Executive Chair And Sovereign Wealth Fund Make Offer For InterRent REIT

Table of Contents

Details of the InterRent REIT Takeover Bid

The offer for InterRent REIT represents a significant acquisition in the Canadian REIT sector. The precise terms of the bid are crucial for understanding its implications.

-

Exact offer price per share: While the exact figure hasn't been publicly released at this time, sources suggest an offer price significantly above the current market value, representing a substantial premium for InterRent shareholders. [Update this with the actual price once released].

-

Key individuals involved and their affiliations: The offer is being spearheaded by [Executive Chair's Name], Executive Chair of InterRent REIT, and [Sovereign Wealth Fund Name], a globally recognized sovereign wealth fund known for its significant investments in real estate and infrastructure. [Insert more detail about the executive chair and the sovereign wealth fund here].

-

Offer structure (cash, stock, etc.): The offer is reportedly structured as a [Cash/Stock/Combination] transaction, aiming for a complete acquisition of InterRent REIT. The details of the financing will be crucial to determining the success of the bid.

-

Timeline for completion of the transaction: The proposed timeline for the completion of the transaction is expected to be [Insert Timeline, e.g., within the next quarter, subject to regulatory approvals].

-

Required regulatory approvals: The successful completion of the acquisition is contingent upon obtaining all necessary regulatory approvals from relevant Canadian authorities. This process is anticipated to take [Insert Estimated Time Frame].

Potential Impact on InterRent REIT Shareholders

The takeover bid presents a significant opportunity for InterRent REIT shareholders. The premium offered is expected to lead to substantial short-term gains.

-

Premium offered vs. market price – percentage increase: The proposed premium is estimated to be [Insert Percentage] above InterRent REIT's current market price, making it a compelling offer for many shareholders.

-

Potential short-term and long-term gains for shareholders: Shareholders stand to benefit from an immediate gain due to the premium offered. The long-term implications depend on the future performance of the acquiring entity.

-

Details of the shareholder voting process and deadlines: Shareholders will have a specific timeframe to review the offer and cast their votes. The details regarding the voting process, including deadlines and proxy materials, will be communicated to shareholders in due course.

-

Risks associated with accepting or rejecting the offer: While the offer presents an attractive premium, shareholders should carefully weigh the risks involved, considering potential alternative investment opportunities and the long-term outlook for InterRent REIT independent of this offer.

Broader Implications for the REIT Market

This acquisition carries significant implications for the broader Canadian REIT market and the global investment landscape.

-

Impact on valuations of comparable REITs: This takeover bid is likely to impact valuations of similar REITs in the Canadian market, potentially setting a new benchmark for pricing and increasing M&A activity.

-

Increased M&A activity in the REIT sector – predictions: This acquisition could trigger a wave of mergers and acquisitions within the REIT sector, as other players assess their strategic positioning and potential targets.

-

Growing role of sovereign wealth funds in global real estate: The participation of a sovereign wealth fund underscores the growing interest of global investors in stable and high-yield real estate assets.

-

Potential changes in investment strategies for REIT investors: The outcome of this acquisition will significantly influence investment strategies for REIT investors, prompting reevaluations of portfolio allocation and risk profiles.

Analysis of the Sovereign Wealth Fund's Investment Strategy

[Sovereign Wealth Fund Name]'s involvement offers insight into its investment strategy and its view of the Canadian real estate market.

-

Overview of the sovereign wealth fund's investment history: [Sovereign Wealth Fund Name] has a history of strategic investments in global real estate, demonstrating a long-term perspective and a focus on stable, high-growth markets. [Insert specific examples of their real estate investments].

-

Alignment with the fund's long-term investment objectives: This acquisition aligns with [Sovereign Wealth Fund Name]'s long-term investment strategy, focusing on stable, long-term returns in real estate.

-

Potential synergies between the fund's portfolio and InterRent REIT: The acquisition of InterRent REIT offers potential synergies with the existing portfolio of [Sovereign Wealth Fund Name], potentially leading to enhanced efficiency and growth opportunities.

Conclusion

The takeover bid for InterRent REIT by its executive chair and a major sovereign wealth fund represents a significant event in the Canadian REIT market. This deal offers considerable implications for InterRent shareholders, influencing their investment decisions, and potentially setting a precedent for future transactions in the sector. The involvement of a sovereign wealth fund highlights the growing interest in real estate assets from global investors.

Call to Action: Stay informed about the progress of this significant InterRent REIT acquisition. Continue following our updates for the latest news and analysis on this developing story and other key developments in the real estate investment trust market. Learn more about how this InterRent REIT takeover bid affects your investment portfolio.

