Examining Trump's Stated Oil Price Preference: Goldman Sachs Report

Table of Contents

Trump's Public Statements on Oil Prices: A Retrospective

During his presidency, Donald Trump frequently commented on oil prices, often using social media and public addresses to express his views. Analyzing these statements reveals a nuanced – and at times, seemingly contradictory – approach to the issue. Understanding the context surrounding these pronouncements is crucial to deciphering his true preference.

- Specific examples of his statements: Trump frequently expressed concerns about high gasoline prices, framing them as detrimental to consumers. Conversely, he also voiced support for energy independence, which could imply a preference for higher oil prices to bolster domestic production. His tweets often directly mentioned oil prices, sometimes expressing satisfaction with lower prices and other times expressing dissatisfaction.

- Contextual factors: His statements often aligned with prevailing economic conditions and political cycles. For example, before elections, there was a more pronounced focus on lower prices to appease voters, while at other times the focus shifted towards promoting domestic energy production.

- Rhetoric employed: Trump often used populist language, framing lower oil prices as a benefit to the "common man" and higher prices as a necessary step for American energy dominance, appealing to themes of economic nationalism.

Goldman Sachs Report Findings: Key Insights on Oil Price Impact

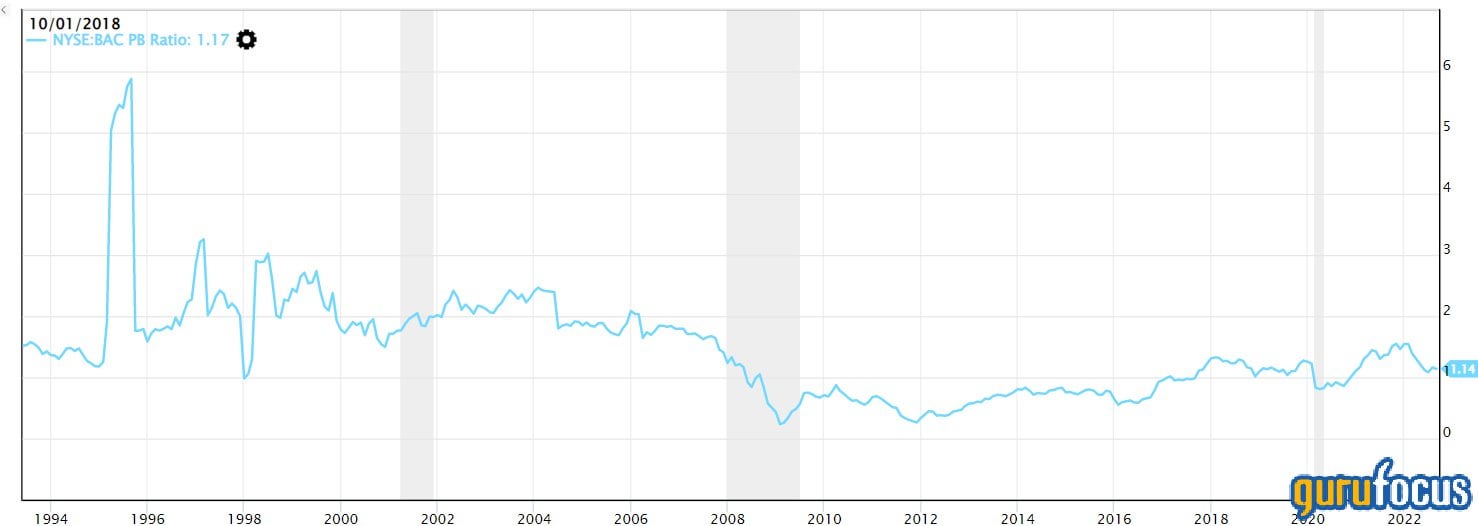

The Goldman Sachs report offers a detailed analysis of oil price fluctuations during the Trump administration. Their methodology involved examining various economic indicators and correlating them with specific policy decisions. Their key findings shed light on the relationship between Trump's oil price preference (or lack thereof) and its impact on the US economy.

- Key data points: The report meticulously tracked oil prices against various economic metrics like inflation, GDP growth, and job creation within the energy sector.

- Policy decisions analyzed: The report examined the impact of Trump's policies, including sanctions on Iran and Venezuela, and the deregulation of the energy sector, on oil prices and the global energy market. These analyses considered supply and demand dynamics, assessing how these policies influenced the global oil market's stability.

- Report conclusions: The report's conclusions offered a nuanced perspective, avoiding a simplistic view of a direct correlation between Trump's statements and oil price movements. Instead, it highlighted the interplay of numerous factors influencing oil prices, some under presidential control, and many beyond it.

Economic Implications of Trump's Stated Oil Price Preference

The economic ramifications of fluctuating oil prices are significant and far-reaching, affecting multiple sectors. Understanding the potential consequences of different price scenarios is vital for economic forecasting and policymaking.

- Potential benefits of lower oil prices: Lower oil prices generally benefit consumers by reducing transportation costs and energy bills. This can stimulate economic activity and curb inflation.

- Potential drawbacks of lower oil prices: However, prolonged low oil prices can negatively impact energy producers, leading to job losses in the sector. It can also discourage investment in new energy exploration and development.

- Potential benefits of higher oil prices: Higher oil prices, while burdening consumers, can increase profits for energy companies, encouraging investment in domestic production, creating jobs, and potentially bolstering energy independence.

- Potential drawbacks of higher oil prices: Higher oil prices lead to higher consumer costs, which can trigger inflation and reduce consumer spending, potentially slowing economic growth and damaging the manufacturing sector.

