Extreme Price Hike: Broadcom's VMware Proposal Costs AT&T 1,050% More

Table of Contents

The VMware Acquisition: A Multi-Billion Dollar Deal

Broadcom's acquisition of VMware, finalized in late 2022, was a colossal deal valued at approximately $61 billion. This represented a significant premium over VMware's pre-acquisition market capitalization, signifying a highly contested acquisition in the enterprise software market. The deal involved complex financial engineering and considerable regulatory scrutiny.

- Acquisition Timeline: The deal was announced in May 2022 and completed in late 2022, following regulatory approvals.

- Key Players: The acquisition involved key executives from both Broadcom and VMware, as well as significant input from investment banks and legal teams advising on the transaction.

- Regulatory Approvals: The acquisition required approvals from various regulatory bodies worldwide, reflecting the significant market share held by both companies. The process was lengthy and added to the overall deal complexity. This significantly increased the timeline for the deal's conclusion.

This multi-billion dollar transaction significantly reshaped the competitive landscape of the enterprise software sector, impacting numerous clients, including AT&T.

AT&T's VMware Dependence and the Price Surge

AT&T, a major player in the telecom industry, heavily relied on VMware's virtualization and cloud computing solutions for its critical infrastructure. Their previous contracts with VMware likely involved established pricing structures, offering a level of predictability. However, Broadcom's acquisition fundamentally altered this equation.

The result? An extreme price hike of a shocking 1,050%. This isn't just a rounding error; it represents an astronomical increase in AT&T's operational expenses.

- Specific VMware Products: AT&T utilized various VMware products, including vSphere, NSX, and vRealize, across its network infrastructure and data centers.

- Impact on Infrastructure: This price surge directly impacts AT&T's operational costs, affecting its network capacity, service delivery, and overall efficiency.

- Cost Increase Breakdown: The 1050% increase likely encompasses licensing fees, maintenance contracts, and technical support services, all experiencing substantial increases.

This situation highlights the risks inherent in relying on a single vendor for critical infrastructure components.

Analyzing the Reasons Behind the Extreme Price Hike

Several factors likely contributed to this dramatic price increase. One prominent theory centers on Broadcom's potential leveraging of its newfound market power following the VMware acquisition. The increased market concentration could lead to reduced competition and the ability to dictate higher prices.

- Market Consolidation: The merger of Broadcom and VMware consolidated significant market share, potentially leading to monopolistic practices.

- Broadcom's Business Strategies: Broadcom's history includes a focus on acquiring key players in specific sectors and subsequently adjusting pricing strategies.

- Potential Legal Challenges: The magnitude of the price increase has raised antitrust concerns, with potential legal ramifications still unfolding.

- Alternatives for AT&T: AT&T is likely exploring alternative virtualization and cloud solutions to mitigate future dependence on a single vendor and reduce cost exposure.

Implications for AT&T and the Wider Telecom Industry

The extreme price hike imposed on AT&T has significant implications. The financial burden could impact profitability, investment decisions, and overall competitiveness. Furthermore, other telecom companies relying on VMware now face the risk of similar price increases, creating industry-wide concern.

- AT&T's Response Strategies: AT&T is likely evaluating various options, including renegotiating contracts, migrating to alternative platforms, and potentially challenging Broadcom's pricing practices legally.

- Impact on Competitiveness: The increased operational costs could reduce AT&T's competitiveness in the market, affecting its ability to invest in innovation and expand services.

- Shift in Market Dynamics: The acquisition has significantly altered the market landscape, forcing other companies to reconsider their reliance on large enterprise software vendors.

Conclusion: Navigating the Aftermath of the Extreme Price Hike

Broadcom's acquisition of VMware and the subsequent extreme price hike for AT&T underscore the risks associated with market consolidation and the power dynamics within the enterprise software sector. The 1050% increase serves as a stark warning to other businesses reliant on large vendors for critical infrastructure. This event necessitates a renewed focus on contract negotiation, diversification of suppliers, and a deeper understanding of potential risks associated with mergers and acquisitions in the technology sector. The telecom industry, and indeed the broader tech world, must learn from this situation and adopt strategies to mitigate future extreme price hikes and maintain a competitive landscape. Further research into Broadcom's acquisition strategy and its cascading effects on other businesses is crucial for navigating the complex realities of the modern tech market.

Featured Posts

-

Interpreting Big Rig Rock Report 3 12 Data In Conjunction With Laser 101 7

May 23, 2025

Interpreting Big Rig Rock Report 3 12 Data In Conjunction With Laser 101 7

May 23, 2025 -

Rybakina V Tretem Kruge Turnira V Rime

May 23, 2025

Rybakina V Tretem Kruge Turnira V Rime

May 23, 2025 -

The Zak Crawley Conundrum Englands Continued Support

May 23, 2025

The Zak Crawley Conundrum Englands Continued Support

May 23, 2025 -

Vaguada Y Sistema Frontal Lluvias Intensas Este Sabado

May 23, 2025

Vaguada Y Sistema Frontal Lluvias Intensas Este Sabado

May 23, 2025 -

Egan Bernals Comeback Insights From A Medical Research Paper On His Critical Injury

