Extreme Price Hike: Broadcom's VMware Acquisition Faces Backlash From AT&T

Table of Contents

AT&T's Concerns Regarding Increased Prices and Reduced Competition

AT&T's opposition to the Broadcom-VMware merger stems primarily from concerns about significantly increased prices and reduced competition within the networking technology market. The telecom giant fears that the combined entity will wield excessive market power, leading to a domino effect of negative consequences for businesses and consumers alike.

The Price Hike Argument

AT&T argues that the merger will eliminate a major competitor, giving Broadcom unchecked control over crucial networking equipment and services. This lack of competition will directly translate into higher prices for telecom companies.

- Higher prices for networking hardware: AT&T anticipates substantially increased costs for essential networking infrastructure components, impacting their operational expenses and potentially leading to higher service charges for customers.

- Reduced bargaining power for telecoms: The merger could severely limit AT&T's and other telecom providers' ability to negotiate favorable pricing on vital networking equipment, leaving them vulnerable to Broadcom's pricing power.

- Potential for monopolistic practices: AT&T worries about Broadcom leveraging its increased market share to engage in monopolistic practices, such as price gouging and limiting access to crucial technologies.

- Impact on innovation: Reduced competition could stifle innovation as Broadcom, without the competitive pressure of VMware, may have less incentive to develop cutting-edge networking technologies.

Impact on Network Infrastructure and Innovation

The potential consequences of reduced competition extend beyond mere price increases. The merger could lead to a stagnation of innovation within the networking technology sector.

- Reduced choice for telecom providers: Fewer vendors mean fewer choices for telecom providers, limiting their ability to tailor their networks to specific needs and potentially resulting in less efficient and adaptable infrastructure.

- Slower technological advancements: Without the competitive pressure to innovate, the merged entity may prioritize profits over technological advancement, potentially leading to slower progress in crucial networking technologies.

- Loss of competitive pricing pressure: The absence of VMware as a competitor will remove a significant force pushing for competitive pricing and better value for customers.

- Potential for inferior products: A lack of competition could lead to the development of less innovative and potentially inferior products, as the merged entity will have less incentive to continually improve their offerings.

Regulatory Scrutiny and Antitrust Concerns

The Broadcom-VMware merger is facing intense scrutiny from regulatory bodies worldwide, raising significant antitrust concerns. The potential for a substantial reduction in competition is a major factor driving these investigations.

Antitrust Investigations and Potential Roadblocks

Several regulatory bodies are currently reviewing the merger, including the Federal Trade Commission (FTC) in the US and the European Commission (EC). These investigations are focused on assessing the potential anti-competitive effects of the merger.

- Review by regulatory bodies (e.g., FTC, EU Commission): Thorough investigations are underway to determine whether the merger violates antitrust laws and harms competition.

- Potential lawsuits from competitors: Other companies in the networking technology sector could file lawsuits to challenge the merger on antitrust grounds.

- Public opinion and political pressure: The deal is facing considerable public and political pressure, which could influence the outcome of the regulatory reviews.

- Conditions imposed for approval: Even if approved, the merger might be subject to conditions imposed by regulatory bodies, such as divestitures of certain assets or commitments to maintain fair pricing.

Global Implications of the Merger

The impact of this merger extends far beyond national borders. Its consequences for global competition and pricing in the technology sector are significant and far-reaching.

- Impact on international telecom markets: The merger could significantly alter the competitive landscape in international telecom markets, impacting pricing and innovation worldwide.

- Responses from international regulatory bodies: Regulatory bodies in other countries are also scrutinizing the merger, potentially leading to a complex and multifaceted regulatory process.

- Global implications for consumers: The ultimate impact on consumers worldwide could include higher prices, reduced choices, and slower technological advancements.

- Effects on technological innovation worldwide: The merger's potential to stifle innovation could have global consequences, impacting the development of crucial technologies for years to come.

Broadcom's Response and Defense Strategy

Broadcom has defended its acquisition of VMware, arguing that the merger will lead to increased innovation and cost savings, ultimately benefiting consumers. However, these arguments are facing skepticism in light of AT&T's and other parties' concerns.

Broadcom's Arguments for the Acquisition

Broadcom maintains that the merger will create synergies that will drive innovation and efficiency.

- Claims of synergy and cost savings: Broadcom claims that combining its resources with VMware will lead to significant cost savings and operational efficiencies.

- Arguments for increased innovation: The company argues that the merger will unlock new opportunities for innovation by combining their respective technologies and expertise.

- Promises of maintaining competition: Broadcom asserts that the merger will not harm competition and that they will continue to offer competitive pricing and products.

- Responses to antitrust concerns: Broadcom is actively responding to antitrust concerns raised by regulatory bodies and competitors, aiming to address their apprehensions.

Potential Solutions and Concessions

To address regulatory concerns and potentially appease critics like AT&T, Broadcom may offer concessions or solutions.

- Divestiture of assets: Broadcom might be forced to divest certain assets to reduce its market power and address antitrust concerns.

- Price commitments: The company might offer price commitments to ensure fair pricing of its products and services after the merger.

- Regulatory undertakings: Broadcom could provide regulatory undertakings to guarantee compliance with antitrust laws and prevent anti-competitive behavior.

- Structural changes to the merged entity: Broadcom might be required to make structural changes to the merged entity to address concerns about market dominance.

Conclusion

The proposed Broadcom-VMware acquisition is a high-stakes deal with potentially far-reaching consequences. AT&T's strong opposition, fueled by fears of an extreme price hike and reduced competition, underscores the significant concerns surrounding this merger. The intense regulatory scrutiny and potential antitrust roadblocks highlight the complexity and challenges of this deal. While Broadcom argues for synergies and increased innovation, the potential for stifled competition and higher prices for consumers remains a major point of contention. Keeping a close eye on the unfolding events and the regulatory response is crucial. Stay informed about the latest developments in this contentious merger and the ongoing debate surrounding the potential for an extreme price hike in the networking technology sector. Further research and analysis are needed to fully understand the long-term implications of this landmark deal.

