Facing Government Action For Delinquent Student Loans? Here's What To Do

Table of Contents

Understanding the Stages of Government Action for Delinquent Student Loans

The government takes a series of steps when student loans become delinquent. Understanding this process is crucial to navigating your situation effectively. The progression typically involves default, wage garnishment, tax refund offset, and potentially, lawsuits.

Default: The Starting Point of Serious Trouble

Default occurs when you fail to make your student loan payments for a specific period (typically 9 months). The immediate consequences of default are severe:

- Loss of eligibility for federal student aid: This means you can't receive any further federal student loans or grants.

- Negative impact on credit score: Default significantly damages your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future.

- Potential for wage garnishment: The government can legally seize a portion of your wages to repay your delinquent loans.

Wage Garnishment: A Direct Impact on Your Income

Wage garnishment involves the government directly deducting a portion of your paycheck to satisfy your delinquent student loan debt. The amount garnished is typically capped at a percentage of your disposable income (income after taxes and other deductions).

- How much is garnished? The exact amount varies depending on your income and state laws, but it can be substantial, impacting your ability to meet your living expenses.

- Challenging a garnishment: If you believe the garnishment amount is incorrect, you can challenge it by contacting your loan servicer or seeking legal counsel.

Tax Refund Offset: Losing Your Refund

The government can seize your federal tax refund to offset your delinquent student loan debt. This is a common method of collection, leaving many borrowers without their expected refund.

- How it works: The IRS intercepts your refund and applies it directly to your student loan balance.

- Preventing tax refund offset: The best way to prevent this is to resolve your delinquent student loan debt before tax season.

Lawsuits and Legal Action: The Most Extreme Measure

In some cases, the government may resort to lawsuits to recover delinquent student loan debt. This is typically a last resort, but it can result in significant legal consequences, including wage garnishment, bank levy, and property seizure.

- Potential legal ramifications: Lawsuits can lead to judgments against you, further damaging your credit and potentially resulting in additional fees and costs.

- Seeking legal representation: If you're facing a lawsuit, it's crucial to seek legal representation from an attorney specializing in student loan debt.

Strategies for Resolving Delinquent Student Loans

There are proactive steps you can take to resolve your delinquent student loans and avoid further government action.

Contacting Your Loan Servicer: The First Step

Proactive communication with your loan servicer is essential. They can explain your options and may be willing to work with you to create a manageable repayment plan.

- Steps to contact your servicer: Find their contact information on your loan documents or the National Student Loan Data System (NSLDS) website.

- Information to gather: Before contacting them, gather all relevant information about your loans, including loan numbers, balances, and payment history.

- Repayment options: Discuss possible repayment options, such as income-driven repayment plans, deferment, or forbearance.

Exploring Repayment Plans: Finding an Affordable Solution

Several repayment plans can help manage your student loan debt.

- Income-Driven Repayment (IDR) Plans: These plans base your monthly payments on your income and family size. Several IDR plans exist, including ICR, PAYE, REPAYE, andIBR. Each has different eligibility requirements and payment calculations.

- Deferment: This temporarily postpones your payments, but interest may still accrue depending on the loan type.

- Forbearance: This allows for temporary suspension of payments, and interest may or may not accrue.

Loan Consolidation and Refinancing: Simplifying Your Debt

Consolidating your loans combines multiple loans into a single payment, simplifying repayment. Refinancing replaces your existing loans with a new loan, potentially at a lower interest rate.

- Eligibility criteria: Eligibility varies depending on your credit score and income.

- Potential benefits: Lower monthly payments, a simplified repayment process, and potentially lower interest rates.

- Drawbacks: You may lose benefits associated with federal loans, such as income-driven repayment plans.

Seeking Professional Help: Getting Expert Guidance

If you're struggling to manage your delinquent student loans, seek assistance from a non-profit credit counselor or student loan attorney.

- Benefits of professional guidance: They can provide personalized advice, negotiate with your loan servicer, and help you navigate the legal complexities of student loan debt.

- Finding reputable professionals: Look for accredited non-profit credit counseling agencies or attorneys specializing in student loan law.