Featured Posts

-

Efficient Lng Bunkering For Cruise Ships Barcelonas Shell Solution

May 29, 2025

Efficient Lng Bunkering For Cruise Ships Barcelonas Shell Solution

May 29, 2025 -

Riesgo Vs Recompensa En Las Carreras Sprint De Moto Gp Un Estudio

May 29, 2025

Riesgo Vs Recompensa En Las Carreras Sprint De Moto Gp Un Estudio

May 29, 2025 -

Dont Miss Out Huge Nike Dunk Discounts At Revolve

May 29, 2025

Dont Miss Out Huge Nike Dunk Discounts At Revolve

May 29, 2025 -

Troy Cassar Daleys Historic Queensland Music Awards Win 2025 Triumph

May 29, 2025

Troy Cassar Daleys Historic Queensland Music Awards Win 2025 Triumph

May 29, 2025 -

Harry Potter Show On Hbo J K Rowlings Views Will Not Be Included Says Hbo Head

May 29, 2025

Harry Potter Show On Hbo J K Rowlings Views Will Not Be Included Says Hbo Head

May 29, 2025

Latest Posts

-

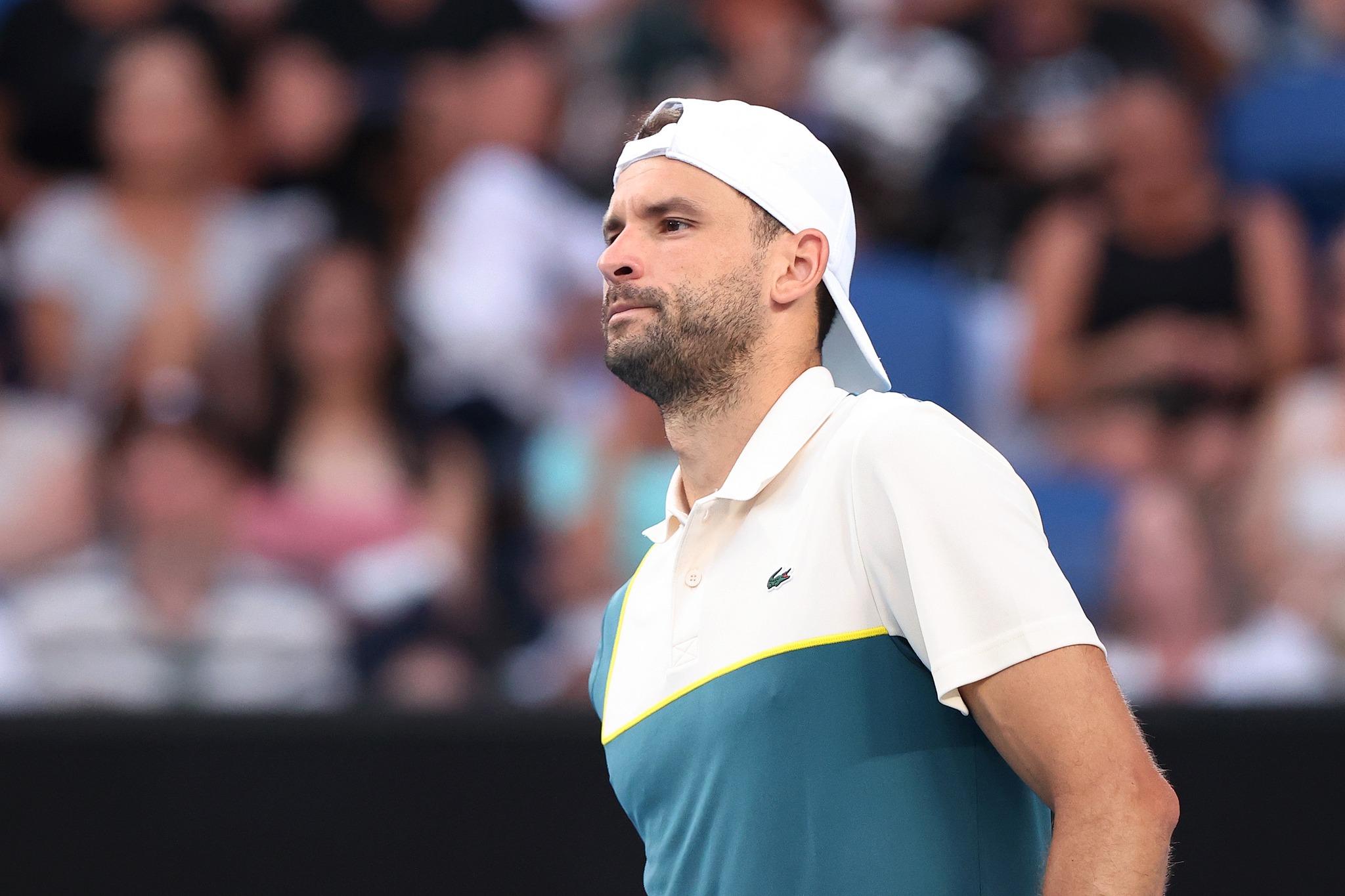

Posledni Novini Za Kontuziyata Na Grigor Dimitrov

May 31, 2025

Posledni Novini Za Kontuziyata Na Grigor Dimitrov

May 31, 2025 -

Trump And Musk A New Era Of Collaboration

May 31, 2025

Trump And Musk A New Era Of Collaboration

May 31, 2025 -

Podrobnosti Za Kontuziyata Na Grigor Dimitrov

May 31, 2025

Podrobnosti Za Kontuziyata Na Grigor Dimitrov

May 31, 2025 -

Kontuziyata Na Grigor Dimitrov Koga Sche Se Zavrne Na Korta

May 31, 2025

Kontuziyata Na Grigor Dimitrov Koga Sche Se Zavrne Na Korta

May 31, 2025 -

Star Trek Strange New Worlds Season 3 Teaser Breakdown Plot Points And Speculation

May 31, 2025

Star Trek Strange New Worlds Season 3 Teaser Breakdown Plot Points And Speculation

May 31, 2025