Extreme Price Hike: Broadcom's VMware Deal Faces AT&T Backlash

Table of Contents

The Financial Implications of Broadcom's VMware Acquisition

The Broadcom VMware acquisition has sent shockwaves through the industry, primarily due to the anticipated significant price increases for VMware products and services. This section will explore the financial ramifications of this deal for businesses and consumers alike.

The Extreme Price Increase and its Impact on the Market

The acquisition has fueled concerns about a dramatic price hike for VMware's virtualization and cloud software. Industry analysts predict substantial increases in VMware licensing fees, potentially impacting businesses of all sizes.

- Specific examples of price increases: While precise figures remain speculative, reports suggest potential double-digit percentage increases in licensing costs across VMware's product portfolio. This could translate to millions of dollars in added expenses for large enterprises.

- Potential cost savings for Broadcom: Broadcom anticipates significant cost synergies post-acquisition, potentially justifying the price increases through increased efficiency and economies of scale. However, concerns remain whether these savings will translate into tangible benefits for customers.

- Ripple effect: The price hike in VMware products could trigger a domino effect, influencing the pricing of related services and products. Competitors might follow suit, resulting in a wider increase in IT infrastructure costs for businesses.

- Data and statistics: While concrete numbers are still emerging, independent market research firms are actively analyzing the potential financial impact of the price increase on various business segments. Their findings are expected to provide a clearer picture in the coming months.

Broadcom's Justification for the Price Hike

Broadcom maintains that the acquisition is strategically sound and will ultimately benefit customers through enhanced innovation and improved services.

- Key points from Broadcom's statements: Broadcom has consistently emphasized the synergistic potential of combining its semiconductor expertise with VMware's software portfolio, leading to a more integrated and efficient infrastructure. They've highlighted plans to invest heavily in R&D.

- Analysis of Broadcom's arguments: While Broadcom's claims about enhanced services and innovation are plausible, the considerable price increase remains a major point of contention. The extent to which these benefits will offset the higher costs for customers remains to be seen.

AT&T's Opposition and the Antitrust Concerns

AT&T's vocal opposition to the Broadcom VMware acquisition is largely driven by concerns about potential anti-competitive behavior and the implications for the telecommunications industry.

AT&T's Specific Concerns and Arguments

AT&T has raised serious antitrust concerns, arguing that the merger could stifle competition and lead to higher prices for essential networking and cloud services.

- Key arguments presented by AT&T: AT&T's arguments center on Broadcom's potential to leverage its combined market power to disadvantage competitors and raise prices across the board. Their concerns revolve around VMware's significant market share in virtualization technologies.

- Evidence presented by AT&T: AT&T's objections likely include data and market analyses demonstrating the potential for monopolistic behavior, potentially influencing regulatory decisions. Specific details may emerge as the legal process unfolds.

- Legal challenges and regulatory investigations: AT&T's opposition may trigger further regulatory scrutiny and antitrust investigations by relevant authorities. The outcome of these investigations will significantly influence the future of the Broadcom VMware deal.

The Potential Impact on the Telecommunications Industry

The acquisition's impact on the telecommunications sector could be substantial, affecting both service providers and consumers.

- Consequences for service providers: Higher VMware licensing costs could force telecommunication companies to absorb these increased expenses, potentially impacting their profitability and competitiveness.

- Consequences for consumers: The increased costs could be passed on to consumers in the form of higher prices for telecommunication services or reduced service quality.

- Reduced innovation and choice: The merger might limit innovation and reduce consumer choices if Broadcom gains an undue level of market dominance.

Wider Industry Response and Future Outlook

The Broadcom VMware acquisition has sparked a widespread debate across the tech industry.

Reactions from Other Tech Companies and Industry Experts

Reactions to the acquisition have been mixed, with some expressing concern over potential anti-competitive practices while others remain cautiously optimistic.

- Quotes and opinions: Statements from leading tech companies and industry analysts reveal a range of perspectives. Some highlight the potential for innovation, while others voice apprehension regarding the price hike and its consequences.

- Diverse perspectives: This section aims to present a balanced view, showcasing a variety of opinions from across the industry spectrum to provide a comprehensive picture.

Potential Outcomes and Future Implications

Several potential outcomes could unfold, ranging from regulatory interventions to adjustments in Broadcom's pricing strategy.

- Possible scenarios: Scenarios include regulatory intervention resulting in divestitures or behavioral remedies, Broadcom altering its pricing strategy in response to criticism, or, less likely, a complete unraveling of the deal.

- Long-term implications: The long-term impact on the tech industry's competitive landscape remains uncertain. The outcome will significantly affect the future of enterprise software and cloud computing pricing.

Conclusion: Navigating the Aftermath of Broadcom's VMware Price Hike

The Broadcom VMware acquisition presents a complex scenario with significant implications for the tech industry. The extreme price hike, coupled with AT&T's strong opposition and rising antitrust concerns, raises serious questions about fair competition and the future cost of essential software and services. The potential impact on consumers, businesses, and the competitive landscape warrants careful monitoring. Stay tuned for updates on this evolving situation as we continue to monitor the fallout from this extreme price hike in the Broadcom VMware deal, and the ongoing debate surrounding its impact on the broader tech market. The future implications of this "Broadcom VMware acquisition" and the related "price increases" remain a significant area of discussion and concern for the entire industry.

Featured Posts

-

311 Heat Related Deaths In England A Public Health Crisis

May 30, 2025

311 Heat Related Deaths In England A Public Health Crisis

May 30, 2025 -

Casper Ruuds Knee Problem Leads To French Open 2025 Loss Against Nuno Borges

May 30, 2025

Casper Ruuds Knee Problem Leads To French Open 2025 Loss Against Nuno Borges

May 30, 2025 -

Djokovic Cruises To Victory In French Open Opener

May 30, 2025

Djokovic Cruises To Victory In French Open Opener

May 30, 2025 -

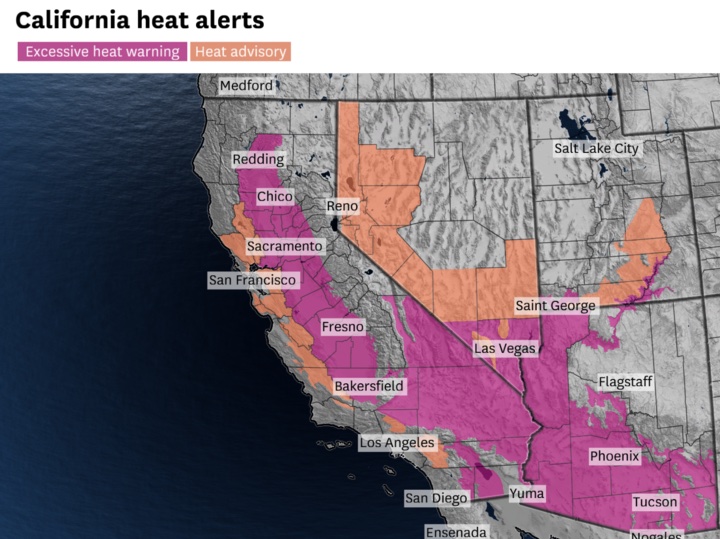

Excessive Heat Warnings Why They Re Not Always Included In Forecasts

May 30, 2025

Excessive Heat Warnings Why They Re Not Always Included In Forecasts

May 30, 2025 -

Bad Bunny Madrid And Barcelona Entradas A La Venta En Ticketmaster Y Live Nation

May 30, 2025

Bad Bunny Madrid And Barcelona Entradas A La Venta En Ticketmaster Y Live Nation

May 30, 2025