May 23, 2025

Egan Bernals Comeback Insights From A Medical Research Paper On His Critical Injury

May 23, 2025

Latest Posts

-

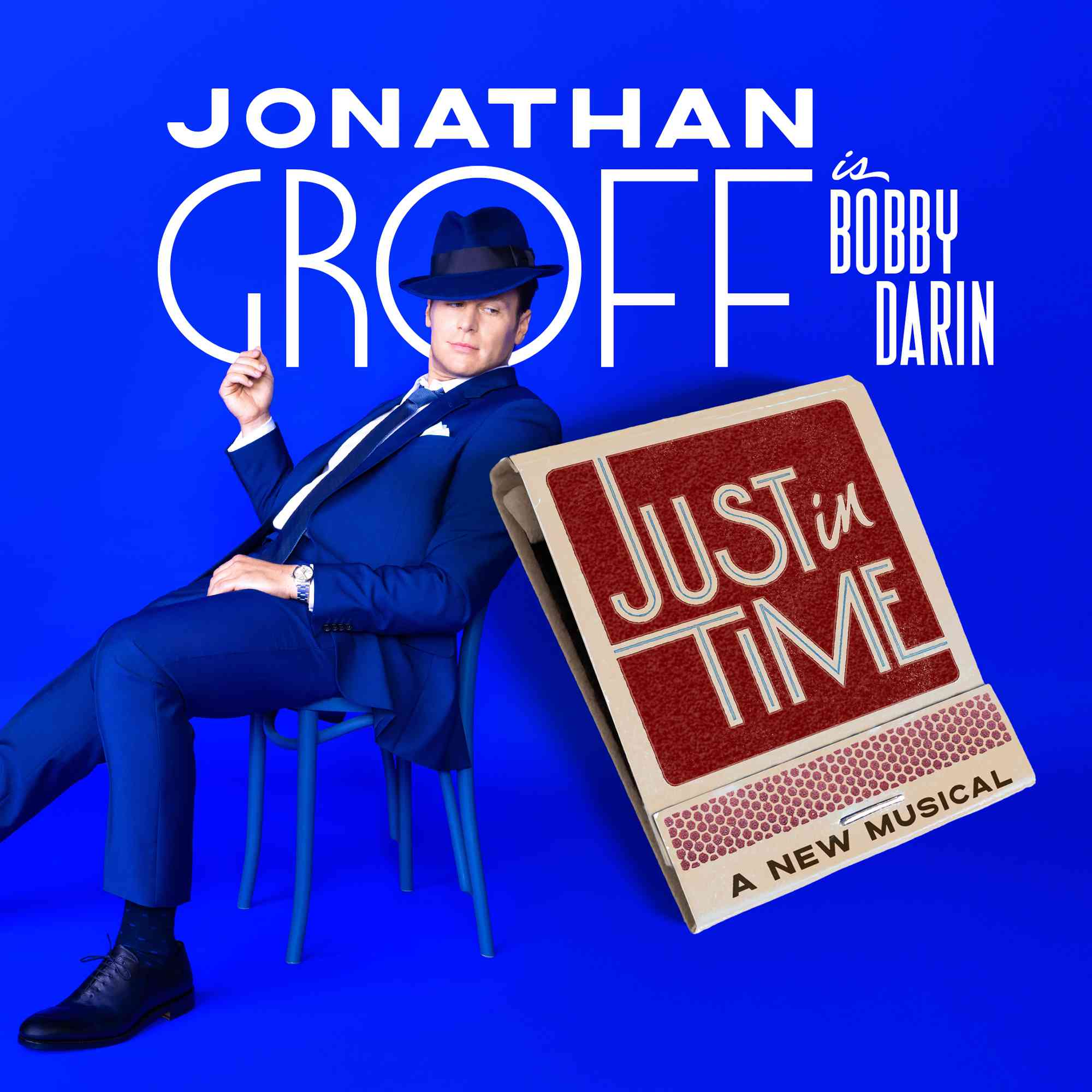

Jonathan Groffs Just In Time A 1965 Style Party On Stage

May 23, 2025

Jonathan Groffs Just In Time A 1965 Style Party On Stage

May 23, 2025 -

Just In Time Review Jonathan Groff Shines In A Stellar Bobby Darin Musical

May 23, 2025

Just In Time Review Jonathan Groff Shines In A Stellar Bobby Darin Musical

May 23, 2025 -

Jonathan Groff Discusses His Experiences With Asexuality

May 23, 2025

Jonathan Groff Discusses His Experiences With Asexuality

May 23, 2025 -

Jonathan Groffs Bobby Darin Transformation Just In Time And The Power Of Performance

May 23, 2025

Jonathan Groffs Bobby Darin Transformation Just In Time And The Power Of Performance

May 23, 2025 -

Broadway Buzz Jonathan Groffs Just In Time And The Raw Energy Of Bobby Darin

May 23, 2025

Broadway Buzz Jonathan Groffs Just In Time And The Raw Energy Of Bobby Darin

May 23, 2025