posthumous Pardon For Pete Rose A Presidential Promise

Apr 29, 2025

Trumps Posthumous Pardon For Pete Rose A Presidential Promise

Apr 29, 2025 -

Snow Fox Weather Update Service Impacts For Tuesday February 11th

Apr 29, 2025

Snow Fox Weather Update Service Impacts For Tuesday February 11th

Apr 29, 2025