Falling Iron Ore Prices: Impact Of Chinese Steel Production Cuts

Table of Contents

China's Steel Production Cuts: The Driving Force

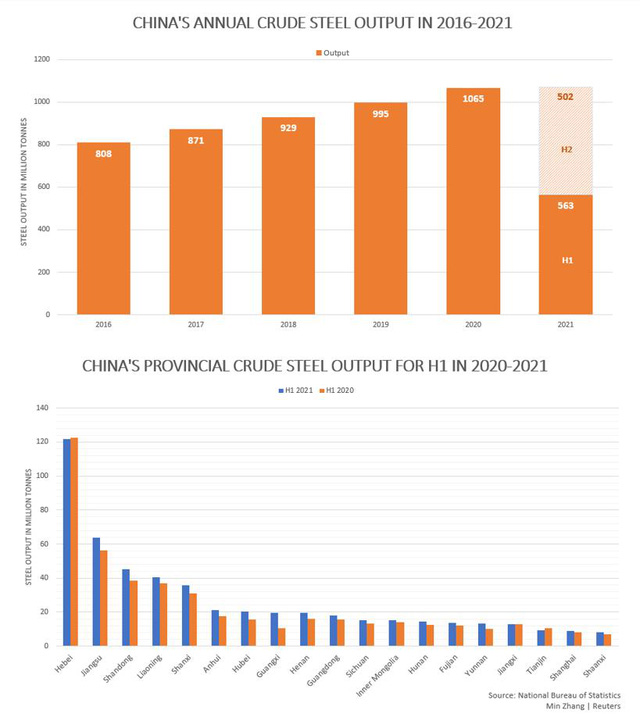

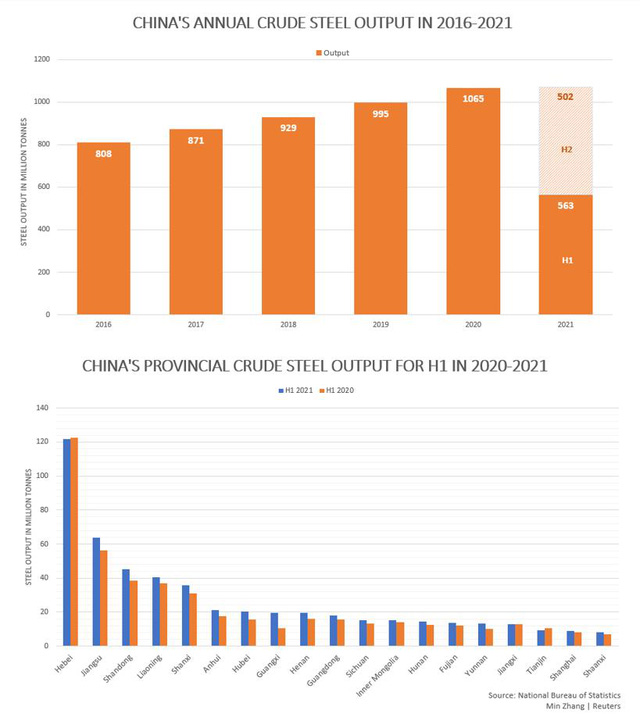

China's steel industry, the world's largest, is undergoing a period of significant restructuring, directly impacting global iron ore demand. This contraction is driven by two key factors: stricter government regulations and weakening domestic demand.

Government Regulations and Environmental Concerns

China's commitment to environmental sustainability and its ambitious decarbonization goals are forcing substantial changes in its steel production sector. The government is implementing increasingly stringent regulations to curb pollution and promote cleaner production methods.

- Increased scrutiny on illegal steel production facilities: The crackdown on smaller, unregulated mills is reducing overall steel output.

- Stringent emission standards and penalties for non-compliance: Steel mills face hefty fines and operational restrictions if they fail to meet rigorous environmental standards. This incentivizes investment in cleaner technologies but also limits production in the short term.

- Focus on improving energy efficiency in steel mills: The government is pushing for modernization and technological upgrades to improve energy efficiency and reduce carbon emissions within the steel industry.

Weakening Domestic Demand

Beyond environmental concerns, a slowdown in China's domestic demand for steel is contributing to the production cuts. This reduced demand stems largely from a cooling construction sector and a more cautious approach to infrastructure spending.

- Impact of the real estate market slowdown on steel consumption: The Chinese real estate sector, a major consumer of steel, has experienced a significant downturn, reducing demand for construction materials.

