Evaluating Uber Technologies (UBER) As An Investment

Table of Contents

Financial Performance and Valuation of UBER Stock

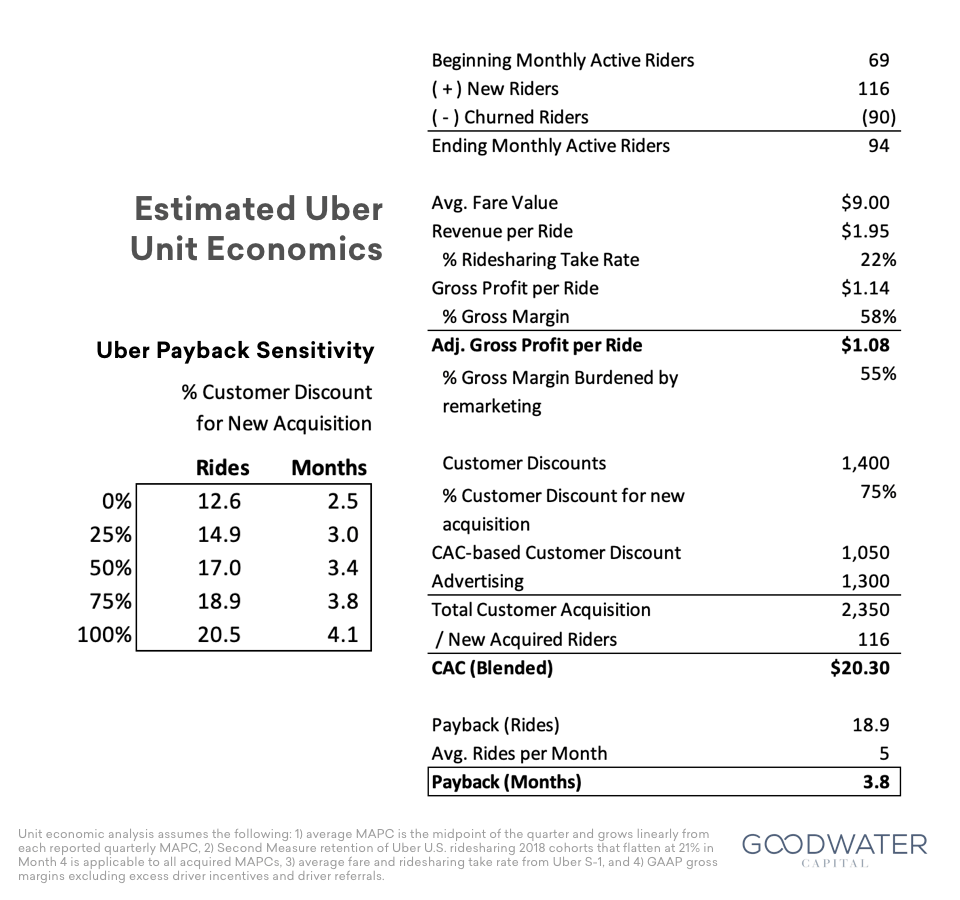

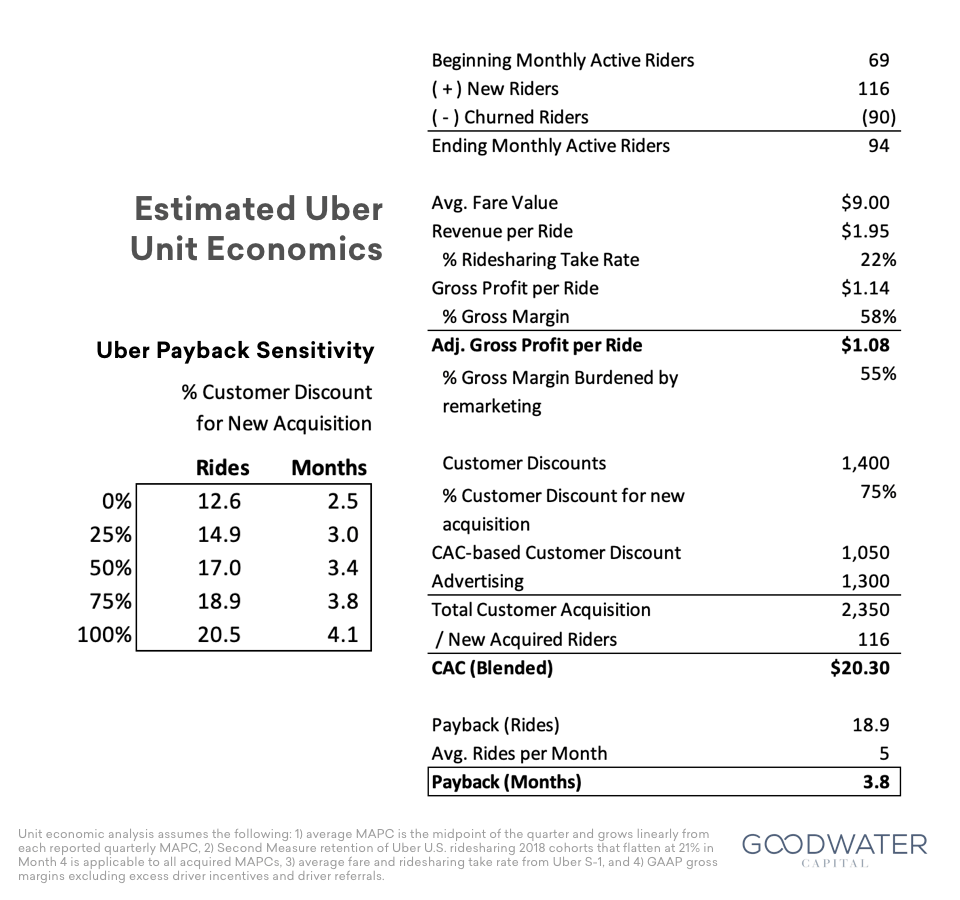

Analyzing Uber's financial health is crucial for any potential investor. While Uber has demonstrated significant revenue growth, its path to profitability has been complex. Examining key financial ratios provides a clearer picture.

-

Revenue Growth: Uber's revenue has shown consistent growth over the past few years, driven by both its ride-sharing and food delivery segments (Uber Eats). However, the rate of growth can fluctuate depending on economic conditions and global events.

-

Profitability and EPS: Uber has faced challenges in achieving consistent profitability. While the company has reported periods of positive earnings per share (EPS), these have often been offset by losses in other areas. Understanding the drivers of these fluctuations is critical.

-

Key Financial Ratios: Analyzing the Price-to-Earnings ratio (P/E ratio) is essential to gauge the valuation of UBER stock relative to its earnings. Additionally, the Debt-to-Equity ratio provides insight into the company's financial leverage and risk profile. Comparing these ratios to industry competitors like Lyft and Didi is also crucial for a comprehensive evaluation.

-

Comparison to Competitors: Uber's performance should always be benchmarked against its main competitors. Lyft, for example, presents a direct comparison within the ride-sharing sector, offering valuable insights into market dynamics and competitive pressures.

-

Bullet Points:

- Revenue trends show significant year-over-year growth, though this varies across segments.

- Profitability remains a key focus, with ongoing efforts to optimize operations and improve margins.

- Debt levels have fluctuated; monitoring this aspect is essential for assessing financial risk.

- Valuation metrics (P/E ratio, etc.) should be compared to industry averages and competitor data.

Competitive Landscape and Market Share

Uber operates in a fiercely competitive market. Understanding its position within this landscape is critical for assessing the long-term prospects of UBER investment.

-

Main Competitors: Uber faces competition from various players globally, including Lyft in the US, Didi in China, and several regional ride-sharing and food delivery services.

-

Market Share: Uber holds significant market share in many regions, particularly in the ride-sharing sector. However, this market share varies geographically and is subject to constant fluctuation due to competitive pressures.

-

Competitive Advantages: Uber benefits from strong brand recognition, a sophisticated technology platform, and extensive network effects. These advantages provide a strong foundation for its continued growth.

