Extreme Price Increase: AT&T Challenges Broadcom's VMware Deal

Table of Contents

AT&T's Concerns Regarding the Extreme Price Increase

AT&T's opposition to the Broadcom-VMware merger stems primarily from concerns about a substantial and unjustified price hike following the acquisition. This extreme price increase, AT&T argues, would significantly impact its business and could stifle competition within the industry. Their objections are multifaceted:

- Increased costs for AT&T's VMware services: AT&T relies heavily on VMware's virtualization technologies. A drastic price increase would directly translate to higher operational costs, potentially affecting profitability and competitiveness. This could force AT&T to explore alternative, possibly less efficient, solutions.

- Potential for reduced competition and innovation: Broadcom's acquisition of VMware, coupled with the significant price increase, raises concerns about reduced competition and stifled innovation. With less competition, VMware may be less incentivized to innovate and improve its products, potentially leading to a stagnant market.

- Concerns about market dominance by Broadcom: Broadcom's already significant presence in the semiconductor and networking industries, combined with VMware's dominance in virtualization, creates the potential for a monopolistic situation. This market dominance could result in less choice and higher prices for customers across the board.

- Regulatory concerns: AT&T likely anticipates raising regulatory concerns with antitrust bodies. The extreme price increase could be presented as evidence of anti-competitive practices, prompting a thorough investigation.

Broadcom's Response to the AT&T Challenge

Broadcom has yet to issue a comprehensive response directly addressing AT&T's specific concerns regarding the extreme price increase. However, Broadcom's general stance has been to emphasize the synergistic benefits of the merger and the resulting enhanced value for customers. Broadcom's likely arguments will include:

- Explanation for the price increase: Broadcom will likely justify the increase by highlighting investment in research and development, expansion of services, and improved features following the merger.

- Arguments addressing AT&T's concerns about competition: Broadcom will likely argue that the merger will enhance competition, not stifle it, by fostering innovation and creating a more robust product ecosystem. They might highlight potential cost savings and efficiencies.

- Proposed solutions or concessions: In an attempt to alleviate AT&T's concerns and potentially appease regulatory bodies, Broadcom may offer concessions, such as price adjustments or commitments to maintain competitive pricing.

The Potential Impact on the Tech Industry

The outcome of this legal battle holds significant implications for the broader tech industry. The AT&T-Broadcom-VMware dispute highlights the ongoing tension between the pursuit of large-scale mergers and the maintenance of a competitive market.

- Potential for increased prices for VMware services: If Broadcom's acquisition goes through with the current proposed price structure, it could trigger price increases for VMware services across the industry, impacting businesses of all sizes.

- Impact on cloud computing and virtualization markets: This case sets a crucial precedent for future mergers and acquisitions in the cloud computing and virtualization markets. A rejection of the deal due to price concerns could significantly alter the industry landscape.

- Effect on other potential mergers and acquisitions: The outcome of this challenge could deter future mergers and acquisitions, particularly those involving substantial price increases. Regulatory bodies will likely scrutinize such deals more closely.

- The role of regulatory bodies: The FTC, EU, and other relevant regulatory bodies play a crucial role in determining the fate of the deal. Their decisions will significantly shape the future of the industry.

Regulatory Scrutiny and the Future of the Deal

The success of the Broadcom-VMware deal hinges largely on the scrutiny of regulatory bodies like the FTC and the EU Commission. These entities will assess the deal's potential impact on competition and market prices.

- The roles of relevant regulatory bodies: The FTC and EU will investigate whether the extreme price increase constitutes anti-competitive behavior, hindering market competition and innovation.

- Potential outcomes: The deal could be approved, rejected outright, or renegotiated with conditions attached, potentially including price concessions.

- Timeline for regulatory decisions: The regulatory process could be lengthy, spanning several months or even longer.