- What to expect: They can provide financial counseling, debt management strategies, and legal representation if needed.

Preventing Future Delinquency: Proactive Strategies

Preventing future delinquency requires proactive financial management.

Budgeting and Financial Planning: Taking Control of Your Finances

Create a realistic budget to track your income and expenses, prioritizing student loan repayments.

- Tips for creating a budget: Use budgeting apps or spreadsheets to track your spending and identify areas where you can save.

- Tracking expenses: Monitor your spending regularly to stay within your budget.

- Prioritizing loan repayment: Allocate sufficient funds for your student loan payments each month.

Automating Payments: Ensuring Timely Repayments

Set up automatic payments to ensure timely repayments and avoid late fees.

- Setting up automatic payments: Most loan servicers offer online tools to automate payments.

- Benefits: It eliminates the risk of missed payments and simplifies the repayment process.

- Avoiding late payments: Automatic payments ensure consistent and on-time payments.

Monitoring Your Loan Account Regularly: Staying Informed

Regularly monitor your loan account to stay informed about your balance, payment due dates, and any changes in your loan terms.

- Accessing online account statements: Use online portals to review your account activity.

- Checking for changes: Stay alert for any changes in your payment amount, due date, or loan servicer.

Conclusion

Addressing delinquent student loans requires proactive action. By understanding the stages of government action, exploring repayment options, and implementing preventative measures, you can regain control of your finances. Don't let delinquent student loans control your future. Take action today by contacting your loan servicer or seeking professional guidance. Understanding your options and proactively managing your student loan debt can prevent further government action and safeguard your financial well-being.