- Decreased demand from automotive and other manufacturing sectors: A slower economic growth rate across various sectors translates to lower demand for steel products used in manufacturing.

- Shift towards higher-quality, value-added steel products: While overall demand is softening, there's a growing emphasis on higher-quality steel, potentially requiring less overall volume for similar applications.

The Ripple Effect: Impact on Iron Ore Prices

The reduced steel production in China has had a direct and significant impact on global iron ore prices. The decreased demand for steel translates to lower demand for iron ore, the essential raw material in steelmaking.

Reduced Iron Ore Demand

The correlation between steel production and iron ore prices is undeniable. As China's steel mills curtail production, their demand for iron ore plummets, leading directly to falling iron ore prices.

- Analysis of the correlation between steel production and iron ore prices: Statistical analysis clearly demonstrates a strong negative correlation between Chinese steel output and global iron ore prices.

- Impact on iron ore mining companies and their profitability: Lower iron ore prices squeeze the profit margins of mining companies, leading to potential production cuts and job losses.

- Geographical variations in iron ore price fluctuations: The impact of falling iron ore prices varies geographically, depending on the proximity of mines to key steelmaking regions and transportation costs.

Global Market Dynamics

The impact of China's steel production cuts extends far beyond its borders. The drop in iron ore prices affects global markets, impacting producers and consumers worldwide.

- Changes in iron ore supply from Australia, Brazil, and other major exporters: Major iron ore exporters are feeling the pressure of reduced demand and lower prices.

- Impact on global steel prices and international trade: Lower iron ore costs can lead to slightly lower steel prices, but overall market conditions remain complex and affected by many other factors.

- Potential for increased competition among iron ore suppliers: With lower demand, competition among iron ore suppliers is intensifying, potentially leading to further price adjustments.

Future Outlook and Implications for the Market

The future trajectory of iron ore prices remains uncertain and highly dependent on several interconnected factors.

Potential for Price Stabilization or Further Decline

Predicting future iron ore price trends requires careful consideration of various economic and environmental factors.

- Analysis of various market forecasting models: Different forecasting models offer varying predictions, ranging from a slow recovery to a continued decline.

- Discussion of potential scenarios – price recovery, continued decline, or stabilization: Several scenarios are possible, each with its own set of implications for market participants.

- Consideration of alternative steelmaking processes and their impact: The emergence of alternative steelmaking technologies with lower carbon footprints could significantly influence future demand for traditional iron ore.

Investment Implications

The fluctuating iron ore prices present both challenges and opportunities for investors.

- Strategies for navigating market volatility: Diversification and hedging strategies are crucial for mitigating risks in this volatile market.

- Opportunities in sustainable steel production and recycling: Investment in companies focusing on sustainable steel production and recycling could offer long-term growth potential.

- Considerations for diversification in investment portfolios: Investors should carefully consider diversifying their portfolios to reduce exposure to the volatility of the iron ore market.

Conclusion

The decline in iron ore prices is inextricably linked to the reduction in Chinese steel production, driven by government regulations, environmental concerns, and weakening domestic demand. This ripple effect impacts global markets, creating both challenges and opportunities. Understanding the complex interplay between these factors is crucial for navigating the volatile iron ore market. Stay informed on the latest developments regarding falling iron ore prices and their impact on the global steel industry to make informed decisions. Continuously monitor the evolving dynamics of falling iron ore prices to optimize your strategies.

Featured Posts

-

Thailands Transgender Community A Fight For Equality In The Spotlight

May 10, 2025

Thailands Transgender Community A Fight For Equality In The Spotlight

May 10, 2025 -

Frances Europe Minister Advocates For Shared Nuclear Shield

May 10, 2025

Frances Europe Minister Advocates For Shared Nuclear Shield

May 10, 2025 -

Oilers Vs Kings Game 1 Nhl Playoffs Prediction Picks And Betting Odds

May 10, 2025

Oilers Vs Kings Game 1 Nhl Playoffs Prediction Picks And Betting Odds

May 10, 2025 -

Lab Owner Admits Guilt In Covid 19 Test Result Fraud Case

May 10, 2025

Lab Owner Admits Guilt In Covid 19 Test Result Fraud Case

May 10, 2025 -

Ma Aldhy Hqqh Fyraty Me Alerby Alqtry Bed Antqalh Mn Alahly

May 10, 2025

Ma Aldhy Hqqh Fyraty Me Alerby Alqtry Bed Antqalh Mn Alahly

May 10, 2025