Geopolitical Implications: Trump's Oil Policy and International Relations

Trump's oil policies had significant geopolitical implications, influencing relationships with other nations. The Goldman Sachs report also analyzed the international ramifications of these policy decisions.

- International relations impacted: Trump's approach to the Iran nuclear deal and sanctions on Venezuela directly affected international relations with those countries and other OPEC members.

- Energy security: The administration's focus on energy independence had direct implications on US energy security, impacting the country’s vulnerability to global oil price fluctuations.

- Future implications for US foreign policy: The report's findings offer valuable insights into the complexities of balancing energy independence with international cooperation, especially in the context of global energy markets.

Conclusion: Understanding the Complexities of Trump's Oil Price Legacy

The Goldman Sachs report, coupled with an analysis of Trump's public statements, paints a complex picture of his approach to oil prices. His preference, if one can be definitively ascertained, appears to have been influenced by a multitude of factors, including political expediency, economic conditions, and a drive towards energy independence. It is critical to understand this interplay between political decisions and energy markets to properly assess the impact of past policies and formulate effective future strategies. We encourage you to explore the Goldman Sachs report and related news articles to further your understanding of Trump's oil price preference and its lasting effects on the US and the global economy. The enduring complexity of this issue underscores the importance of continued research and informed discussion.

Featured Posts

-

Actie Dreigt Onrust Rondom Npo Directeur Frederieke Leeflang

May 15, 2025

Actie Dreigt Onrust Rondom Npo Directeur Frederieke Leeflang

May 15, 2025 -

Discussie Leeflang Noodzaak Voor Gesprek Tussen Bruins En Npo Toezichthouder

May 15, 2025

Discussie Leeflang Noodzaak Voor Gesprek Tussen Bruins En Npo Toezichthouder

May 15, 2025 -

Trumps Claim Does The Us Really Need Canadas Goods Expert Analysis

May 15, 2025

Trumps Claim Does The Us Really Need Canadas Goods Expert Analysis

May 15, 2025 -

Are Stretched Stock Market Valuations Justified Bof As Take

May 15, 2025

Are Stretched Stock Market Valuations Justified Bof As Take

May 15, 2025 -

Protest Tegen Npo Bestuur Frederieke Leeflang In Het Vizier

May 15, 2025

Protest Tegen Npo Bestuur Frederieke Leeflang In Het Vizier

May 15, 2025

Latest Posts

-

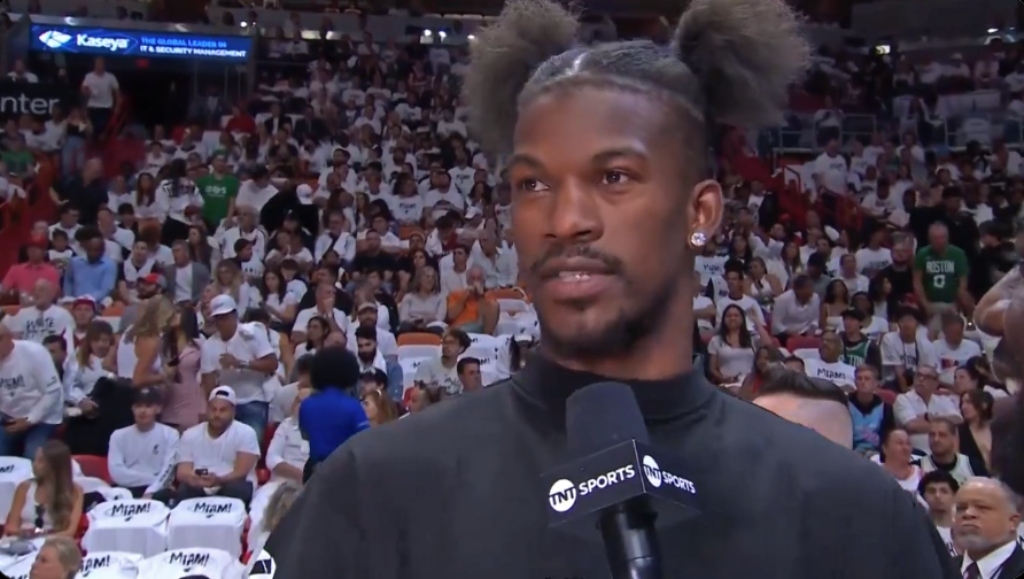

Jimmy Butlers Injury Fan Reactions And Predictions For Game 4

May 15, 2025

Jimmy Butlers Injury Fan Reactions And Predictions For Game 4

May 15, 2025 -

Jimmy Butler Partners With Bigface To Offer Discount To Warriors Employees

May 15, 2025

Jimmy Butler Partners With Bigface To Offer Discount To Warriors Employees

May 15, 2025 -

Was Jimmy Butler Overwhelmed Evaluating His Need For Support In The Miami Heat Playoffs

May 15, 2025

Was Jimmy Butler Overwhelmed Evaluating His Need For Support In The Miami Heat Playoffs

May 15, 2025 -

Nba Fans React To Jimmy Butlers Injury Will He Play Against The Warriors

May 15, 2025

Nba Fans React To Jimmy Butlers Injury Will He Play Against The Warriors

May 15, 2025 -

Bigface Jimmy Butler Offers Employee Discount To Golden State Warriors Staff

May 15, 2025

Bigface Jimmy Butler Offers Employee Discount To Golden State Warriors Staff

May 15, 2025