Featured Posts

-

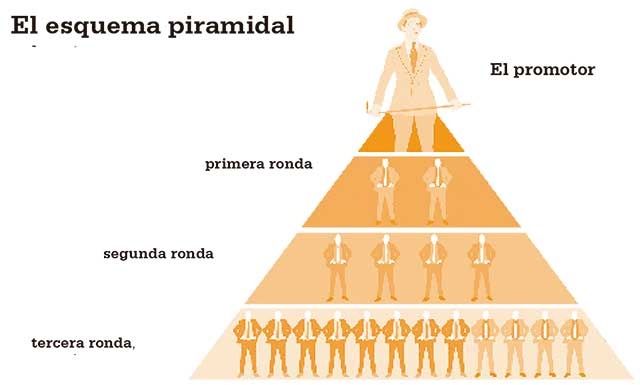

Que Fue El Esquema Ponzi De Koriun Inversiones

May 17, 2025

Que Fue El Esquema Ponzi De Koriun Inversiones

May 17, 2025 -

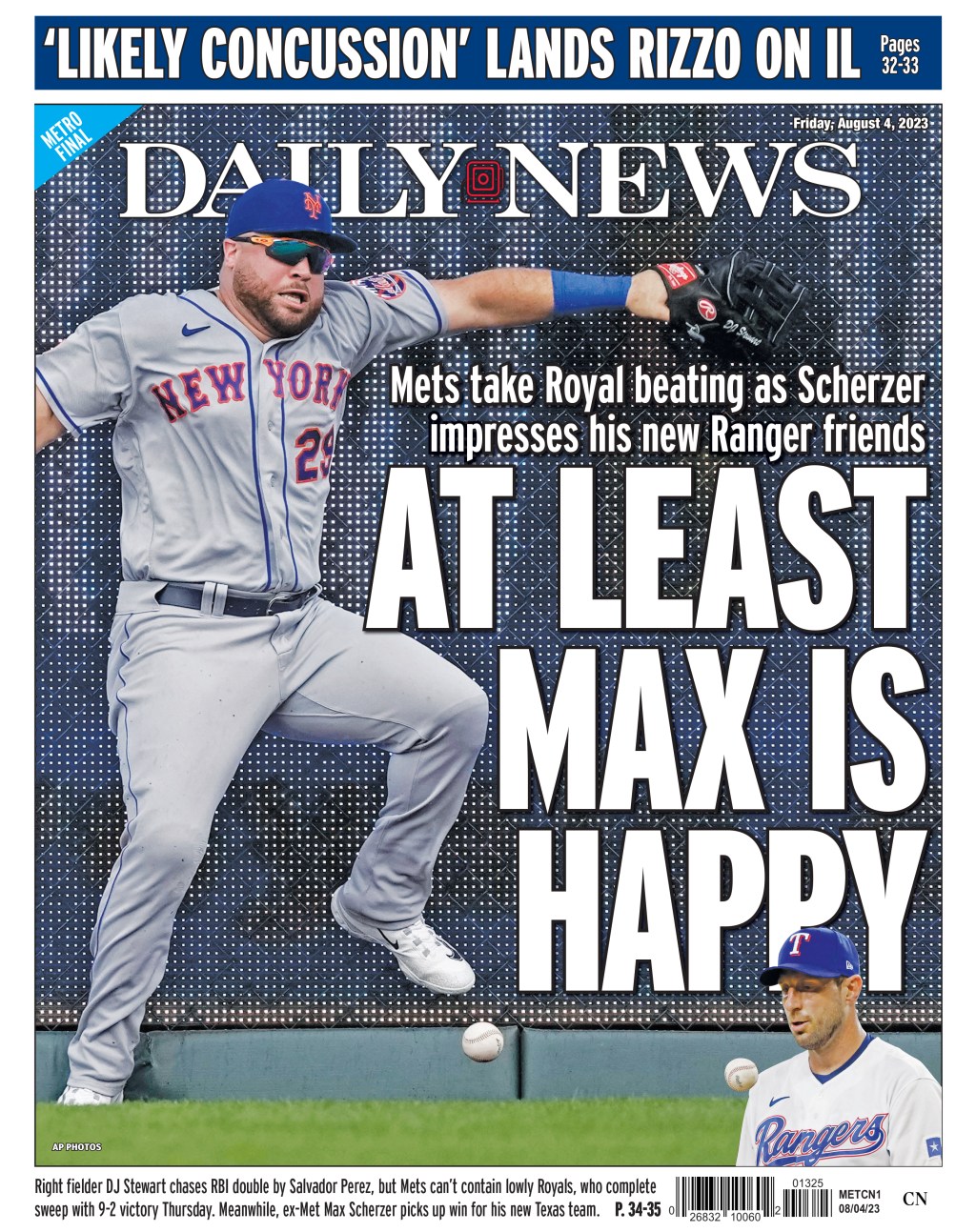

Where To Find New York Daily News Back Issues May 2025

May 17, 2025

Where To Find New York Daily News Back Issues May 2025

May 17, 2025 -

Yankees Vs Mariners Prediction Picks And Odds For Tonights Mlb Game

May 17, 2025

Yankees Vs Mariners Prediction Picks And Odds For Tonights Mlb Game

May 17, 2025 -

New Uber Shuttle Option For United Center 5 Rides Home

May 17, 2025

New Uber Shuttle Option For United Center 5 Rides Home

May 17, 2025 -

Breaking News Seaweed Research Condo Damage And Corporate Crisis Updates

May 17, 2025

Breaking News Seaweed Research Condo Damage And Corporate Crisis Updates

May 17, 2025

Latest Posts

-

Knicks Vs Pistons Magic Johnsons Series Prediction

May 17, 2025

Knicks Vs Pistons Magic Johnsons Series Prediction

May 17, 2025 -

Magic Johnsons Bold Prediction Who Will Win The Knicks Pistons Series

May 17, 2025

Magic Johnsons Bold Prediction Who Will Win The Knicks Pistons Series

May 17, 2025 -

Nba Legend Magic Johnson Predicts Knicks Vs Pistons Winner

May 17, 2025

Nba Legend Magic Johnson Predicts Knicks Vs Pistons Winner

May 17, 2025 -

Zeygaria And Imerominies Agonon Nba Playoffs 2024

May 17, 2025

Zeygaria And Imerominies Agonon Nba Playoffs 2024

May 17, 2025 -

Magic Johnsons Knicks Pistons Series Prediction

May 17, 2025

Magic Johnsons Knicks Pistons Series Prediction

May 17, 2025