Conclusion: Extreme Price Increase and the Future of the VMware Acquisition

The AT&T challenge to Broadcom's acquisition of VMware centers on the extreme price increase associated with the deal. AT&T's concerns regarding higher costs, reduced competition, and market dominance are significant, prompting intense scrutiny from regulatory bodies. Broadcom's response, along with the eventual decisions from regulators, will profoundly shape the future of the cloud computing and virtualization sectors. Stay updated on the AT&T-Broadcom-VMware saga and the implications of this extreme price increase. Follow our coverage for the latest updates on this crucial challenge to the Broadcom VMware deal. Learn more about the ongoing debate surrounding the extreme price increase associated with Broadcom's acquisition of VMware.

Featured Posts

-

Mark Zuckerbergs Leadership In A Trump Era America

May 29, 2025

Mark Zuckerbergs Leadership In A Trump Era America

May 29, 2025 -

Queensland Music Awards Antisemitism Controversy Erupts

May 29, 2025

Queensland Music Awards Antisemitism Controversy Erupts

May 29, 2025 -

Court Hearing Provides Update On Joshlin Smith Disappearance Investigation

May 29, 2025

Court Hearing Provides Update On Joshlin Smith Disappearance Investigation

May 29, 2025 -

Marine Le Pen Paris Rally Speech On Conviction Verdict

May 29, 2025

Marine Le Pen Paris Rally Speech On Conviction Verdict

May 29, 2025 -

Nike Air Max Dn8 Snakeskin Hv 8476 300 Drop Confirmed Release Date And Where To Buy

May 29, 2025

Nike Air Max Dn8 Snakeskin Hv 8476 300 Drop Confirmed Release Date And Where To Buy

May 29, 2025

Latest Posts

-

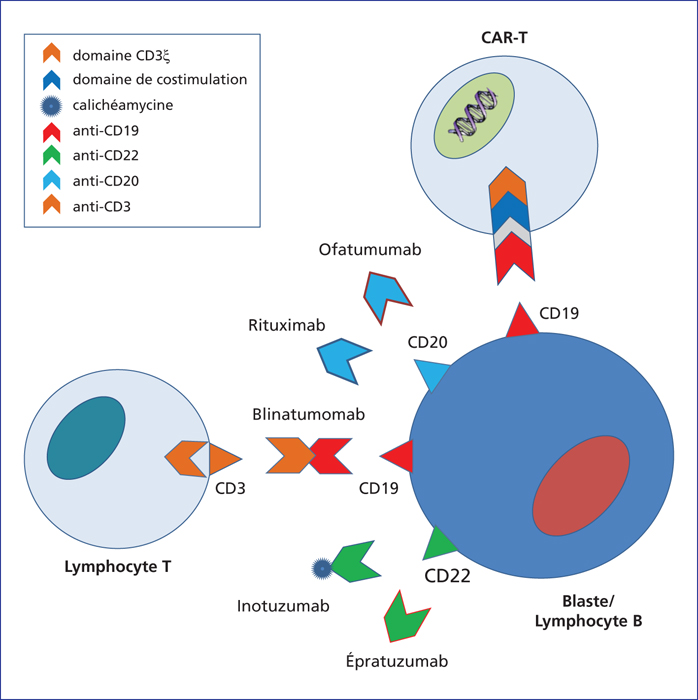

Acquisition Sanofi Nouveaux Anticorps Bispecifiques De Dren Bio

May 31, 2025

Acquisition Sanofi Nouveaux Anticorps Bispecifiques De Dren Bio

May 31, 2025 -

Anticorps Bispecifiques Sanofi Signe Un Accord Avec Dren Bio

May 31, 2025

Anticorps Bispecifiques Sanofi Signe Un Accord Avec Dren Bio

May 31, 2025 -

Sanofi Et Dren Bio Acquisition D Anticorps Bispecifiques

May 31, 2025

Sanofi Et Dren Bio Acquisition D Anticorps Bispecifiques

May 31, 2025 -

Lancement D Un Nouveau Site Sanofi En France Communique De Presse

May 31, 2025

Lancement D Un Nouveau Site Sanofi En France Communique De Presse

May 31, 2025 -

Sanofi Acquiert Les Anticorps Bispecifiques De Dren Bio Un Accord Majeur

May 31, 2025

Sanofi Acquiert Les Anticorps Bispecifiques De Dren Bio Un Accord Majeur

May 31, 2025