Featured Posts

-

Damiano David A Deep Dive Into Funny Little Fears

May 18, 2025

Damiano David A Deep Dive Into Funny Little Fears

May 18, 2025 -

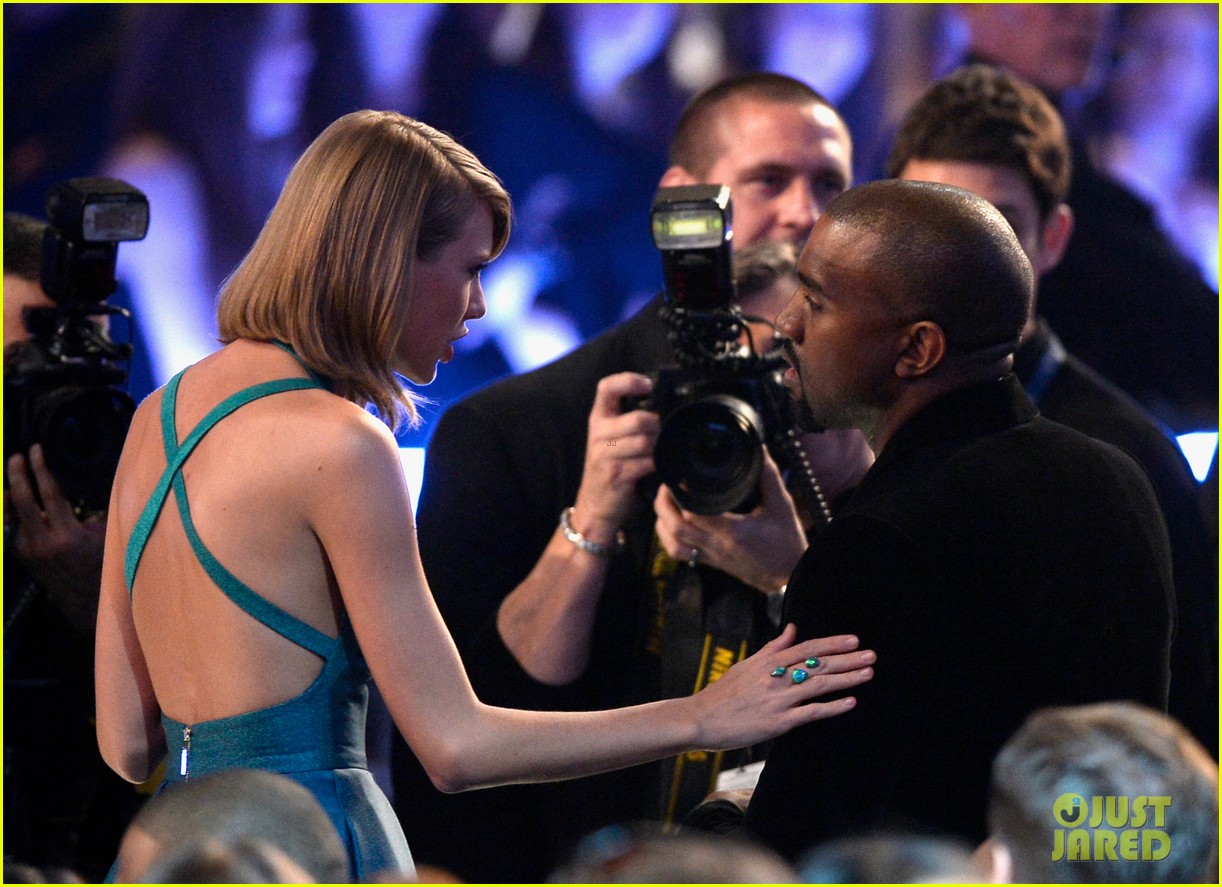

Taylor Swifts Legal Battle Against Kanye Wests Explicit Lyrics

May 18, 2025

Taylor Swifts Legal Battle Against Kanye Wests Explicit Lyrics

May 18, 2025 -

Maneskins Damiano David Rocks Jimmy Kimmel Live Alt 104 5

May 18, 2025

Maneskins Damiano David Rocks Jimmy Kimmel Live Alt 104 5

May 18, 2025 -

Analysis State Officials Rome Trip And Potential Conflicts Of Interest

May 18, 2025

Analysis State Officials Rome Trip And Potential Conflicts Of Interest

May 18, 2025 -

Moodys Downgrade Of Us Debt Rating White House Criticism And Market Reaction

May 18, 2025

Moodys Downgrade Of Us Debt Rating White House Criticism And Market Reaction

May 18, 2025

Latest Posts

-

Dodgers Conforto A Hernandez Esque Impact

May 18, 2025

Dodgers Conforto A Hernandez Esque Impact

May 18, 2025 -

Confortos Path To Success Following In Hernandezs Footsteps

May 18, 2025

Confortos Path To Success Following In Hernandezs Footsteps

May 18, 2025 -

Dodgers Bet On Conforto Following Hernandezs Success

May 18, 2025

Dodgers Bet On Conforto Following Hernandezs Success

May 18, 2025 -

Pete Crow Reports Cubs Clinch Series With Armstrongs Two Homer Performance

May 18, 2025

Pete Crow Reports Cubs Clinch Series With Armstrongs Two Homer Performance

May 18, 2025 -

Dodgers Vs Cubs Armstrongs Two Home Runs Decide Series

May 18, 2025

Dodgers Vs Cubs Armstrongs Two Home Runs Decide Series

May 18, 2025