-

Competitive Disadvantages: Regulatory hurdles, driver compensation issues, and intense competition represent significant challenges to Uber's dominance.

-

Bullet Points:

- Key competitors include Lyft, Didi Chuxing, and local ride-hailing companies.

- Uber's market share varies significantly across different geographical markets.

- Uber's technological advancements and brand recognition give it a significant advantage.

- Increased competition and regulatory changes pose significant ongoing risks.

Growth Prospects and Future Opportunities for UBER

Uber's growth trajectory hinges on several factors, including expansion into new markets, innovation within existing services, and technological advancements.

-

Market Expansion: Uber continues to expand its services into new geographical markets, aiming to capitalize on the growing demand for ride-sharing and food delivery worldwide.

-

Service Diversification: Beyond ride-sharing and food delivery, Uber is exploring new avenues for growth, including freight transportation and other mobility-related services.

-

Technological Advancements: The potential impact of autonomous vehicles on Uber's operations is a crucial aspect to consider. While still in its early stages, autonomous driving technology could significantly alter the company's cost structure and operational efficiency.

-

Bullet Points:

- Expansion into untapped markets in developing economies presents considerable growth potential.

- Increased penetration rates in existing markets can further fuel revenue growth.

- Autonomous vehicle technology may offer significant cost reductions and efficiency improvements.

- Partnerships and strategic alliances can open new revenue streams.

Risks and Challenges Facing Uber Technologies (UBER)

Investing in UBER stock comes with inherent risks. Understanding these potential challenges is crucial for responsible investing.

-

Regulatory Risks: Uber operates under a complex regulatory environment, facing potential legal challenges and changes in regulations that could impact its operations.

-

Economic Risks: Economic downturns can significantly affect demand for Uber's services, impacting its revenue and profitability.

-

Competition: The intense competition within the ride-sharing and food delivery markets poses a constant threat to Uber's market share and profitability.

-

Operational Risks: Challenges such as driver shortages, safety concerns, and maintaining a positive driver experience can impact the company's performance.

-

Bullet Points:

- Regulatory changes in different jurisdictions pose ongoing uncertainty.

- Economic downturns can lead to reduced consumer spending on ride-sharing and delivery services.

- Intense competition from existing players and new entrants is a persistent challenge.

- Operational inefficiencies and safety concerns can negatively impact the company's reputation and profitability.

Conclusion: Should You Invest in Uber Stock (UBER)?

Investing in Uber Technologies (UBER) presents a complex equation. While the company enjoys significant market share and growth potential, considerable risks exist. Its financial performance shows a path toward profitability but is still volatile. The competitive landscape remains intense, and regulatory uncertainty continues.

Conducting thorough due diligence, including a careful review of its financial statements, market analysis, and competitive landscape, is paramount before making any investment decisions. Weighing the potential for high returns against the considerable risks is vital. While investing in Uber Technologies (UBER) presents both exciting opportunities and considerable risks, understanding its financial performance and competitive landscape is crucial. Conduct your own comprehensive research before making any investment decisions related to UBER stock.

Featured Posts

-

Cryptocurrency And The Trade War A Potential Winner

May 08, 2025

Cryptocurrency And The Trade War A Potential Winner

May 08, 2025 -

3 Star Wars Andor Episodes Streaming Free On You Tube

May 08, 2025

3 Star Wars Andor Episodes Streaming Free On You Tube

May 08, 2025 -

Check The April 12th Lotto Results Winning Numbers Here

May 08, 2025

Check The April 12th Lotto Results Winning Numbers Here

May 08, 2025 -

General Motors Us Tariffs And Reduced Canadian Operations An Auto Analysts Perspective

May 08, 2025

General Motors Us Tariffs And Reduced Canadian Operations An Auto Analysts Perspective

May 08, 2025 -

Prelista De Brasil Incluye A Neymar Posible Regreso Contra Argentina

May 08, 2025

Prelista De Brasil Incluye A Neymar Posible Regreso Contra Argentina

May 08, 2025